bjdlzx

(Note: This article was in the newsletter November 3, 2022.)

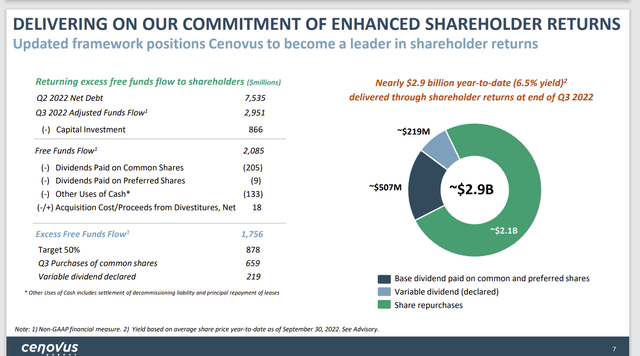

Cenovus Energy (NYSE:CVE) is a Canadian company that is listed on the NYSE and reports in Canadian dollars. The company recently mentioned that net debt was approaching the C$5 billion level. At this time, the company devotes 50% of free cash flow to returning money to shareholders either through dividends or through share repurchases. That rapidly growing dividend and share repurchases are about to take a significant jump.

The minute net debt gets to C$4 billion, the company will devote 100% of free cash flow to a combination of dividends and share repurchases. Management expects to meet that goal easily in the coming quarter. One way or another that is going to lead to an excellent combination of income and growth for this variable distribution entity.

This thermal oil producer is known for generous cash flow because thermal projects generally need a big cash investment to even get started. Many thermal oil producers are known for cash flowing decently even when the firm is losing money because of the large initial investment.

This well-run company currently has a base dividend that it will attempt to maintain and grow. Variable dividends have also been initiated. The first normal course issuer bid (share repurchases in Canada) will expire soon. Management now has permission from the board to get approval for another normal course issuer bid. The two bids together are for roughly 10% of the initially 2 billion (approximately) shares of common stock outstanding. So far, management has purchased roughly 100 million shares.

Cenovus Energy Calculation Of Amounts Returned To Shareholders (Cenovus Energy Third Quarter 2022, Earnings Conference Call Slides)

Returns to shareholders have been rising at an unexpectedly rapid rate because commodity prices have been robust. The firm has so far preferred to repurchase common shares because the shares are relatively cheap compared to expected cash flow.

The company recently became integrated with a lot more downstream capacity through the Husky (OTCPK:HUSKF) acquisition. It will take the market some time to assess the new earnings pattern of a company that used to be mainly an upstream operator. Earnings are expected to decline in volatility due to the increased integration of the company after the acquisition. In the meantime, management has taken advantage of the low price of the common and intends to continue that practice as long as the common shares remain cheap.

But sooner or later, the dividend paid will become significant. The emphasis on debt reduction is literally saving hundreds of millions of Canadian dollars. Even if commodity prices decline somewhat, the lower debt levels have freed up a lot of cash that used to service the bond debt.

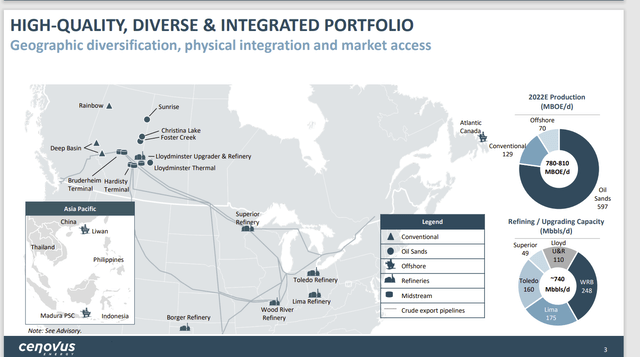

Cenovus Energy Map Of Operating Locations (Cenovus Energy Third Quarter 2022, Earnings Conference Call Slides)

Furthermore, management keeps making acquisitions to grow the company profitably. When I first began coverage of this company, it had been spun off from what was then Encana (and is now Ovintiv (OVV)). The company at the time was literally tied up in partnerships which made forward progress extremely hard.

The recent acquisition of Sunrise (the 50% interest held by BP (BP) was recently acquired) is a good example of the partnership issues. Management stated during the conference call that a new well at Sunrise had not been drilled in years. Things did not progress probably because at least one partner did not want to invest for progress.

Similarly, management recently made an offer for the ownership portion of the Toledo, Ohio refinery that it did not own. But then a fire broke out causing that discussion to completely stop until all the facts are known. Otherwise, that purchase would have completed in the current quarter. The operator, BP needs to investigate the whole fire circumstances and determine repairs needed before any purchase agreement conditions can be modified.

As a result of this management unwinding a lot of partnerships, this company now has full control of its future. Since I began following the company, costs have come down sharply and cash flow is many times higher than was the case in my initial article.

It looks like management will continue to make acquisitions close to areas they know well. There is still plenty to do with the acquisitions made. But the adjusted funds flow promises to continue for the foreseeable future. That means there will be a lot of cash available after all the obligations are met, for shareholders. Base dividends are maintainable dividends are very likely to significantly increase in the future.

Management also mentioned that the Superior refinery will start up operations in the first quarter of the next fiscal year. That will be adding more refining capabilities to the downstream segment of the company. For a company of this size, there is a lot of growth potential in the near future.

Finances are in the best shape they have been in for a very long time. There is not really a significant amount of debt due until fiscal year 2027. The plan is to have a debt ratio of 1.0 if the WTI (benchmark) price drops to $45. What would be different if that does happen is that management has the downstream capability to upgrade a significant amount of production to end products that command better prices. Going forward, any downturns will be far less threatening than they were for a company that sold a discount product, thermal oil, into a market with weak commodity prices. The refining capacity allows a lot of production to completely skip the WTI pricing and head to the end products.

I have often stated that the best time to buy variable distribution products is before they are actually distributing. In this case, management only recently began to declare base dividends and has now begun variable dividends additionally. The overall yield has not been that great because the first thing that happened was debt reduction. Once the debt levels became low enough, management-initiated stock repurchases until finances achieved a level that management figured would allow for a base dividend to be maintained and grown.

But when debt levels reach C$4 billion of net debt (and that should happen by the end of the current quarter), then the amount available for all the shareholder return programs will double percentage wise. That is going to be a lot of money because this company has strong cash flow that is only going to get better as management optimizes the acquisitions made. That means profitability will improve at a pace in excess of revenue growth. That will make for a lot of future shareholder returns.

Be the first to comment