Frank Wagner/iStock via Getty Images

As NGL prices bounced back in the past few days after a drop in August and September, Enterprise Products Partners (NYSE:EPD) stock price increased to $25 per share. According to SA ratings (Wall Street price target), EPD has a price target of between $27 to $35. NGL prices are not as high as in the second quarter of 2022; however, significantly higher than in 3Q 2021. Thus, I expect the company’s financial results in the third quarter to be strong. The stock is a buy.

Quarterly highlights

In its 2Q 2022 financial results, EPD reported an operating income of $1764 million, compared with a 2Q 2021 operating income of $1492 million, driven by record results from natural gas processing and octane enhancement businesses. The company’s net income increased from $1146 million, or $0.50 per common unit on a fully diluted basis in 2Q 2021 to $1440 million, or $0.64 per common unit on a fully diluted basis in 2Q 2022. In the second quarter of 2022, Enterprise reported adjusted EBITDA, adjusted CFFO, and adjusted FCF of $2418 million (up 20% YoY), $1718 million (up 58% YoY), and $2018 million (up 26% YoY), respectively. “Enterprise reported record results in the second quarter of 2022,” Teague, co-chief executive officer of Enterprise’s general partner, stated.

In 2Q 2022, EPD reported pipeline volumes of 6.6 million BPD, up 1.5% YoY. The company’s marine terminal volumes increased from 1.6 million BPD in 2Q 2021 to 1.7 million BPD in 2Q 2022. Its natural gas pipeline volumes increased from 14.2 TBtus/d in 2Q 2021 to 16.8 TBtus/d in 2Q 2022. Moreover, EPD’s NGL fractionation volumes, Propylene plant production volumes, free-based natural gas processing volumes, and equity NGL-equivalent production volumes increased in the second quarter of 2022, compared with the same period last year. “The partnership reported record natural gas pipeline volumes and octane enhancement sales volumes during the second quarter of 2022,” Teague commented. “We have $5.5 billion of organic growth projects under construction. These major projects remain on-time and on-budget,” he continued. Furthermore, Enterprise reported 2Q 2022 distributions of $0. 475 per unit, up 5.6% YoY. The company has recently announced a quarterly cash distribution of $0.475 per unit for the third quarter of 2022.

The market outlook

Due to higher NGL prices in the first half of 2022 (the weighted-average indicative NGL price for the second quarter of 2022 increased 66 percent to $1.06 per gallon compared to the second quarter of 2021), EPD’s natural gas processing business improved significantly.

