Andrii Yalanskyi/iStock via Getty Images

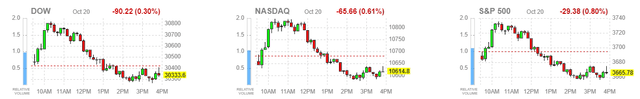

Higher Treasury yields trumped better-than-expected earnings reports for a second day in a row, dragging the major market averages down from what were early morning gains. A drop in weekly unemployment claims from 226,000 to 214,000 would normally be good news, but at a time when the Fed is trying to snuff out any signs of growth, it was not welcome. In that vein, the 1.5% decline in existing homes sales for September should have been a positive catalyst, but it wasn’t able to override the labor market’s strength. That’s misguided in my view, because the housing market will have more to do with bringing down the rate of inflation moving forward than suppressing job and wage growth.

Rapid monetary policy tightening has adversely impacted the housing market more so than any other sector of the economy, as can be seen by the punishing run up in mortgage rates. Existing home sales have fallen eight months in a row to the tune of 23.8% over the past year. The median sale price fell for the third month in a row, and the annual price increase has fallen from 25% in May 2021 to 8.4% in September. It should keep falling in this environment. The writing is on the wall for home values to decline modestly in 2023 on an annualized basis. That should be followed by a similar decline in owners’ equivalent rent, as well as actual rents, both of which combine to account for approximately 40% of the Fed’s preferred rate of inflation, which is the personal consumption expenditures price index (PCE). As a result, the rate of inflation should fall as rapidly in 2023 as it rose over the past 18 months.

Yet Fed officials continue to myopically focus on the rate of inflation over the past 12 months, based on their daily rhetoric, as though that were a leading indicator. I am still holding out hope that what they say is intended to anchor expectations, while what they do in the meetings ahead will account for the disinflationary factors that are starting to present themselves in the real economy.

Still, hawkish rhetoric continues to drive short- and long-term interest rates higher, which continues to weigh heavily on stock valuations. What impresses me is the fact that the Russell 2000, which is a more domestically-focused index, has been able to hold its June low, while the S&P 500 closed yesterday just above its June low. This comes despite a much stronger dollar and a full percentage-point increase in interest rates over the past four months. The offsetting factor has been the continued growth in corporate profits.

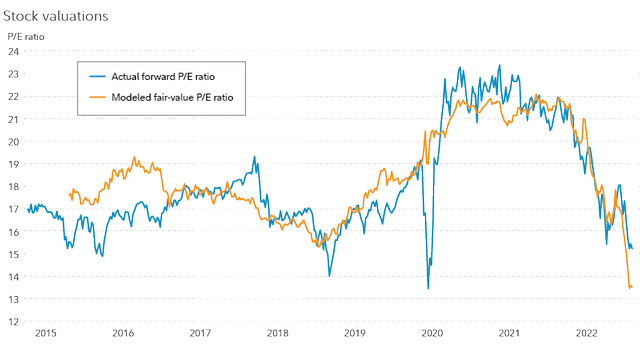

The ongoing debate today is centered around how low the S&P 500 must go to complete the bear market decline and fully factor in the peak in both short- and long-term interest rates for this cycle. I think this obfuscates the glaring opportunity that a bear market presents for investors, which is that they should be buying stocks and not the stock market. Jurrien Timmer, who is the director of global macroeconomic strategy at Fidelity, pointed out this week the overriding impact interest rates have on stock valuations based on the discounted-cash-flow model. This model dictates that a stock’s current value is a function of its collective future cash flows, which are then discounted to a present value by dividing the sum by current interest rates. Therefore, the higher interest rate rise, the lower the present value of future cash flows. It is as simple as that, which is reflected in the chart below.

He arrives at a fair value price-to-earnings multiple for the S&P 500 of 13.5x, which is based on his own version of the model that uses the 2-year Treasury yield and 10-year real yield (inflation adjusted) to discount estimated earnings for the next 12 months. That results in a fair value of 3,200 for the S&P 500, implying approximately 9% downside. The two variables here are earnings estimates and interest rates. If rates come down, fair value goes up. If earnings estimates come down, fair value goes down. You can see this play out each day by looking at the seesaw price action between interest rates and the major stock market averages. Earnings estimates adjust on a far more infrequent basis.

Bear markets present outstanding investment opportunities because practically all stocks are sold indiscriminately as we approach their bottoms. The greatest opportunities are found in stocks that are trading at multiples well below the fair-value multiple for the broad market. They are innumerous today, and if they have better growth prospects than the broad market, then they are ideal candidates for the year ahead. That remains my focus.

Be the first to comment