Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 16.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of October.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

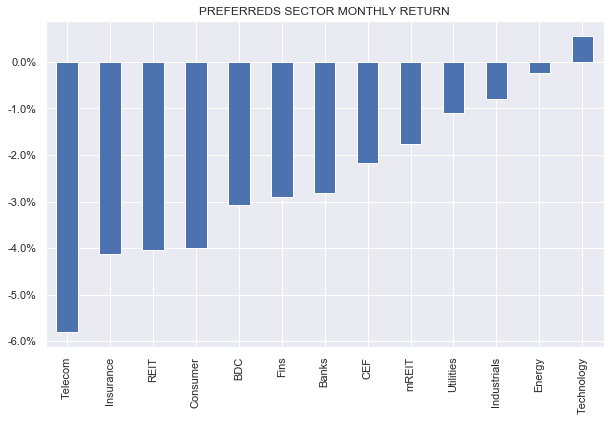

Preferreds struggled this week, as Treasury yields rose across the yield curve. Month-to-date only the Tech sector is in the green. It was the fifth down week in a row for preferreds and 8th down out of the last 9 weeks.

Systematic Income

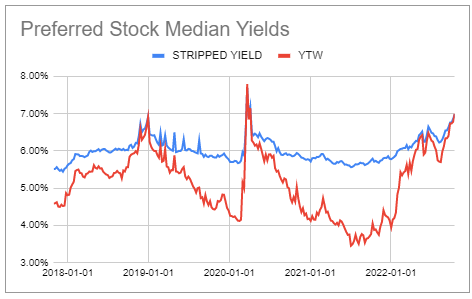

The broader preferreds space is now trading at a 7% yield, which has been exceeded by only a handful of days during the COVID crash. Even the higher-quality banks space is trading at yields of around 6.5%.

Systematic Income Preferreds Tool

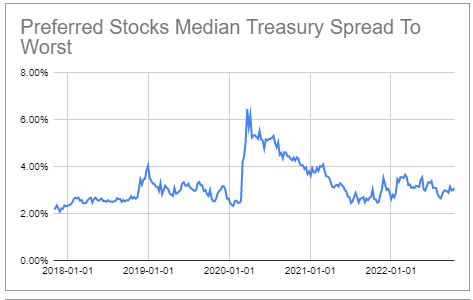

What’s different between now and the COVID period is that the preferreds credit spreads are still very well behaved. We don’t expect spreads to widen to their COVID levels given the humdrum, rather than existential, nature of the likely coming recession.

Systematic Income Preferreds Tool

Market Themes

It’s unusual to see preferreds redemptions in a difficult market environment. This is because on redemption the issuer will typically want to refinance the preferred since few have spare cash lying around. When markets are difficult issuers will have to pay higher yields on redemptions (the other side of the coin of preferreds stocks trading below “par”) and this keeps most preferred outstanding.

However, what’s interesting about the current market environment is that the yield curve is inverted and is expected to get even more inverted as short-term rates continue to rise. For example, while the Fed Funds rate (and by extension SOFR / 3M Libor) is expected to rise to 4.5-5% while 5-10Y Treasury yields are at 4-4.2%.

Recent redemptions of floating-rate preferreds suggests it is likely this dynamic that is behind redemptions. Many investors think that issuers are naturally incentivized to redeem floating-rate preferreds in a period of rising short-term rates because their interest cost rises however this is not correct, particularly for financial institutions. This is because higher cost of preferreds does not necessarily lower a bank’s net income as it has floating-rate assets, e.g., corporate loans whose income also increases. A redemption would also normally require a refinancing. In a normal market environment a company that wanted to refinance a floating-rate preferred with a fixed-rate alternative would have to pay a significantly higher coupon as yield curves are usually upward sloping. However, in an inverted yield curve environment a refinancing can make sense as it can lead to a lower coupon. Moreover, it can make sense in an environment where short-term rates are expected to remain elevated.

Over the last few weeks we have seen a number of floating-rate preferreds redemptions. One was in the retail PNC.PP and there were three institutional redemptions from Schwab and two JPMorgan, all based on the 3M Libor base rate.

