Justin Paget

In the past, I have written 2 articles on Power REIT (NYSE:PW), in which I was very positive about the company. In my last article on the company, which was published on the 25th of October, I wrote that the legalization of the cannabis market, the company’s recent acquisitions, and cheap valuation made the company very attractive. Since then the economic environment has changed, while there have also been multiple negative headlines. Recently, I sold my position as I thought the company had too many risks. The reason why I did not cover this in previous articles is that a) the economic environment was great for companies that had stellar growth and thus things like tenant quality was less important and b) the company wasn’t involved in a major lawsuit at the time.

Governance

On March 22 Power REIT published an 8-K that announced the departure of Paula Poskon, one of the members of the board of trustees. In her resignation letter she stated that her fellow board members were reluctant with holistic reviews of governance, which could have led to the implementation of best practices. Additionally, she mentioned that she agreed with the acquisition of the Marengo Township Property but only if the board would revisit the topic of corporate governance. A few weeks after the acquisition, in March, she and fellow board member Virgil Werner passed resolutions to engage outside independent counsel. After the resolution passed, she, according to her statement, was retaliated against by CEO David Lesser. As she had a different view on governance than the company and she felt that resigning was her best option. Although this cannot be verified completely there have been some questionable actions to say the least. One example is the fact that the company is renting out some major properties, including their largest, to Millennium Sustainable Ventures Corp (OTCPK:MILC). MILC is partly owned by David Lesser, who owns approximately 20%. What is interesting is that MILC hasn’t made a profit in the past few years and while the rent for the Vinita Property, the Walsenburg Property, the Marengo Township Property, and the Produce of Nebraska property combined is over $7 million a year.

MILC revenue, income and FCF (Tikr.com)

This means that MILC most likely has to borrow cash or raise cash through an equity offering, this a riskier business than renting out properties to for example some of the larger cannabis companies like Tilray (TLRY). The question that remains is are these deals made at arm’s length? The company mentions that the board of trustees has to give permission, among other things so that shareholders will not be hurt. However, if Paula Poskon spoke the truth, the actions of the board of trustees can be described as questionable.

Tenant quality

I mentioned something about one of PW’s largest tenants, MILC, which does not have a profit and/or positive cash flows. What this means is that they have to rely on cash that is currently in the business, increase debt, or increase its shares outstanding. The other tenants of Power REIT are harder to investigate as most of them are not publicly listed and have a limited operating history, which makes it hard to know their exact finances. What we do know is that they aren’t rated by rating agencies. The main reason for not getting rated is that the majority of tenants are very small, and getting an investment grade rating is very expensive. From the company’s latest 10-Q it becomes also clear that some of its tenants in Colorado are getting rent relief as the Colorado wholesale market has compressed.

What also catches the eye is that Power REIT is currently not taking into account the rents it receives from MILC, as they are uncertain if the rent would be collectible.

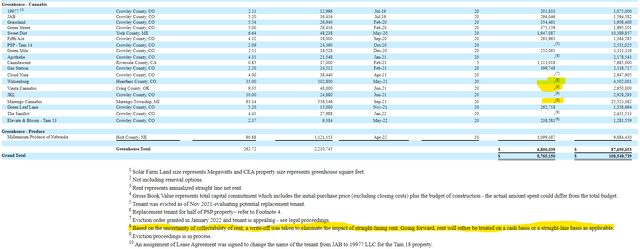

Cannabis properties overview (10-Q)

What can also be seen in the picture above is that the company is evicting a lot of tenants or has evicted tenants in the past (footnotes 5,6,7 and 9). This is in line with the quality of the tenants but could also mean higher legal costs.

Lawsuit

On the topic of legal costs, the company has been involved in numerous lawsuits in the past few years, which includes a lawsuit with Norfolk Southern Company (NSC) about its railroads. The company lost this lawsuit and is still carrying an NOL, which allows them to keep their REIT status while not paying a dividend, as they are technically not making a profit.

