Darren415

This article was first released to Systematic Income subscribers and free trials on July 24.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of July.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

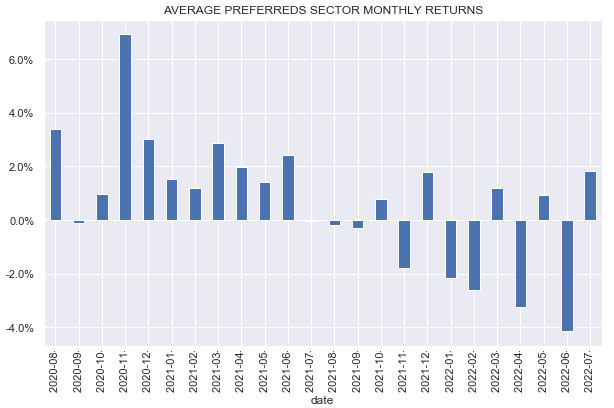

Preferreds enjoyed a strong week, along with the rest of the income space. The rally in Treasuries, stocks and a tightening in credit spreads have all helped the sector. 30Y Treasury yields have come back down to 3% after peaking recently at 3.45%.

Longer-duration / higher-quality sectors like Banks and Insurance outperformed in July so far on the back of a sharp drop in Treasury yields and credit spreads. July has so far retraced about half the loss the market saw in June.

Systematic Income

Market Themes

Most preferreds are now trading well below $25 which, from an economic perspective, implies very little chance of redemption. Recall that issuers often redeem preferreds when they trade at or above $25 because the market is sending a message to the issuer that we will buy your preferred at a lower coupon than its current level. Issuers then redeem the higher-coupon preferred and issue at a lower coupon, saving on financing costs.

When preferreds trade below $25 this is in reverse – an issuer who refinances the preferred will have to pay a higher coupon which is why preferreds will remain outstanding past their first call date.

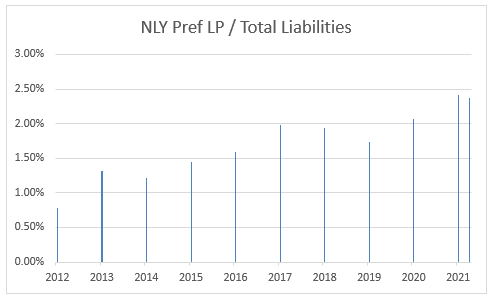

However, sometimes an issuer may want to redeem the preferred without issuing a new one in its place. For example, many mREIT book values have fallen significantly in the last few quarters. This has required the companies to also lower their outstanding repo borrowings. However, as the size of their preferreds has not adjusted as quickly this means that the size of the preferreds relative to repo has increased – see the chart below for NLY. This has raised the overall financing cost of mREITs, lowering their net income (repo is still cheap at around 2% which is miles below the preferreds coupons).

Systematic Income

What this suggests is that some mREITs may actually want to redeem their preferreds outright.

Readers may recall that this actually happened with (TWO) a while back which redeemed two preferreds in one go which were trading below $25. This was because TWO had a sharp drop in its book value and outstanding repo in 2020 as it unwound its entire non-agency portfolio.

If this is right, we could see some windfall redemptions this year – perhaps in (AGNCN) or (NLY.PF). To be clear we are not forecasting these redemptions as we still consider this likelihood to be fairly low, but we wouldn’t be surprised if it happens. These two preferreds are worth holding for other reasons – despite the recent tumble in book values their equity coverage is still quite high while agency MBS valuations are on the cheaper side. This should help support book values going forward. These two preferreds will also switch to floating rates in a few months which will significantly raise their stripped yields.

Market Commentary

Mortgage REIT Ellington Financial (EFC) has released a preliminary NAV of $16.22 – a 8.5% drop from Q1. This is a big move for EFC. It has tended to be pretty resilient – its Q1 NAV drop was only 3.5% when other mREITs showed double digits falls.

The key factor here is that EFC is more of a credit-oriented mREIT and credit spreads have widened sharply over Q2 which is what has likely driven the drop. This is why Q2 may end up being a bad quarter for both agency and credit mREITs. Going forward the key driver of book value for credit mREITs will be whether delinquencies increase significantly and this seems unlikely, at least for Q2, given the strength of the labor market and a sharp uptick in housing equity given what’s happened to house prices.

Elsewhere, New Residential REIT (NRZ) is internalizing (getting rid of an external manager and bringing management in-house) and rebranding as Rithm Capital (RITM) – preferred tickers will be updated as well. The company will pay its manager FIG LLC $400m while saving $60-65m per year – a breakeven of around 6 years. Most BDCs and mREITs are externally-managed. The idea of bringing management in-house is meant to save on costs and, potentially, to improve performance as, arguably, the interests of internal management are more fully aligned with the performance of the company. Some external managers have proved disappointing – TWO, notably, fired (and sued) their external managers and brought everything in-house. For other companies like Ares for example, external management seems more of a formality since everyone works for the same broader umbrella organization anyway.

Be the first to comment