koto_feja

“Potential has a shelf life.” – Margaret Atwood

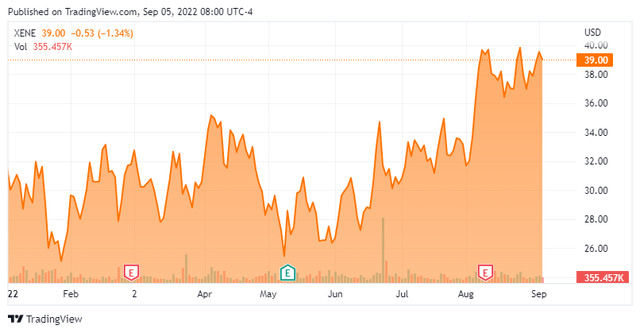

We last looked in on Xenon Pharmaceuticals (NASDAQ:XENE) nearly nine months ago. In the summary of that article, the conclusion was that the company had some promising attributes and was worthy of a small ‘watch item’ via covered call positions. That turned out to be a profitable trade. Time for another potential round trip? We update the investment thesis on Xenon below.

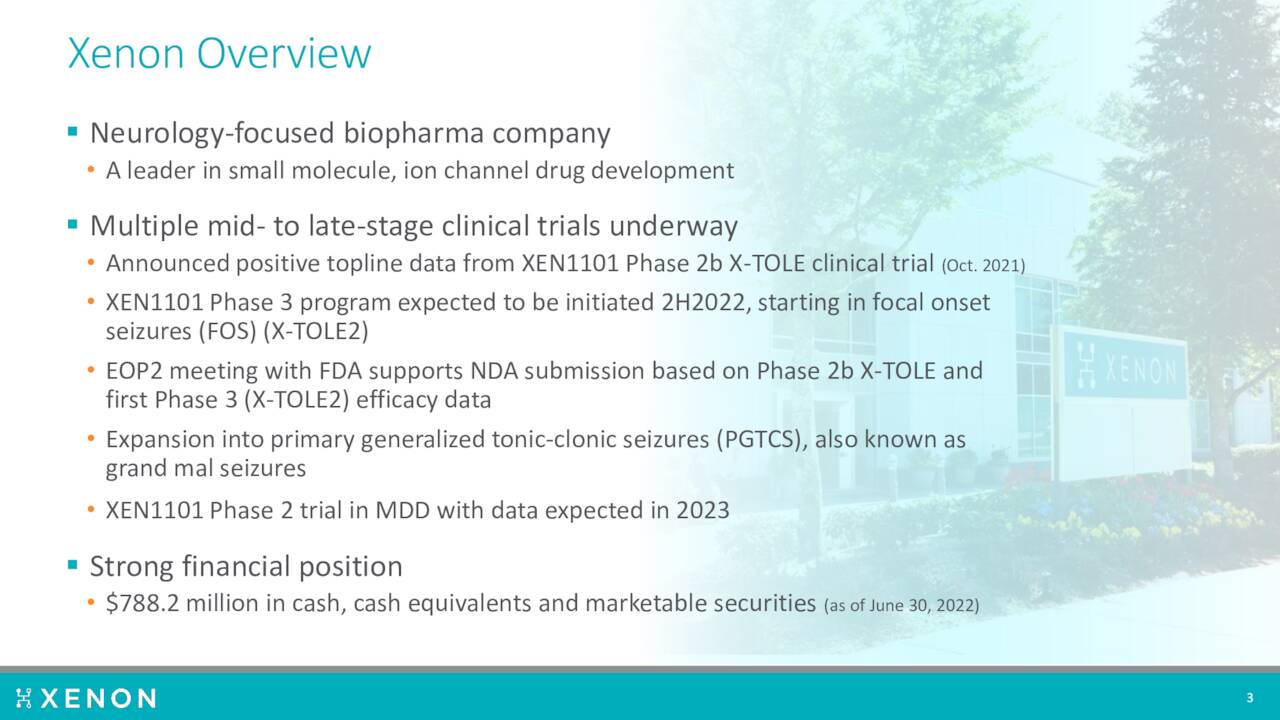

Company Overview:

Xenon Pharmaceuticals is a clinical-stage biotech company focused on developing therapeutics to treat patients with neurological disorders. The company is based just outside of Vancouver, Canada. The stock trades just under $40.00 a share and sports an approximate market cap just north of $2.4 billion.

August Company Presentation

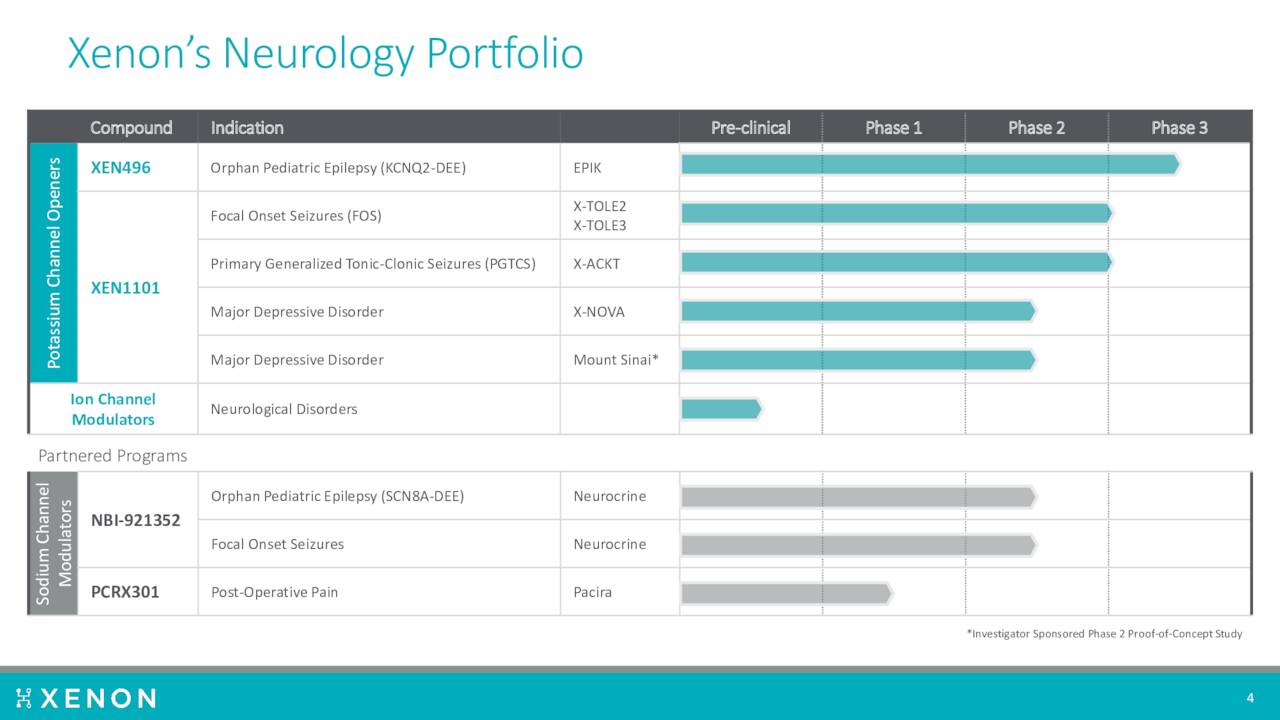

The company has several compounds in development as can be seen by the pipeline chart above.

