Scott Olson

South African mining and metals group, Sibanye Stillwater Ltd. (NYSE:SBSW), has a diverse portfolio of platinum group metals (PGM) assets in South Africa, and the United States, and gold and base metals in South Africa and the Americas. The company has made a number of strategic bets that have made it one of the most important players in the sector, while also lifting its profitability. Industry-wide dynamics suggest that this profitability is sustainable. Sibanye Stillwater is trading at very attractive levels.

Sibanye Stillwater Has Been a Great Investment

Since listing in 2013, Sibanye Stillwater has earned investors a 113.92% return at time of writing, compounding returns at 8.1% per year, compared to around 11.18% for the S&P 500.

Source: Google Finance

The company’s long-term underperformance reflects the underperformance of mining and metals companies over the last decade. In the last decade, the MSCI World Metals and Mining Index has earned investors 3.33% a year, compared to 10.21% for the MSCI World Index.

To understand returns of companies within commodity industries, you have to start with industry-wide dynamics. Broadly, mining and metals follow Kaldor’s cobweb model, in which the time lag between supply and demand decisions is such that there is a tendency for the suppliers to overshoot (or undershoot) demand. In other words, suppliers respond to rising prices by increasing expenditure on the productive capacity, financing that with both equity issuance and, more dangerously, indebtedness, and building up supply until the market has an excess of supply. When that happens, the bubble bursts, profitability plunges, suppliers are forced to clean up their balance sheets to clean up their debts, and returns go into free fall until the market clears and profitability returns. During the bursting of the bubble, many firms go into bankruptcy, and some firms are forced into mergers. This process of capital destruction helps the industry become more profitable. The cobweb model of the industry is why, generally, asset growth is inversely related to future returns, a phenomenon known as the asset growth effect.

Rising, Sustainable Profitability

Investors are well aware of the capital destruction that the industry has gone through. Strategist Ross Kernez has praised the company’s capital allocation strategy. Sibanye Stillwater has helped to consolidate the metals and mining industry ever since its unbundling from Gold Fields Ltd. (GFI) in 2012. The company has been able to acquire Cooke operations from Gold One, and WitsGold, Stillwater mine in Montana (hence the name change from Sibanye to Sibanye Stillwater) in gold, Aquarius Platinum (OTC:AQPBF), Anglo American Platinum Limited’s (OTCPK:ANGPY) Rustenburg operations, and Lonmin Plc (OTCPK:LNMIY) in PGM, and since February 2021, the company has also invested in the battery metals industry thanks to its investment and partnership with Keliber.

