ljubaphoto

By Gargi Pal Chaudhuri

Transcript

This year, the Federal Reserve raised interest rates for the first time since 2018.

But what do these rate hikes mean for investors and the broader market? Let’s talk about it.

Factors such as worker shortages, rising wages, and supply chain woes pushed inflation to a 40-year high. People have felt it in the price of everything from a dozen eggs to a gallon of gas. Raising interest rates is one way the Federal Reserve fights inflation.

At their core, these rate increases make it more expensive to borrow money, whether it’s for a home, car, or personal business loan.

Making loans more expensive may encourage people and businesses to be more selective in their spending and investments.

This can help bring down prices and combat inflation, but it can also mean economic growth may slow down, which can contribute to market volatility.

While the Federal Reserve manages this balancing act, investors can consider a rebalancing of their own.

Investors might consider dedicating a portion of their portfolios to quality companies, those with stable cashflows and higher profit margins that can absorb or pass on higher prices.

To prepare for a potential slowdown in the economy, investors might want to also consider Minimum Volatility ETFs such as iShares MSCI USA Min Vol Factor ETF (USMV).

Most importantly, remember that market dips and spikes are part of normal, long-term cycles. And these small, progressive steps may be a possible solution to help investors – and the market itself – return to normal in the long run.

Key Takeaways

- The U.S. economy has slowed for two consecutive quarters, does that mean we’re already in a recession?

- Our Recession Monitor is flashing pink in two of its five categories. That’s cause for concern, but not necessarily indicative of imminent recession.

- The risks of recession are rising as U.S. economic data softens. Slowing periods of growth could favor fixed-income, value stocks, and minimum volatility strategies.

The economy shrank 0.9% in the second quarter vs. the prior year, the second consecutive drop in quarterly U.S. GDP. So, are we in a recession?

We think the answer is ‘not yet’. Our own recession deck (see below) shows 2 of 5 indicators are flashing pink; but not all 5. Still, the risks of a recession have risen as U.S. economic data is softening.

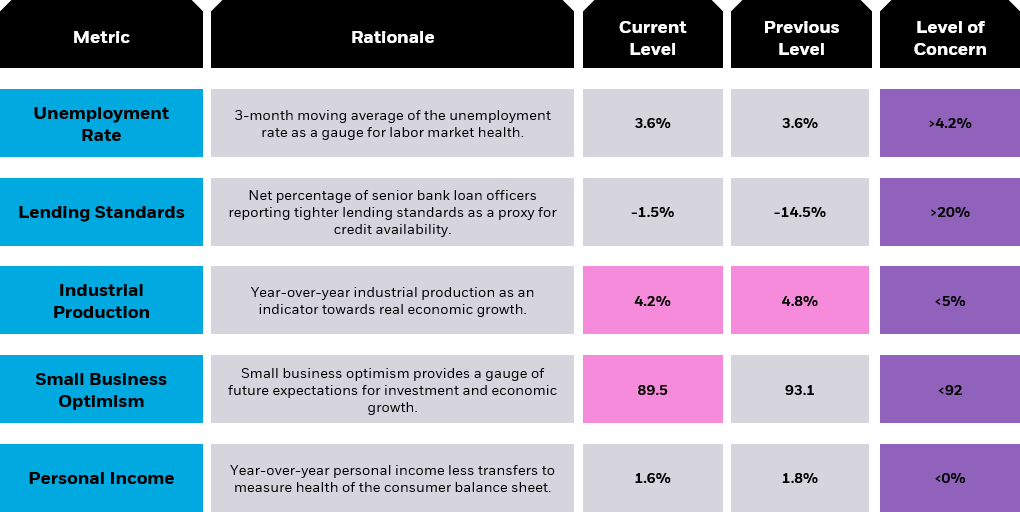

BlackRock Recession Monitor: Signs of Weakness, But Not Recession (Yet)

Chart showing BlackRock’s recession monitor, which is currently flashing “pink” on two of its five categories, suggesting recession risks are rising but not imminent. (BlackRock, Bloomberg. As of July 20, 2022. Metrics, rationale, and levels of concern are determined by iShares Investment Strategy research and analytics. Level of concern is generally determined using historical recession levels, on average. For illustrative purposes only.)

Consistent with the advanced second quarter GDP report, our recession monitor flashes pink for corporate health, but shows a strong consumer and still fairly easy credit conditions. Economic indicators such as real income, spending, and the labor market are certainly not yet showing the broad-based decline historically associated with a recession.

That said, second quarter GDP fell 0.9%, well below expectations of a modest rise, following a 1.6% decline in the first quarter. Drivers of the second quarter drop were:1

- A plunge in inventory investments as retailers are sitting on unsold goods. (Earlier this week, the world’s-largest retailer said they are reducing prices across discretionary goods as inventories increase.)2

- A decline in residential investment given less home building

- A drop in non-residential structure investment, showing that office segments continue to struggle with expansion plans – especially in a stalling growth environment.

The Federal Reserve acknowledged the slowdown Wednesday – “real indicators of spending and production have softened,” the FOMC’s policy statement said – even as it issued another 75-basis point rate hike.

What Is A Recession, Anyway?

Although “two consecutive negative quarters” is commonly used, ultimately, there isn’t one best definition of a recession. There are different ways to measure economic activity and the rules-based “consecutive negative quarters” approach can miss nuances. The National Bureau of Economic Research (NBER) is the official arbiter of U.S. recessions; the NBER uses a qualitative approach, which is more subjective.

We are currently in such an atypical cycle that we are more inclined to favor a qualitative approach to a recession call, be it the NBER’s or our own recession monitor. That’s especially relevant today as first cuts of GDP often get revised, something Fed Chairman Jay Powell stressed in a press conference after the Fed’s rate hike.

In this environment, we think it is important to remain invested in the markets but recognize that volatility may remain higher, as detailed in the iShares Mid-Year 2022 Investor Guide.

Ultimately, we believe the Federal Reserve – which has raised the target Fed Funds rate from 0-0.25% in the start of 2022 to 2.25-2.5% now – will need to slow their pace of rate hikes if economic activity continues to stall. The market is currently pricing in for rates to rise to over 3% by the end of 2022 before moving lower in 2023 to support a slowing economy.3

Slowing periods of growth may favor fixed-income allocations; a weakening dollar, which will likely result from a slower pace of rates hikes, may favor emerging market bonds. Within equities, strategies that focus on minimum volatility and companies with healthier balance sheets may fair better than the broader market.

________

© 2022 BlackRock, Inc. All rights reserved.

1 Source: BlackRock, U.S. Bureau of Economic Analysis, Advanced Estimate 2Q GDP Report, July 28, 2022.

2 Source: Walmart Inc. Provides Update for Second Quarter and Fiscal Year 2023, July 25, 2022.

3 Source: CME Group FedWatch Tool, as of July 28, 2022.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0722U/S-2318875

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment