NicoElNino/iStock via Getty Images

Company Background

Topicus.com Inc. (OTCPK:TOITF) is the product of a February 2021 spinoff from Topicus B.V. and thereafter listed on the TSX (TSXV:TOI:CA). The company is a serial acquirer of software businesses. TOITF acquires, manages, and builds vertical market software businesses in Europe. The software solutions are usually used by clients to simplify and streamline processes and, therefore, allows TOITF to be implemented within the roots of an organization.

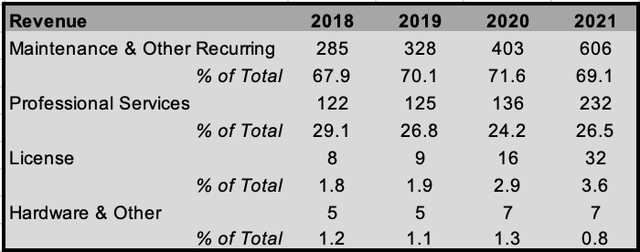

Revenue consists of fees attributed to licenses for software, maintenance, and professional service fees and hardware sales. The Maintenance and other recurring segment accounts for ~70% of total revenue, and consists of fees charged for customer support on software products post-delivery. The professional service segment accounts for ~26% of revenue and consists of fees charged for implementation and integration of services along with consulting fees. Software licenses and hardware sales in total represent about 4.5% of sales and are attributable to fees obtained for securing access to software and the sale of physical products.

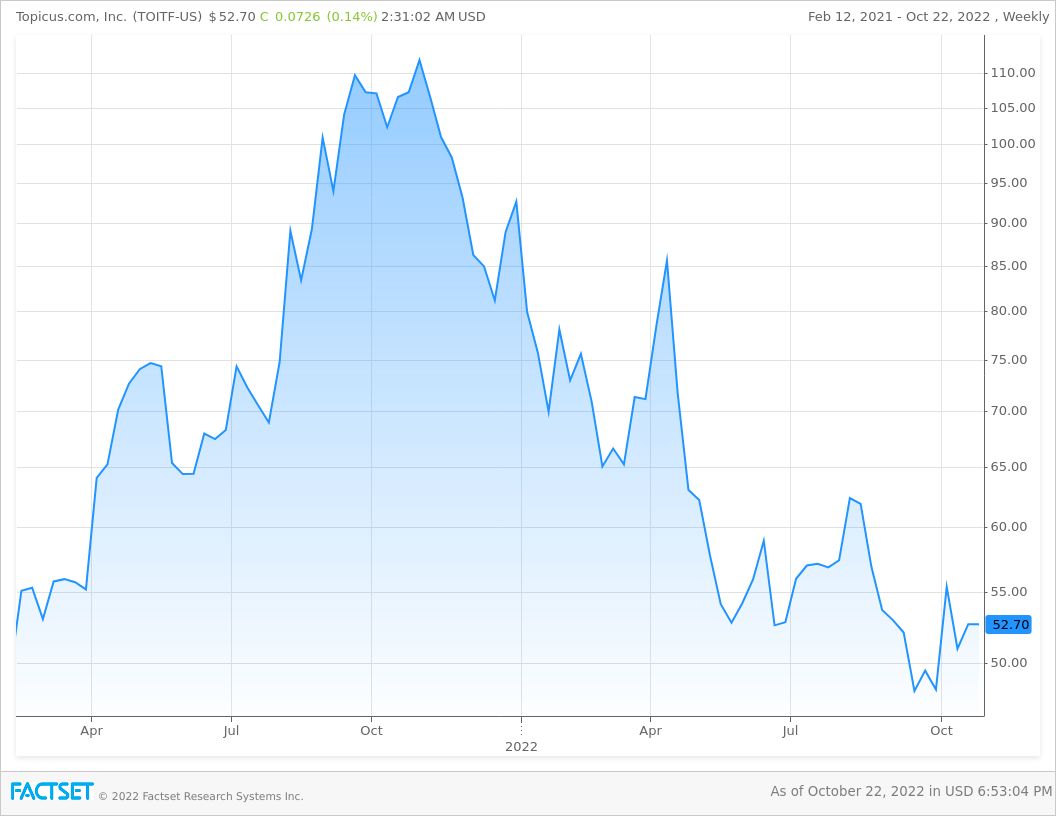

TOITF exhibits the signs of a 2021 Internet start up, ranging from the dramatic 2021 peak in the share price to the, also dramatic, ~50% drop in price. This, coupled with an IPO date of February 2021, can deceive the ill-informed investor into believing that TOITF does not own and produce strong shareholder value.

FactSet

Strategy

The company’s strategy is as follows.

-

Start working by producing software solutions for back office “boring solutions” and work to move up the value chain.

