jetcityimage/iStock Editorial via Getty Images

I’ve been a follower of PPG Industries (PPG) for some time. The company has carried overvaluation for many months now, and at times, it seemed that this company would never again drop down to more humane valuations.

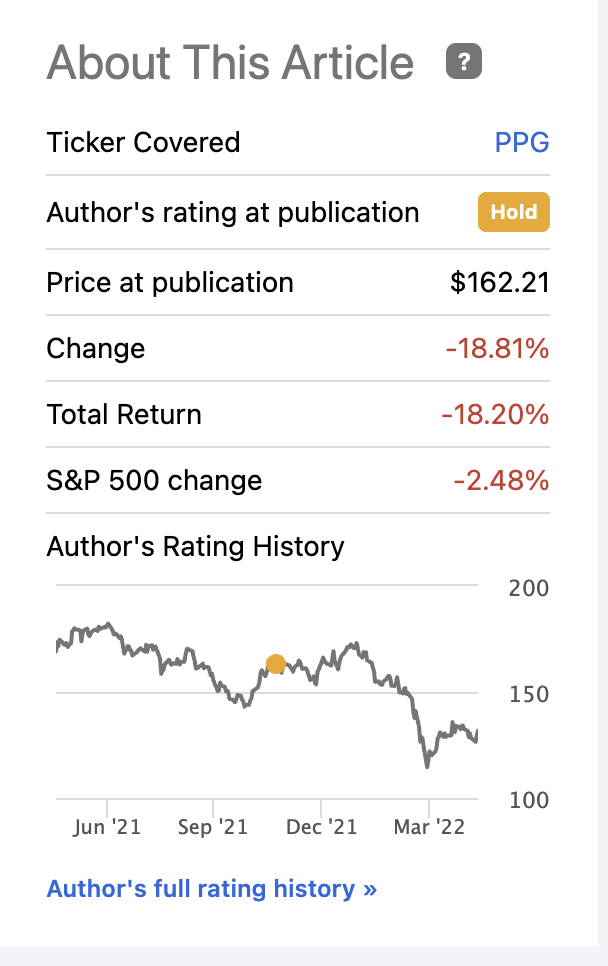

That has now shifted. As of my latest article, the current RoR for the company has gone deep into the red, and investors who invested contrary to my stance have suffered significant and market-underperforming losses.

PPG Industries (Author’s Data)

For a complete overview of PPG and what it does, I refer you to my original piece on the company. In this article, we’ll review things.

PPG Industries – Some Updates, Some Declines

PPG Industries has declined in valuation and has been on a negative roll since early 2022. Valuations well above 22X P/E have declined back down to below 20X.

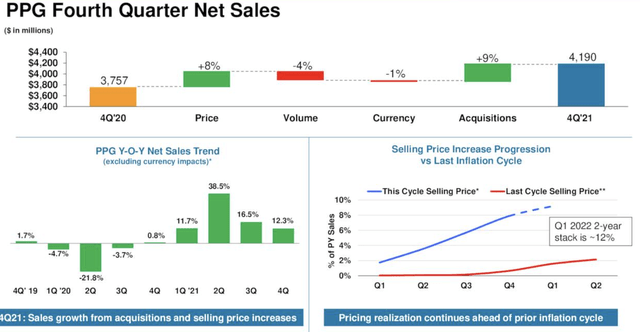

This is despite some good 4Q21 numbers despite pandemic constraints. We’re looking at an increase in net sales, but a decrease in volumes, and continued SCM constraints that cost the company around $150M – but most of this was offset by the company passing on costs through increased sales prices. All of this pushed EPS to around $1.26, with the main impacts being supply and COVID as well as cost inflation on the raw material side – especially in coatings, which saw 30% inflation.

So PPG is battling some fairly serious cost inflation issues due to its feedstock specifics. Despite near-$20M in savings, this wasn’t completely offset by positives. PPG did deploy cash for repurchases and has plenty of cash on hand. On the demand and performance side, things are fine.

PPG Industries 4Q21 (PPG IR)

On a segment-by-segment basis, things are positive as well. Demand is good. Performance coatings saw raw material and logistical issues impacting all of the company’s businesses, but this was acted on through an 8% in company-wide sales price increase. Aerospace also hasn’t fully recovered to normalized levels as of yet, with orders remaining elevated due to supply constraints, leading to a materially higher-order book.

Still, positives abound, with Home Depot (HD) and the company signing increased supply relationships across all US locations. Early 2022 is expected to see further sales price increases across the board, and for raw material inflation to continue. The company is also selling assets.

