krblokhin

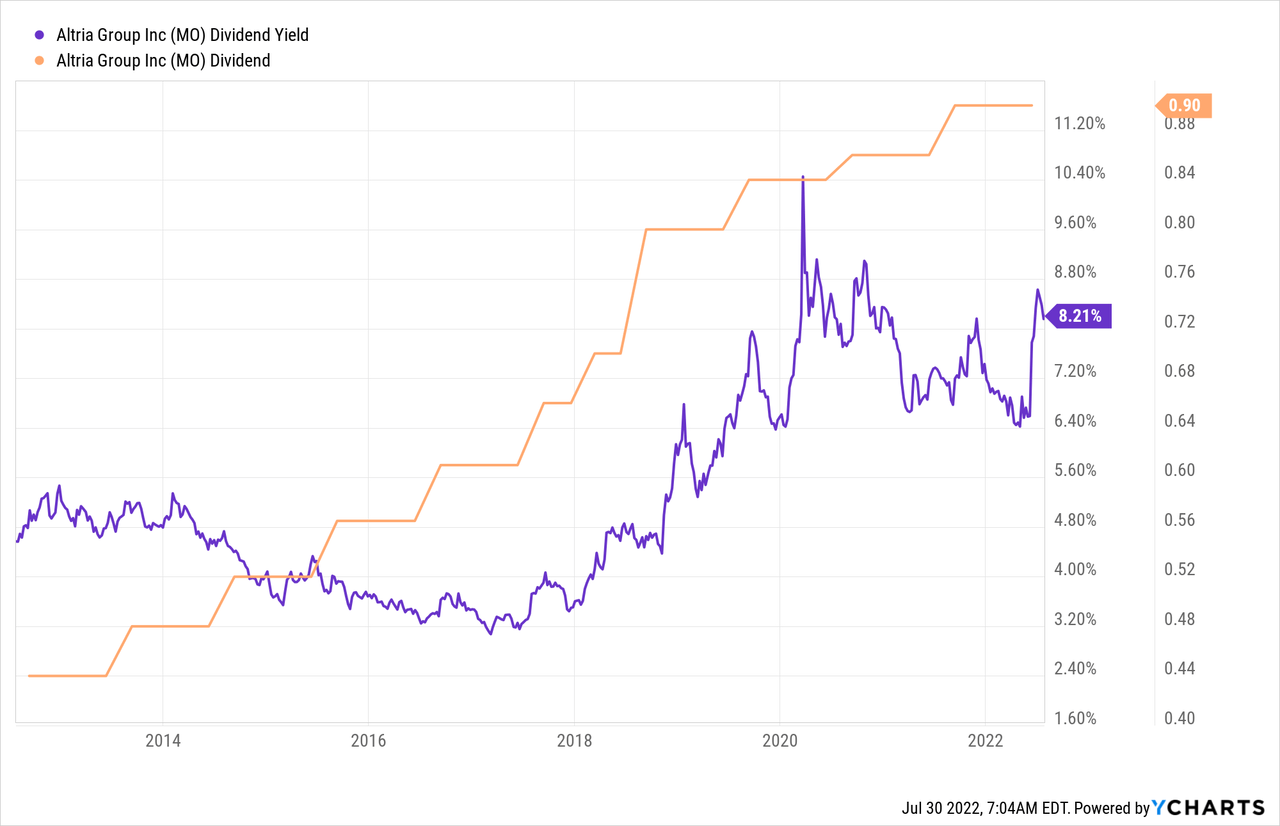

Altria Group (NYSE:MO) wrote down the value of its equity investment in JUUL in the second quarter due to a lower expected recoverable value after the FDA banned JUUL’s e-cigarettes in June. The FDA later stayed its ban in July, and Altria is appealing the ban in the court system. Additionally, inflation has started to make a negative impact on the industry’s shipments which puts new pressure on Altria’s top line growth. Despite those challenges, I believe the risk profile for Altria investors is favorable due the firm’s covered 8.2% dividend and cheap valuation!

Major development regarding JUUL

The U.S. Food and Drug Administration (FDA) issued a ban on JUUL’s e-cigarettes in June which set off a major revaluation in Altria’s shares. Altria has a 35% ownership interest in JUUL which has become a popular vape brand with younger smokers. Because of the FDA’s e-cigarette ban, which the regulator suspended in July, Altria had to write down the value of its equity investment in JUUL in the second quarter.

