Justin Sullivan

Polestar (NASDAQ:PSNY) has just unveiled its new Polestar 3 SUV, slated to go on sale in late 2023 to 2024 following the discontinuation of the Polestar 1. The startup is also targeting one of the highest growth rates in the EV industry in Q4, looking to grow deliveries by over 110% q/q to reach 20,000 units; in essence, Polestar is aiming to deliver 40% of its annual volume in just one quarter. With production and deliveries scaling substantially alongside a long slate of upcoming vehicle models, Polestar will need cash, and a lot of it in order to execute its plan.

Rapid Delivery Growth Projections In Question

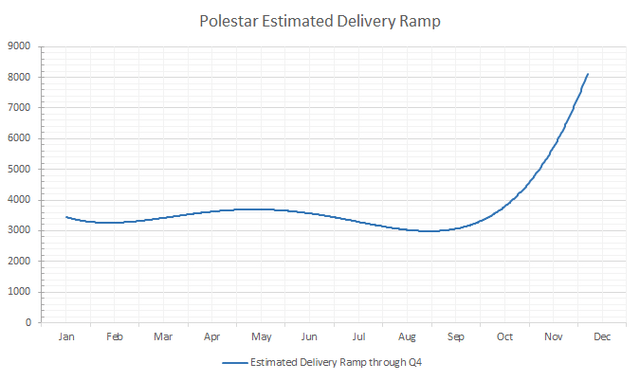

Polestar is targeting a massive ramp in deliveries in Q4, after recording a string of weakness during Q3, thus raising concerns about the OEM’s ability to grow sales to such a degree with just one vehicle model on the market.

As a newly public company, Polestar has limited delivery data to date; however, the startup has announced sales figures for the first four months as well as Q3, providing an insight into production and deliveries.

For the first four months, Polestar announced deliveries of approximately 13,600 vehicles, or about 3,400 vehicles per month on average. For Q3, Polestar reported vehicle volumes of 9,215 units, or approximately 3,071 per month on average; this leaves May and June’s volume at about 7,585 units, or 3,793 vehicles per month on average.

Overall, from May to September, Polestar record average volumes of 3,360 per month, down slightly from the first four months’ 3,400 per month tally. In essence, what Polestar likely witnessed is a bit of strength in deliveries during the early summer months, followed by a slowdown into Q3 as delivery volumes slipped.

Moving through Q4, Polestar’s targeted volumes near 20,000 project quite a rapid growth rate, compared to volumes witnessed throughout the rest of the year. Polestar is targeting delivery volumes to more than double q/q in Q4, essentially moving from a 3,000 to 3,500 monthly run rate to a 7,500 to 8,500 monthly run rate by December.

Scaling to this degree could be challenging, but it also raises some critical questions about the pace of delivery growth through Q3:

- Demand: if demand was the main limiting factor through Q3 — if demand was the driver of weaker deliveries — Polestar’s ability to double deliveries comes into question as it is relying on one single model following the discontinuation of the Polestar 1. Assuming demand had prevented Polestar from reaching a 4,000 unit run rate during Q3 (12k units), where is the demand surge coming from to support a >7k run rate? Given the fact that Polestar has said that a “majority of Polestar 2 cars set for delivery in Q4 are ready,” it seems like the problems were related to production capacity and/or supply chain.

- Supply/supply chain: another factor that has impeded production for a handful of leading OEMs is supply chain constraints, namely for critical parts and chips. Honda (HMC) and Toyota (TM) have repeatedly cut production output for factories in Japan due to supply chain problems, as effects still linger. Polestar could be an additional victim to supply chain issues, finding increased difficulty sourcing parts at competitively low prices.

- Production capacity: given Polestar’s manufacturing concentration in China, production capacity has ramped up, according to the company, paving the way to meet this rapid ramp in volumes. However, moving forward, scaling past 20,000 units per quarter will be costly and likely to increase the OEM’s cash burn rates until the Polestar 3 comes to market in Q4 2023. Cash burn is in focus, as Polestar only has ~$1.6 billion in cash to boost production for the Polestar 2 and build out production capacity for the 3.

