andreafidone

Thesis

Volkswagen AG (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY) is pushing to bring Porsche (OTCPK:POAHY) public on Thursday, September 29, in an offering that is expected to be the largest IPO in Europe after more than a decade. The listing, however, comes at a time when risk sentiment is fading and when the economic outlook is clouded by multiple challenges.

Porsche’s rumored valuation of about $75 billion appears attractive. And the carmaker’s accelerating strategy push toward battery electric vehicle (“BEV”) cars could unlock a portfolio of premium electric vehicles that rivals Tesla (TSLA). Accordingly, investor interest for the IPO is high.

But should you buy into Porsche equity? Here is what you need to know.

IPO Background

The Porsche IPO has for a long time attracted speculation and rumors. And, after the official prospectus has been published on Sunday 18, the carmaker is expected to commence trading on September 29.

Volkswagen Group, the seller, is aiming to raise between $8.71 billion to 9.39 billion, in exchange for 12.5% of Porsche ownership. This would price the leading German sports brand at a valuation of about $69.7 billion to $75 billion.

So far, the syndicate of the leading investment banks, including Citi (C), JPMorgan (JPM), Goldman Sachs (GS) and Bank of America (BAC) have managed to sell the Porsche IPO quite well, and investor interest appears elevated. Notably, Qatar Investment Authority, Norway’s Sovereign Wealth Fund, T. Rowe Price (TROW) and ADQ have agreed to cumulatively buy approximately $3.7 billion worth of stock.

Interestingly, Porsche’s IPO price would imply a valuation equal to approximately 80% of Volkswagen’s entire market capitalization – a group that owns – amongst others – Audi, Volkswagen, SEAT and Skoda, as well as continue to own 75% of Porsche’s equity.

Complex Post-IPO Holding Structure

Some market commentators have highlighted that the Porsche transaction will result in a quite complex post-IPO shareholder structure.

The press release states:

… the share capital of Porsche AG has been divided into 911 million shares, 50% of which are Preferred Shares and 50% of which are ordinary bearer shares.

A total of up to 25% of the Preferred Shares, comprised of (I) 99,021,740 Preferred Shares as part of the base offering and (II) 14,853,260 Preferred Shares in connection with a potential over-allotment, is being offered to investors from the holdings of Porsche Holding Stuttgart GmbH (the ‘Selling Shareholder’).

The Preferred Shares will be publicly offered to investors in Germany, Austria, France, Italy, Spain and Switzerland, as well as through private placements in certain other jurisdictions in accordance with applicable regulations.

So basically, the Porsche equity will be split into two share classes, 50% preference share and 50% common share with voting rights. Post-IPO, the Volkswagen Group will hold 75% of Porsche, while PSE (Piech family and associates) will acquire 12.5% of Porsche (with voting rights) and 12.5% will be floated to the public. Notably, PSE will pay a 7.5% premium to the IPO offering price.

Accordingly, there are two major takeaways for investors: First, the IPO will float only 12.5% of equity, which is actually a rather small stake. Second, Volkswagen and PSE will retain the voting rights.

Financials

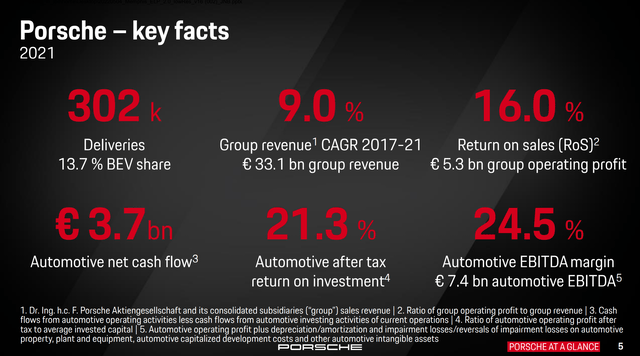

Porsche’s financials are without a doubt exceptional for the industry. Notably, in 2021 Porsche sold and delivered 302,000 cars at an average selling price considerably above $100.000. Given the company’s premium pricing power, Porsche managed to claim a 24.5% EBITDA margin, which is materially above Tesla’s 21x. Accordingly, for 2021 Porsche managed to generate $33.1 billion of revenues and $7.4 billion of EBITDA.

Moreover, Porsche is growing at a strong pace. From 2017 to 2021, Porsche managed to achieve a compounded annual growth rate of 9%, which is about triple the global nominal GDP expansion over the same period.

Geographically, Porsche’s revenue exposure is well diversified: the NAM region accounts for about 27% of revenues, Europe accounts for 29% and Asia is about 32%.

Valuation

Personally, I believe it is reasonable to value Porsche based on an annuity that anchors on the carmaker’s 2021 EBITDA annuity, with a 10% discount rate and a 3% terminal growth rate. This would equal a $105.7 billion enterprise value ($7.4 billion / (10% – 3%), and an EV/EBITDA multiple of x14.4 respectively. For reference, Tesla is valued at a one-year forward EV/EBITDA of x43. And Ferrari’s EV/EBITDA valuation multiple is x24.

Accordingly, Porsche’s IPO valuation of about x12.9 EV/EBITDA provides an attractive risk/reward for investors. And as a consequence, I personally believe that Porsche shares will surge on the IPO.

Interestingly, according to a recent Bloomberg report, Porsche shares in the unregulated grey market were trading at as much as 17% above the IPO top-range price estimate of EUR 82.5. This could indicate that Porsche shares could jump significantly in the first day of trading, as a larger retail investor community could rush to buy shares in the highly popular sportscar maker.

Risks

The valuation for Porsche’s IPO, I argue, provides a reasonable risk/reward for investors. And the multiple times oversubscribed book highlights that there is still excess demand waiting to buy the carmaker’s share. This should definitely protect investors from downside. However, the nature of an IPO is inherently unpredictable. Especially in a highly challenging macroenvironment that is pressured by multiple headwinds – most notable fading risk-appetite towards stocks – investors should consider that the Porsche IPO might fail to meet the high expectations.

In addition, investors should reflect on any possible risks that Porsche’s complex shareholder structure and leadership might imply. For example, given that Oliver Blume is CEO of both Porsche and Volkswagen, will Porsche be able to pursue independent goals? And, given that the IPO float does not give voting rights, what guarantees are in place to secure the interests of shareholders? So far, these concerns have not yet been addressed by the Volkswagen and Porsche management team. And accordingly, uncertainty connected to these questions adds to the risk balance.

Conclusion

I am very cautious investing in IPOs, given that considerable speculation is involved due to the nature of the transaction. But valued at an EV/EBITDA multiple of about x12.9, I argue the risk/reward for prospective Porsche investors is very attractive. And as a consequence, if I could get Porsche shares within the estimated valuation range of $69.7 billion to $75 billion, I am a buyer.

Be the first to comment