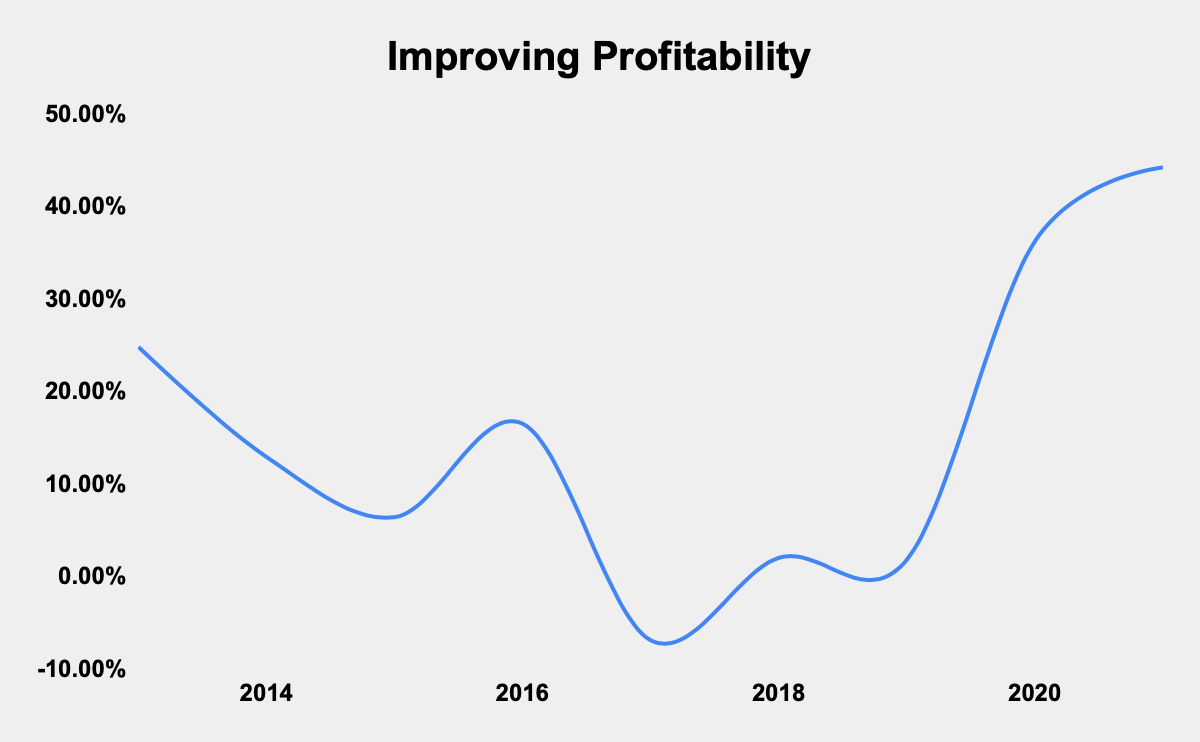

While making these strategic bets, Sibanye Stillwater has been able to earn a positive return on invested capital (ROIC) in all but one year since 2013. The company’s profitability has risen in tandem with rising profitability in the metals and mining sector, going from 24.8% in 2013, to 44.2% in 2021. According to data from Aswath Damodaran, the metals and mining sector has a current ROIC of 36.12%, compared to the total market, which has a ROIC of 8.61%.

Source: Author Calculations

Similarly, in that time, revenue has risen sharply from nearly ZAR16.6 billion in 2012, to ZAR172 billion in 2021. Net income has gone from nearly ZAR3 billion to over ZAR33 billion in 2021. The company has been a great cash machine, with free cash flow (FCF) rising from over -ZAR480 million in 2012 to nearly ZAR19.6 billion in 2021.

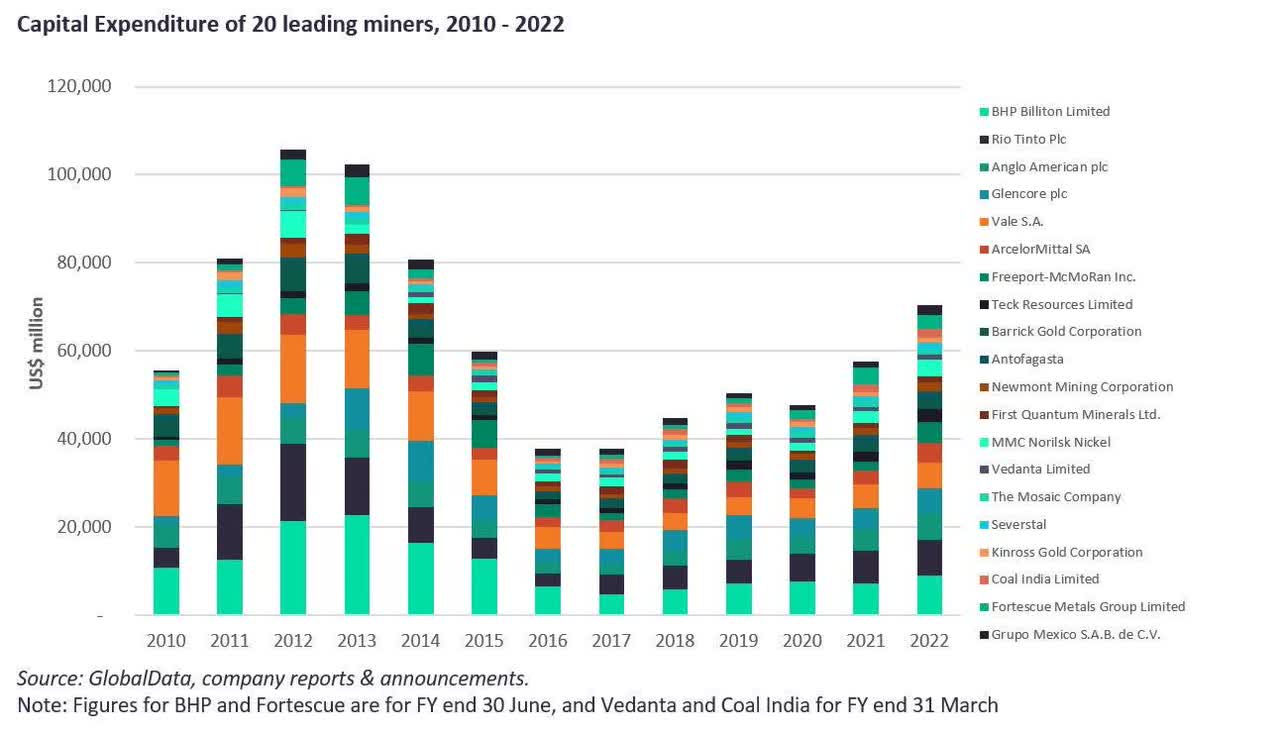

Data from Mining Technology shows that although the industry’s capital expenditure has risen over the last five years, that rise has generally been moderate.

Source: Mining Technology

The industry’s moderate capital expenditure reflects the industry’s greater capital discipline. Capex in 2022 could rise by 22%, its highest level since 2014, but this is a rise fueled by inflation, and across the last decade, it would push capex to levels still well below those of the boom times.

That suggests that Stillwater-Sibanye will be able to maintain top tier ROIC given the favourable capital cycle that the metals and mining industry is in at present.

H1 2022

The company just released its H1 earnings results, and they are abysmal. Earnings fell 51% compared to the same half-year period in 2021, falling from ZAR12.3 billion after a record-setting ZAR25.3 billion for H1 2021. Nevertheless, this is still greater than what the company earned in H2 2021, when the company earned ZAR8.5 billion.

The company declared an interim dividend of ZAR1.38 per share.

Although these are incredibly bad numbers, they do not reflect on the underlying business operations, although they point to country-wide problems that clearly affect the company. Gold production declined by 63% compared to H1 2021, thanks to a 3-month long strike. The company also suffered from flooding in its US PMG facilities, reducing production.

The strike issue was resolved after the unions agreed to an inflation-linked 3-year pay settlement, so this really is a one-off.

The decline in profitability is, in a sense, overstated. This sharp deterioration has still delivered the third highest ever profit for the company, thanks in part to commodity prices. That goes back to our discussion on the importance of industry fundamentals pushing up valuations.

The market has understood that these results do not reflect the company’s fundamentals, and since the results were released, shares in the company have gone up nearly 6%. The market has based poor performance in, and expects H2 results to be strong given the resolution of all the issues that dogged the company in H1.

Attractive Valuation

The metals and mining sector is outperforming the general market, with the MSCI World Metals and Mining Index down just -7.61% year-to-date, compared to -14.19% for the MSCI World Index. However, Sibanye Stillwater has struggled, with shares down 20.21% year-to-date, compared to the S&P 500, which is down 12.46% year-to-date.

Source: Google Finance

I believe that this presents investors with an opportunity to buy the company at a sharp discount to the market.

The company has a FCF yield (FCF/enterprise value) of 22.8%. This is in comparison with an FCF yield of 1.6% for the 2,000 largest companies in the United States, according to New Constructs.

Similarly, the company has a price-earnings ((P/E)) ratio of 3.66, against a 5-year average of 256.76. The metals and mining sector has a P/E ratio of 48.19, according to Aswath Damodaran’s data. The S&P 500 has a P/E ratio of 20.91. In other words, not only are the company’s growing FCF trading at a very attractive valuation, but the stock is trading cheaply against its own historical valuation, and in comparison to its peers and the broad market.

Conclusion

Sibanye Stillwater has pursued a value-additive capital allocation strategy that has helped consolidate the gold and PGM markets, while also lifting its own profitability. In that time, the metals and mining industry has been more disciplined in its capital allocation, lifting industry-wide profitability and giving Sibanye Stillwater the platform to sustain its profitability. The company is trading at very attractive valuations that also suggest that its future stock and operating performance will be good.

Be the first to comment