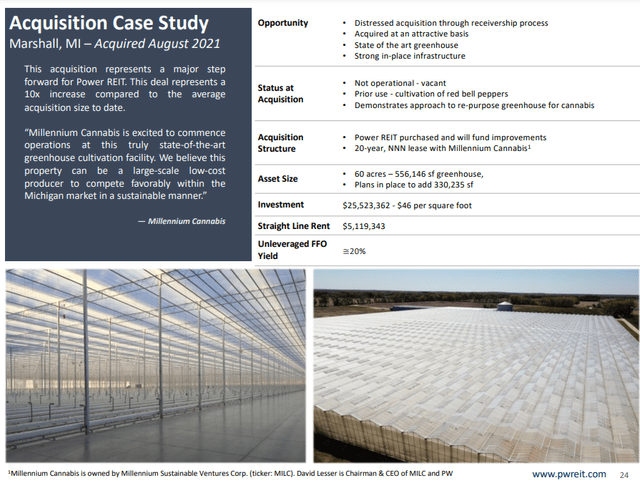

Currently, the Marengo Township lawsuit might be the most important one. In September of last year, the company announced its acquisition of the Marengo Township property. The Marengo Township property is the largest property of Power REIT and is leased to MILC. A few months later the company filed a lawsuit against the Marengo Township, stating that the township made false promises, and constitutional violations of the defendant’s civil rights through refusal and failure to comply with its ordinance and state law as well as a common dispute resolution mechanism. What it came down to was that the property does not have a certificate of occupancy (CO), and was built without a CO or building permit. It had been treated as an agricultural structure by the township, which meant that it wasn’t required to have them and was “grandfathered” exempt by the Michigan building code. However, government officials stated that by changing the plant that was grown inside the properties (it was used for peppers before), so did the classification of the building (from greenhouse to industrial property). In the company’s latest 10-Q it stated that it is working on mediation with the township and thus it looks like this will all come to an end soon. However, given that we do not know the exact details of the mediation and that it could take longer than expected, this can have a significant influence on the company as it is its largest property.

Marengo Township property (Investor presentation)

Valuation

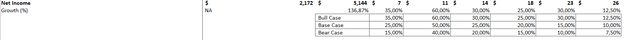

In order to estimate the value of Power REIT I made a discounted AFFO estimation. My estimation was based on the company’s net income and accounts for all the adjustments as stated in the company’s 10-K. The estimated growth rates were based on the growth rate estimates in TIKR. This led to the following growth rate assumptions:

Power REIT NI estimated growth rates (Author)

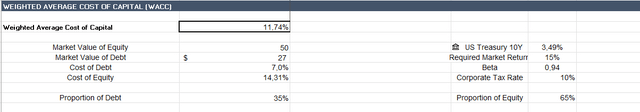

In order to discount the future cash flows of the company we also need to calculate the weighted average cost of capital (WACC). In order to this we need to know the company’s beta, tax rate, risk-free rate, and required return among others. I used my own estimations as well as information from the company’s 10-K and Yahoo Finance for this:

WACC calculation (Author, Yahoo Finance, PW 10-K)

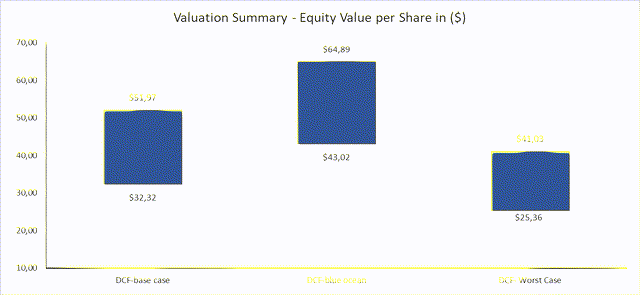

Some people might be surprised that my required return is 15%. The reason for this is that I think that the company is on the riskier side and thus require a higher return to compensate for the additional risk. In the end this gives me the following prices based on the base, bull or bear case.

Estimated price PW (Author)

What can be concluded is that the company is trading at a discount and even my lowest price would lead to a return of approximately 30%. This could make the risk worth it for some people so it is important to understand your own risk tolerance.

Conclusion

Power REIT stock has fallen dramatically over the past couple of months and is down over 70% YTD. The company is having some issues, which I am personally not very comfortable with. This made me sell my own position in the company as I think that the company is very risky. However, the company is severely undervalued and if they are able to fix its problems, it could be a huge winner in the coming years. I would therefore recommend investors to do their own due diligence and check if they are comfortable with the risk of the company.

Be the first to comment