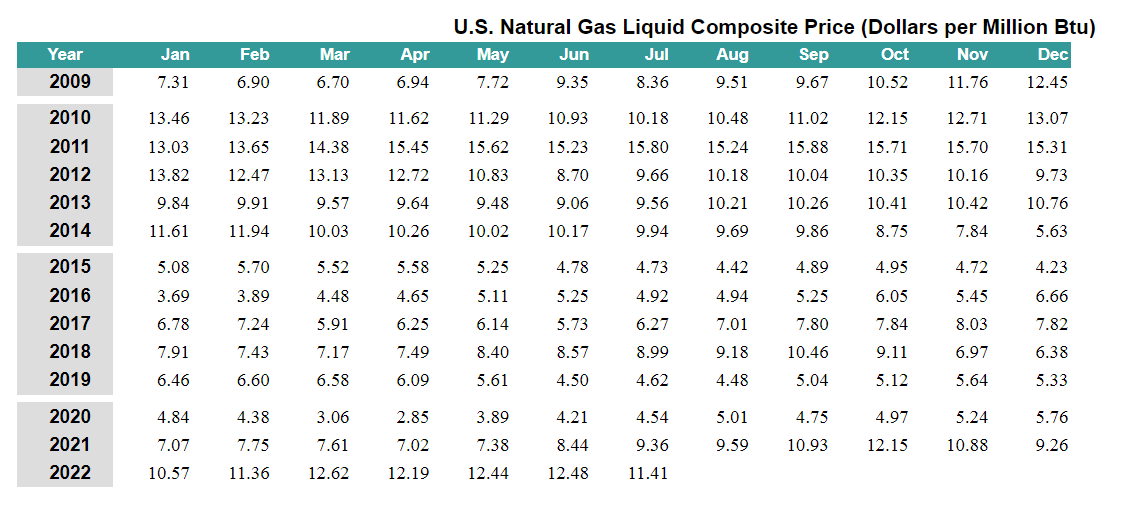

Figure 1 shows that the U.S. NGL composite price in the first month of 3Q 2022 was lower than in 2Q 2022. However, NGL prices in 3Q 2022 were significantly higher than in the same period in the past ten years. The NGL pipelines & services segment is the major segment in EPD’s operations. The gross operating margin of this segment increased from $1098 million in 2Q 2021 to $1327 million in 2Q 2022, up 21%, driven by increased NGL prices (The weighted-average indicative market price for NGLs increased 66% YoY percent to $1.06 per gallon in the second quarter of 2022). In the past five days, past month, and past three months, Mont Belvieu ethane (Oct 2022) futures increased by 5%, decreased by 19%, and decreased by 13%, respectively. In the past five days, past month, and past three months Mont Belvieu LDH propane (Oct 2022) futures increased by 4%, decreased by 12%, and decreased by 21%, respectively. In the past five days, past month, and past three months Mont Belvieu normal butane (Oct 2022) futures increased by 4%, decreased by 9%, and decreased by 24%, respectively. Figure 2 shows that after a sharp decrease, Mont Belvieu natural gas (Oct 2022) futures bounced back in the past few days. Moreover, Mont Belvieu iso-butane (Oct 2022) futures increased in the past few days (see Figure 3). Thus, I expect EPD’s NGL pipelines & services 3Q 2022 gross profit margin to be lower than in 2Q 2022; however, significantly higher than in 3Q 2021. Moreover, we can see that in the past week, NGL prices have increased, implying that the market condition may improve for Enterprise.

Figure 1 – U.S. natural gas liquid composite price (dollars per million Btu)

eia

Figure 2 – Mont Belvieu natural gas (Oct 2022) futures

www.cmegroup.com

Figure 3 – Mont Belvieu iso-butane (Oct 2022) futures

www.cmegroup.com

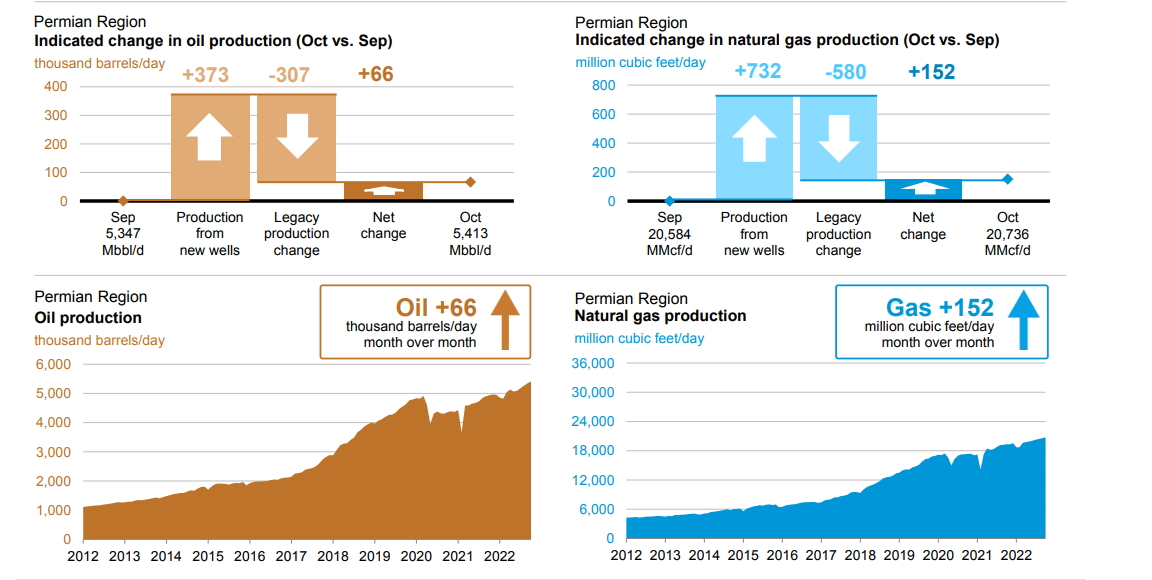

As oil and natural gas production in the Permian Basin is increasing, Enterprise announced three expansions in the Permian Basin to improve its natural gas processing operations and NGL pipeline system. “The Permian Basin continues to be the driver for U.S. production growth of crude oil, natural gas, and NGLs that supports increasing energy demand both domestically and abroad,” the co-chief executive officer of EPD stated. Figure 4 shows that On October 2022, oil and natural gas production in the Permian Basin is expected to increase by 66 thousand barrels per day and 152 million cubic feet per day, respectively (month over month). Due to EPD’s recent developments and expansions, the company will be able to benefit from the increasing production in the Permian Basin in the future more than now.