August Company Presentation

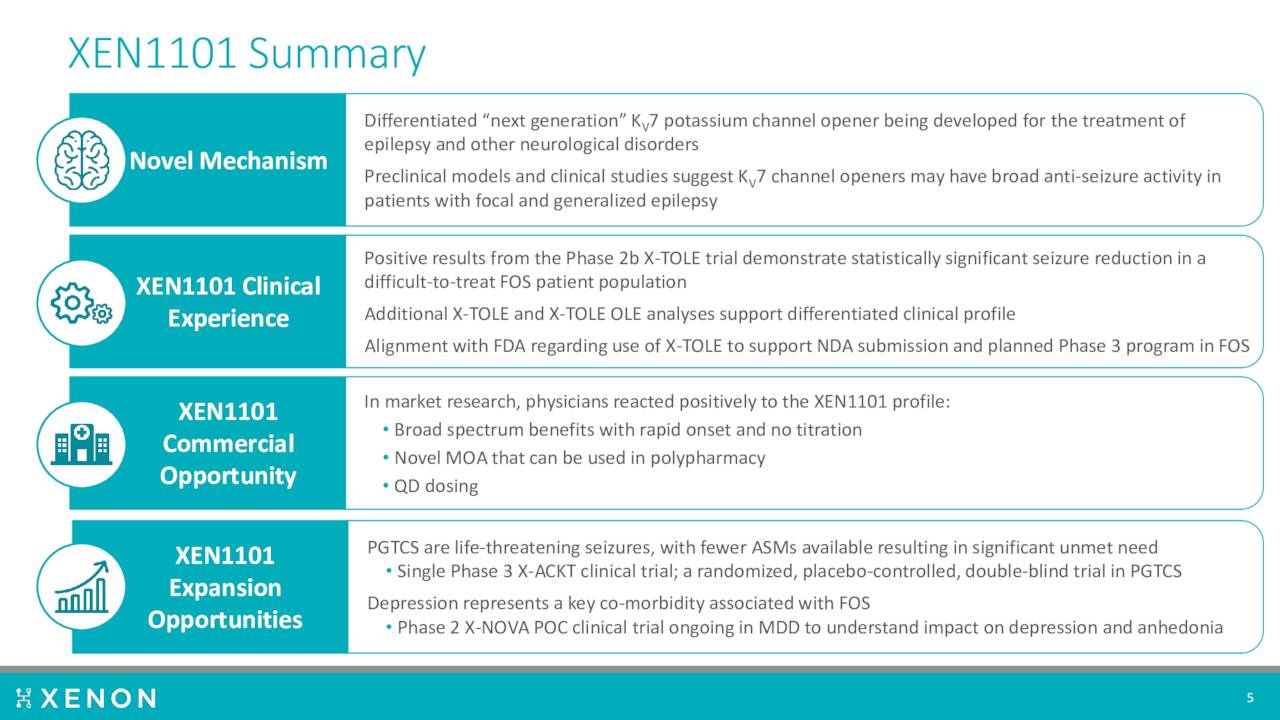

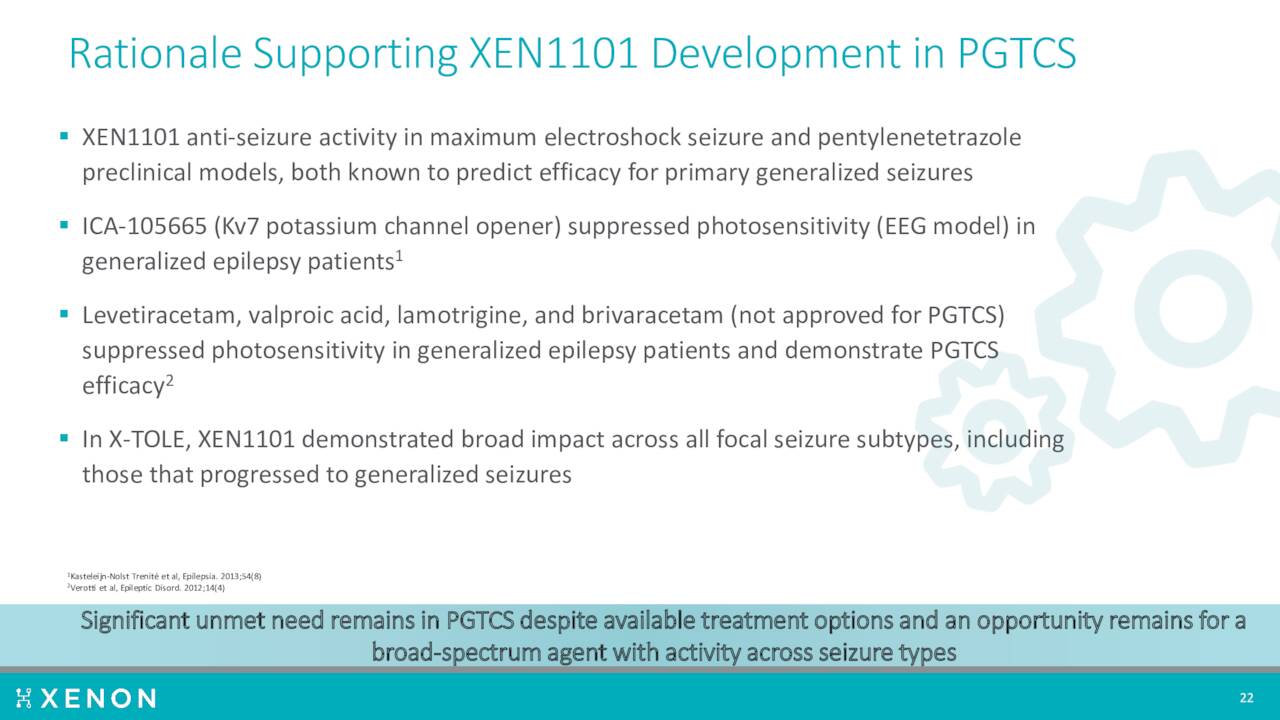

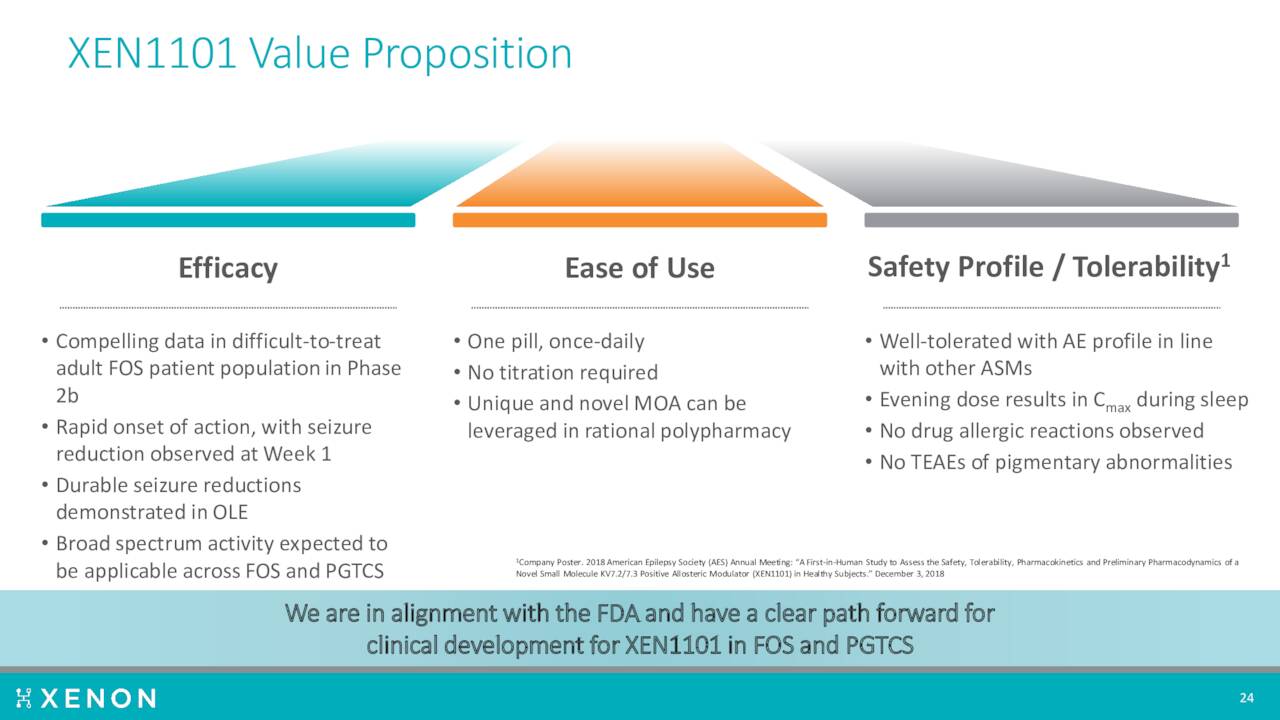

The most important asset in development is a candidate called for the moment XEN1011. This is a next generation Kv7 potassium channel opener with potential applications in treating the focal onset seizures which occurs in epileptics as well as other potential neurological disorders.

August Company Presentation

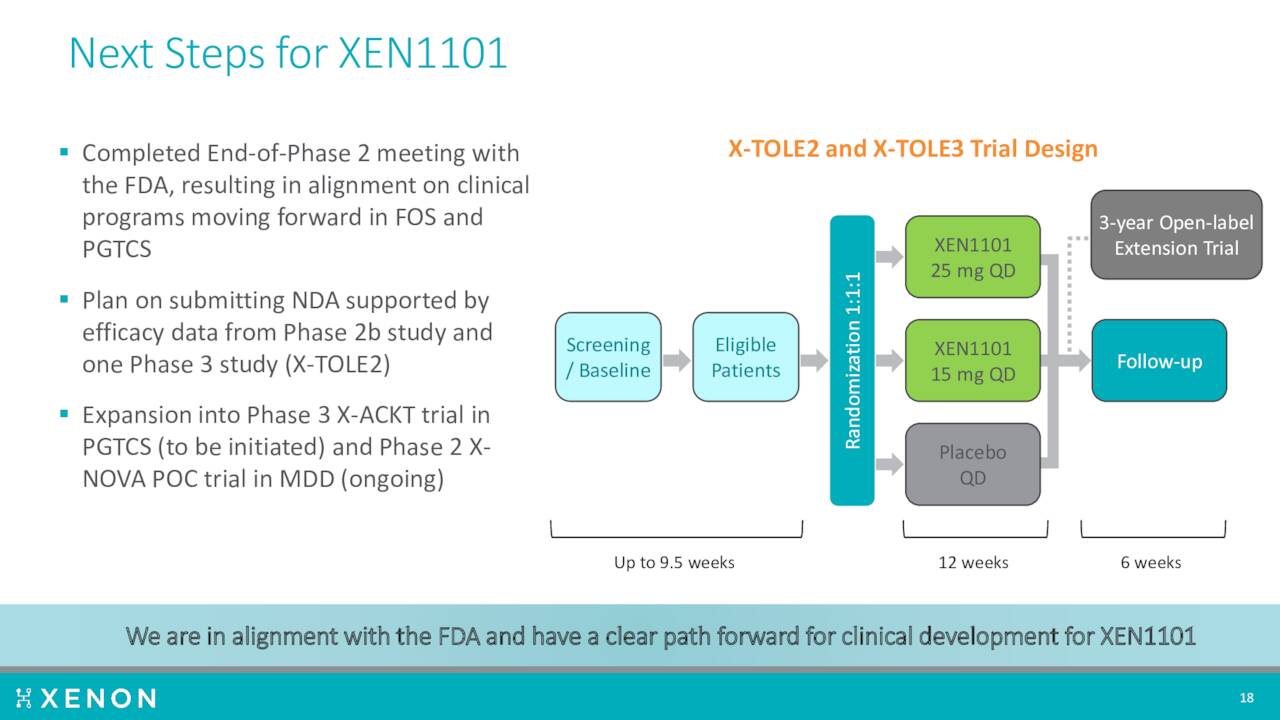

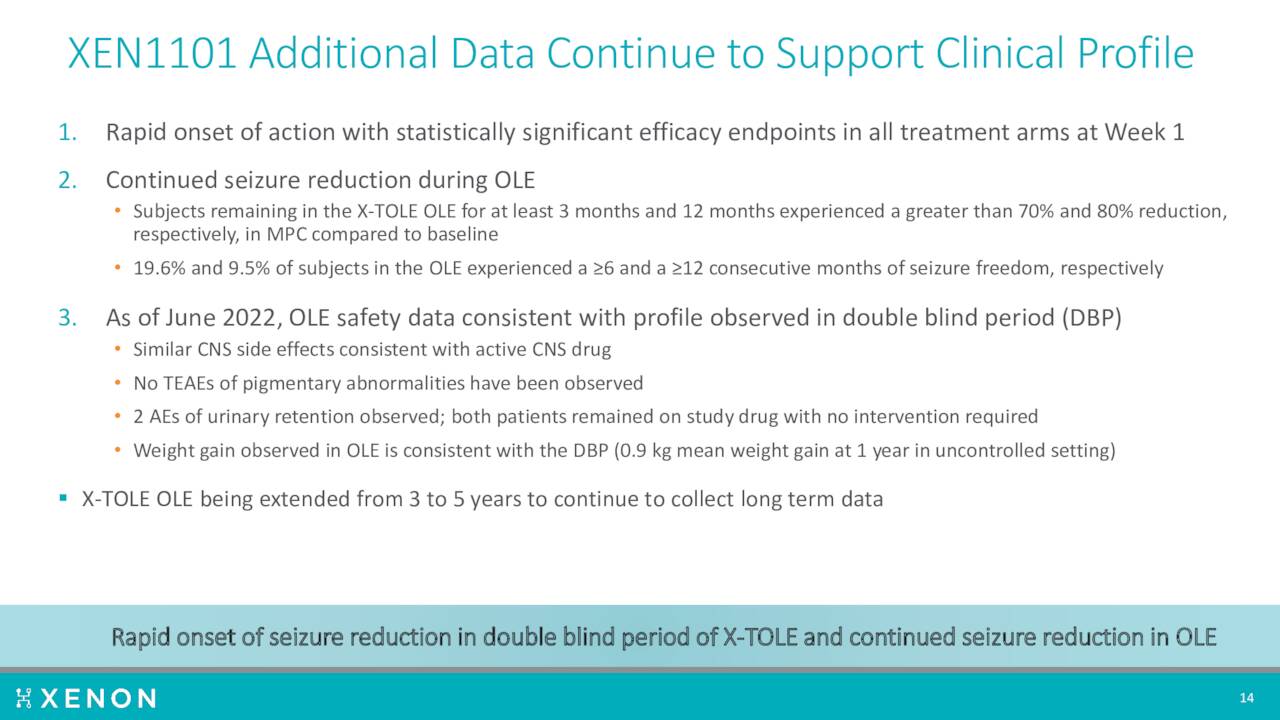

A Phase 2b trial produced encouraging results in the fourth quarter of last year. The company then disclosed new, compelling efficacy data from that study ‘X-TOLE’ in June of this year. A Phase 2 study ‘X-TOLE2’ should initiate by the end of this year, followed shortly by a Phase 3 trial X-TOLE3. If successful, the company plans to submit a market application around this compound to treat epilepsy.

August Company Presentation

The compound is also in development for other neurological disorders. The company currently has a Phase 2 ‘X-NOVA’ study underway examining XEN1101 in major depressive disorder or MDD. This trial in parallel with an investigator-led Phase 2 MDD study led by Xenon’s collaborators at Mount Sinai. Topline results should be out in 2023.

