Siarhei SHUNTSIKAU/iStock via Getty Images

This article was coproduced with Mark Roussin.

Here’s the good news: According to data released this week, we’re no longer in a recession by any definition of the word!

To quote Yahoo Finance from Oct. 27:

“A report from the Commerce Department released on Thursday delivered positive news about the U.S. economy, showing the nation’s gross domestic product grew at an annual rate of 2.6% in July through September after recording two consecutive quarters of negative growth. Economists surveyed by Bloomberg had estimated a 2.4% uptick.”

Admittedly, it does add that:

“‘All the growth in GDP was due to a huge swing in net foreign trade, contributing 2.8 percentage points, while domestic final demand rose only 0.5%,’ Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote in a statement.”

But who cares about that detail? Not the markets.

They’re too hopped up on supposedly dovish comments from the Fed to care much about anything beyond headline data. And sometimes they don’t care to read even that far.

For those who do care though, here’s the bad news: Most economists don’t expect a rebound of any kind to last.

Very Real Recession Worries Remain

One widely circulating MarketWatch story declares “U.S. economy grows 2.6% in the third quarter, but recession worries aren’t going away.” Here’s some of what it says:

“Big picture: The rebound in GDP in the third quarter is already being overshadowed by increasing signs that the economy is slowing.

“The Federal Reserve is rapidly raising interest rates to try to tame high inflation, and the economy is caught in the crosshairs. Higher borrowing costs retard economic growth and boost unemployment by causing consumers and businesses to spend less.

“Early estimates suggest GDP could decline in the fourth quarter, and many economists predict a recession is likely by early next year.”

Happy New Year to us, right? First 2020 was a horrific year on so many levels. Then 2021 wasn’t the relief we all so desperately wanted. 2022 has been marred by some of the highest inflation the U.S. has ever seen…

And we’re not even going to catch a break once this calendar year turns.

This clearly puts the markets in a pickle. On the one hand, they seem pretty determined to be optimistic at the moment. On the other, there are so many reasons to exert caution.

And I’m not even talking about the very real likelihood of the Federal Reserve continuing to raise rates at a rapid clip.

There’s also the fact that this earnings season isn’t showing the prettiest of pictures so far. At last check, 170 companies listed on the S&P 500 had reported, with 75% of them beating expectations.

That’s better than the 72% we were hearing about earlier in the week… but still worse than the five-year average of 77%.

It’s just a lackluster, or at least confusing, time to trade in. Or is it?

Here’s Why I’m Rooting for a Recession

Did you read my article from September 30? The one titled “I’m Rooting for a Recession 2.0”?

In it, I acknowledged all the criticism I’d gotten from my first “Rooting for a Recession” article, such as this comment:

“The author missed that people don’t pay rent during recessions. That’s what happens when businesses close, people get laid off and times get bad. Which is what the author apparently is hoping to happen. Because he’s part of the 1% hoping to profit off of people getting their lives destroyed.”

As I said in “2.0,” that’s a little harsh and completely inaccurate. After all, I’ve built my writing career around teaching people how to avoid the catastrophic mistakes I made. My goal is to boost your portfolio profits, not decrease them.

With that said, I understand how riled up the possibility of a recession gets most of us, especially after the last few years we’ve been through.

It’s just that I also understand the opportunity a recession involves – the deeply discounted stock prices that become available and therefore the price increase potential at our fingertips.

And when we’re talking about dividend-paying stocks like real estate investment trusts (REITs), we’re also looking at higher yields. This also helps increase our ability to access impressive profits.

That’s what I mean when I say I’m rooting for a recession. I mean I’m rooting for a smorgasbord of cheaper prices on stocks that are bound to bounce back.

With that said, we don’t have to wait for a recession to find discounted REITs that are very well worth considering. There’s almost always going to be one or two available no matter the economic client.

In fact, in this case, thanks to all the complicated factors I listed before, there’s three. Better yet, they’re all blue-chip landlords.

REIT #1 – Simon Property Group

Simon Property Group (SPG) is the leading mall landlord in the world, owning more than 200 properties primarily here in the U.S. Its strong portfolio is mostly made up of Class A Malls – which means it produces some of the best results for tenants when it comes to retail sales per square foot.

