jonathanfilskov-photography

by Alex Rosen

Summary

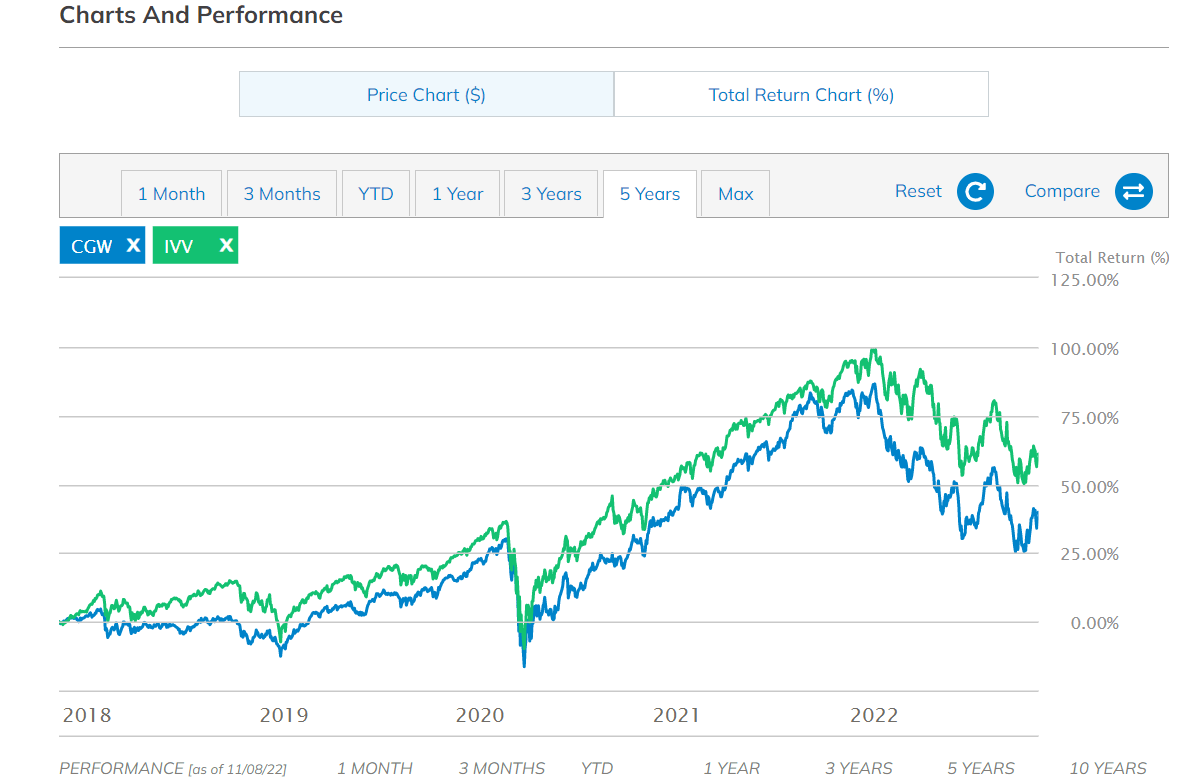

The Invesco S&P Global Water Index ETF (NYSEARCA:CGW) is an ETF focusing on water in all its forms, from utilities to infrastructure to equipment. The fund has taken a beating this year, but has shown a nice little rebound in the last month. The notion of tracking water seems like a good idea, but has not really shown to be successful. We rate CWG a Sell as it appears to perform in harmony with growth in the underlying holdings, and right now the outlook is not sunny. The chart below shows how CGW rises and falls with the economies of the U.S. and the U.K.

CGW Rise and Fall (PERFORMANCE)

Strategy

CGW offers broad coverage of the global water segment. The fund starts with all eligible securities from the S&P Global BMI Index that are classified in either water equipment & materials or water utilities & infrastructure. To identify industry relevance, each company is assigned an exposure score based on its business description and most recent reported revenue. The 25 largest companies with an exposure score of one will be selected for the fund. However, if the 25 fund threshold is not met the fund will select the largest companies with a 0.5 exposure score until the portfolio contains a total of 25 funds. Stocks are weighted by market-cap and are limited, so securities with an exposure score of 1 are capped at 10% and those with 0.5 exposure score are capped at 5%. The index is rebalanced twice a year.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Industrials

-

Sub-Segment: Water

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

75% of CWG’s ETF is concentrated in the US and the UK. The fund will invest at least 90% of its total assets in the securities American depositary receipts (ADRs) and global depositary receipts (GDRs) which comprise the index. The index consists of developed market securities including water utilities, infrastructure, equipment, instruments and materials. The fund and the index are rebalanced semi-annually. The major holdings as of this writing are utilities and water manufactured products.

Strengths

At a time when the world is focusing on energy shortages, long term the real global issue will be a demand for clean water. Global climate change has seen parts of East Africa stricken by droughts so severe, millions face starvation. Currently French wine growers are buying up land in England because the weather conditions there are more conducive to growing wine than the traditional French vineyards. Last summer saw record heat waves across the globe, and Egypt and Ethiopia are threatening war over a dam that blocks the Nile from flowing into Egypt.

How is this a strength? If the world doesn’t start investing in water infrastructure very soon, the lack of resources will create a drain on already exacerbated communities and lead to more insurrection and political instability. In short, if we don’t invest in water, we will be forced to drink oil.

Weaknesses

Water is not sexy. No one posts the daily water futures on the commodities board. By the time people wake up to the reality that the real shortage is not energy but water, it may be too late. The ETF focus on water infrastructure and utilities in the UK and the US misses many of the key places where the demand for water resources is greatest.

Opportunities

CGW meets a need. However, much of that need in developed countries is met by governments as opposed to the private sector. With countries around the world looking to reduce expenses, it is possible that many of the formerly public works projects may be turned over to the private sector. If this becomes a reality, then CGW could potentially be a high value proposition, but so far we are not seeing that become a reality.

Threats

Any threats that CGW may have faced have likely already actualized. Because water is a public utility (as it well should be), its price will closely be tied to the rise and fall of the countries that it invests in. Despite the dollar continuing to hold strong, the shocks to both the U.S. and U.K. economies have really caused a downturn and, as a result, funds tracking government utilities are suffering in lock step.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

CWG’s fundamentals are sound, and the investment strategy is solid. Unfortunately, it is a commodity that even in the best of times has struggled to produce outsized gains. As stated above, CWG will rise and fall like the tide, following overall economic conditions.

ETF Investment Opinion

We rate CWG as a Sell, because we don’t see a reversal of global economic fortunes anytime soon. Looking at historical charts, it is clear that CGW has risen, fallen and flatlined at about the same pace as overall economy. As investors, we seek something more than that.

Be the first to comment