Thomas Barwick/DigitalVision via Getty Images

On a year-over-year basis, the gross revenue of Pool Corporation (NASDAQ: POOL) increased astonishingly by 34%. This year, it may see more enticing growth drivers due to supply chain improvements, strong demand, and increased customer desire for more customizable pools.

Meanwhile, the stock price appears divorced from fundamentals. It has dropped from Q1 2022 to Q3 2022 and does not suggest undervaluation. Even so, investors should still be optimistic about it. With its ongoing expansion and internal improvements, growth prospects may become more promising.

Company Performance

Pool Corporation grew its earnings despite the pandemic and unfavorable weather conditions in the certain market. Sales are sharply rising due to the heightened trend in pool customization and the enhancement of its supply chain, increasing the company’s marketability.

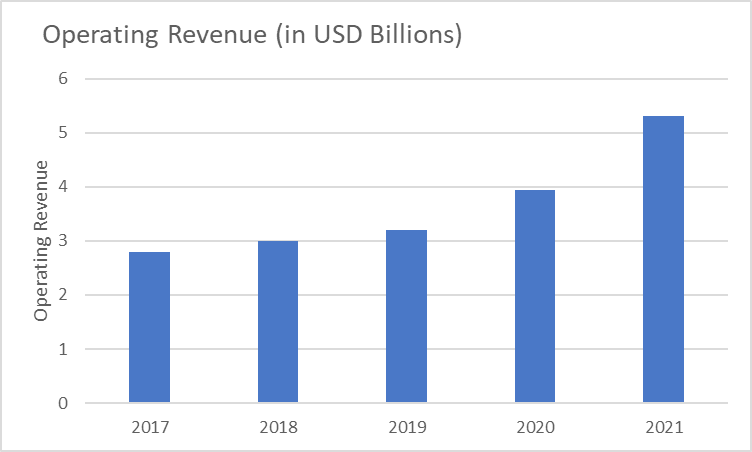

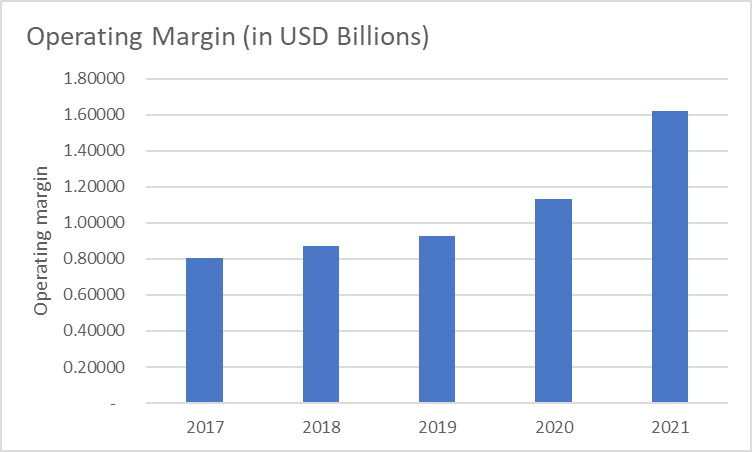

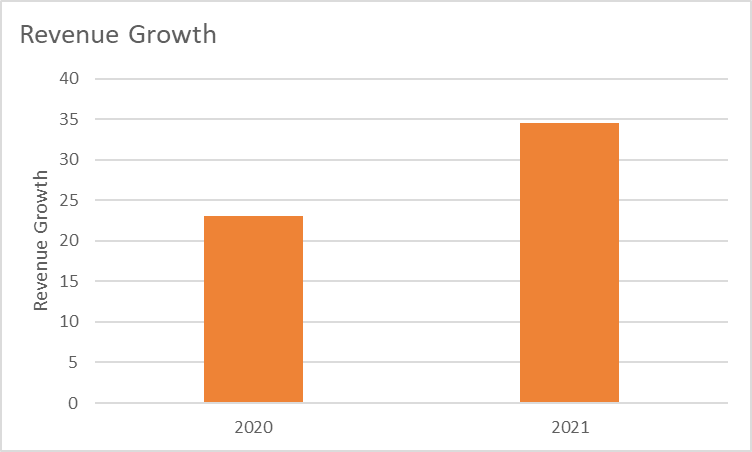

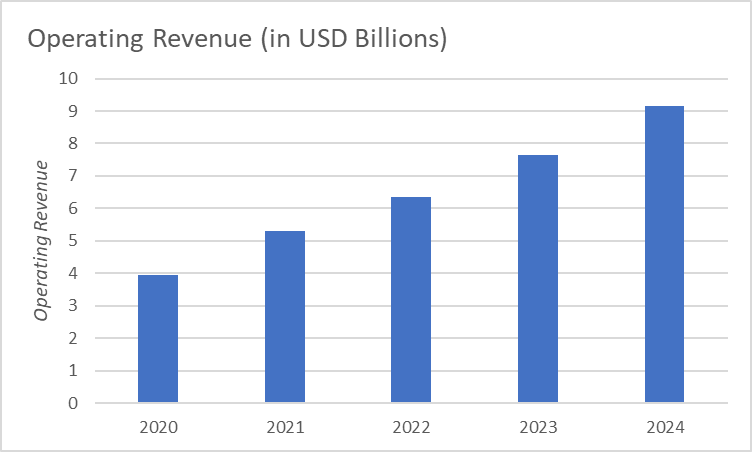

As POOL’s activities expanded in 2021, revenues moved from $3.94 billion to $5.30 billion, an increase by 34.52%. Meanwhile, expenses were cut to keep the core business. As a result, the company was able to raise its margin to 42.99% or $1.62 billion. The expansion and rising demand worked with its efficient asset management. It remained open all year long. So, coping up with the trend in pool customization allowed it to deal with challenging market conditions.

