Cappan/iStock via Getty Images

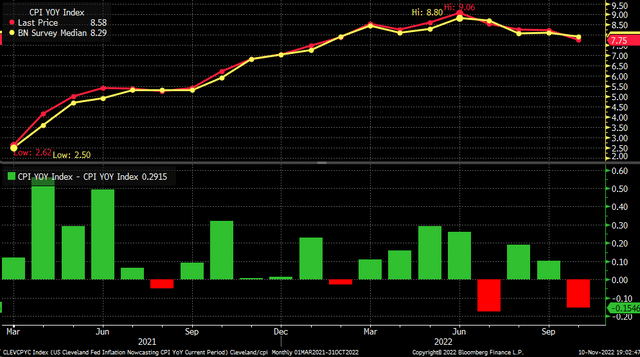

The CPI report on November 10 was shocking, just that instead of coming in hotter than expected, it came in cooler than expected. Which came as a real shock because it was only the fourth time it was below estimates since March 2021.

Bloomberg

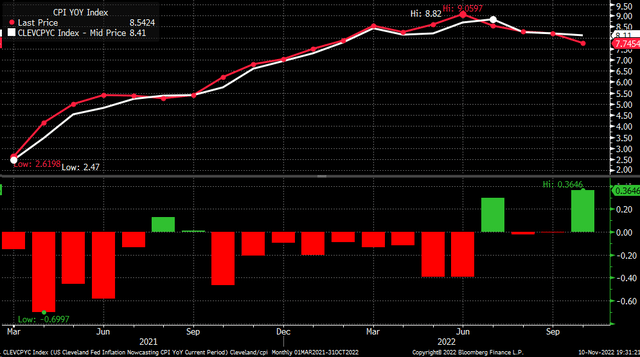

It was only the fourth time since March 2021 that the Cleveland Fed overestimated the y/y change in CPI. The only previous time that had happened was in July 2022 and the fall of 2021.

Bloomberg

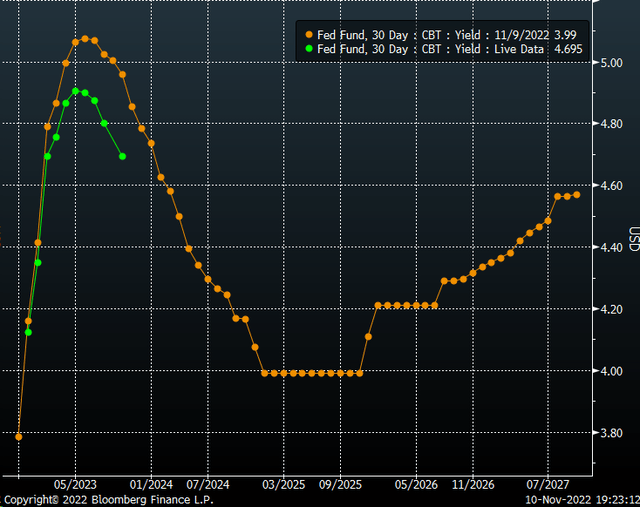

The slightly cooler level of inflation means that a 50 bps rate hike in December seems to be the most likely course for the Fed. The Fed Funds Futures now see a terminal rate of 4.90%, down from around 5.05% on November 9.

Bloomberg

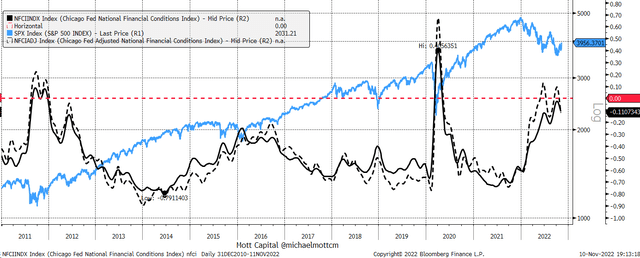

Financial Conditions

The better-than-expected CPI report resulted in a massive short-covering rally in stocks, while yields and the dollar declined sharply. But one needs to go back to the basics because when stocks rise, and the dollar and rates fall, financial conditions ease, which means the Fed’s monetary policy transmission becomes less effective and restrictive. A less restrictive monetary policy means the Fed will need to tighten further or leave rates higher for an extended period.

Financial conditions have been hovering around the restrictive zone since the middle of July, wavering back and forth. It is obvious that when conditions are tightening, the stock market falls, and when conditions ease, the stock market rises. The more markets rally, the more financial conditions will ease and work against the Fed.

Additionally, the Fed has continued to make it clear that once it finishes raising rates, it will likely hold those rates there for some time. It would probably single that financial conditions would need to remain restrictive territory for some time. As long as financial conditions remain restrictive, it is not an environment suitable for equities to rally significantly.

Bloomberg

Inflation Troubles Far From Over

The Fed has also made it incredibly clear that it will keep rates high until there is a clear sign of inflation coming down, and at this point, one miss of 0.2% on a 7.7% y/y CPI rate is hardly a sign of inflation coming.

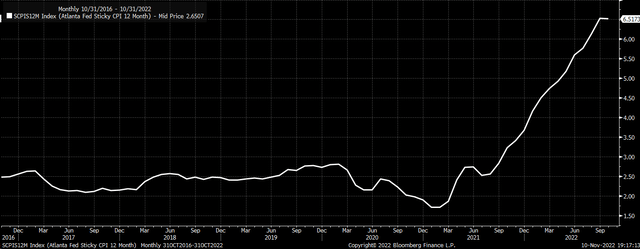

On top of that, the Atlanta Fed’s Sticky 12-month CPI reading came in at 6.51%, down slightly from last month. The market should consider this type of inflation because sticky inflation could cause the Fed the most significant problems down the road.

Bloomberg

Stocks can rally, but once financial conditions begin to ease outside of the range the Fed desires, it seems more likely than not that the Fed will start pushing back against the markets again. Just like the Fed did at Jackson Hole and the November FOMC meeting.

At this point, the inflation battle is far from over, while very little, if anything, has changed.

Be the first to comment