bhofack2/iStock via Getty Images

It’s been a rough year thus far for the restaurant sector, with the AdvisorShares Restaurant ETF (EATZ) underperforming the S&P 500 (SPY) by a wide margin. Unfortunately, despite Portillo’s Inc.’s (NASDAQ:PTLO) industry-leading unit growth rates, it hasn’t been able to buck this trend, and it’s down 33% year-to-date even after its sharp rally. While the Q2 report for the stock was better than expected, with only a slight miss on sales, industrywide trends are not in PTLO’s favor, with guest traffic decelerating further in June in the restaurant space. Therefore, I see this rally above $25.00 as an opportunity to book profits on 3/4 of one’s position and ride the rest of the position for free with a trailing stop.

Portillo’s – Sterling Heights, MI (Company Website)

Just over two months ago, I wrote on Portillo’s, noting that while there were much safer bets elsewhere, given the unfavorable dining trends, the stock would enter a low-risk buy zone at $15.70 – $16.00. Since then, the stock has risen more than 40% and is now making a run at the $25.00 mark. This is partially attributed to the sharp rebound we’ve seen in the general market. However, many restaurant stocks were priced for large misses heading into Q2 and had relatively high short interest, and the results have been slightly better than expected. In my view, this has also contributed to the recent rally. Let’s take a closer look at Portillo’s Q2 report below:

Q2 Results

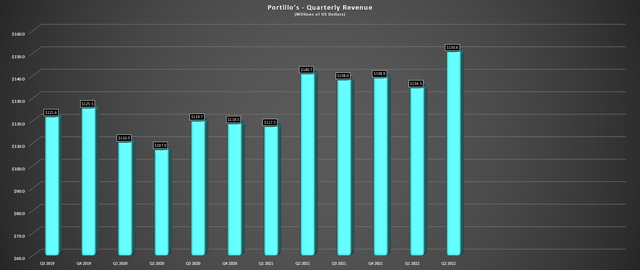

Portillo’s reported its Q2 results this week, reporting quarterly revenue of $150.4 million, a 7% increase from the year-ago period. This sales growth was driven by the addition of 4 new restaurants in the period and low single-digit same-restaurant sales growth (1.9%), which grew in the least attractive way through menu pricing offset by a decline in items sold per transaction. It is worth noting that the company was up against tough comps in the year-ago period, lapping 25% same-restaurant sales. Still, given the menu pricing increase of nearly 7% in the period, these figures were below my estimates.

Portillo’s Quarterly Revenue (Company Filings, Author’s Chart)

While the sales performance wasn’t terrible considering the difficult macro environment, the company’s margins left much desired. This was related to a sharp increase in labor costs and cost of goods sold, which jumped by 70 basis points and 440 basis points, respectively, as a percentage of sales. The culprit for the increase in labor costs was additional investments in wages, with a further boost to wages at the start of Q3. Meanwhile, food & beverage costs were impacted by double-digit commodity inflation, with the company calling out chicken, beef, and pork as the items being the most affected.

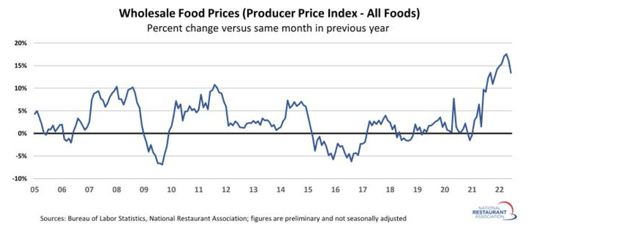

Wholesale Food Prices (National Restaurant Association, BLS)

Unfortunately, for investors hoping that we’d seen peak inflation and meaningful moderation by now after Wingstop’s (WING) discussion of bone-in wing deflation, Portillo’s noted that it expects prices to remain elevated for the remainder of the year (13-15%). This is consistent with what we’re seeing from the Producer Price Index (wholesale food prices), which are up 13.4% year-over-year, with items most affected being eggs, butter, fats and oils, milk, cheese, and processed poultry. The result was a significant decline in restaurant-level margins for Portillo’s, which dipped to 25.5%, a 10% decline year-over-year.