August Company Presentation

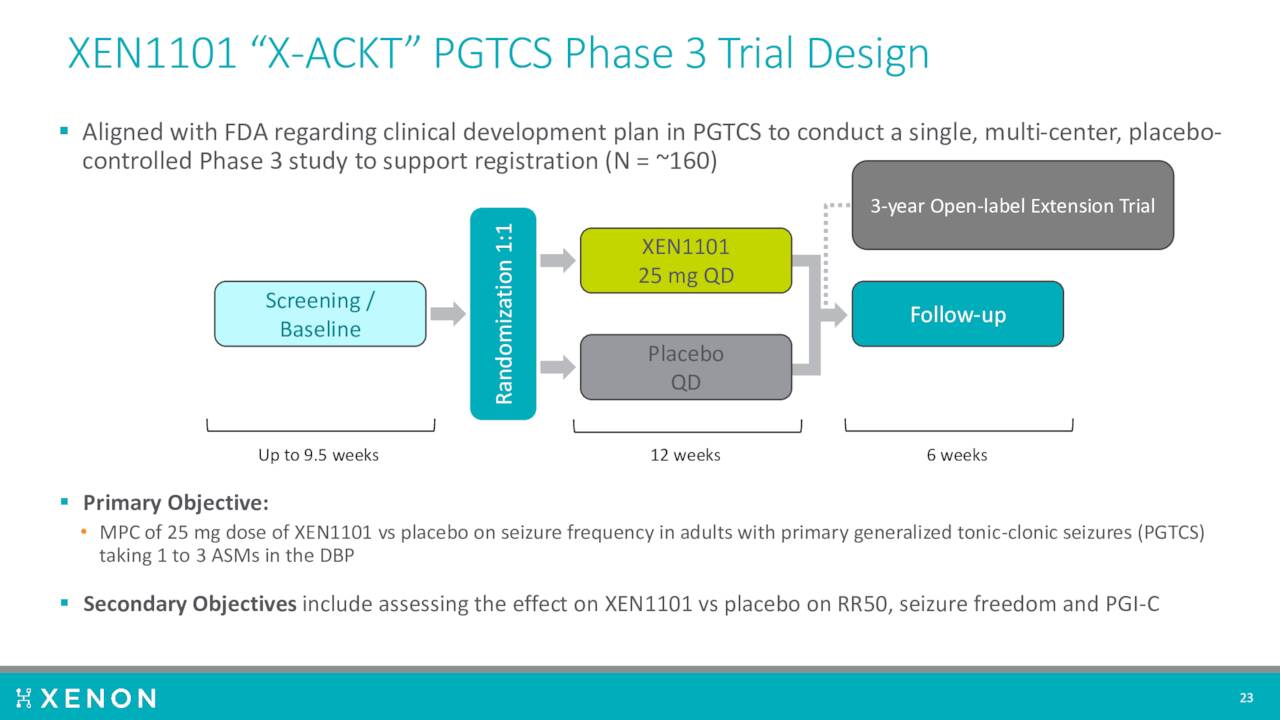

XEN1101 is also now targeting primary generalized tonic clonic seizures or PGTCS. Management plans to initiate a Phase 3 clinical trial, called X-ACKT, to support potential regulatory submissions in PGTCS. This study should kick soon after initiation of the X-TOLE2 trial.