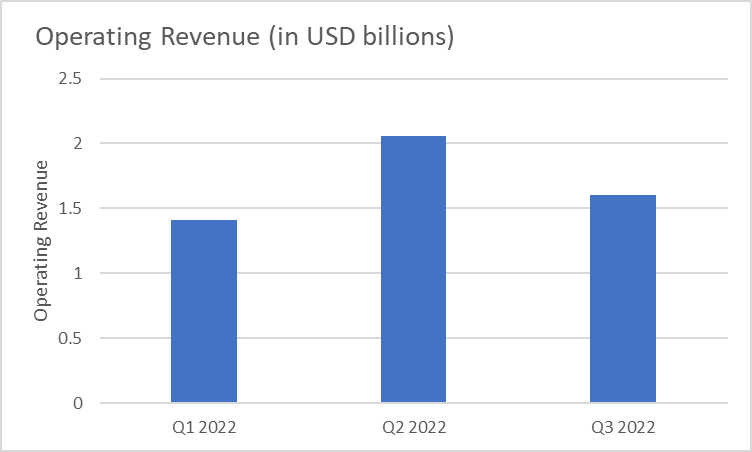

Currently, the operations of Pool have cooled down amidst inflationary pressures, pandemic disruptions, and less favorable weather conditions. The growth rate in sales is now at 28% vs. 45% from the previous quarter. Still, its operating revenue of $1.60 billion is a 14% year-over-year growth from 3Q 2021. Factors benefiting the growth in sales are the demands in pool customization despite product cost increases due to inflation. In addition, its recent acquisitions have contributed to 4% sales growth.

Weather is one of the principal external factors affecting the business. Unexpected changes in the weather negatively impacted the operating revenue this 3Q 2022. Furthermore, macroeconomic uncertainty from the war in Ukraine and Russia affected revenue due to currency exchange rate fluctuations and a reduction of volume in sales.

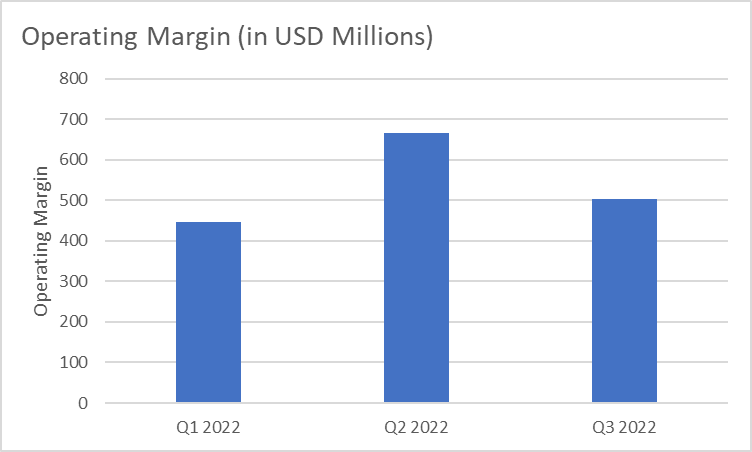

Operating expenses on the other hand. increased 17% in 3Q 2022 compared to 3Q 2021. It reflected inflationary increases and incremental costs to support business growth, including acquisitions and investments in digital transformation initiatives. As a percentage of net sales, operating expenses increased to 14.8% in 3Q 2022 compared to 14.5% in the same period of 2021. Nevertheless, the operating margin remains higher as demand and acquisition offsets inflation.

