tifonimages/iStock via Getty Images

Copper Mountain Mining (OTCPK:CPPMF) made a major strategic decision, as it announced the sale of the Eva copper project to Harmony Gold Mining (HMY), for a total consideration of up to $230 million. Harmony agreed to pay $170 million on the closing of the transaction, and further $60 million in contingent payments tied to future copper prices and potential new discoveries on the property.

Copper Mountain acquired the project in 2018, when it acquired Altona Mining. Copper Mountain issued 53,538,984 shares to former shareholders of Altona. As of the day of the transaction closing, the shares were worth $57.3 million. However, along with the Eva project and the vast land package, Copper Mountain acquired also Altona’s cash balance of approximately $30 million. It means that the Eva project was technically acquired for $30 million. Although further money was expended on exploration and new economic studies, the expenses didn’t approach the $140 million mark, let alone the $200 million mark, which means that Copper Mountain is about to book some nice overall gains. However, the transaction also changes the growth profile of the company rapidly.

The Eva project is located in Queensland, Australia. According to the feasibility study updated in December 2021, Eva should be able to produce 100 million lb copper and 14,000 toz gold per year on average, over 15-year mine life. The C1 cash cost was projected at $1.53/lb copper, and the initial CAPEX at nearly $600 million. At a copper price of $3.39/lb and gold price of $1,598/toz, the after-tax NPV(8%) equals $622 million and the after-tax IRR equals 35%. However, there is a risk of further growth of the costs. The cash cost projections increased only by 6%, but the CAPEX projections increased by nearly 25% between the May 2020 feasibility study and December 2021 update, or in 1.5 years.

Without Eva, the 75%-owned Copper Mountain mine will remain Copper Mountain’s only producing asset which means less diversification of the operational risks. Moreover, the growth prospects will be limited too. According to the recently updated life of mine plan, the plant capacity should be increased from today’s 45,000 tpd to 65,000 tpd, starting in 2028. This should help to elevate the average annual production rates to 114 million lb copper, 54,000 toz gold, and 367,000 toz silver, over 32-year mine life. Moreover, the reserves account for only approximately 2/3 of measured and indicated resources which means that there is a high probability of a further extension of the mine life. And Copper Mountain is evaluating also the options for a bigger expansion to 100,000 tpd. While these numbers are respectable, the sale of Eva erases future production of 100 million lb copper and 14,000 toz gold per year from the overall picture.

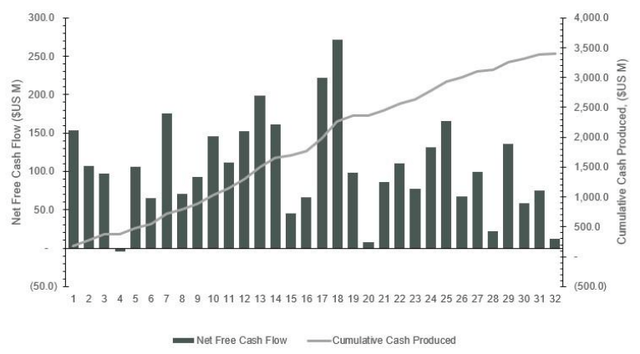

The Copper Mountain mine expansion to 65,000 tpd should cost $237 million. So, in theory, the proceeds from the sale of Eva should cover a major portion of the Copper Mountain mine expansion CAPEX. However, this shouldn’t be necessary. As shown in the chart below, the expansion should be self-funded, as the Copper Mountain mine is expected to generate cash flows of over $300 million over the next 3 years alone (at a copper price of $3.6/lb, gold price of $1,650/toz, and silver price of $21.35/toz).

Source: Copper Mountain Mining

So the question is what is Copper Mountain going to do with the money received for Eva. As of the end of Q2, it had a total debt of approximately $280 million and net debt of $211 million. With the $170 million received upon the closing of the transaction, and adding cash flows generated during Q3, the net debt should be closer to 0. But repaying the debt doesn’t make much sense in the current inflationary environment. And holding a cash pile of around $250 million makes even less sense. Therefore, it is possible to speculate that Copper Mountain is about to make an acquisition soon. Whether it acquires a development project or a producing mine is to be seen, but I believe that there is a very high probability that a deal will be made over the next 12 months.

Conclusion

As can be seen in the chart below, the market reacted relatively calmly to the news. However, the near-term technical picture looks positive. The steep share price decline was related not only to the poor performance of the broader stock market and the decline in copper prices, but also to operational issues at the Copper Mountain mine. What is positive, the operational issues should be history, and H2 2022 should be much better than H1 2022. Lately, the share price bounced off the support line in the $0.95 area and stands just below the resistance level in the $1.4 area now. The RSI is below 60, far from overbought levels, moreover, the 10-day moving average crossed the 50-day one to the upside. If the copper market and broader stock market provide some support, the share price should break the resistance over the coming days. The next resistance lies near $2.3.

Fundamentally, Copper Mountain Mining remains strong. Following the sale of Eva, its net debt should be close to zero, which may be positive in the current environment of economic uncertainty. On the other hand, given the high inflation rates, holding a cash pile of around $250 million isn’t too rational. To evaluate the sale of Eva, it is important to see what Copper Mountain is going to do with the money. Secured bonds worth $250 million will mature only in 2026, so the money probably won’t be used for debt repayment. Another expansion of the Copper Mountain mine is expected only in 2028. As a result, it seems highly probable that the management is about to acquire a new asset soon. Some more clarity on this question might be shed during the Q3 earnings call that is scheduled for November 9.

Regardless of the future acquisition plans, Copper Mountain Mining is attractively valued. Its market capitalization is $282 million and the enterprise value should be around $300 million. This is not much for a company that owns 75% of a mine that should be producing 114 million lb copper, 54,000 toz gold, and 367,000 toz silver, over 32-year mine life. According to the August update of the mine plan, the Copper Mountain mine has an after-tax NPV(8%) of $1.24 billion ($930 million attributable to Copper Mountain Mining). The share price must grow by 200% for the enterprise value to approach the $900 million mark.

Be the first to comment