Figure 4 – Oil and natural gas production in the Permian Basin

eia

EPD performance outlook

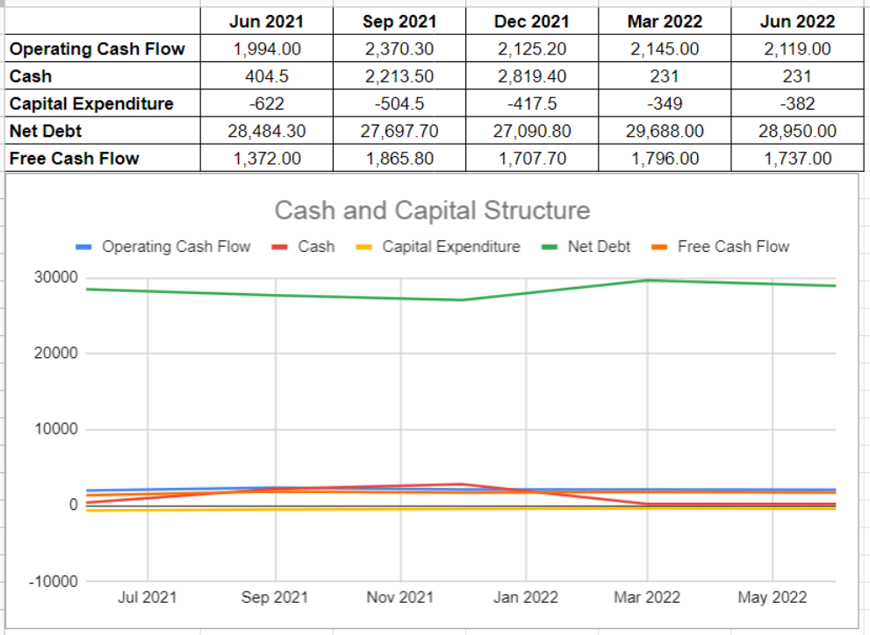

As can be seen from EPD’s cash flow performance, the company’s operating cash flow of $2.11 billion during the second quarter of 2022 increased by 6% year-over-year versus its level of $1.99 billion at the same time in 2021. Moreover, for the sake of its little amount of capital expenditure, which is 38% lower than its $622 million in 2Q 2021, most of the company’s cash operation would be translated as free cash flow and sit at $1.73 billion in the second quarter of 2022. Its higher free cash flow year-over-year versus its level of $1.37 billion in 2Q 2021, provides scope for more distributions in the future. In the case of Enterprise Products Partners’ net debt, the Navitas Midstream acquisition, costing about $3.2 billion, curtailed the company’s net debt from decreasing during 1H 2022. However, in light of their up-to-now performance and the management’s point of view for 2022, we can expect strong cash and capital structure outlook for the rest of 2022 (see Figure 5).

Figure 5 – EPD’s cash and capital structure (in millions of USD)

Author (based on SA data)

