hxdyl

A recession is coming, but that doesn’t mean all stocks will go down. While most secular growth industries have had large stock declines this year, there is a small new secular growth industry undiscovered by the market. It is companies that supply electrical power grid infrastructure. This industry is reaching an inflection point from historical slow and steady growth to much faster growth.

Massive Power Grid Buildout Needed

On October 29, 2021, I wrote an article titled Sleepy Electric Utilities Suddenly Face Major Disruption: How To Play It. In that article, I noted the following.

The electric utility industry has been slow, steady, and predictable for over a century. It suddenly faces unprecedented positive and negative disruptions. These disruptions include increased renewables throwing the grid out of balance, EVs, security, cryptocurrency mining, ESG investing, environmental, forest fire protection and more. The increased demand goes beyond EVs. Utilities in forest fire prone areas need to bury their power lines. Crypto mining uses massive amounts of energy. Grid security is becoming more important. Due to global warming, there are real concerns whether the Texas grid (and others internationally) can handle the increasingly hot summers there. Increased solar and wind energy production need to be connected to the grid.

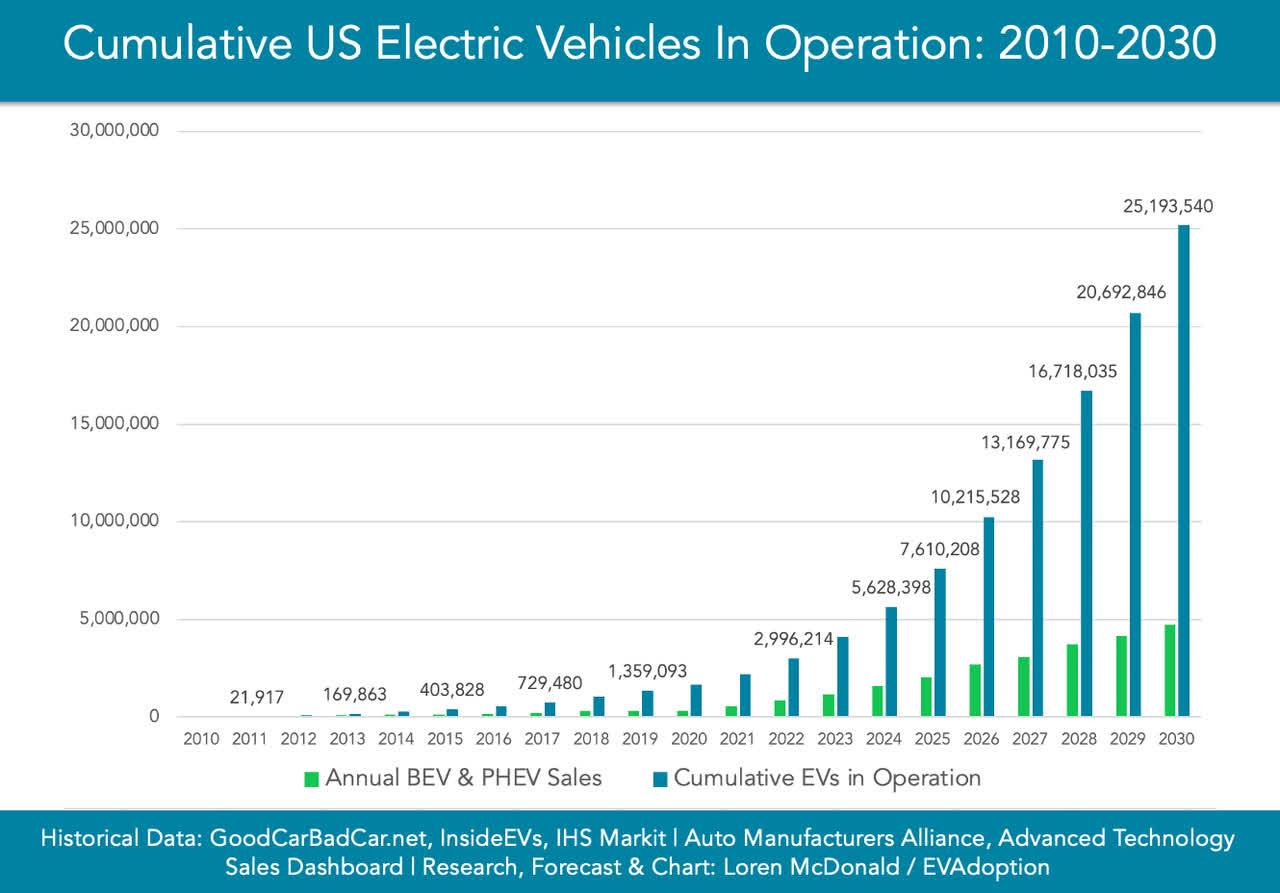

The EV revolution alone will require a massive upgrade to our power grid. Think of all the gasoline that will be replaced with electricity. The current power grid is not capable of handling the amount of new power needed and the increased surges at recharging stations. This is especially true of the power flowing through the smaller distribution lines going from the substations to the users.

I own a Tesla (TSLA). When I power it in my garage, I hook it up to a 240-volt outlet, which is more powerful than my other outlets. I needed an electrician to install it. It can fully charge my car overnight. But what about charging your EV when you are on the road? Motorists are going to demand a 15-minute or less full charge for their EVs before mass adoption can take place. That’s a massive surge in electricity for just one car and there will be millions of EVs.

evadoption.com

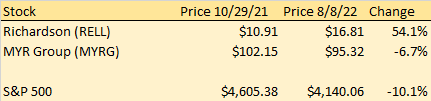

In the aforementioned article, I listed 2 stocks to play it. There was a third, Bloom Energy (BE) but it is not a grid play. These 2 are shown below. Both have outperformed the S&P 500 since then.

Yahoo Finance

I still own RELL but have found a more direct way to play this secular growth trend with Preformed Line Products (NASDAQ:PLPC).

Background

PLPC is based in Mayfield Ohio and was started in 1947. PLPC manufactures products used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable industries. These include things like closures, ties, insulators, motion control, and wildlife protection. They recently started selling solar panel mounts. CEO Robert Ruhlman is the third generation of his family in that position. The family owns about 33% of the stock. He has a son who is the VP of marketing.

In the first half of 2022, sales were 53% in the U.S., with the rest spread throughout the world. During that period, 60% of sales were for power lines and 32% for cable. As of December 31, 2021, the Company had in force 49 U.S. patents and 131 international patents in 21 countries and had 37 pending U.S. patent applications and 47 pending international applications.

Financials

Financial results for the last four and a half years are shown below.

SEC forms 10-K and 10-Q

As shown above, PLPC has historically exhibited strong profit margins and steady growth. Growth has picked up in the past year or so. In speaking with management, a little over half the revenue growth in 2022 to date is organic volume growth. The 10-Q indicates $3.6 million was from a small acquisition. The rest was from price increases. The company has done a good job passing along cost increases to customers. There were no non-recurring items shown on the income statements used for the above chart.

Revenues in the first half of 2022 were actually reduced by $8 million by currency translation, due to the strong dollar. On a currency-neutral basis, revenues were actually up 23.5%. Keep in mind, some of that was pricing due to inflation, but over half of it was organic volume growth. Earnings in the first half of 2022 benefited from a moderately lower tax rate than normal. With earnings leverage (discussed below) I believe a 7%+ profit margin is sustainable.

The balance sheet is strong. As of June 30, 2022, tangible net worth was $283 million, versus interest-bearing debt of $78 million. Working capital was $187 million on that date. The company has enough balance sheet strength to make acquisitions and hold extra inventory if needed. PLPC has historically done both, though the acquisitions tend to be small. It purposely holds extra inventory as a competitive edge to supply utilities in weather or fire emergencies.

PLPC is a very stable, strong and steady company which is well positioned in an industry entering a significant secular growth phase.

Catalysts and Strengths

PLPC has a number of catalysts and strengths that should lead to a sustained higher level of growth and earnings than in recent years.

1. Secular Power Grid Growth – This was covered earlier in this article and in more detail in my earlier article about the power grid. It is no fluke that revenue growth is suddenly picking up.

2. Earnings leverage – The company has the infrastructure in place to grow earnings faster than revenues. There is significant excess capacity internationally.

3. Real Estate – The company owns most of its factories. The gross book value of real estate was $118 million on June 30, 2022. While some were originally built long ago, there have been numerous additions over the years. There is a $15 million U.S. expansion going on right now. This is a large potential source of cash either through a sale leaseback or borrowing if needed.

4. Stability– PLPC has a strong balance sheet and a long history of growth. The customer base is diverse and strong. Utilities tend to be less cyclical and much less bankruptcy prone. The strong balance sheet allows it to accommodate customers in emergencies by keeping extra inventory.

5. Lower imports – PLPC tries to build in the country it is selling in. It also doesn’t use a lot of parts that need to be imported. That has resulted in less supply chain issues than the average manufacturer.

