Robert vt Hoenderdaal

While the prospects of e-commerce are exceptionally strong for the years to come, PostNL N.V. (OTCPK:PSTNY) is not one of the companies benefiting. That is, benefiting from it. In fact, macroeconomic pressures are so big that the company issued a profit warning for Q3 and is downbeat for the remainder of the year. At the AEX (Amsterdam Exchange Index), shares are trading 5.4% lower at the time of writing.

In this report, I will have a look at the results for Q2 as well as the outlook provided during the second quarter in call in August, which already put on display significant pressure and the reasons for removing the guidance.

Post NL: Q2 2022 Results Provided A Step Towards Outlook Deterioration

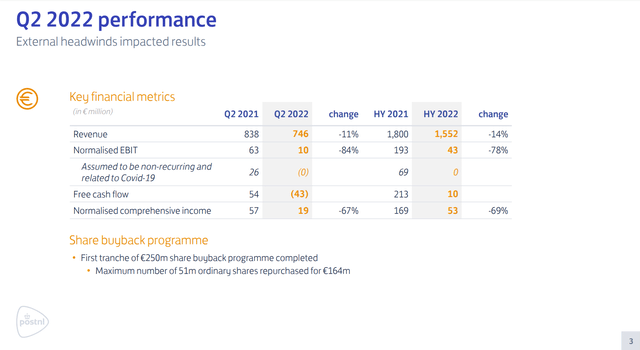

PostNL Q2 2022 results (PostNL )

In Q2 2022, we already saw that things were not heading in a growth direction for the Dutch logistics company. Revenue was down 11% and normalized income was down 84% with free cash flow dropped from positive €54 million to negative €43 million. Overall, going from Q2 2021 EBIT to Q2 2022 there was €27 million pressure related to non-recurring impact of Covid-19 and €27 million on business development driven mostly by parcels.

For PostNL, parcels are their bread and butter. It accounts for nearly 70% of the revenues and 140% of the normalized EBIT but already saw a 12.6% reduction in volumes while inflationary costs increased. Going from Q2 2021 to Q2 2022, there was a €50 million pressure on revenue from volume declines partially offset by higher price mix for parcels while collective labor agreements, volume and indexation at delivery partners drove cost up by €16 million offset by €29 million in aligning for lower volumes and a negative €17 million in other results accounting for negative Covid-19 impact.

PostNL Removes Guidance

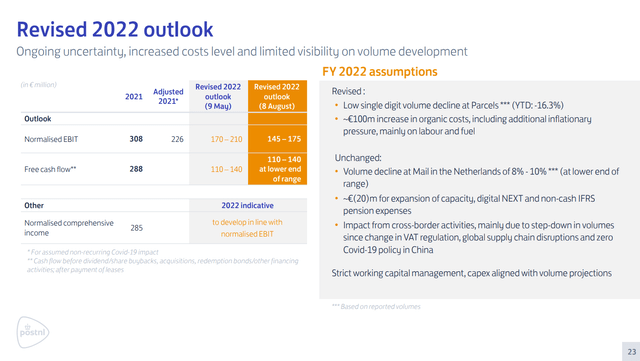

Outlook Q2 20220 is now removed (PostNL)

In Q2 2022, PostNL already reduced its Normalized EBIT by €25 million on the lower and higher bound, but keeping its free cash flow guidance the same. For Q3 2022, preliminary results show a €20 or 2.7% million drop in revenues to €709 and normalized EBIT is expected to be a €20 million loss compared to a €23 million gain a year earlier.

This is driven by a volume reduction of 1.1% at the parcel delivery business resulting in a €1 normalized EBIT loss comparing unfavorable to a €27 million profit a year earlier, while mail in The Netherlands saw a 9.3% volume drop resulting in a normalized EBIT loss of €1 million compared to a €12 million profit a year earlier.

The problem that PostNL is facing is peak inflation, and that drives up costs on elements such as labor and fuel. It has reduced consumer confidence, leading to lower volumes. PostNL previously had positioned itself for growth in the back half of the year, but those projections were too rosy under the current circumstances and declines are expected instead.

The tight labor market is already increasing costs for PostNL, and inflation further worsen the labor cost picture and as PostNL previously positioned for growth, they are now too big of a business for the volumes they will handle this year and that is capacity that they cannot just take out of the equation. There are elements such as sorting capacity that are pretty much fixed, labor contracts they are stuck with until early 2023 and because the labor market is tight they cannot cut drastically in costs because employees that are being sent off are unlikely to come back and that means that cost control is a major challenge so PostNL has to carry some capacity in order to deliver during the Christmas season. At the same time, for Christmas cards which traditionally provide a November bump in mail volumes PostNL has no vision on how inflation and consumer confidence will affect that volume this year.

So, with all those factors combined, the company is removing its outlook for 2022 altogether without providing an update at this time because the uncertainty is too big. PostNL will try to adjust pricing, indirect costs, capital expenditures and optimize the parcel and mail pick up rides but they have not been able to provide any cost reduction value on that.

PostNL: Unclear Path For Dividend

PostNL’s dividend policy outlines that its adjusted net debt to EBITDA should be 2 or better. By July 2022, the adjusted net debt was €494 million, indicating that the EBITDA should be at least €247 million. The adjusted net debt is likely going to increase as the cash flows are going to come in weaker than expected previously while investments have been made to realize a higher EBITDA.

Since no EBITDA numbers have been provided, it is hard to outline whether the adjusted net debt to EBITDA would start exceeding 2.0, but with Q3 expected to be weak with a normalized EBIT loss and Q4 also not looking rosy while the first half of the year was not strong either. I doubt that PostNL can sustain its dividend. Taking the normalized EBIT for H1+Q3, we get to €23 million. If we model in Q4 at the same level as last year, which is optimistic at best, we get to €89 million. That would require the adjusted debt to be €178 million and that is something I do not see happening with negative cash flow in Q3 2022 and continued cost pressures.

Conclusion: PostNL Get Slammed By Reality

For PostNL, this is a rude awakening. After several years of Covid-19-driven performance, the company is now finding out that overall in the labor market it is not positioned nicely. With higher costs due to inflation, it sees volume fall and cost driven up, which provides negative diverging performance that puts its dividend at stake from what can be derived now. The company has provided some mitigation paths, but overall I don’t see a positive path forward for PostNL for 2022. 2023 can only be better with adjustments to rates, but this is going to be tough to negotiate with e-commerce companies, and possibly taking out capacity that they cannot take out this year if inflation remains significantly elevated and demand remains under pressure. With PostNL, there are too many ifs and too many unknowns, and, therefore, I believe it is not a stock you should have in your portfolio.

Be the first to comment