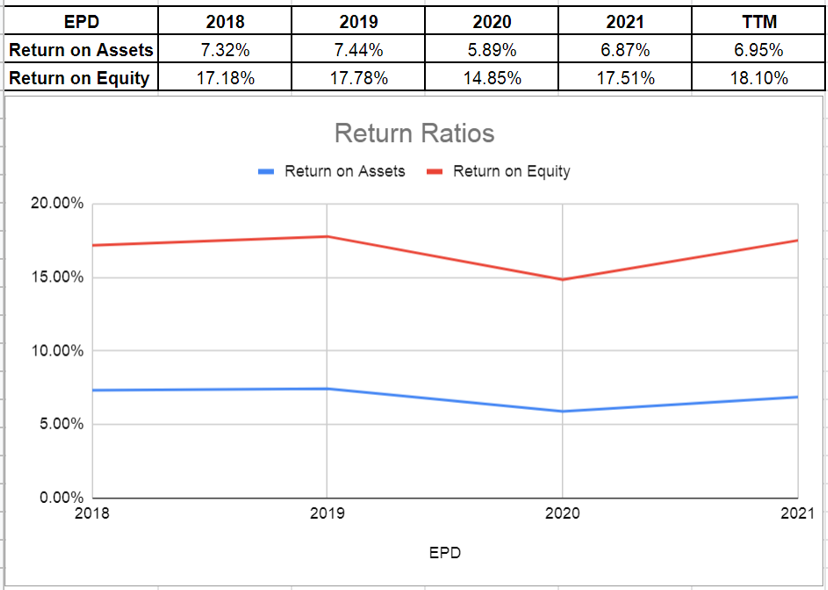

To represent Enterprise Products Partners’ ability to cater returns to its unitholders, I have investigated its return on assets and return on equity ratios. Referring to the Investopedia explanation, the ROA ratio reflects how much profit a company can generate for every dollar of its assets. During the severe downturn of 2020, EPD’s ROA ratio plunged by 155 bps and sat at 5.89% at the end of 2020. However, the company has paved its recovery path very successfully up to now and increased its return on assets back by 106 bps to 6.95% (TTM). Similarly, EPD’s return on equity experienced a deep drop to 14.85% following the 2020 downturn. Whilst its ROE has recovered and reached 18.1% (TTM), which is even higher than its 17.78% at the end of 2019 before the pandemic started. The return on equity ratio is useful as it measures the rate of return on the money invested in the company. Thus, Enterprise Products Partners increasing return on equity shows its capability of generating cash, and thereby, less dependency on debt financing (see Figure 6).

Figure 6- EPD’s return ratios

Author (based on SA data)

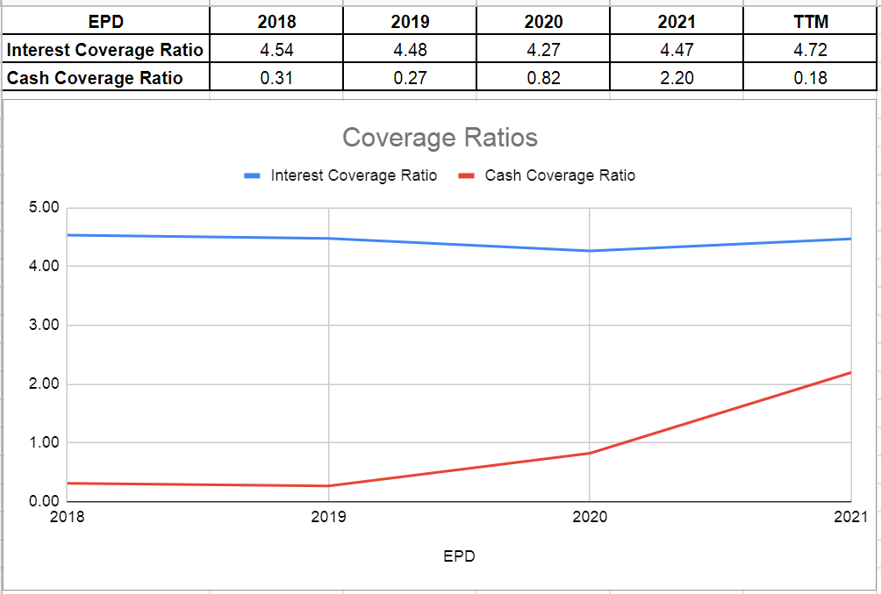

Furthermore, we can analyze EPD’s coverage ability across the board of its interest coverage and cash-coverage ratios. Its ICR in TTM indicates that 4.7 times the company can pay its interest expenses on its debt with its operating income. Thankfully, there is another witness for the company’s ample scope to cater income for its unitholders in the tough times, as its ICR ratio has been increasing. EPD’s ICR ratio is higher than its amount of 4.48 at the end of 2019, before the COVID-19 turndown.

Meanwhile, as a conservative metric to compare the company’s cash balance to its annual interest expense, EPD’s cash coverage ratio in TTM is 0.18, which is not surprising due to the company’s lower cash generation. However, apart from 2020 and 2021, it is observable that the company’s cash coverage ratio was not very significant such as its level of 0.27 at the end of 2019. In sum, there may not be concerns about Enterprise Products Partners’ ability to cover its obligations (see Figure 7).

Figure 7 – EPD’s coverage ratios

Author (based on SA data)

Conclusion

Ultimately, all was said and done, according to the preceding remarks and analyzing some profitability and coverage ratios, I realized that Enterprise Products Partners has a good scope of ability to cater stable benefits for its unitholders in the future. Thus, following my performance outlook on EPD, I believe that the stock is a buy.

Be the first to comment