Bank OZK

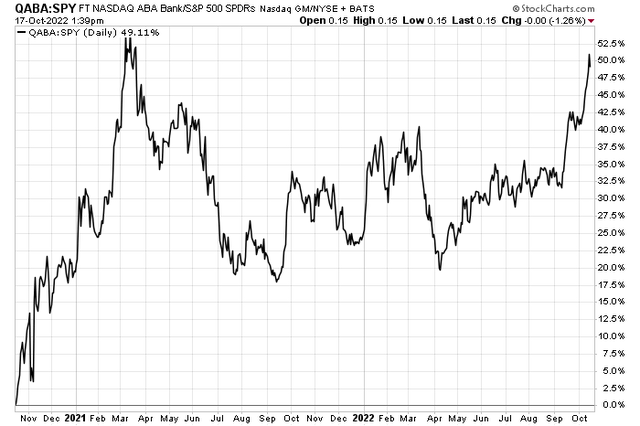

Community banks could be a sweet spot given the interest rate environment. Small banks in favorable parts of the country are positioned well to earn strong returns on deposits while paying out still modest rates to account holders. One of the top holdings in the First Trust Nasdaq ABA Community Bank Index Fund (QABA) is an Arkansas-based depository institution with a good valuation and favorable chart. It reports earnings later this week.

QABA Community Bank ETF Shining Versus the S&P 500 YTD

Stockcharts.com

According to CFRA Research, Bank OZK (NASDAQ:OZK) provides retail and commercial banking services. It accepts various deposit products, including non-interest-bearing checking, interest-bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time deposits. Downside risks include a shrinking spread between what the bank can earn on deposits and what it pays out to account holders. Moreover, a tightening of the credit cycle could lead to a reduction in lending activities.

The Arkansas-based $5.1 billion market cap Regional Banks industry company within the Financials sector trades at a low 10.1 trailing 12-month GAAP price-to-earnings ratio and pays a 3.1% dividend yield, according to The Wall Street Journal.

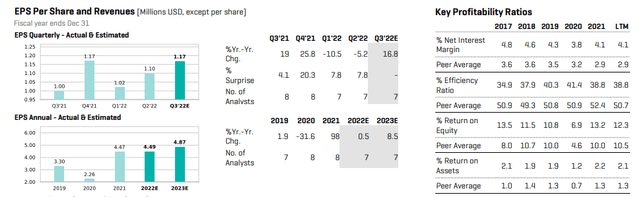

On valuation, OZK shares appear attractively priced. The company’s Q3 earnings report, due out on Thursday, should show a jump in quarterly profits. Full-year 2023 EPS are seen increasing by 8.5%. Bank OZK hopes its net interest margin increases over the coming quarter as Treasury rates rise while bank deposit account rates stay somewhat low.

Bullish for OZK is that its net interest margin has been significantly higher than the industry average over the past four quarters. The firm also has better return on equity and assets metrics vs. its peers. Overall, I like the valuation situation and growth ahead given the interest rate environment. At just 1.2 times book, that’s rather attractive for this regional bank. Moreover, the stock pays a solid yield.