August Company Presentation

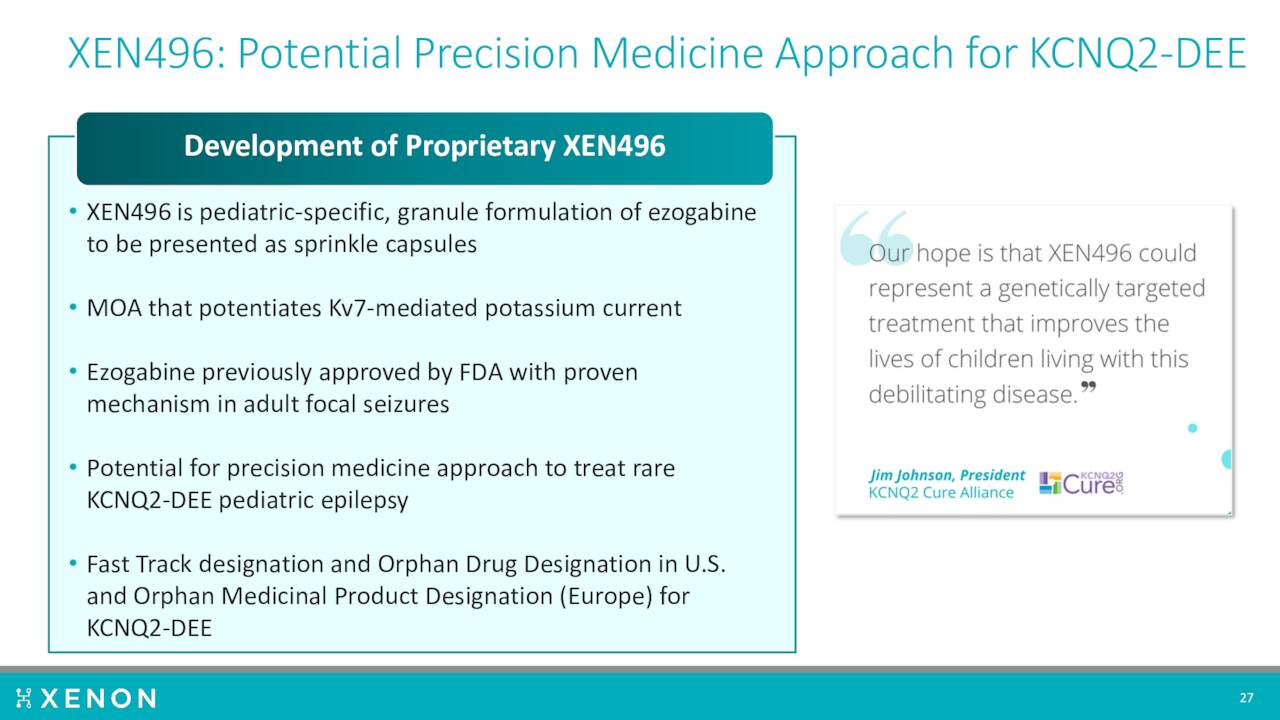

Another compound ‘XEN496’ is being developed to treat rare KCNQ2-DEE pediatric epilepsy. A Phase 3 study called EPIK, is ongoing to evaluate the efficacy, safety, and tolerability of XEN496 administered as adjunctive treatment in approximately 40 pediatric patients aged one month to less than six years with KCNQ2-DEE. This trial should complete sometime in 2023.

August Company Presentation

Finally the company has licensed a selective Nav1.6 sodium channel inhibitor ‘XEN901’, now known as NBI-921352, to Neurocrine Biosciences (NBIX). That compound is in Phase 2 development for a couple of indications. As the result of this licensing agreement, Xenon has the potential to receive certain clinical, regulatory, and commercial milestone payments, as well as future sales royalties on any eventual commercialization.

Analyst Commentary & Balance Sheet:

Since second quarter results were posted on August 9th, five analyst firms including Needham and Wedbush have reissued Buy ratings on XENE. Price targets proffered ranged from $46 to $52 a share. On August 29th, Bank of America initiated the shares as a new Buy with a $45 a share price target. Here is the commentary from the bank’s analyst at the time of that call.

XEN1101 has a “differentiated product profile,” with strong early anti-seizure data and simplicity of dosing, which positions it as a potential blockbuster anti-seizure medication. We see ‘1101 as closer to Vimpat as a launch-analog (nearly $2bn peak sales) given potential to widely be used as 3L/4L SOC (third line and fourth line standard of care) with upside if broader benefits (broader spectrum ASM or improving mood) are confirmed in future trials“

Approximately three percent of the outstanding float in currently held short. Insider selling has picked up of late. Numerous insiders sold just north of $10 million worth of shares from August 12th through September 1st in aggregate. The company had just under $790 million of cash and marketable securities on its balance sheet as of the end of the second quarter. That funding should give Xenon a cash runway into 2026.

Verdict:

August Company Presentation

Over the past nine months, the company has made steady progress advancing its pipeline. XEN1101 would seem to have blockbuster potential and the company is more than well-funded. That said, after the recent rally in the shares, the stock is getting closer to analyst price targets. Insiders also seem to be doing some significant profit taking.

August Company Presentation

My view is the escalating situation between Russia and Europe, which I recently posted an article around, will trigger the next leg down in our markets. If that pullback brings XENE back down under the $35 level, I plan to once again to take a small position in this name via covered call orders and hope for the same outcome as my first covered call trade back in last December.

“It isn’t where you came from; it’s where you’re going that counts.” – Ella Fitzgerald

Be the first to comment