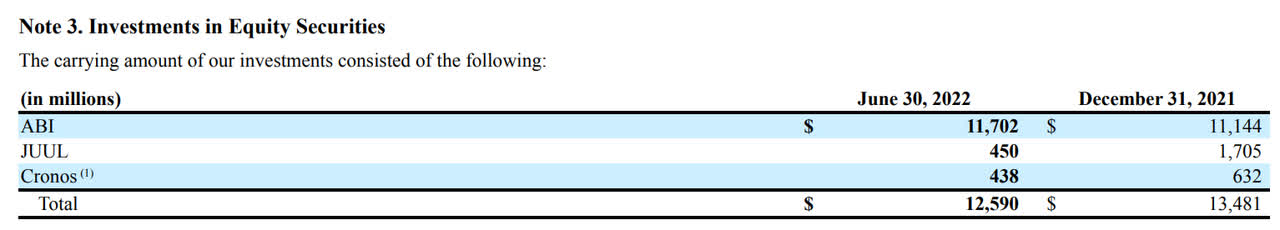

At the end of Q1’22, Altria valued its equity interest in JUUL at $1.61B, but the tobacco firm has now written down the value by $1.26B to just $450M. When Altria acquired its 35% equity ownership, the tobacco company paid $12.8B. Since then, JUUL’s investment value on Altria’s books has declined 96%.

Altria: Q2’22 Equity Investments

My opinion on the FDA’s June decision is that a complete ban of JUUL’s e-cigarettes is highly unlikely, chiefly because other tobacco products are freely available for purchase in the market, including tobacco products that are arguably more harmful than vaping products.

Inflation and long-term consumer trends pose a challenge for Altria

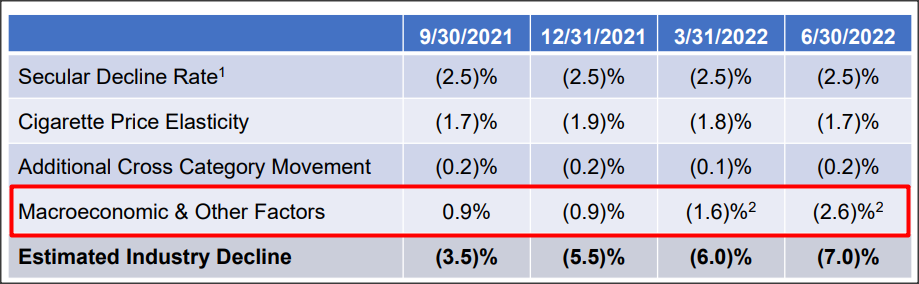

Inflation is starting to make an impact on the cigarette industry: the rise in consumer prices in 2022 is estimated to have contributed 2.6 PP to the industry’s 7.0% volume decline in the last twelve months. With inflation soaring, smokers are cutting back on consumption which poses a challenge to Altria as well as the broader industry. Macroeconomic factors are now the biggest factor explaining declines in industry volume while secular declines (decreasing share of smokers) was the key driver of contracting volumes earlier.

Altria: Industry Decline LTM

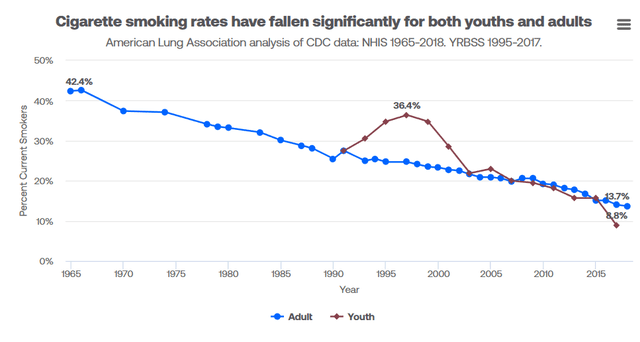

The declining share of tobacco consumers continues to pose a long-term challenge for Altria. The share of smokers has declined since the 1960s which is why new product categories like e-cigarettes and nicotine pouches are seen as an important growth driver for the industry.