6. 5G – Recent growth is not just in the largest power segment. Sales to the second largest segment (communications) are actually growing faster than power right now. I attribute this to the 5G buildout being ahead of the EV buildout.

7. Climate bill – The Senate just passed a $369 billion climate bill known as the Inflation Reduction Act to reduce greenhouse gases by 40 percent below 2005 levels by 2030. It includes tens of billions to expand solar and wind power and for EV rebates to increase EV sales. This will only quicken the need for PLPC’s parts.

Concerns

There is currently little investor contact. The company holds no earnings calls and doesn’t attend investor conferences. There is no stock analyst coverage despite being larger than many companies with several analysts. It has been an insular family-controlled company that focuses on the long term, not quarter to quarter. However, the company isn’t entirely shareholder unfriendly. When I called the company, CFO Andrew Klaus called me back the same day. He is interested in reaching out more. PLPC does pay a modest dividend. It is also buying back stock. Stock buybacks totaled $1.8 million in the first half of 2022, $5.2 million in 2021, and $9.5 million in 2020. I believe being closely held and limited investor contact is the biggest weight on the stock.

The stock is relatively thinly traded. The average volume is currently 14,179 per day. Though at a closing price of $70.86 on August 8, 2022, that is about $1 million in trades per day. That volume is more than enough for most individual investors but not for many institutional investors. As of March 31, 2022, Royce & Associates was the only actively managed institutional investor owning over 5% at 5.2%. This may become a tailwind in the future as PLPC continues to grow and attract institutions.

Management compensation is high for a company this size. Total compensation for CEO Ruhlman has averaged $5 million over the last 3 years. About half of that is in stock.

Valuation

What is a company with a strong balance sheet, solid profit margin, and accelerating growth worth? It should be worth above the market average if the company wasn’t closely held and had limited investor contact. The average P/E ratio for the S&P 500 is 21 right now.

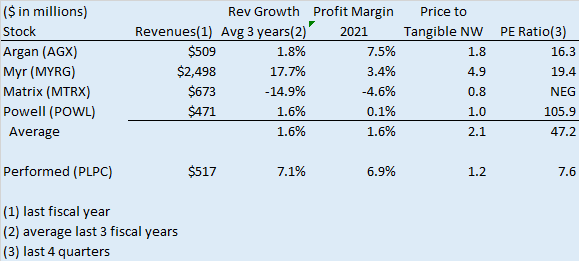

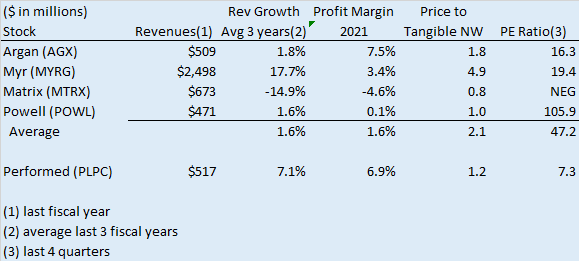

The chart below shows 4 peers who also primarily serve the power grid.

Value Line, SEC forms 10-K and Yahoo Finance

Argan, Myr Group and Matrix are all contractors primarily serving power transmission and distribution. Powell is a manufacturer like PLPC. Argan’s recent growth is greater than the number above appears as it is coming back up after several years of declining revenues. Both Matrix and Powell have been weak performers and serve only to show a bottom end. The average P/E ratio of Myr and Argan is about 18. That is slightly below the current S&P 500 P/E ratio of 21, mentioned earlier. I recommended Myr in my article about the power grid last year. I still like them but believe PLPC is a better value.

PLPC earned $9.19 in the last four quarters and closed at $67.45 on August 9, 2022 for a P/E ratio of 7.3. Compared to Argan and Myr, it should trade at a moderate discount due to being family controlled with limited shareholder contact. Otherwise, it compares better than Argan and just below Myr. PLPC had a historical revenue growth rate of 7.1% the last three years. But growth is picking up and I believe they can average 10% or more going forward. Based on the above I believe it should trade at a P/E ratio of 15 which is $138. That is just over double the current price.

Takeaway

Investors have not picked up on the secular change in PLPC’s market and its recent surge in growth. Perhaps it’s because its industry has historically seen slow and steady growth. Some of that surge is pricing to offset inflation, but the majority appears sustainable volume. The stock is ridiculously cheap trading at 1/3 the market average. This is despite having a strong balance sheet, solid profit margin, and surging growth in a growing industry. I recommend a long position in PLPC.

Be the first to comment