POUND STERLING TALKING POINTS

- Boris Johnson no-confidence vote.

- UK economic forecast.

GBP/USD FUNDAMENTAL BACKDROP

GBP/USD opened weaker this morning after yesterday’s vote of no-confidence kept the British Prime Minister Boris Johnson from immediate resignation. The vote which read 211-148 is not favorable for the party as it is clear that a large proportion seem to be at a disagreement which could sow the seed for forthcoming turmoil. The timing is unfortunate for pound sterling as the economy looks to be slowing and facing a potential recession. Recent key economic data from the UK has been showing signs of decline after last weeks poor manufacturing PMI print while we look forward to today’s services figure (see economic calendar below) for further guidance. On the contrary, the U.S. economy has not let up with better than expected Non-Farm Payroll (NFP), ISM manufacturing PMI and consumer confidence releases allowing the Federal Reserve to maintain its hawkish narrative to combat rampant inflation.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

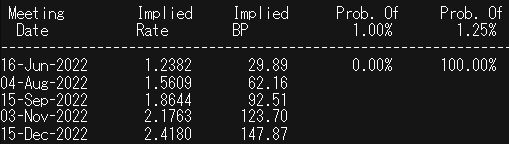

Continued geopolitical stress from Russia and Ukraine remain a negative for GBP with the UK being geographically handicapped relative to the U.S. exacerbating downside risks for the currency. Interestingly, money markets have been pricing in further rate hikes from the Bank of England (BoE), now roughly 148bps for 2022 as shown in the table below. I think this overexuberance from markets may again compound any downside movement for cable.

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

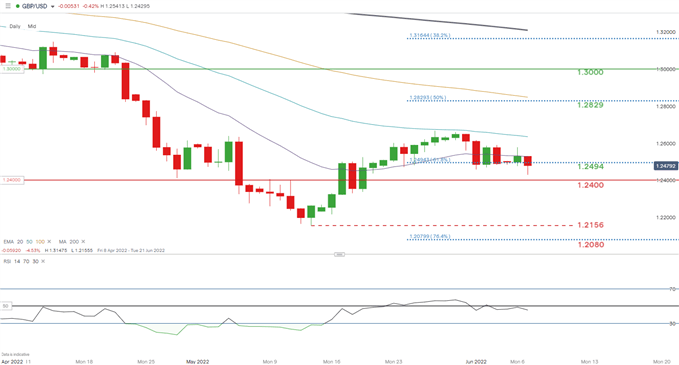

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

GBP/USD price action extends its consolidatory move around the 61.8% Fibonacci level at 1.2494. A break below will bring 1.2400 psychological zone into question with a further push opening up room towards subsequent support at the May swing low (1.2156).

Key resistance levels:

- 20-day EMA (purple)

- 1.2494

Key support levels:

CAUTIOUS IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 68% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning result in a mixed bias.

Contact and follow Warren on Twitter: @WVenketas

Be the first to comment