Finally, on an adjusted EBITDA basis, Portillo’s reported Q2 adjusted EBITDA of just $27.6 million, down from $32.5 million in the year-ago period. This translated to a significant decline year-over-year, with Portillo’s seeing a larger hit to profits than its peers due to its operator model vs. mostly franchised models like RBI (QSR). When combined with the ~$18 million in Q1 adjusted EBITDA, H1 2022 adjusted EBITDA sits at just ~$45 million, a paltry figure for a company sporting a market cap of ~$1.80 billion.

Industry Headwinds & Traffic Trends

While inflationary pressures have dented restaurant margins for nearly all brands, and labor tightness continues to be an issue for some operators, the most recent headwind has come from a top-line standpoint. This is because consumers are getting hit from every angle, impacted by rising mortgage rates, elevated gas prices, and rising grocery costs, causing some to tighten their budgets. At the same time that discretionary budgets are shrinking, restaurant brands are raising prices to combat inflationary pressures (wages, commodities).

Portillo’s Menu (Company Website)

In some cases, the result is less guest satisfaction, as consumers are already tight and now pay 10% more for the same meal/menu item they received 18 months ago. In fact, Black Box Intelligence analysts noticed that higher average checks were linked to a lower intent to return and decreased traffic. The report noted that companies reporting the lowest increase in guest checks (25% lowest check growth) saw increased guest counts. The other 75% of restaurant companies reported negative traffic growth (Q2-22 vs. Q2-19).

Additionally, guests at low check growth restaurants (brands more conservative with menu price increases) saw improved guest sentiment. This shouldn’t be a huge surprise, with those brands offering value seen more positively than those where checks are constantly creeping up. Given that Portillo’s is one company that is raising its prices at a relatively steep pace (6.8% menu pricing in Q2) and continues to take a hit from commodity inflation (suggesting further menu price increases could be on deck), this doesn’t place it in a great position.

Of course, this assumes that the analysis done by Black Box turns out to be correct related to guest satisfaction and intent to return.

Portillo’s Restaurant (Company S-1)

There’s also bad news from an industry-wide traffic standpoint. While the May numbers from Black Box Intelligence for restaurant traffic were disappointing, with twelve consecutive weeks of negative traffic, the June numbers didn’t alleviate any concerns. Comparable traffic for June was down 4.8% for the month, decelerating from (-) 2.9% in May. Meanwhile, same-store sales growth came in at its lowest levels since February 2021, an alarming figure given that this is despite meaningful menu price increases across the board. Finally, even fine dining/upscale casual saw a hit in June, a change in character. This suggests that even more affluent consumers may be curtailing their spending a little or changing dining habits.

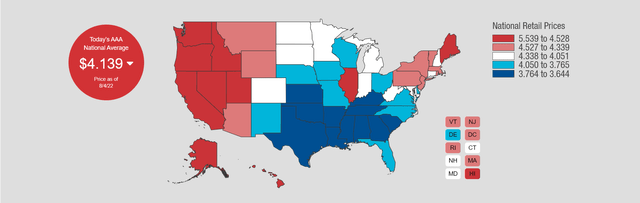

National Gas Prices (GasPricesAAA.com)

So, while Portillo’s might have put together a decent quarter that was better than expected (marginal sales miss), industry-wide trends are not in the company’s favor, and little has changed since Q2 other than some moderation in fuel prices. Besides, from a reverse wealth effect standpoint, we’ve just seen home prices cool at a record pace, which, combined with the bear market in cryptos and equities, could also impact consumer spending. The wealth effect is the notion that when households become richer from a rise in asset values, they spend more, with the opposite being that when home prices/equities fall, consumers may feel less wealthy.

In my view, this could lead to a softer Q3 for many brands from a sales standpoint. Therefore, I believe this violent rally in the restaurant space over the past month that has correlated with falling gas prices could provide an opportunity to book some profits ahead of a more difficult Q3 report for some casual dining names. For quick-service names which could benefit from trading down, I don’t as much of a risk from a traffic standpoint, suggesting they could be safer bets as long as they are trading at deep discounts to fair value (very few are after the recent rally).

Valuation

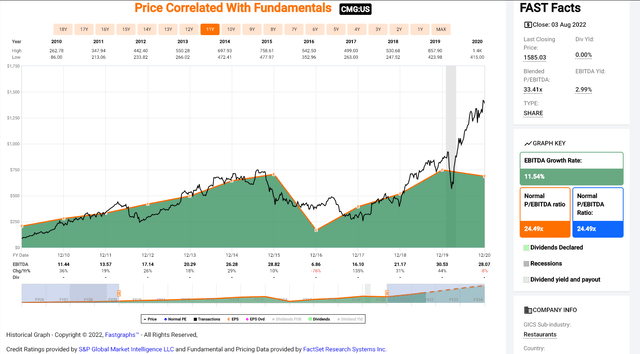

Based on ~72 million shares outstanding and a share price of $24.80, Portillo’s trades at a market cap of ~$1.78 billion, or an enterprise value of ~$2.04 billion. Assuming the company generates ~$77 million in EBITDA in FY2022, the company is trading at an EV/EBITDA ratio of 26.5. In my view, this is a very steep valuation, given that even some of the best concepts have struggled to command multiples this high, including Chipotle (CMG), which is a much more proven concept. Besides, this was Chipotle’s multiple pre-COVID, and the industry is up against considerable headwinds currently (labor tightness, inflationary pressures, rising cost of living for consumers impacting demand).

CMG Historical EBITDA Multiple (FASTGraphs.com)

Based on what I believe to be a more conservative EBITDA multiple for Portillo’s of 19x EV/EBITDA due to its impressive growth profile and FY2023 estimates ($92 million), I see a fair value for the stock of ~$1.50 billion, or $20.80 per share. Hence, I do not see any upside from current estimates unless the company can trounce its estimates next year. Given this outlook, I no longer see Portillo’s stock as anywhere near a low-risk buy zone and believe this is an opportunity to book profits into strength. Let’s see if the technical picture confirms this view:

Technical Picture

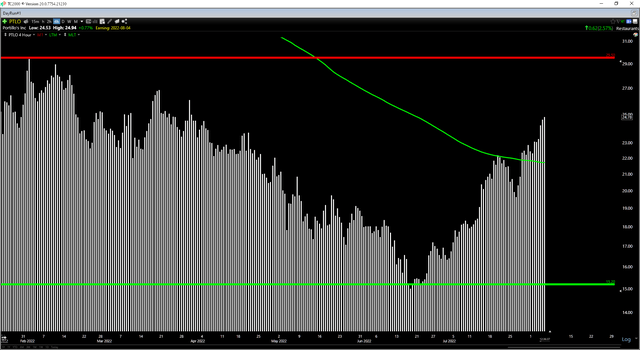

Looking at the daily chart below, Portillo’s found strong support below $16.00, as I expected, and now has a new confirmed support area at $15.20, where it saw some accumulation in mid to late June. However, the stock has now run up more than 65% off its lows and is trading in the upper portion of its support/resistance range. This is based on strong resistance at $30.00 from the stock’s initial post-IPO support, given that there’s no strong support until $15.20 due to this near-parabolic rally. From a current share price of $24.80, this translates to a reward/risk ratio of 0.55 to 1.0, well below the 6.0 to 1.0 reward risk/ratio I prefer to justify entering new positions.

Meanwhile, PTLO is also rallying into the underside of its 200-period moving average. This often represents a sticky point for a stock after a sharp technical breakdown. Therefore, investors that bought the dip would be wise to take profits on at least 3/4 of one’s position. In fact, if the stock were to rally above $28.20 before September, it might even become a compelling short, given how overbought it is becoming short-term. For now, I am not interested in shorting the stock, given that I prefer shorting closer to resistance to limit my risk (PTLO resistance: $30.00), but I would be a seller into this strength on the back of what was a mediocre report.

Summary

Portillo’s has enjoyed a strong rally since its Q2 lows and is now up 67% in 34 trading days, translating to an annualized return of over 3000%. As the saying goes, an Italian beef sandwich in the hand is worth two in the bush, and I don’t see any reason to be greedy after a rally of this magnitude. To summarize, while PTLO is a promising long-term story, its current valuation leaves a lot to be desired. Hence, I believe it’s best to take profits when they’re available with the market trading below its 200-day moving average.

Be the first to comment