Justin Sullivan

Thesis

SoFi Technologies, Inc.’s (NASDAQ:SOFI) post-earnings surge and selloff demonstrated that the bears remained firmly in charge. We have also highlighted several times to investors not to chase momentum surges in SOFI.

Astute bearish investors have used such surges with relative success over the past year to ensnare unsuspecting SOFI bulls. It has been so predictable that they repeated the “trick” from SOFI’s post-Q2 surge/digestion (which we highlighted in August).

With SOFI’s short-interest percentage of float at more than 10% (below August’s 14%), we postulate the bears have not given up. Moreover, these short-sellers are likely sitting on significant gains from betting against SOFI over the past year, as it collapsed nearly 68% YTD on a total return basis. Hence, SOFI bulls must be very cautious in selecting their entry zone as SOFI remains an unprofitable company on GAAP or adjusted EPS terms.

With the significant pullback (down 21% from this week’s highs) as the Fed remains hawkish, the bears had a field day. However, the bears have also tended to lose momentum as SOFI closes in on its near-term support.

Maintain Speculative Buy, with a reduced price target (PT) of $6 for now.

Jerome Powell Fed The Bears

Fed Chair Jerome Powell was unequivocal as he stated that the Fed’s terminal rate needs to be revised upward from its previous expectations. However, we would likely only know the Fed’s projections in the December FOMC meeting as the Fed parses more economic data releases, with October’s CPI print due on November 10.

Therefore, the market has attempted to price in Powell and his team’s increasingly hawkish cadence by lifting forward terminal Fed Fund rates (FFR) to 5.1%, seeing upside risks to the Fed’s previous 4.6% median projections.

Does it matter to SoFi? Of course. As a lender, while it has benefited from higher net interest income due to the rate hikes, it will also increase credit risks, behooving SoFi to set aside higher provisions for credit losses.

Notably, it will likely continue to impact its home refinancing business, even as originations growth in personal loans has continued to slow. Hence, the de-rating by the market is justified, as it needed to de-risk SoFi’s Q4 execution risks after management raised guidance.

SoFi’s Raised Guidance Is Not Followed Through By The Market

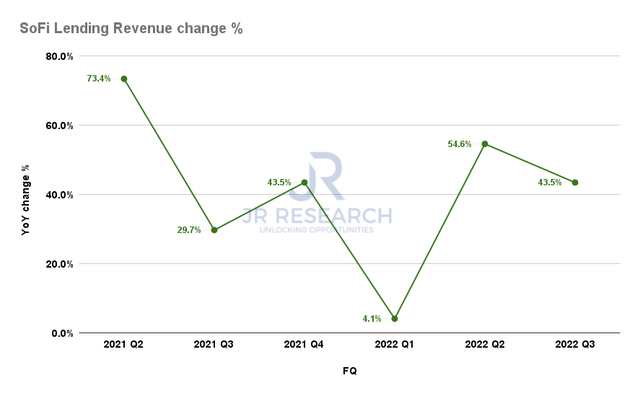

SoFi Lending revenue change % (Company filings)

Lending revenue grew by 43.5%, which came in below its corporate average of more than 50% growth in its adjusted net revenue for Q3. Therefore, the malaise in SoFi’s housing and student loans segment has continued to impact the momentum in its personal loan segment.

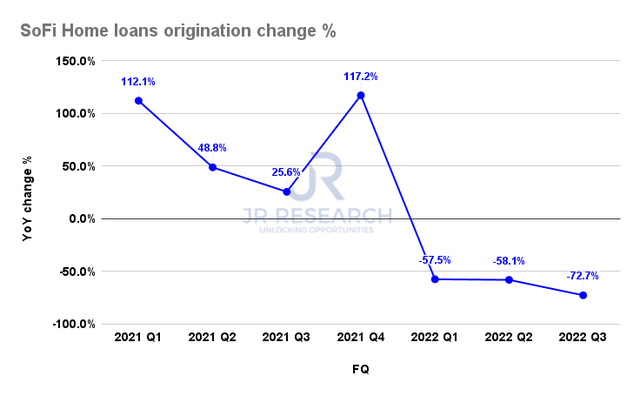

SoFi Home loans origination change % (Company filings)

Accordingly, home loan origination fell by 72.7% YoY, down from Q1’s 58% decline. We believe this segment will continue to drag down SoFi’s recovery over the next few quarters as the housing market undergoes its correction phase. In addition, with the Fed rate hikes pressing on further, SoFi needs to rely increasingly on the strength of its personal loans segment to drive profitability growth.

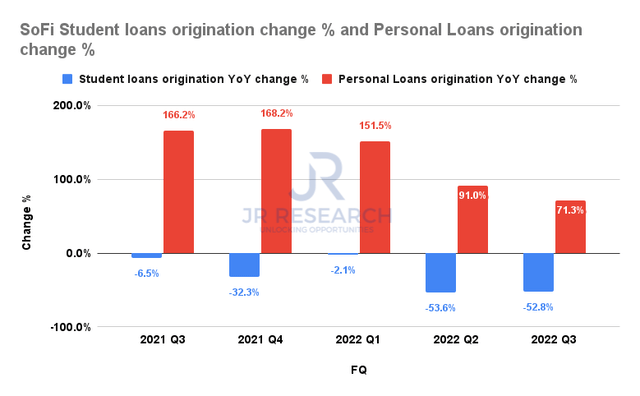

SoFi Student origination change % and Personal loans origination change % (Company filings)

However, the growth of personal loans (71.3%) has continued to slow from Q2’s 91% uptick. As such, the market could have reflected increased risks to SoFi’s upgraded FY22 guidance as the Fed goes on the offensive.

Fighting the Fed has been increasingly arduous for equity bulls all year. While we are getting closer to the end of the tunnel, a near-term re-rating on SOFI is looking increasingly unlikely.

Is SOFI Stock A Buy, Sell, Or Hold?

SoFi remains unprofitable on GAAP or adjusted EPS terms. Hence, valuing it can be highly challenging. It suggests why SOFI can move more than 20% within a week, as the bulls and bears jostle for dominance.

For now, the bears retain the upper hand, with the bulls unable to force a decisive covering rally, leading to a sustained reversal in trend.

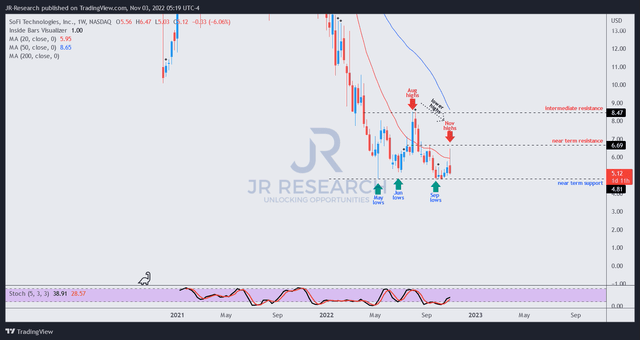

SOFI price chart (weekly) (TradingView)

The bears have followed yet another scripted move to demolish the bulls who kept thinking this is it.

As seen above, SOFI’s post-Q2 surge in August was astutely rejected at its highs before the bears digested it through its September lows. SOFI’s November highs saw yet another familiar move, with bulls thinking they could finally reclaim their mojo.

However, it only led to a significant rejection of its momentum spike, digesting all its post-earnings gains completely. It was a nasty reversal, but we think SOFI’s near-term support should hold.

The bears are not dumb. They know where those support zones are and can see it too. SOFI’s volatility has allowed them to profit at the expense of the bulls, but they ultimately need to cover to realize their profits.

We believe the logical point for the bears to cover remains at SOFI’s near-term support. So SOFI bulls can consider entry levels close to that zone to add/initiate exposure.

Remember, don’t chase! Let SOFI come to you. Don’t get slaughtered by the bears.

Maintain Speculative Buy.

Be the first to comment