Moving on to 2023, the next question that arises is the degree to which Polestar can grow deliveries with the majority of the year, if not the full year, focused on sales of the 2. Given that supply chain issues are likely to persist, along with risks for economic weakness and lockdowns in China, Polestar may see limited growth to ~70,000 vehicles.

Cash Burn, Expenditures In Focus

Polestar’s last reported cash figure was approximately $1.38 billion during Q2, leaving the OEM with little runway before needing more cash — given the expected ramp in vehicle volumes in Q4 and 2023, and the necessary expenditures to develop and scale a new model in the back half of the year, Polestar’s cash burn rates are likely to rise. Sharing a facility with Volvo (OTCPK:VLVLY) in South Carolina will help minimize costs required to scale production to a degree, considering Polestar will not have to build a facility from scratch.

Looking at Polestar’s cash burn rates and margins, the company is expected to run thin on cash by Q2 to Q3 2023, suggesting that a large capital raise is necessary to fund operations to launch the Polestar 3 and scale through 2024.

For the first six months, Polestar recorded a razor thin 5.1% gross margin, a ~160 bp decrease y/y. Operating expenses totaled ~$566.8 million, excluding listing costs. SG&A cost increased 60% y/y from $278.9 million to $446.8 million due to “rapid commercial expansion, with Polestar increasing its global presence significantly during the period.”

Based on figures for the first six months, Polestar is on track to burn an additional $400 million to $500 million in the second half of the year, putting cash on hand close to $850 million moving into 2023.

For Q4 and 2023, operating expenses are likely to increase due to the following factors:

- Increased global presence: Polestar is likely to expand to 30 to 32 markets, while adding service points and locations, which will increase SG&A (potentially by $30 million to $60 million depending on the degree of expansion)

- Increased R&D spend: Polestar has already “increased spend on future vehicles and battery electric technologies, including the Polestar Precept and the P10 powertrain.” Development of Pilot Pack and adding new features along with developing new vehicle platforms is likely to add to R&D expenses, potentially up to $50 million per quarter by Q3 2023

- Scaling production volumes of the 2, and preparing for the launch of the 3: Polestar has been operating at approx. a 3,300 vehicle run rate per month, but plans to boost production to 7,000 on average per month. Scaling production beyond these levels for the Polestar 2 in early 2023 is likely to add to costs, as more materials and more production shifts may be necessary to support such capacity expansion. Building final validation prototypes and the initial launch ramp of the 3, and getting it up to scale rapidly, could add a further $50 million to $100 million to operating expenses.

All in all, Polestar could be looking at expenditures of ~$650 million to $720 million in 1H 2023, rising further to $750 million to $800 million by the end of next year. Given Polestar’s thin margin profile, revenues of ~$5 billion by the end of next year may only generate $300 million in gross profit, weighed down by ~$1.2 billion to $1.4 billion in operating expenses.

Polestar is likely to raise a significant amount of cash in the first half of 2023 to support its rapid commercialization plans, potentially diluting shareholders to a substantial degree; take Chinese startup NIO (NIO), which raised over $5 billion via common stock issuance from Q2 to Q4 2020, as production volumes ramped from 10,000 per quarter to over 17,000 per quarter.

Outlook

While Polestar’s targeted production ramp in Q4 looks attractive from the massive sequential growth rate of over 110%, the company still faces a core challenge arising from its cash burn rates and rising operating expenditures. Razor thin gross margins will fail to offset increasing expenditures, which could arise from expansion plans, scaling volumes, and developing new models. Given Polestar’s $1.38 billion in cash on hand at the end of Q2, combined with the company’s projected cash burn and operating expense rates, Polestar likely will need to raise a substantial amount of cash early in 2023, weighing on the outlook of shares due to the dilutive risk of such a capital raise.

Be the first to comment