Yes, the economy is facing a possible recession in 2023 on top of this year’s economic slowdowns. But that’s why it’s so important to focus on high-quality investments that can provide cash flow to investors.

With the greater S&P 500 down over 20% on the year, we need to weigh risk and reward very carefully.

In which case, let’s fully acknowledge the risks in owning a massive mall landlord. Recessions typically mean that consumers tighten their wallets, of course.

However, Simon Property has been around since 1960 and went public in 1993. It has a long history of success and has navigated numerous recessions already.

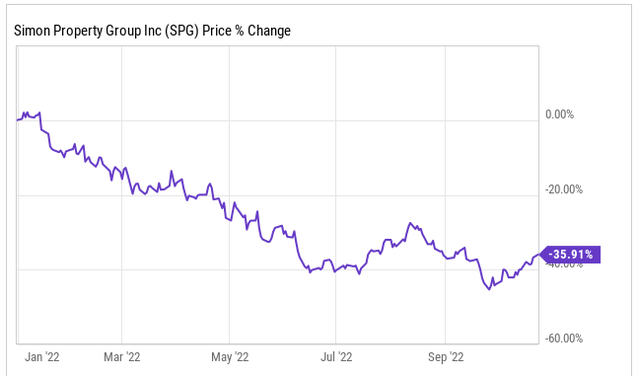

Plus, a good chunk of the negativity has already been priced in. On the year, shares of SPG are down over 35%.

Seeking Alpha

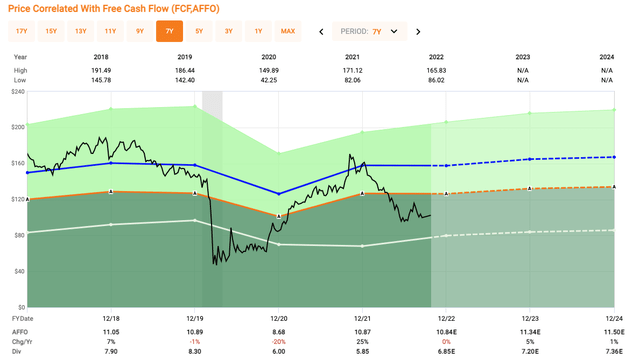

At these levels, shares of SPG are trading at only 9x next year’s adjusted funds from operations (AFFO) estimates. Over the past five years, they’ve traded at an average of 14.5x.

So shares appear very cheap at the moment.

FAST Graphs

So we saw the stock fall with valuations in the single digits – which is eerily similar to what we saw in March 2020, when valuations dropped to about 6x AFFO. Investors are clearly pricing in a recession and expecting further volatility in the U.S. economy.

But that means long-term investors have a great opportunity to pick up shares of this blue-chip REIT.

In terms of Simon’s dividend, investors are being paid an annual $7.00 per share, which equates to a 6.9% yield. It’s well covered with a low payout ratio of around 60%.

At the start of the pandemic, SPG was forced to cut its dividend. But it wasted little time bringing that back up, increasing it every quarter last year.

So far in 2022, the company has increased the dividend twice. And that’s while simultaneously adding assets to its portfolio, such as its 50% stake in global REIT Jamestown.

commercialobserver.com

Lastly, the company has maintained an impeccable A- rated balance sheet. That gives Simon a huge advantage in general but especially in times of rising interest rates – allowing it to obtain more favorable financing in order to expand the portfolio.

We currently rate shares of SPG a Buy.

REIT #2 – Public Storage

Self storage may not be the most exciting industry to write about. But it has remained one of the most consistent industries to invest in over many decades.

In fact, it might be the most recession-proof sector within commercial real estate. So, given the potential for that kind of downturn, I’d be remiss not to discuss Public Storage (PSA).

Self-storage sees strong demand across multiple stages of life and life events, from moving to downsizing… handling a deceased family member’s estate… divorce… running a small business… and the list goes on.

Let’s just say there’s a reason for all the storage facilities you probably see around you.