www.lung.org: Trends in Cigarette Smoking Rates

Confirmed guidance for FY 2022

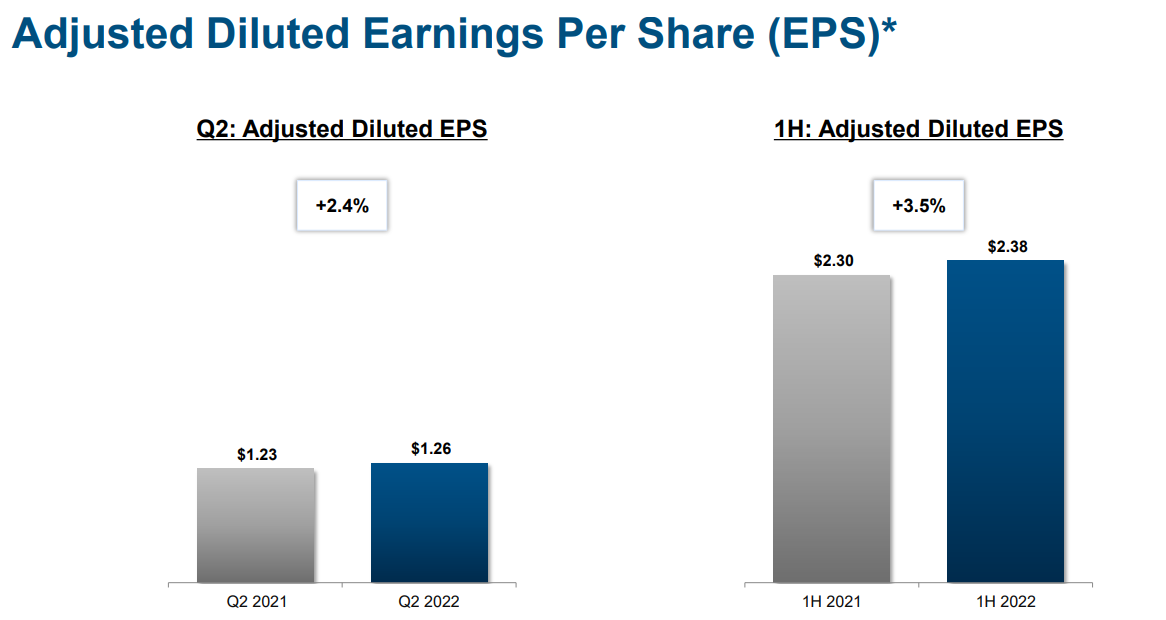

Altria confirmed its guidance of adjusted EPS of $4.79-4.93 for FY 2022, implying 4-7% earnings growth year over year. The impairment of JUUL does not affect Altria’s guidance.

Altria targets a long-term 80%-payout ratio based off of adjusted earnings, although the historical payout ratio has consistently been lower than this. For that reason, adjusted EPS should also be used as a guideline to determine how safe Altria’s dividend is. In the first six months of the year, Altria generated adjusted EPS of $2.38, showing 3.5% growth over the comparable period last year. Based on H1’22 adjusted EPS and an 80% payout ratio, Altria could have paid up to $1.90 per-share in dividends… which is 10 cents more than the $1.80 per-share Altria actually paid in the first half of the year.

