stanzi11/iStock via Getty Images

Sun Communities (NYSE:SUI) shares have fallen 44% year-to-date and have significantly underperformed the Vanguard REIT Index/ETF (VNQ). While the price chart of the recent past is indeed ugly, over the past decade. SUI shares have been a massive out-performer versus VNQ as mobile home and RV parks are a fantastic business with favorable long-term supply and demand dynamics. With shares selling at the low end of their historical range, I think it is a great time for a long-term, conservative investor to pick up shares in Sun Communities.

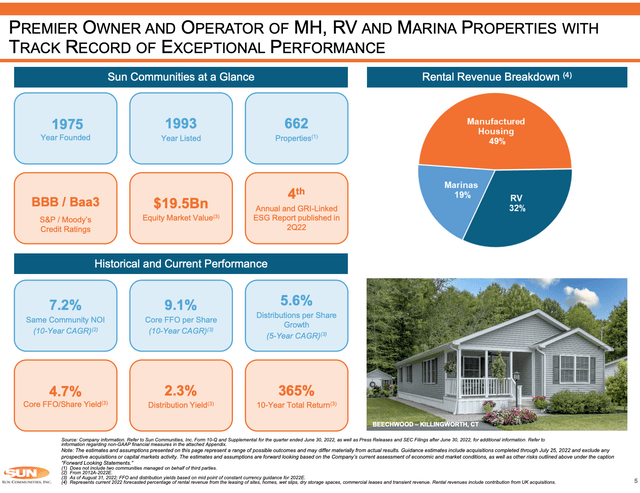

Overview (Sun Communities Investor Presentation)

Supply (or Lack Thereof)

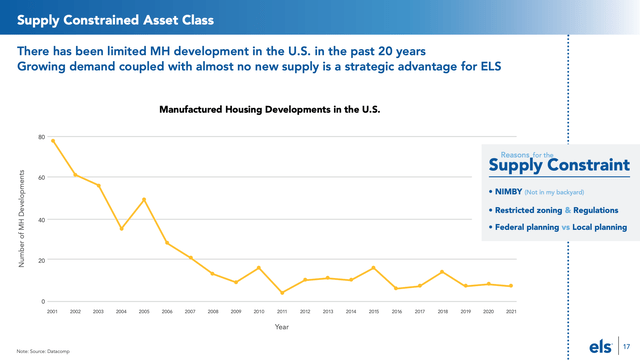

While we have seen a building boom in apartments which is set to hit the market over the next 12-18 months (primarily in sunbelt markets), there has been no boom in the supply of mobile home parks. Mobile home park supply growth is constrained by a couple of factors the main one being NIMBYism (Not In My Back Yard). Home ownership associations near a proposed mobile home/RV park tend to oppose the development because homeowners believe will create blight and negatively impact single family home values.

Very Limited new MH supply (Equity Lifestyles Investor Presentation)

Over long periods of time, supply in the mobile home business has been about flat – while we do see a small number of new mobile home park openings, this is offset by mobile home park closures. Mobile home/RV park closures are generally a result of converting the property to ‘its highest and best use’, for instance redeveloping the property into a community for single family homes or even an industrial park.

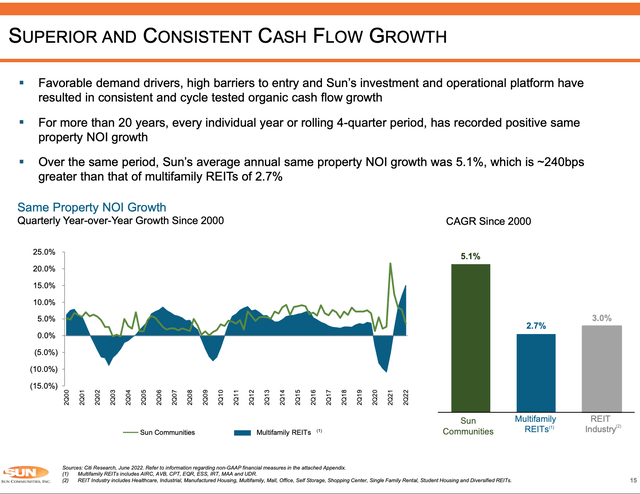

These limitations on supply have helped SUI to produce very steady results as shown below.

Same-store NOI growth through all cycles (Sun Communities Investor Presentation)

Demand

The demand outlook for mobile home park operators is excellent as

1.) Mobile homes are the most affordable form of housing with total monthly costs significantly below renting an apartment or owning a single family home. This is becoming more important as apartment rental rates have soared over the past couple of years while the cost of owning a single family home has risen even more due to the boom in housing prices coupled with surging mortgage rates.

2.) Mobile home park living is favored by folks who are 55 and over (in fact, many of SUI’s properties are age restricted, i.e. 55+ only), a market segment which will grow faster than the overall population over the next 15 years.

3.) There has been an RV boom in the US over the past few years which bodes well for transient occupancy in the company’s RV segment.