OZK Earnings History and Expectations, Key Profitability Ratios

CFRA Research

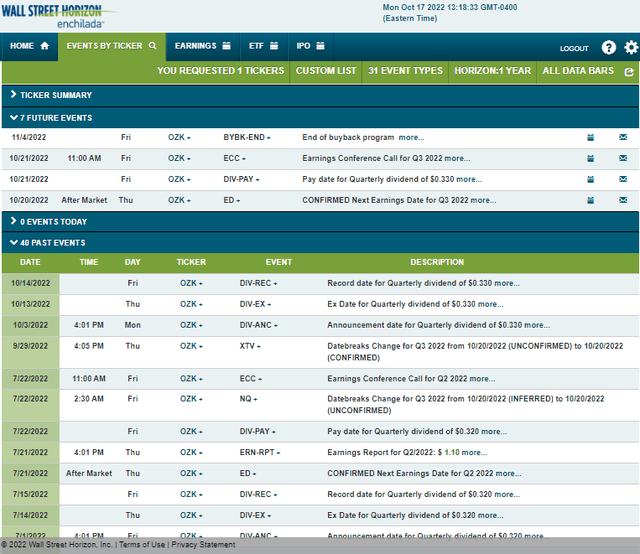

Looking ahead, OZK has a confirmed Q3 earnings date of Thursday, Oct. 20 after market close, according to corporate event data provided by Wall Street Horizon. A conference call is scheduled for Friday morning – you can listen live here. Also coming up is a dividend pay date on Friday. Be on the lookout for potential changes to its share repurchase program since the firm has a scheduled stock buyback end date on Nov. 4.

Corporate Event Calendar

Wall Street Horizon

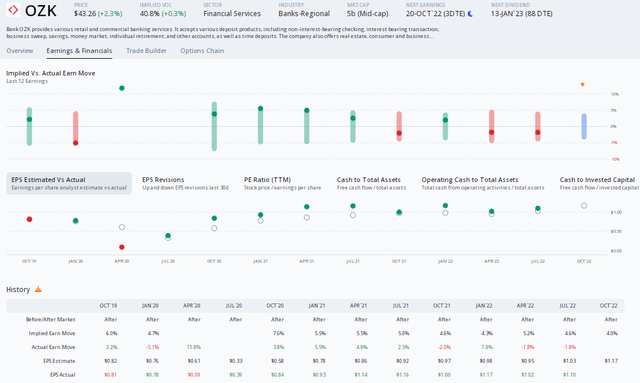

The Options Angle

Digging into expectations for the earnings report Thursday afternoon, Option Research & Technology Services (ORATS) data show a consensus EPS forecast of $1.17, which would be a solid jump of 17% compared to the per-share profit figure of $1.00 reported in the same quarter a year ago. Remarkably, Bank OZK has beaten earnings expectations in each of the previous nine quarters, though past earnings-related stock price reactions have been mixed.

In terms of this week’s anticipated volatility, options traders have priced in just a 4.1% implied moving using the nearest-expiring at-the-money straddle. Despite heightened market volatility, that’s the lowest expected swing post-earnings in the last three years, per ORATS. There has been one analyst upgrade of the stock since its July reporting date.

OZK: A Small Share Price Swing Expected Post-Earnings

ORATS

The Technical Take

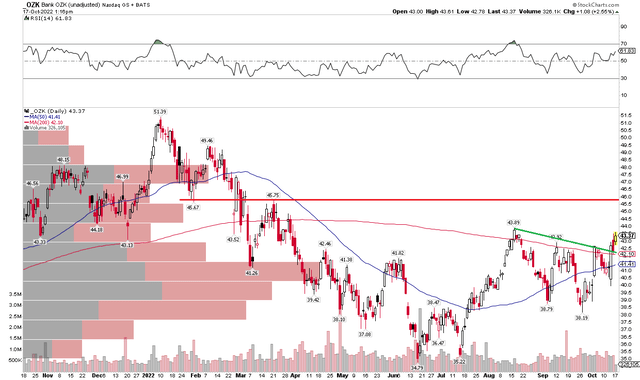

OZK has been putting in what appears to be a solid basing pattern for much of the year. Notice how shares peaked above $51 back in January, but then trended lower, hitting a nadir of just under $35 in June, underperforming the S&P 500.

There has been alpha since then, however. While the broad equity market has stumbled to fresh lows, OZK nears a fresh seven-month high. In addition to relative strength, its absolute chart shows a near-term breakout from a minor downtrend off its August high. I think the stock can head to the $45 to $46 zone in short order. Overall, the trend could be turning bullish, and I think being long makes sense.

OZK: Outperforming With A Bullish Near-Term Breakout

Stockcharts.com

The Bottom Line

Expect an earnings beat from Bank OZK Thursday night. I also think the stock has a strong chance of continuing higher. Long-term investors can own this regional bank for its solid yield and low valuation while swing traders should like its chart and relative strength.

Be the first to comment