Altria: Q2’22 And H1’22 Adj. EPS

14% upside plus income

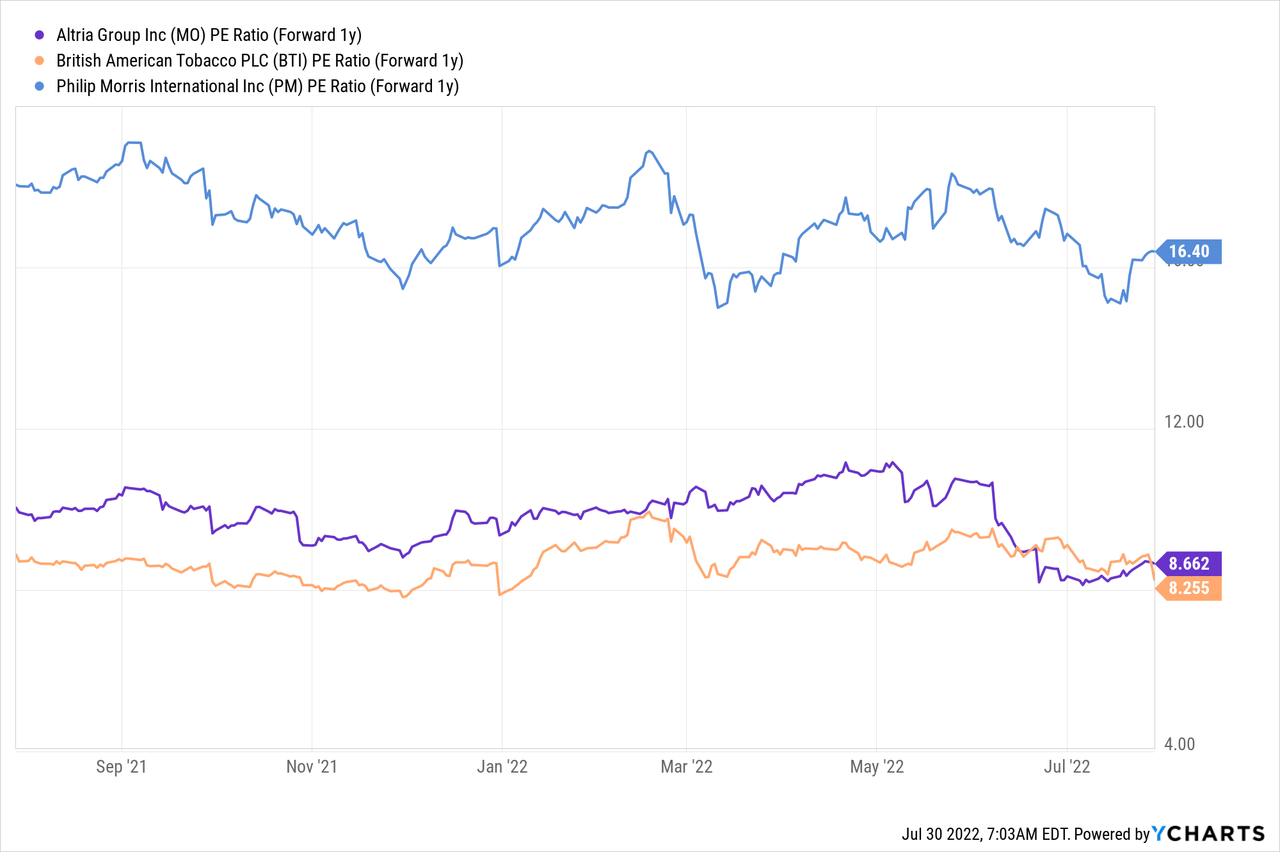

Altria is undervalued with a P-E ratio of 8.7 X, but Altria is not even the cheapest tobacco company currently on sale: British American Tobacco (BTI) is. I like British American Tobacco a lot, chiefly because of its yield and its strong product portfolio in the alternative tobacco category.

Because shares of Altria are still reeling from the proposed FDA ban of JUUL’s e-cigarettes, there is an opportunity to invest before a possible rebound. Now with the near-complete write-down of its JUUL investment out of the way, Altria may be ready for a bounce.

I believe the recovery in Altria’s valuation is just starting and the stock could power higher to around $50 if Altria faces a catalyst, such as securing a legal victory against the FDA. At $50, Altria would have a P-E ratio of 10.1-10.4 X, based off of Altria’s confirmed guidance for FY 2022, and a yield of 7.2%. The current yield remains significantly above the longer term average.

Risks with Altria

Altria’s JUUL investment value has been written down to $450M, but there are still risks associated with the FDA ban. JUUL is a popular vape brand with younger smokers and losing a rapidly growing business in the alternative product category, which has helped Altria compensate for declines in its traditional tobacco business, would constitute a major setback for the company and hurt the stock’s prospects. I would change my opinion on Altria if the firm would guide for weaker adjusted EPS growth or failed to raise its dividend in the second half of the year.

Final thoughts

Altria not only supplies an 8.2% covered yield but the stock also has 14% upside to my estimate of fair value. The FDA ban still weighs on Altria’s valuation and the company has responded by writing down the value of its JUUL investment to next to nothing (relative to the $12.8B purchase price). Yet, the dividend is attractive, FY 2022 guidance has been confirmed and Altria’s stock remains cheap!

Be the first to comment