rookman

The market price of just about everything has fallen, but not everything has gotten cheap. In identifying those that have gotten opportunistically cheap I am looking for four things:

- Price declines greater than the market

- Reasonably priced before the selloff

- Rising earnings

- Strong fundamental outlook

Global Medical REIT (NYSE:GMRE) epitomizes this kind of opportunity.

The selloff

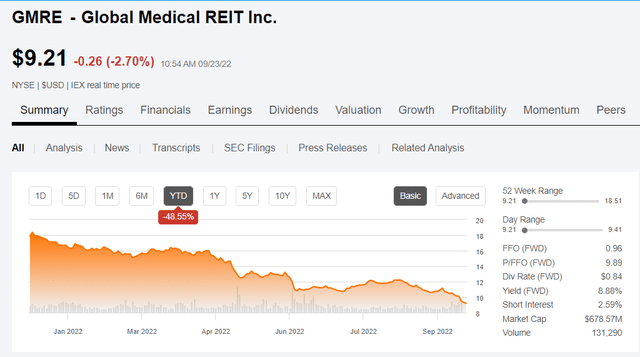

GMRE’s price declines have been absolutely brutal this year with a 48.55% selloff.

SA

This compares to the market down somewhere in the mid 20s.

Most of the stocks declining almost 50% were overvalued going in so the declines are arguably justified as bringing valuation back to earth.

GMRE, however, never had a bloated multiple. At its peak, FFO and AFFO multiples were still below 20 and in-line with peers.

Rising earnings

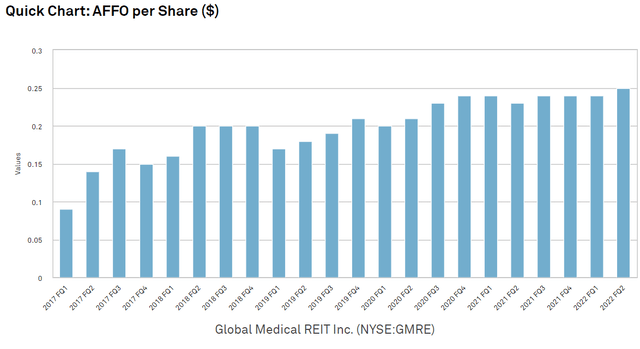

GMRE has built a nice track record of AFFO/share growth

S&P Global Market Intelligence

There was some lumpiness in AFFO growth, but that was simply a result of acquisition size being large relative to the company. Thus, little timing issues in which capital was not fully deployed caused momentary dips in AFFO/share, but the trend is quite clearly positive.

The fundamental performance to date does not justify a selloff of anywhere near the magnitude GMRE has experienced. This suggests that one of the following must be true:

- The selloff was incorrect and GMRE is opportunistically cheap

Or

- Fundamental outlook has taken a turn for the worse.

Fundamental outlook for GMRE

The most recent available data is positive. At an industry level, experts are calling for strong leasing and increased occupancy.

Bryan Lewitt, a managing director for healthcare at JLL said in an interview with Wealthmanagement.com

“The landlords are going to have a lot of leverage, plus you have increased construction costs that will make it difficult for providers to relocate. I suspect that rents are going to continue to go up because 80 percent of tenants renew their lease in health care. It’s a very sticky business.”

GMRE specific data also looks rather strong with positive 2Q22 earnings data. Commentary from management also portends good things with the 2Q22 conference call and the REITWEEK conference both featuring discussions about how they still have a pipeline of accretive acquisitions and that re-leasing of expiring leases is likely to result in small to medium roll ups in rate.

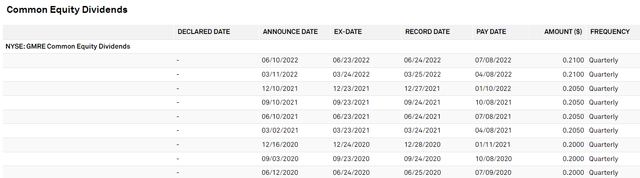

The only news since then was the September declaration of a $0.21 dividend representing the third at that level since the raise.

S&P Global Market Intelligence

GMRE’s historic pattern is to raise dividends once per year so the default expectation is that they will have one more flat at $0.21 and then go to $0.215 for the next year.

There has been a paucity of negative news on GMRE specifically and as far I can find, the medical office industry news remains positive.

One of the challenges in such a rapidly changing environment is that data becomes stale very quickly. Although the strong data was just a couple of months ago, it feels much longer given the monumental change to interest rates and the potential for economic fallout. As such, it behooves us to look into how either of these new factors could affect GMRE.