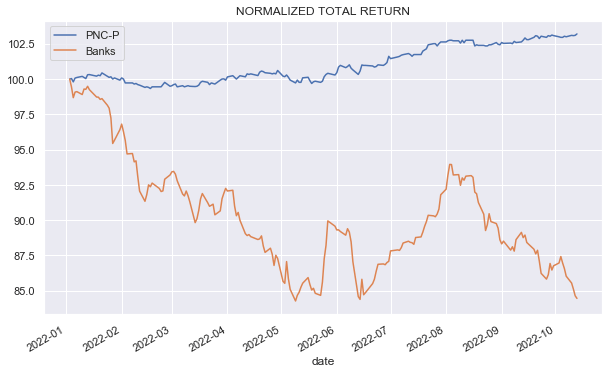

For investors this dynamic is important because the likelihood of redemption can support the price of the given stock as the following chart shows. PNC-P has tended to bob right around $25 while the broader Banks sector, most of which is Fixed-rate has struggled.

Systematic Income

The key takeaway here is that it can make sense to hold some exposure to floating-rate and soon-to-float preferreds as they can remain relatively resilient in the current rising rate environment.

Market Commentary

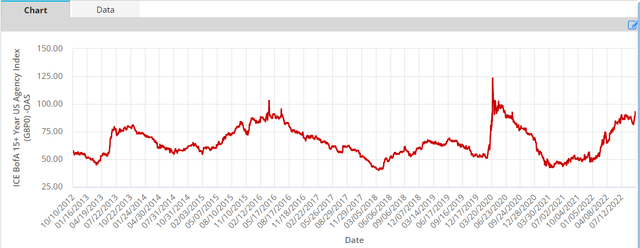

AGNC Investment Corp (AGNC) released book value estimate for Q3 which is expected to be down around 20%. The drop does look high but the direction is not a surprise as agency MBS basis has widened out once again in Q3. It’s currently trading pretty close to its COVID peak and higher than all but only a few weeks over the past decade. It’s hard to know where things will settle down but whenever we get to a valuation that is near historically cheap levels it can make a lot of sense to allocate new capital. AGNC equity / preferred coverage will fall from about 5x to about 4x on the back of the Q3 drop.

Two Harbors (TWO) and Armour Residential (ARR) estimate similar book value drops of around 20%. TWO did announce a buyback of its preferreds, so if they managed to buy some back the equity / preferreds coverage should not see as big a drop. Interestingly, many of the mREITs increased their leverage in response to improved agency valuations. That’s going to be painful for book value since they didn’t do it exactly at the trough but could provide a tailwind in the eventual recovery.

Agency MBS valuations are not far off their decade highs. The 2019 Fed autopilot episode as well as the most recent Bank of England backstop of the gilt market shows that fixed-income markets can struggle in a low-liquidity environment. The risk of a market malfunction is fairly high particularly given the Fed has recently doubled caps for balance sheet runoff so it could be reducing as much as $95bn per month across Treasuries and Agencies. Any serious blow-up will very likely be followed by a pause in QT and, possibly, a financing program for Agencies like the one we saw in March of 2020.

ICE

Stance And Takeaways

We continue to see value across different types of preferreds. Specifically, we like floating-rate preferreds such as mREIT Annaly Series F (NLY.PF) and Valley National Bancorp Series B (VLYPO) as these can remain resilient in the face of rising rates and heightened volatility. For example, 3M Libor has already risen by 0.45% from the last fixing at the end of September for NLY.PF and is expected to be closer to 4.5% meaning the next coupon (i.e. which starts to accrue from end of December) will be equivalent to a yield of 10.8% from 10.3% for the coupon that is accruing now. We also see value in higher-quality preferreds that feature a Fixed coupon over the medium term such as the bank KeyCorp Series H (KEY.PL) which resets to a variable rate in 2027 and currently trades at a 6.47% stripped yield. These preferreds can outperform if Treasury yields stall and fall lower under pressure from the coming recession.

Be the first to comment