Operating Revenue (MarketWatch)

Operating Revenue (MarketWatch)

Operating Margin (MarketWatch)

Operating Margin (MarketWatch)

Today, POOL is the largest wholesale distributor of swimming pools and related backyard products. It now operates 417 sales centers in North America, Europe, and Australia. Sales and profits rose last year given an additional sales center in 2021 and strong customer demand for outdoor living products throughout the year because of warmer weather across most of the United States. So, expanding the number of sales locations may help satisfy rising demand and expand customer service. It is quite probable to be accomplished given that POOL has 120,000 clients annually. It may not materialize in the short-run due to the rising costs and supply chain disruptions. But, the continued easing of restrictions and gradual improvement in prices will help drive the success.

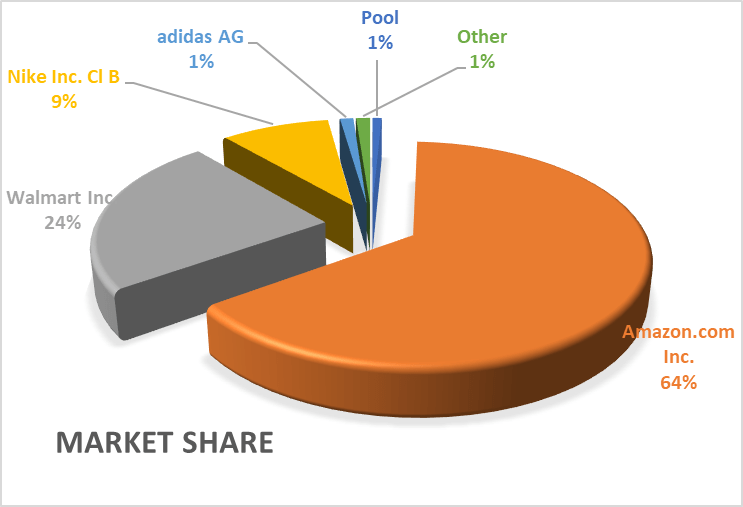

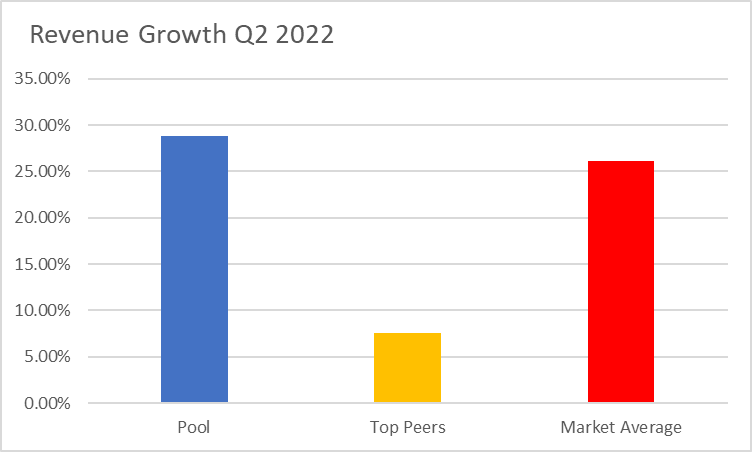

In the most recent financials, Pool holds 0.76% of the market share of sporting goods wholesaling. It is a slight increase from 0.02% in Q1 2022. Its Q2 2022 year-over-year revenue growth of 28.80% is higher than its top peers (7.53%) and the market average (26.11%). It may still have to work on some of its strategies since many of its peers are growing faster. The information demonstrates its effectiveness and ability to steadily grow its income in the future.

Market Share (MarketWatch)

Revenue Growth (MarketWatch)

Revenue Growth (MarketWatch)

Strong Customer Demands for Outdoor Living

Today’s opportunities are greater due to the industry’s unmet demand as the pandemic comes to an end. Taking advantage of the desire for outdoor living caused by the warmer weather around the US.

