turk_stock_photographer

Buying and holding onto moat-worthy and economically essential companies is generally a winning strategy for the long haul. What’s even better is when these companies can be had at closer to their 52-week lows than their highs.

This brings me to PPG Industries (NYSE:PPG), which is now trading much closer to its 52-week low of $107 than its 52-week high of $177. In this article, I highlight what makes now a good time to pick up this quality name, so let’s get started.

Why PPG?

PPG has been around for almost 140 years and became the world’s largest producer of coatings, after its purchase of select Akzo Nobel assets. Its products are sold to a wide variety of end customers, including those in the industrial, aerospace, automotive, and construction markets.

The company has a global footprint in over 75 countries, with less than half of sales coming from North America in recent years. This is exemplified by its Comex acquisition, which expanded PPG’s coatings and specialty products into emerging regions. In 2021, PPG generated $16.8 billion in total sales.

PPG continues to exemplify strong growth, with record sales of $4.7 billion in the second quarter, equating to 8% YoY growth from the prior year period. This was driven by higher selling prices, as a demonstration of PPG’s pricing power in the market. Selling prices rose by a robust 11% YoY, which more than offset the 4% decline in product volume.

Of course, PPG isn’t immune to inflationary headwinds, as raw material costs are up 20% YoY, and energy and transportation costs remain elevated, but nevertheless, efficiencies in other areas enabled PPG to improve its segment operating margin by 200 basis points on a sequential basis.

Moreover, I see supply bottlenecks and softened consumer demand in its DIY segment as being more transitory in nature, as that was due to lockdowns in China and geopolitical tensions in Europe. In addition, PPG’s aerospace and traffic solutions segments saw a solid rebound with 10% and 15% volume growth, respectively. Looking forward, management expects this momentum to continue as it seeks to deliver a strong second half, as noted during the recent conference call:

In the second half, year-over-year comparisons will be aided by the sharp declines we experienced last year during the height of the supply disruption that impacted several industries, particularly in the US. Outside of a few commodities, we expect supply chain conditions to continue to improve, including better raw material and transportation availability as our suppliers’ production capabilities are returning to a more normal condition.

Also, in the second half and specific to PPG, we expect several businesses, including automotive OEMs and Aerospace to deliver strong growth due to large supply deficits and low inventories in these end-use markets. Other PPG-specific positives for the second half are continuing acquisition synergy realization and additional cost savings from previously announced restructuring actions.

Meanwhile, PPG sports a strong BBB+ rated balance sheet, it pays a well-covered 2.1% dividend yield that’s protected by a 38.5% payout ratio. The dividend has a 7.7% 5-year CAGR and PPG is close to becoming a dividend king with 49 consecutive years of raises under its belt.

Furthermore, while the dividend yield isn’t particularly high, PPG should be thought of as a total return story with share buybacks being a part of it. This includes $135 million in share buybacks in Q2 alone and management expects to balance buybacks with opportunistic bolt-on acquisitions. As shown below, PPG retired 23% of its total outstanding shares over the past 10 years, with most of the buybacks occurring prior to 2020.

PPG Shares Outstanding (Seeking Alpha)

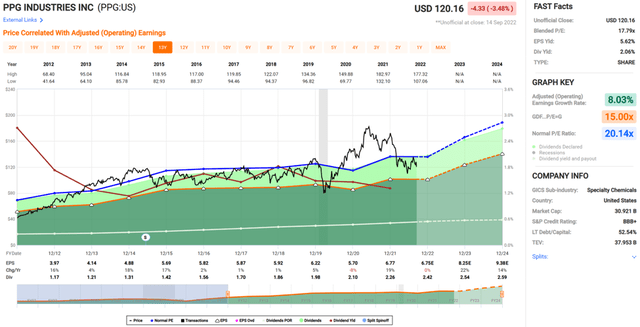

Lastly, I view PPG as being a buy at the current price of $120 with a forward PE of 17.7, sitting well below its normal PE of 20.1 over the past 10 years. Analysts estimate 11% to 22% annual EPS growth over the next 2 years, and have a consensus Buy rating on the stock with an average price target of $147. This implies a potential one-year 24% total return including dividends.

PPG Valuation (FAST Graphs)

Investor Takeaway

In summary, PPG is a moat-worthy company that has demonstrated pricing power. It has an impressive track record of shareholder returns via share buybacks and dividend growth, while also investing in bolt-on acquisitions. I believe the market is underestimating its earnings power and thus, see upside potential in the shares.

Be the first to comment