GMRE with rising rates

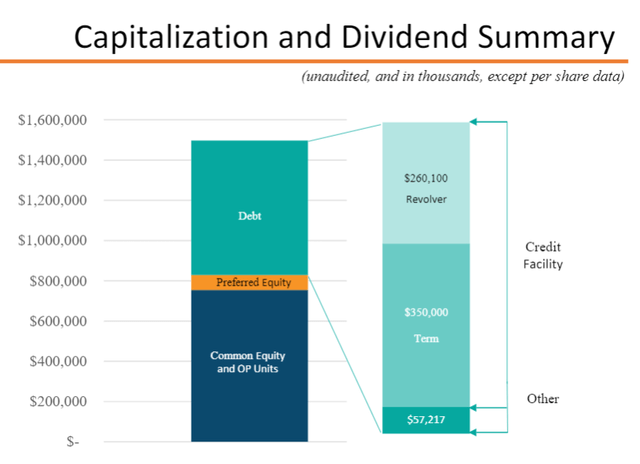

Prima facie, GMRE appears to be at high risk to interest rates with $610 million floating rate debt on the balance sheet.

Supplemental

Both the Term Loan and revolver float based on LIBOR and are transitioning to floating based on SOFR.

I suspect this is the reason GMRE’s market price has crashed so hard. $610 million of floating rate debt would represent $6.1 million extra cost for every percentage point increase to interest rates.

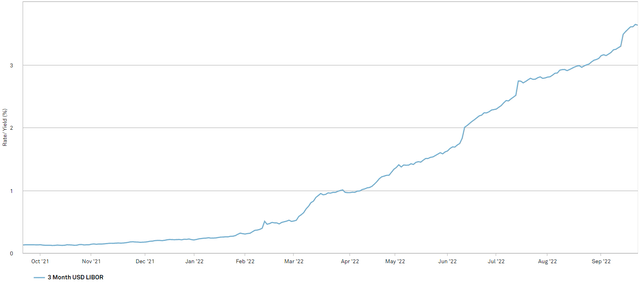

3-month LIBOR sits today at 3.63%. in 2Q22 it averaged about 1.5% so that would be a 210 basis point increase over the most recently recorded level of interest expense.

S&P Global Market Intelligence

That would be an extra $12.81 million of interest expense or about $0.18 per share. For a company with about $1.00 in annual FFO, that would be a huge hit. If all of that debt were truly variable I could understand why GMRE has fallen so far.

However, GMRE does have a significant amount of hedges on its balance sheet.

Per the 10-Q:

“Hedging Instruments. We have six interest rate swaps with a total notional amount of $350 million that are used to manage our interest rate risk and fix the LIBOR component on the Term Loan, and subject to the transition to SOFR, hedge our exposure to SOFR”

Additionally, on 8/2/22 GMRE added another $150 million of hedges.

“On August 2, 2022, we entered into $150 million of forward starting interest rate swaps that commence in October 2022 and mature in January 2028 that will fix the SOFR component on the new term loan at 2.54%.”

So that totals $500 million of hedges against $610 million of notional floating rate debt. As such, about $110 million is truly floating. That is still not ideal, but the impact to FFO is going to be significantly less.

$110 million at the now 210 basis point higher rate equates to about $2.31 million extra interest rate expense annually or about $0.033 per share.

Given that GMRE is growing at a pace exceeding 3 cents per share the extra interest rate expense will be quickly absorbed. It will still cause a slowing of growth, but is certainly not of a magnitude that justifies the nearly 50% drop in market price.

GMRE in a potentially recessionary environment

One of the main reasons I like healthcare right now is the inelasticity of demand in a downturn. People still need to go to a clinic regardless of economic conditions so I think the tenant base will be largely unbothered. With aggregate tenant EBITDARM coverage of rent around 5X, GMRE has a substantial cushion.

Forward leasing environment

There are a number of factors that bode well for medical office leasing, but I will focus primarily on the new factors that have surfaced just in the last few months.

As an operator expands their practice they are faced with the lease versus own decision. Ownership of property has gotten far more expensive for two reasons:

- Increased cost of construction (absolute dollars)

- Increased cost of construction (higher interest rates)

What used to be a $10 million dollar construction cost is now a $12 million cost and financing the debt portion of that cost now incurs about double the expense of just a couple years ago.

This substantially higher cost of the alternative will drive many operators to lease real estate as they expand their practice and creates the opportunity for landlords to raise rent.

Overall take on GMRE

While interest rates are taking a small bite out of earnings, the rest of the fundamental strength more than offsets it which should result in continued AFFO/share growth. At the now much lower market price GMRE looks opportunistic.

It has a growing and well covered 9% dividend yield so the income side alone makes it a decent return. I also see significant potential for capital gains as rents are renewed at higher rates and AFFO/share climbs.

Be the first to comment