For Industrial coatings, results and demands are once again good, with the exception of increased operating costs due to similar impacts as the ones mentioned. The raw material is an issue here as well, as both company segments use similar feedstock, and the company is selling assets here as well. Automotive coatings are expected to be flat for early 2022, and China is expected to see a further impact due to the Olympics.

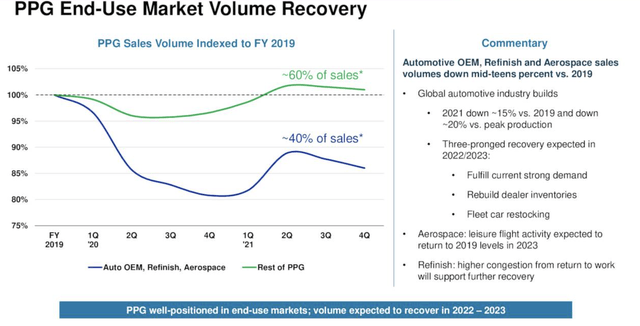

Overall, PPG hasn’t seen the sort of recovery for all segments that we might want to see. Automotive, Aerospace, and refinish are all still below pre-COVID levels, which of course are affecting overall sales and earnings.

PPG Industries (PPG IR)

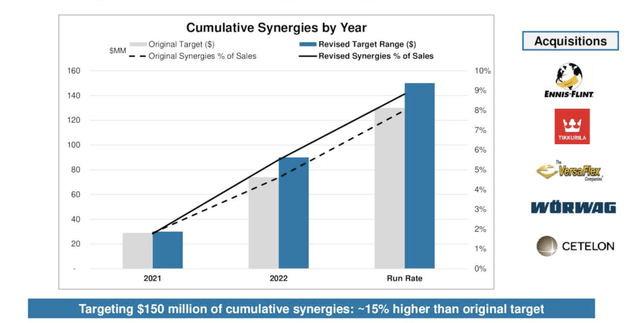

From a fundamental perspective, the company’s overall risk has increased, which is also reflected in company share price performance. Net debt is up to 5.5X from 3.8X in mid-2019. The company has plenty of cash and liquidity on hand, but gross debt and related numbers have increased due to M&As, CapEx costs, and other factors.

Still, cost savings are very much on track, and M&A synergies are in line. Expected synergies are to ramp up significantly in 2022.

PPG Industries (PPG IR)

Expectations for the coming early 2022 period are lower company sales, and EPS lower on a sequential basis. The share price decline is in part due to these expectations, which are a mix of raw material impacts, unfavorable currency exchanges rates and higher expenses.

On a high level, the problems with the company can be referred to as raw material, logistics and COVID-19 issues. These are very significant, and most of the company’s performance can be laid at the feet of these issues. These are also the reasons why some of the analysts following PPG have downgraded the company, such as Wells Fargo.

Overall, it’s important to remember that PPG is a relatively cyclical sort of business. Ups and downs and headwinds aren’t uncommon for the company, though the tops and troughs as we see them on a year-over-year basis tend to be flatter than other cyclical. Still, in terms of real valuation, PPG is no stranger to recession drops to well below 15X P/E – that’s where I bought my stake in PPG when COVID-19 was around, and that’s why I had such solid returns with the company.

Let’s look at what valuation has done to the current thesis on PPG and if now is a good time to buy the company.

PPG – The Valuation

The company’s share price history makes it clear just how “up and down” this company can move. It also helps us in assigning both “BUY” and rotate targets for PPG based on historical valuation patterns.

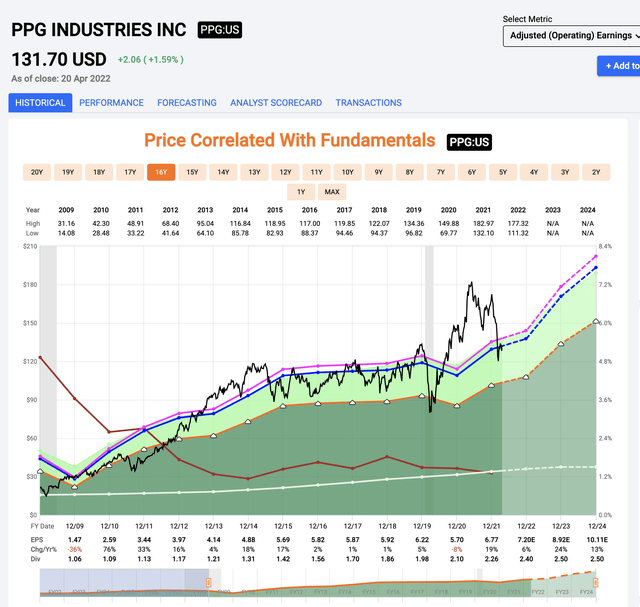

PPG Valuation (F.A.S.T graphs)

This company has a well-established pattern of going as low as 13-16X, and as high as 21-24X P/E. That means that buying at a 13-16X multiple, you can easily make as high returns as 50-80% on a safe business with a well-covered dividend and a credit rating of BBB+ buy following these very simple valuation patterns/rules. I’m a fan of this.

While I’m perfectly willing to hold a stock on a “Forever” period, it bears mentioning that all companies can trade at multiples/ranges that are well outside their historical range. It’s my stance that unless something that fundamentally changes the company’s business or appeal has happened, this is a good time to rotate at least parts of the profits in the investment.

There are, simply put, always things to buy and always things that are expensive – it doesn’t matter what cycle/phase of the market we’re in.

At 19X P/E, PPG is in the lower end of its premium range. The company has clear patterns of going higher than this – even a lot higher, but it could, as you can see, also go significantly lower depending on what the company faces as it moves into 2022-2024. While we’re accounting for headwinds from a supply chain side, raw material side and FX side, the current forecasts call for this to normalize and for 2022E results to come in at a YoY growth rate of 6%. This is due to bolt-on earnings capacity from the M&As, synergies, and the belief in the company’s ability to pass along costs and issues to its customers in the form of increased sell prices.

I believe this faith to be justified. PPG is a great company.

Another catalyst for improved earnings is a normalization in the aerospace/automotive sector. Such a normalization would clearly push company results even higher.

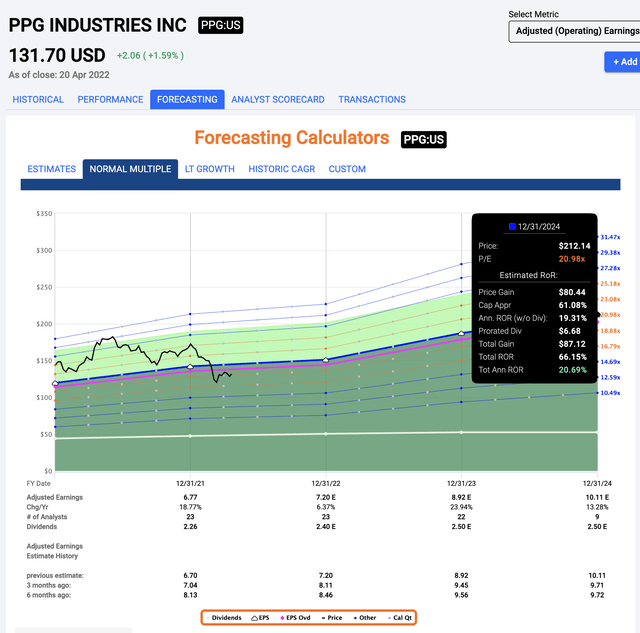

I believe it’s fair to say that there are enough catalysts to justify a bullish case for PPG on the 2022E side. Such an upside based on current expectations would imply an RoR of 24% on an annualized basis to a 21X P/E of $151/share.

Furthermore, if we consider the company’s earnings for 2023 and 2024, which do include full recoveries and synergy inclusions, then we have annualized RoR pushing into the 20% even there, despite a yield of less than 1.8%.

PPG Upside (F.A.S.T graphs)

From S&P Global and overall analyst averages, we get similar positive signals for PPG. The current share price target for the company based on a 20-analyst average of a range of $111 to $200 is $163/share, indicating a 24% current upside based on a multiple of 19X. 13 of the 20 analysts have a “BUY” or “Outperform” rating for the company at this juncture.

To me, this forms the basis of a very clear bullish thesis for PPG Industries, and I’m finally once again shifting my thesis from a “HOLD” to a “BUY”.

Welcome to PPG – I believe it’s a “BUY” at 19X P/E with an upside to at the very least $160 in the short term based on good 2022E.

Thesis

The thesis for PPG is very straightforward.

- PPG Industries is a quality company in chemicals/coatings. It has a solid history, good dividend growth, and very good fundamentals, despite an increasing debt due to M&A. The company has been prohibitively expensive, which is why I’ve had a very somber “HOLD” rating as it was undervalued. I even rotated most of my PPG Industries Holdings at a near-100% profit.

- However, the time has come to dive back in. At current valuations, there’s a very realistic upside to 2022-2024E based on market normalization in key segments, M&A/Integration synergies, cost savings, and increased demand. The risk is that these developments take longer or don’t materialize.

- I believe the likelihood is high that a company that’s been performing well for 20 years will continue to do just that. My thesis, based on this picture, is, therefore, a “BUY” with a PT of $160/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

PPG Industries is a “BUY” here with a significant upside to a $160 PT.

Thank you for reading.

Be the first to comment