In addition, according to the survey, nearly six in 10 Americans buy at least one new piece of accessories for their outdoor living spaces. This significant and increasing percentage is likely due to the amount of time they are spending at home due to Covid-19. The trend has not had substantial changes as remote and hybrid work setups remain prevalent. Fortunately, the business keeps up with market changes and customer preferences. These are the potential areas of growth for POOL.

Products have already increased by 9 to 10%. Yet, the company continues to perform well despite inflationary pressures. However, if the recession concerns keep up, the company could feel the effect of its customers cutting down its discretionary spending.

Competitive Advantage and Sales Center Openings

Sales center openings are essential to draw more clients this year. This Q3 2022 alone, 4% of the sales growth came from acquisitions. By Q3 2022, there were 417 sales locations. POOL hopes to have grown by 2.4%, or 9–10 more sales centers since the beginning of the year 2022. The expansion is viable to keep up with its cost and expenses as the company has a consistent demand for pool customization due to warmer weather conditions and the trend of outdoor living spaces.

If the operating revenue is divided among all the sales centers, the average revenue rises from $12M to $15M in this case. That is the contrast between things before and after applying the assumption of POOL to have a 19% growth rate at the end of 2022 following factors such as normal weather patterns and continued demand for residential pools driven by home-centric trends. It displays marginal revenue of $4.5M on average for sales centers. As a result, POOL keeps growing its capacity and expanding into new areas. As costs and expenses become more controllable due to the ongoing improvement of its distribution network, the operating margin should hold at 30%.

Operating Revenue (Author Estimation)

POOL must watch out for its financial standing

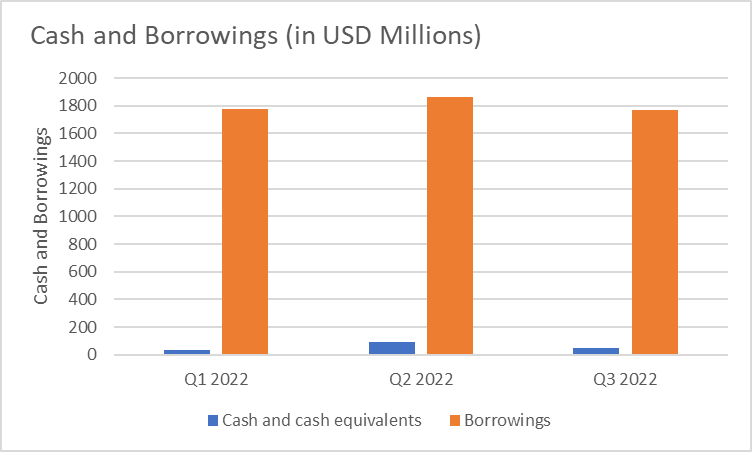

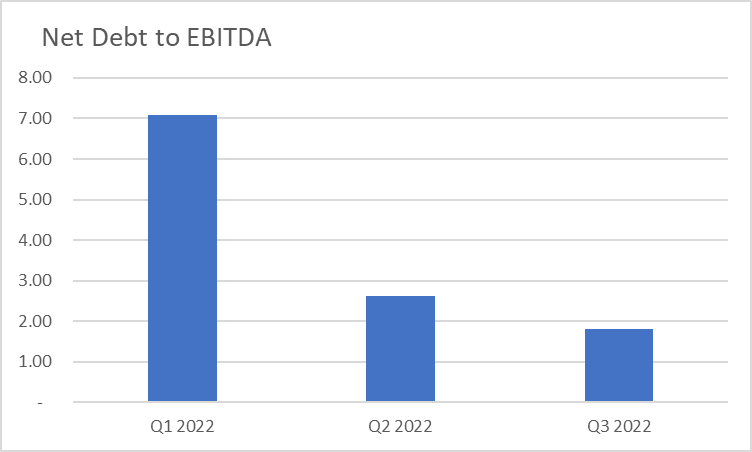

The company’s current ratio is very low as it may indicate a problem with managing its allocation. Moreover, it barely has Cash and Cash equivalents to cover its current obligations. It represents its expenditures on its continued expansion. Total borrowings decreased from $1,861.28 million to $1,771.59 million. Cash and equivalents also decreased from $91.48 million to $49.08 million. So, cash relative to borrowings increased from 4.91% to 2.77%. But, it has to do better to keep up with its total borrowings. In contrast, Pool had an EBITDA of $948.18 million from $674.35 million, Therefore, the company had a Net Debt to EBITDA ratio of 1.82 from 2.62 a decrease of 30.53% quarter-to-quarter. It only shows that the company can generate enough income to cover its borrowings. The income it derives increases faster than it borrows. Indeed, the expansion is ideal.

Cash And Equivalents And Borrowings (MarketWatch)

Net Debt/EBITDA (MarketWatch)

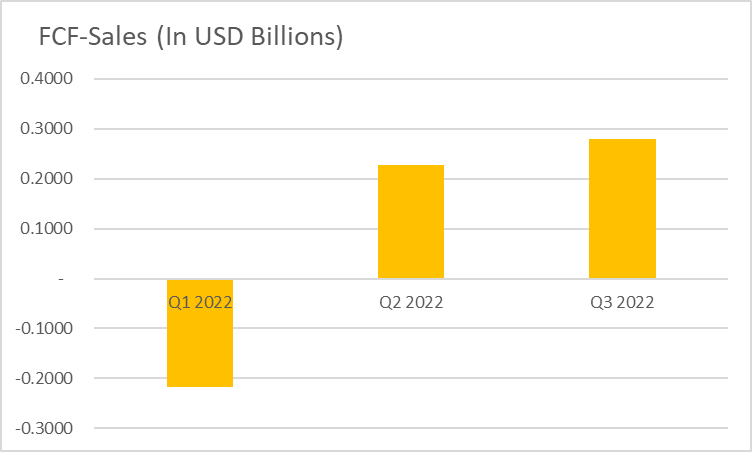

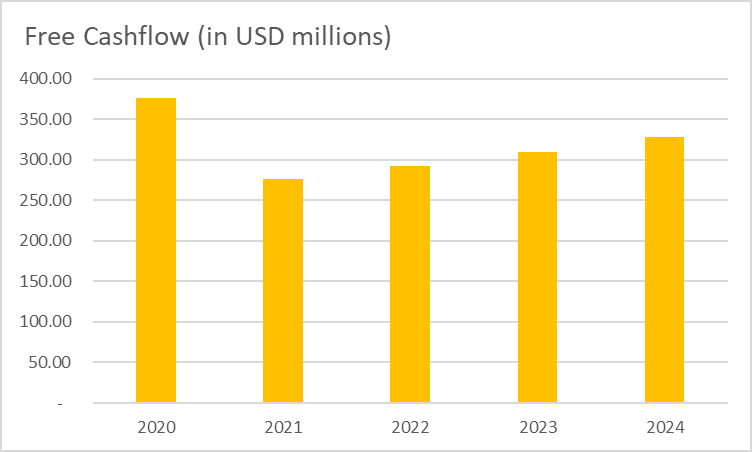

Additionally, the company will be consistently profitable while continuing its operations. Free Cash Flow (FCF) of $279.51 million enables us to verify the growing profitability and sustainability. Despite a $27.96 million CAPEX and $8.30 million Net Assets from Acquisitions, the FCF-to-Sales Ratio is presently 17%. The business keeps its costs and expenses low as it strives to grow. I predict that the FCF-to-Sales Ratio will be consistent at 6% over the next four years due to the rise in CapEx driven by new sales centers. Therefore, the value might increase from $275.83 to $328.52 million.

FCF/Sales Ratio (MarketWatch)

FCF (Author Estimation)

Price Valuation

POOL has decreased and no reversal has been found. The price is showing downward momentum at $318.77. Despite this, the stock price does not appear to be undervalued.

Meanwhile, it is a below-par dividend stock, yielding 1.3%. It is lower than the S&P 400 and NASDAQ components with 2.06% and 1.5%, respectively. Its dividend payout ratio using dividends per share is 52%. As such, dividends are well-covered and sustainable. To assess the price better, we will use the DCF Model.

DCF Model

FCF $379,500,000

Cash $49,080,000

Borrowings $1,500,000,000

Perpetuity Growth Rate 5%

WACC 7.75%

Common Shares Outstanding 39,591,000

Stock Price $318.77

Derived Value $296.82

Bottom Line

POOL is showing a consistent increase in its operating revenue. More customer demands in outdoor living and additional sales centers demonstrate its greater ability to produce income despite inflationary pressures. Consider also its Cash and cash equivalents to borrowings as it is problematic for its liquidity. Other things to think about are its consistent dividend payments, but the stock price is still not yet an ideal entry point. The advice is to continue to hold POOL.

Be the first to comment