So, if you take education, for example, we started in the back office, the financial back office of primary education with our solution. And we’re now moving on to student tracking, and actually learning — adaptive learning systems as well.

Daan Dijkhuizen – CEO

2. Part number two is moving into adjacent verticals.

So, we have a track record, for example, the mortgages, we moved into the wealth management markets through a takeover in 2017. And now, we’re moving from wealth towards the pension market.

Daan Dijkhuizen – CEO

3. The third one is a strategy of selected internationalization.

As you know, I’m Dutch. So, sometimes we jump on the back of the bike of our clientele. And we follow our clientele to another country.

Daan Dijkhuizen – CEO

Constellation Software

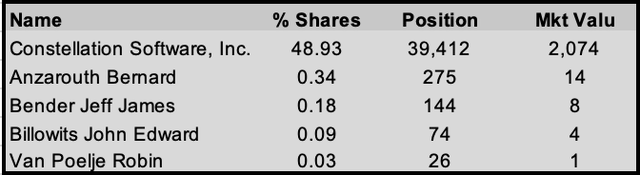

It is important to clarify that being a serial acquirer does have its limitations and risks, but with TOITF there is an added layer of risk. This is in the form of the 48.93% Constellation Software (OTCPK:CNSWF) (“CSI”) ownership stake.

For those not in tune with Constellation Software, they are also a serial software acquirer listed on the TSX. Founded by Mark Leonard, who many view within the same category as Warren Buffett, it has continuously compounded shareholder wealth through the impressive successful acquisitions of software businesses.

It may not initially be intuitively obvious as to why this may present an additional layer of risk, but it is important to understand the mission statement of Constellation Software before we attribute risk.

Our mission is to acquire, manage and build market-leading software businesses that develop specialized, mission-critical software solutions to address the specific needs of our particular industries.

Constellation Website

This is – almost word for word – the mission statement for TOITF. This, therefore, places TOITF in a unique position of inevitably competing with its parent company for businesses. This conflict of interest between the two companies received its own section in the prospectus:

We have established a conflicts protocol with CSI to address conflicts and potential conflicts and to provide guidelines for the allocation of certain transaction opportunities, which may limit the ability of the Company to compete with CSI and CSI’s other subsidiaries for such transaction opportunities.

TOITF Prospectus

Management did have the below to say with regard to possible future conflicts.

In respect of conflicts. I think that’s more in case of, but so far, we haven’t encountered it. But, that might be one day a situation. I can’t give you a concrete example yet. But one day, it might be, but currently it hasn’t been on the table.

Daan Dijkhuizen – CEO

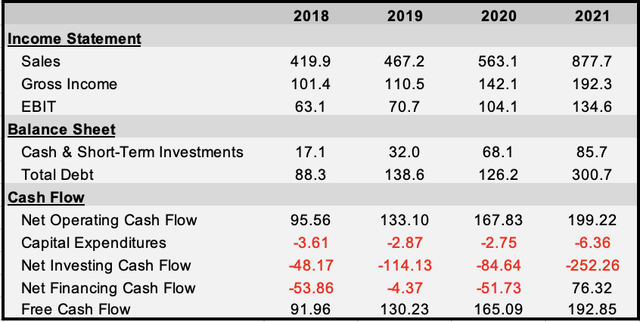

Financial State

Given the recent IPO, and the uptick in debt within the company, it is evident that TOITF has the capital to deploy at ease. The inflation-driven market turmoil of 2022 has hit software companies the hardest, providing companies with experienced management teams and cash, opportunities to salvage through the wreckages that remain.

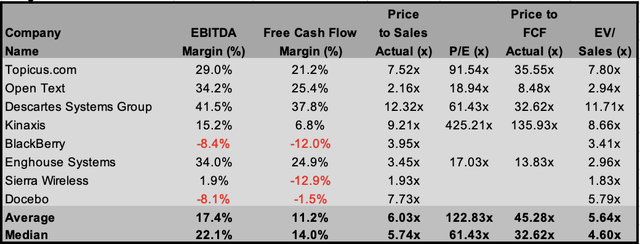

As discussed above, being a serial acquirer does exhibit limitations and risks, one of these limitations is in determining a peer group, or lack thereof. I have worked to pick companies that exhibit similar characteristics in cash flow or business structure.

TOITF does exhibit above-average profitability, but that does come at a price. TOITF is, on a relative basis, above-average in valuation. This does indicate that growth is factored in and, therefore, the risk is to the downside.

Final Thoughts

TOITF has a strong history of creating shareholder value, and is owned by one of the greatest serial acquirers in financial market history. This may prove to be detrimental or instrumental to the continued growth of the company. I look favorably on TOITF as a long-term compounder of wealth, but I would rather buy Constellation Software.

Be the first to comment