Other Things I love about the Mobile Home/RV Park Business

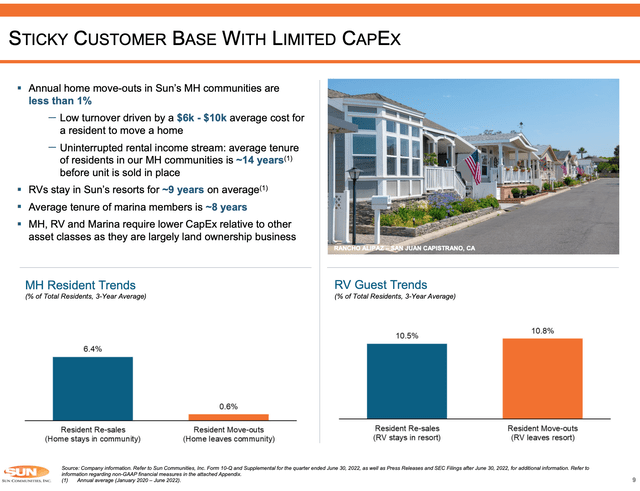

Unlike some real estate asset classes, like office or retail, mobile home/RV parks require very little capital expenditure to maintain. In the vast majority of cases, the tenant (not SUI) owns the structure which sits on SUI’s land. As such, there is very little capital expenditure required to maintain the existing facility (only common areas/recreation facilities).

Low Capex and High Switching Costs (Sun Communities Investor Presentation)

Should the tenant wish to relocate, he/she must move the structure (or, more likely, sell the structure to SUI which will then rent or sell it) which is a fairly expensive ($6,000-$10,000; equivalent to about one year’s site rent). This high switching cost ensures that tenants are much less likely to move due to an increase in rent as evidenced by their 14 year average tenure.

Growth Opportunities

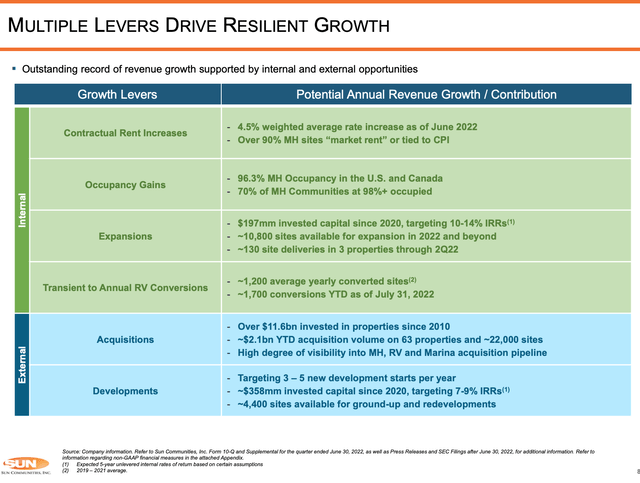

SUI has grown organically (impressively same store NOI has grown at 7% p.a. over the past decade) and through acquiring new properties. In recent years, the company has gone beyond its core US mobile home/RV park business by acquiring a US marinas business as well as a UK mobile home/RV park business.

Growth Opportunities (Sun Communities Investor Presentation)

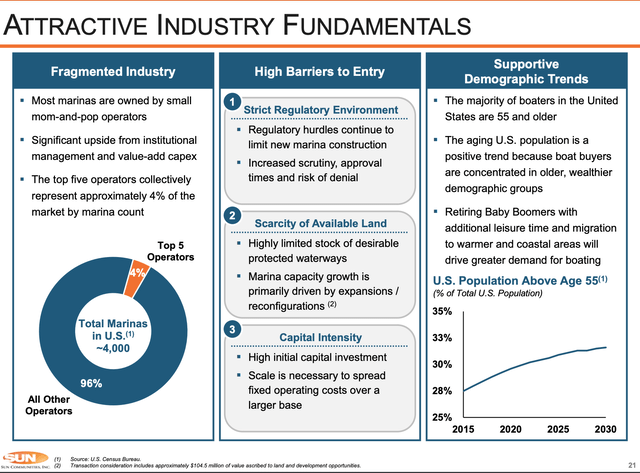

As shown below the Marinas businesses has similar characteristics to the mobile home/RV park business – limited new supply, favorable demand, and high switching costs.

Marina Industry Fundamentals (Sun Communities Investor Presentation)

While the fundamentals of marina ownership are attractive, marinas are generally available at higher cap rates (less competitive market for acquisitions) which should allow SUI another avenue to allow for continued above market growth in FFO/share.

Valuation & Conclusion

After this year’s share price plunge, SUI trades at just 15.5x my estimated 2023 FFO per shares. This is at the low end of where the stock has traded over the past decade (a range of 14.5-29x forward FFO) and well below the valuation of mobile home/RV park peer Equity LifeStyle (ELS).

Interestingly after this year’s decline SUI trades in-line with large cap multifamily REITs whereas historically it has traded at a 10-15% premium (and as I’ve written recently, I find the multifamily REITs to be attractive at today’s prices). I believe that today’s share price represents a compelling entry point for long-term, risk-averse investors. I expect the stock could re-rate to 20-22x FFO (middle of historical range) which would represent 30-40% upside.

Risks

1.) REITs have fallen out of favor in 2022 as interest rates have soared and it is possible that SUI shares may experience further near-term price declines.

2.) While management has a track record of creating value for shareholders via acquisition, it is possible that the company will acquire something which fails to create value for shareholders.

Be the first to comment