jetcityimage

While fintechs have rebounded sharply in the last few weeks, Block (NYSE:SQ) still trades below the levels where the stock traded back in 2018 due to bitcoin hampered results. The company actually reported a very solid quarter, but the market just isn’t capable of getting past the headline weak revenue numbers due to the collapse in the low margin bitcoin transaction revenues. My investment thesis is far more Bullish on the stock while the market is distracted by misleading numbers.

Focus On Gross Profits

Technically, Block reported Q2’22 revenues fell 6%. Not many fintechs are reporting such weak revenue metrics. PayPal (PYPL) surged after reporting revenues grew 9% and a stock buyback combined with activist involvement were positive signs for the business.

PayPal wouldn’t have rallied on a report where sales fell. Though, smart investors in Block wouldn’t even pay attention to the topline metric used by investors in most stocks.

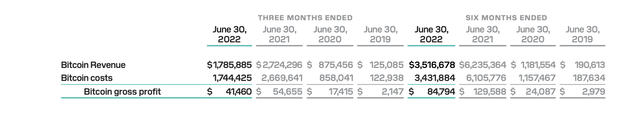

For Q2’22, Block reported bitcoin revenues dived nearly $1 billion from last Q2. Similar to last year, the bitcoin revenues only generated ~$41 million in gross profits in the June quarter. The stock would perform much better without these volatile numbers in the quarterly earnings report.

Source: Block Q2’22 Shareholder Letter

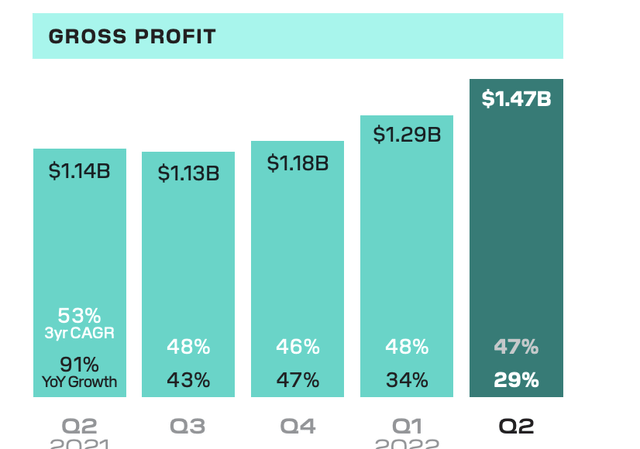

What ultimately matters for Block are the net revenues or the gross profits. The net revenues eliminate the bitcoin passthrough revenues and transaction-based costs for Square transactions. The gross profits naturally subtract these costs and other costs of revenues with these profits growing 29% to reach $1.47 billion.

Source: Block Q2’22 Shareholder Letter

Excluding the BNPL platform, Block reported gross profits increased by 16%. Either way one wants to dice the numbers, the fintech reported a solid quarter. The bitcoin trading platform helps build the financial ecosystem of Square, specially Cash App users, but the numbers convolute the quarterly results.

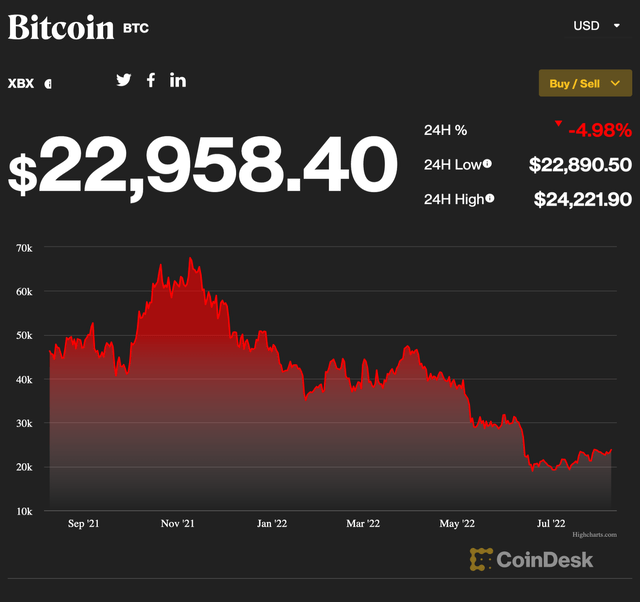

On the flip side here, the stock will likely get a boost as bitcoin revenues rebound. The bitcoin price has already rallied back to nearly $23K. Prices hit a low in mid-June below $19k and Block could quickly see revenues rebound.

The BNPL product hasn’t been a great investment product. Block still claims Afterpay will help convert more sales with customers transacting 3x more than single channel customers in 2021. The only problem with 2021 data is that BNPL became a fad during the period.

The combination here along with general growth in the Square and Cash App ecosystems will continue driving growth in the business. Bitcoin doesn’t move the needle for the business, but the cryptocurrency rebound will drive the needle on revenues boosting investor confidence.

Buy The Dips

The stock trades at the levels originally seen back in 2018 similar to a lot of covid pull forward stories. Block is now on the pace to generate $6.0 billion in annual gross profits while the stock valuation has dipped to a market cap of $51 billion.

Block trades far below 10x gross profits here. The company guided to Square ecosystem GPV up 18% in July in another strong indication of strong growth ahead for the mobile payments firm.

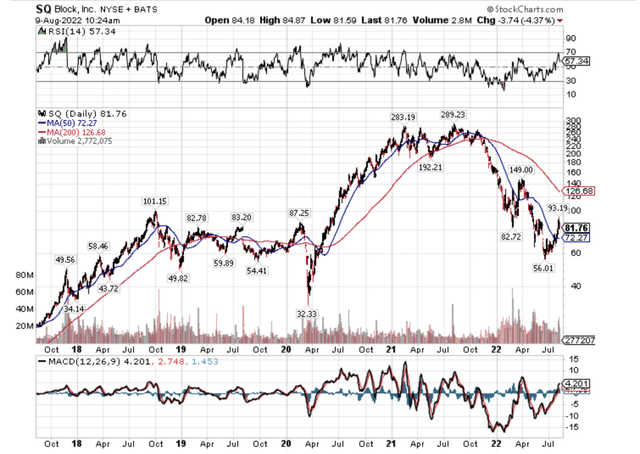

The old Square has been historically one of the most volatile trading stocks on the market. Due to the focus on investing for aggressive growth, the stock had made plenty of big runs and corresponding collapses in the past.

Block reached $100 all the way back in late 2018 when former CFO Sarah Friar left to become the CEO of Nextdoor Holdings (KIND). The stock collapsed to $32 due to covid to only soar to nearly $290 in the next year. Block fell to $56 recently leaving the stock at the recent lows 50% below the 2018 peak.

The biggest problem facing Block shareholders is the limited profits. Analysts forecast the stock as only earning $1.57 per share next year. Block is back to trading at 55x 2023 EPS estimates without the revenue growth to warrant such a valuation.

For Q2’22, Block reported the following non-GAAP operating expenses:

- R&D – $312 million

- S&M – $504 million

- G&A – $313 million

- Total – $1.1 billion

The fintech only had a gross profit of $1.5 billion in the quarter. Block spent a whopping 75% of gross profits alone on operating expenses. Going forward, the market will definitely want to see the fintech improve leverage to increase the bottom line. The company can’t really justify needing to aggressively grow spending from the above quarterly levels.

Takeaway

The key investor takeaway is that Block reported a far better quarter than suggested the headlines. Historically, the stock has been a strong buy after being beaten down. An investor will definitely want Block to start producing strong leverage in the business due to the aggressive spending levels, but the stock will probably just rally again based on a rebound in bitcoin revenues.

Be the first to comment