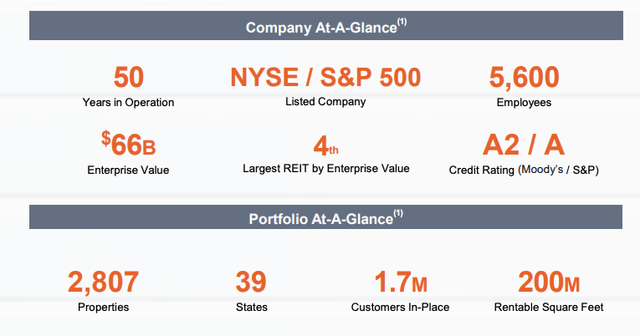

Public Storage, for its part, was founded in 1972. It currently has more than 2,800 facilities featuring more than 200 million square feet of rentable space.

PSA Q2 Presentation

The REIT has great brand awareness with its bright orange facilities and is ranked No. 1 in 14 out of 15 of its top markets. And, similar to Simon, it maintains a fortress balance sheet with an A rating.

One, again, that gives it a great competitive advantage when it comes to financing and expanding its portfolio.

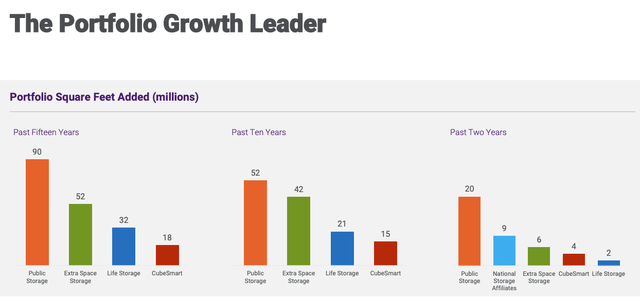

Speaking of expansion, Public Storage may be the industry leader, but that doesn’t mean it’s resting on its laurels. Competition is fierce, and PSA doesn’t want anyone closing the gap.

As you can see below, it continues to expand its portfolio at a strong clip.

PSA Q2 Presentation

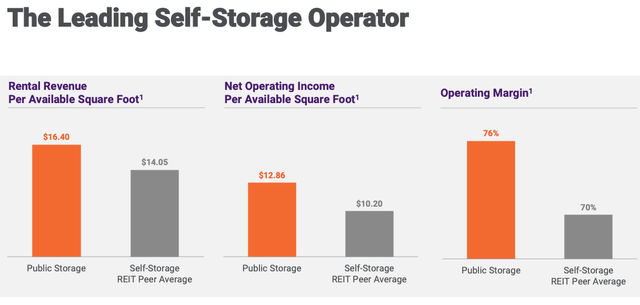

Another thing to take note of is the company’s excellent productivity metrics. This next chart shows the difference in operating efficiency when it comes to rental revenue, net operating income (NOI), and operating margin.

PSA Q2 Presentation

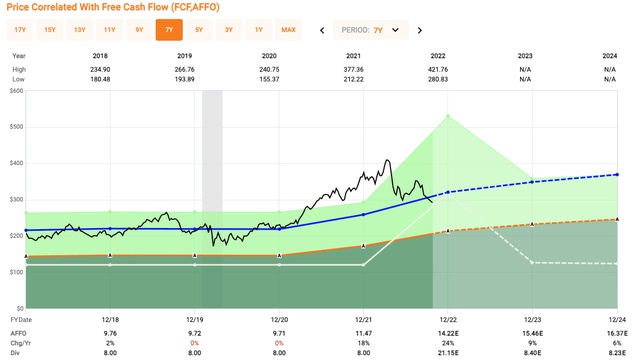

Shares are trading at a p/AFFO of 18.8x, which may sound expensive considering it’s double SPG’s valuation. But for years now, PSA has traded at a premium.

In fact, over the past five years, it’s averaged 22.5x, indicating shares are quite intriguing right now.

FAST Graphs

There’s also its annual $8.00 per-share dividend to consider, which equates to a 2.7% yield. It’s well covered too with an AFFO payout ratio of only 55%.

We rate shares of PSA a Buy.

REIT #3 – Realty Income

Last but certainly not least is Realty Income (O). You can’t talk about blue-chip REITs and fail to mention this one.

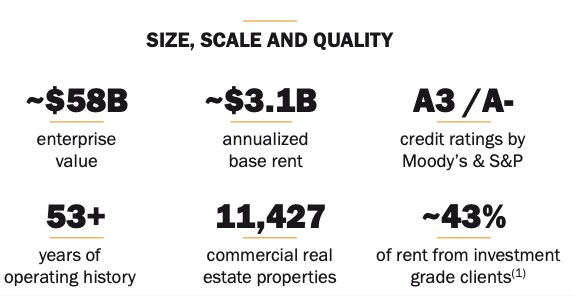

Realty Income has produced positive earnings growth for 25 of the past 26 years, with a median annual AFFO growth rate of 5.1%. It’s also part of the prestigious dividend aristocrats list for having increased its dividend for 27 consecutive years.

The REIT has a 5%-plus dividend yield that’s well covered with a 78% payout ratio.

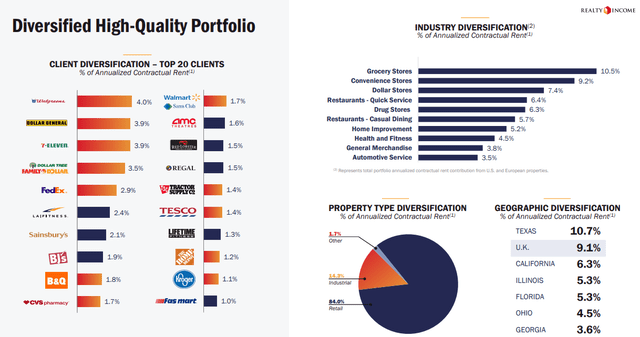

O Q2 Presentation

We’ve talked a lot about quality today, which is always important in preparation for times of economic hardship and uncertainty. In which case, Realty Income is among the best.

Its balance sheet is backed by an A- credit rating and a sizable focus on high-quality tenants. Roughly 43% of its annualized base rent (ABR) is derived from investment-grade lessees.

O Q2 Presentation

As of Q2, its portfolio consisted of over 11,000 properties, earning an annualized base rent of roughly $3.1 billion. And the strong cash flows it generates help fund its growing dividend.

O Q2 Presentation

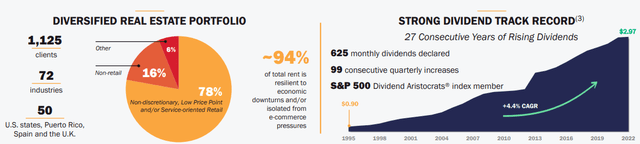

Here’s a snapshot of the diversity within its portfolio.

O Q2 Presentation

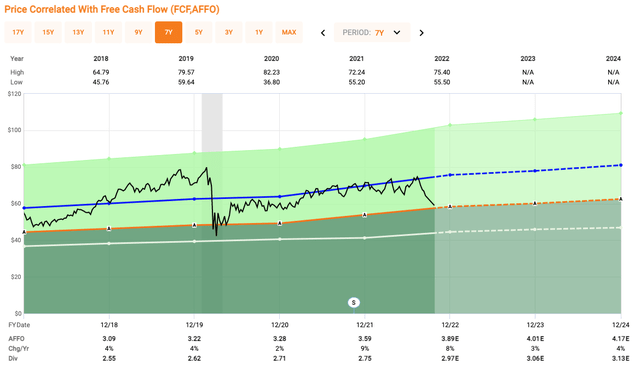

Shares of O currently trade at an AFFO multiple of 15x. Over the past five years, it’s averaged 19.5x.

FAST Graphs

As far as I’ve seen, you can’t go wrong accumulating shares of The Monthly Dividend company at a discount.

That’s why we rate shares of O as a Strong Buy.

Get Ready for Some Spooky Stuff

As I do every year, I always provide some “spooky stuff” during Halloween, so I hope you’ll tune into my next article titled, “Trick Or Treat: A Few Spooky REITs.”

“It was a long and gloomy night that gathered on me, haunted by the ghosts of many hopes, of many dear remembrances, many errors, many unavailing sorrows, and regrets.” ~ Charles Dickens

As always, thank you for reading and commenting…

Happy Halloween!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment