Crude Oil, WTI, OPEC+, EIA, NFPs, Technical Analysis, IG Client Sentiment – Talking Points:

- WTI crude oil prices rallied overnight to reverse deep intraday losses

- OPEC+ output hike doubts, EIA inventories & sentiment were factors

- Oil may rise on NFPs next as retail trader bets offer bullish outlook

Crude oil prices rallied 2.4% on Thursday, reversing earlier losses in the session. In fact, if you measure it from the low, WTI rallied over 5.5% into the close, marking a notable intraday reversal. There were a couple of fundamental dynamics aiding energy prices. The first is the aftermath of this week’s OPEC+ meeting.

WTI rallied despite OPEC+ agreeing to increase daily output by 648k barrels per day starting in July from 432k anticipated prior, meaning more supply. This comes amid potential supply gaps as the west sanctions Russia over its attack on Ukraine. Moreover, prices likely rallied because investors doubt that the group can commit to these goals as most of the countries will likely struggle to meet higher production targets.

Later in the session, the Energy Information Administration (EIA) released weekly stockpile data. Crude oil inventories unexpectedly fell by 5.07 million barrels. That was much worse than the -1.1 million contraction seen, indicating a tightening supply. Meanwhile, improving risk appetitive likely bolstered sentiment-linked oil prices. The S&P 500 rallied 1.84% on Thursday.

Over the remaining 24 hours, WTI will be closely watching May’s US non-farm payrolls report. The world’s largest economy is expected to add 320k jobs, down from 428k in April. Recent data suggest that NFPs could surprise lower, perhaps weakening hawkish Federal Reserve policy expectations. If that is the case, and sentiment continues improving, then it stands to reason that WTI could follow higher.

Crude Oil Technical Analysis – Daily Chart

On the daily chart, WTI is attempting to breach the key 116.61 – 116.64 resistance zone. There was a false breakout in late May, and since then the commodity has been consolidating around that range. A confirmatory upside push could open the door at uptrend resumption, placing the focus on March highs (124.76 – 129.41). Otherwise, a turn lower exposes the rising trendline from December.

Chart Created Using TradingView

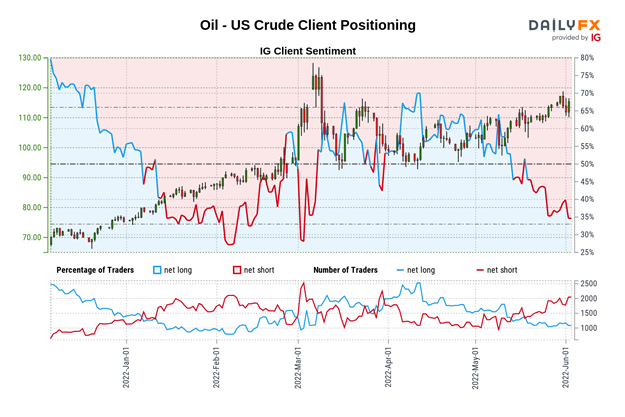

Crude Oil Sentiment Analysis – Bullish

Taking a look at IG Client Sentiment (IGCS), about 34% of retail traders are net-long. Since IGCS tends to function as a contrarian indicator, this hints that prices may continue rising. Downside exposure has increased by 23.82% and 7.61% compared to yesterday and last week respectively. With that in mind, this is offering a stronger bullish contrarian trading bias.

IGCS Chart Pulled from June 2nd report

–— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment