We Are

“For the times they are a-changin’.” Bob Dylan

To My Partners and Friends:

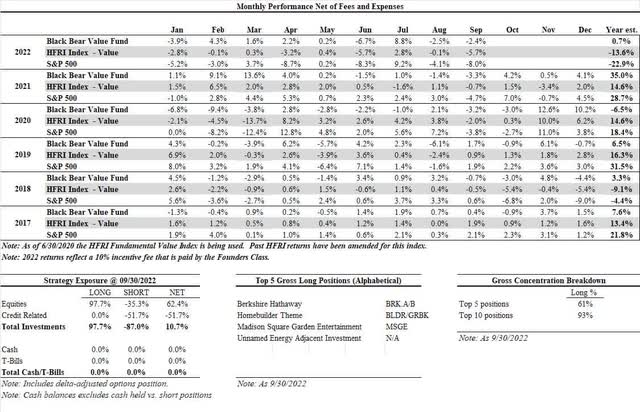

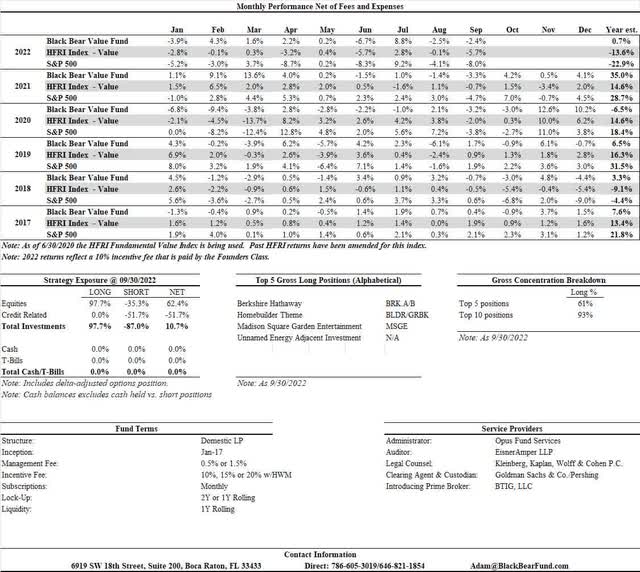

- Black Bear Value Fund, LP (the “Fund”) returned -2.4% in September and +0.7% YTD.

- The S&P 500 returned –8.0% in September and -22.9% YTD.

- The HFRI Index returned –5.7% in September and -13.6% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

- Note: 2022 returns reflect our reduced 10% incentive fee.

| Note: Additional historical performance can be found on our tear-sheet. |

We have been finding compelling ideas both on the long and short side. Some ideas are previously owned names while others are new to the Fund. Patient investors and a long business runway continue to be part of our DNA. For the first 4 years of the Fund, patience and staying power were of limited appeal as FOMO took a hold and uneconomic businesses were rewarded with ever higher valuations. But alas, gravity has returned, and the air has been coming out of the balloon.

This is the kind of environment where the ability to play offense and invest for the future is advantageous to our partnership. We have managed to protect capital through our short exposure and been able to add to our invested position in companies we like. Valuations between what we own, and the “market” are still very wide. In addition, there are many uneconomic companies that still sport multibillion equity values despite the bond market signaling trouble.

Inflation/Credit Shorts/Equity Shorts

In our last letter we cautioned against extrapolating 1 month of “good” inflation data. Many in the media were celebrating “peak” inflation with less focus on the damage from a sustained high plateau. I do not have a crystal ball and cannot predict what inflation will be nor when things will ease. I do believe there are many fundamental changes occurring in the global economy making it hard to return to a 2% inflation anytime soon. Businesses that have pricing power and healthy balance sheets will be the long-term beneficiaries of this environment. As such, that is where our focus is on the long side.

Now onto our shorts…There are a host of business models (and I use that term loosely) designed to take advantage of low rates with seemingly little thought given to a more normalized rate environment. Low-to-no return businesses were saddled with debt to amplify anemic returns and/or extend their cash-burning runway. For a variety of reasons, I do not like to disclose our shorts by name. It is safe to presume that if you are looking at a company a) with a lot of debt, b) that burns money or has weak returns on capital and c) is commoditized, there’s a good chance it’s a short or a prospective short for our portfolio.

We also remain short a variety of credit instruments that include emerging markets, US investment grade and US junk. As US treasury rates have widened, these securities have moved lower in price. We have yet to see any material number of defaults but if rates remain high and the market remains skittish, there could be several companies/countries that cannot refinance their debt. In recent history, many companies have been able to refinance their problems away with ever-decreasing interest rates. Those days seem to be gone.

As a reminder, we own businesses that have pricing power and limited/no dependance on the need for external funding. This is important because as input and wage costs pressure profitability of many companies, our businesses should be able to weather the storm and capitalize through both organic market share gains and/or acquisitions of companies that may not have had a healthy balance sheet or operating structure.

Top 5 Businesses We Own

Berkshire Hathaway (BRK.A, BRK.B – Repeat from Q2 letter)

- Cash of ~$103,000 per class A Share (vs. $104k 1 year ago)

- Down/Base/Up marks cash at book value to an 8% premium (vs. to 10% a year ago)

- Investments based on December prices ~$248,000 per class A share (vs. $194k a year ago)

- Presume a range of stock prices that result in:

- Down = $149,000 per class A share (-40%- assumes portfolio is overpriced)

- Base = $211,000 per class A share (-15% – assumes portfolio is overpriced)

- Up = $285,000 per class A share (+15%)

- Presume a range of stock prices that result in:

- Operating businesses that should generate ~$17,000 of pre-tax income per Class A share (vs. $15k)

- Down = 9x = $153,000 per share – equates to ~8% FCF yield

- Base = 12x = $204,000 – equates to ~6% FCF yield

- Up = 12x = $204,000 – equates to ~6% FCF yield

- Overall (vs. $409,000 at quarter end)

- Down = $413,000 (+1%)

- Base = $526,000 (+29%)

- Up = $600,000 (47% underpriced)

Going forward I expect Berkshire to compound at above average returns from this price.

BRK is a collection of high-quality businesses, excellent management, and a good amount of optionality in their cash position. If the cash were to be deployed accretively, the true value would be greater than an 8% premium (as mentioned above). The combination of a pie that is growing, an increasing share of said pie due to stock buybacks, upside optionality from cash and a tight range of likely business outcomes that span a variety of economic futures gives me comfort in continuing to own Berkshire.

Housing: Builders FirstSource (BLDR)/Green Brick Partners (GRBK)

I would refer you to our Q2 letter as we discuss these names in detail and our feelings have not changed. While mortgage rates are higher, they are not unusual versus history. The low rates of the last 5-10 years are the outlier. We have a structural shortage of housing in the USA. With existing homeowners locked into low-rate mortgages, the aspiring homeowner may increasingly need to find a home from a homebuilder.

The next 6-12 months could be rocky as people adjust to the increase in pricing and rates. Eventually the housing market should adjust to the new normal (or rates could go down). We do have a large credit short which benefits if rates continue to go up.

You can also watch a webcast we did on BLDR at the BTIG Fall Manager Summit here: BTIG Capital Introduction Manager Summit – Fall 2022

Madison Square Garden Entertainment (MSGE)

MSGE has been a top 5 holding in prior years. Their primary assets include the Madison Square Garden arena, MSGN (the regional sports network), Tao Group, the Radio City Rockettes show, and an in-construction entertainment venue in Las Vegas called the Sphere. Management has recently disclosed their intent to explore a spin-off of the Sphere and Tao into a new entity.

These assets have historically traded at a “Dolan Discount”. Some of that discount is warranted as management has sometimes taken actions to benefit some shareholders while harming others (Selling MSGN at a steep discount to MSGE). Alternatively, management has also been thoughtful about spins and share buybacks to benefit shareholders.

The Sphere is a $2BB endeavor that’s ~65% complete and planned to open in the 2nd half of 2023. Until then the Company will be spending the bulk of their cash to complete the development. Part of the opportunity revolves around the uncertainty of the value of the Sphere as well as inflationary pressures for the remaining costs. In our downside we incorporate 25% inflation on the remaining costs as well as a 50% write-down of the asset. I don’t believe this to be the case but provides more of a proof point as to how cheap the entity is trading.

If we take the above-mentioned haircut to the Sphere and haircut their other assets, we arrive at a net asset value of $2.1bb or $62 a share as compared to a price in the mid $40’s. Based on more reasonable estimates I arrive at a fair price that’s 2-3x where the equity is trading now.

Unnamed Energy/Commodity Adjacent Business (repeat from Q2 letter)

We have been accumulating shares in a small-capitalization stock that is an energy/commodity adjacent hospitality business. I believe this business has been through a brutal stretch during COVID yet still generated the equivalent of 12% of its market-cap in cash in a lousy year. In the coming years this business could be worth 2-3x where it’s priced now.

There is limited float and as Black Bear has grown, we have been actively purchasing the stock. We now own close to 1% of the company. As I expect to continue buying the business, I am going to keep the name of the company in-house.

Fund Updates

We are in the process of setting up an Investor Portal where LP’s will be able to access historical statements, K-1’s and financials. Please keep a lookout for an email with the details for that information.

Black Bear was specifically set up for markets like this. While it is uncomfortable for many to be deploying capital in a rocky environment, it is not for me. These are precisely the conditions I find the most rewarding as a longer-term investor. When times are happy few pay attention to risks and prudence is punished. When people get frightened everything looks worrisome and risk-taking becomes rare.

As a result, we can buy ever-cheaper, high-quality businesses and look out beyond the average investors’ investment horizon. We have a structural advantage with longer-term capital, excellent and patient investors and a fully aligned investment manager. We will continue to play offense when many seem to be in retreat.

Thank you for your trust and support.

Adam Schwartz, Black Bear Value Partners, LP

Tear Sheet

Fund Strategy

Black Bear Value Fund, LP is an opportunistic, concentrated, and fundamental value investment partnership. Our partnership operates with low fees and high levels of alignment between the Investment Manager and the Limited Partners. We actively seek undervalued and concentrated investments in the stock and bond markets that can be purchased at discounts to their intrinsic value/recovery value.

Portfolio Manager

The Fund is managed by Adam Schwartz who has 19 years of buy-side investment experience in a variety of themes including equities, structured products, corporate credit, and capital structure arbitrage. Prior to founding the Investment Manager, Adam served as a director and senior member of the investment team at Fir Tree Partners, a $13BB peak-AUM multi-strategy investment manager (2007-2015). Adam received his BS and MS with a concentration in Accounting from Washington University in St. Louis in 2001/2002.

|

THIS DOCUMENT IS NOT AN OFFER OR THE SOLICITATION OF AN OFFER TO BUY INTERESTS IN BLACK BEAR VALUE PARTNERS, LP (THE “FUND”). AN OFFERING OF INTERESTS WILL BE MADE ONLY BY MEANS OF THE FUND’S CONFIDENTIAL PRIVATE OFFERING MEMORANDUM (THE “MEMORANDUM”) AND ONLY TO SOPHISTICATED INVESTORS IN JURISDICTIONS WHERE PERMITTED BY LAW. This document is confidential and for sole use of the recipient. It is intended for information purposes only and should be used only by sophisticated investors who are knowledgeable of the risks involved. No portion of this material may be reproduced, copied, distributed, modified or made available to others without express written consent of Black Bear Value Partners, LP (“Black Bear”). This material is not meant as a general guide to investing, or as a source of any specific investment recommendation, and makes no implied or express recommendations concerning the matter in which any accounts should or would be handled. The returns listed in this letter reflect the unaudited and estimated returns for the Fund for the periods stated herein and are net of fees and expenses. Black Bear currently pays certain fund expenses, but may, at any time, in its sole discretion, charge such expenses to the Fund in the future. Please note that net returns presented reflect the returns of the Fund assuming an investor “since inception”, with no subsequent capital contributions or withdrawals. You should understand that these returns are not necessarily reflective of your net returns in the Fund, and you should follow-up with Black Bear if you have any questions about the returns presented herein. An investment in the Fund is speculative and involves a high degree of risk. Black Bear is a newly formed entity with limited operating history and employs certain trading techniques, such as short selling and the use of leverage, which may increase the risk of investment loss. As a result, the Fund’s performance may be volatile, and an investor could lose all or a substantial amount of his or her investment. There can be no assurances that the Fund will have a return on invested capital similar to the returns of other accounts managed by Adam Schwartz due to differences in investment policies, economic conditions, regulatory climate, portfolio size, leverage and expenses. Past performance is not a guarantee of, and is not necessarily indicative of, future results. The Fund’s investment program involves substantial risk, including the loss of principal, and no assurance can be given that the Fund’s investment objectives will be achieved. The Fund will also have substantial limitations on investors’ ability to withdraw or transfer their interests therein, and no secondary market for the Fund’s interests exists or is expected to develop. Finally, the Fund’s fees and expenses may offset trading profits. All of these risks, and other important risks, are described in detail in the Fund’s Memorandum. Prospective investors are strongly urged to review the Memorandum carefully and consult with their own financial, legal and tax advisers before investing. This presentation contains certain forward-looking statements. Such statements are subject to a number of assumptions, risks and uncertainties which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward-looking statements and projections. Prospective investors are cautioned not to invest based on these forward-looking statements. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment