undefined undefined/iStock via Getty Images

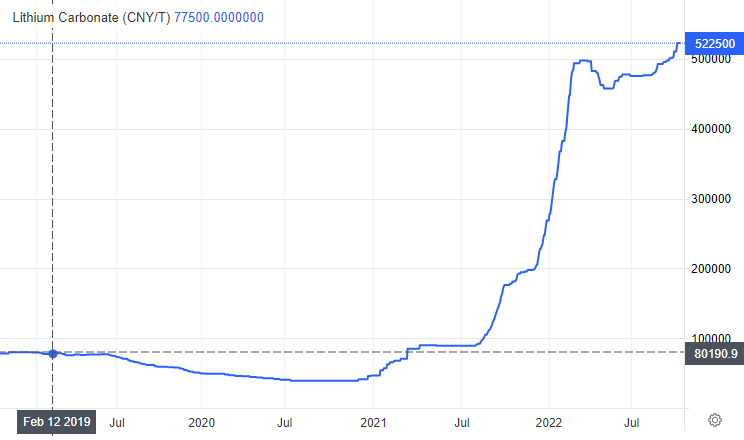

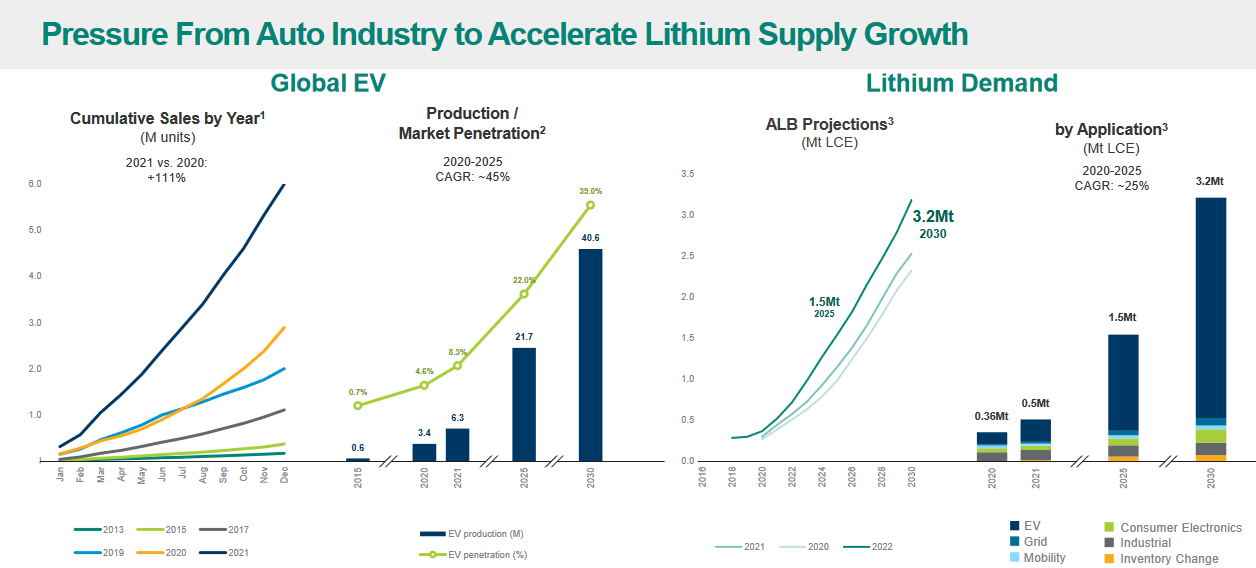

One trading strategy that has worked for me over the years is to buy outlier strength during a bear market phase. In this sense, watching lithium prices refuse to decline since the spring has me intrigued, to say the least. While most every other industrial commodity has been declining during 2022 by 20% to 30% (hurt by higher interest rates and a spreading recession causing demand destruction), lithium stands out against the grain, winning for investors at every turn. Important Chinese production has been affected by COVID-19 related shutdowns and power disruptions, but massive growth in demand from things like smartphones, portable electronics, and spiking electric vehicle manufacturing needs has created a real scarcity problem. Without doubt, it appears the marketplace is worried rising electric vehicle demand for lithium batteries will support prices for years. The question is how high can lithium rise before demand for lithium batteries is affected?

TradingEconomics.com – Lithium Carbonate Priced in Chinese Yuan per Tonne, 4 Years

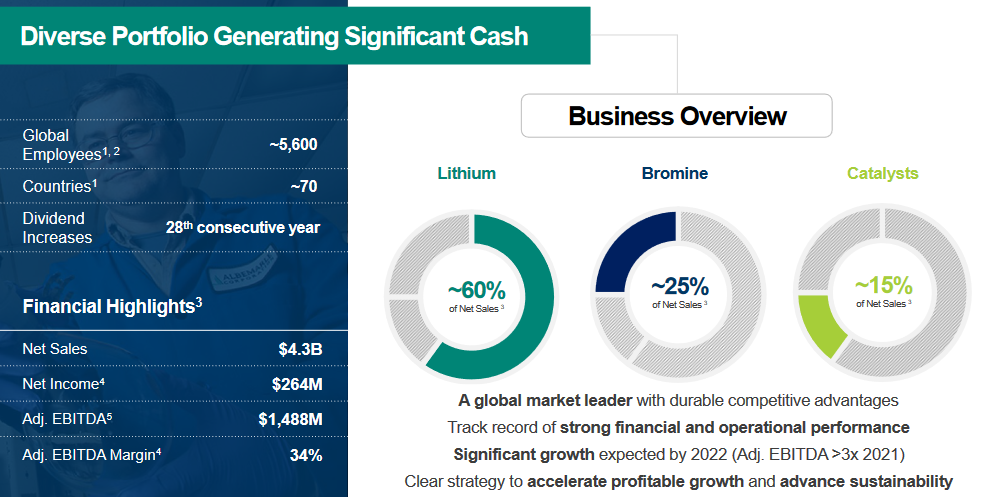

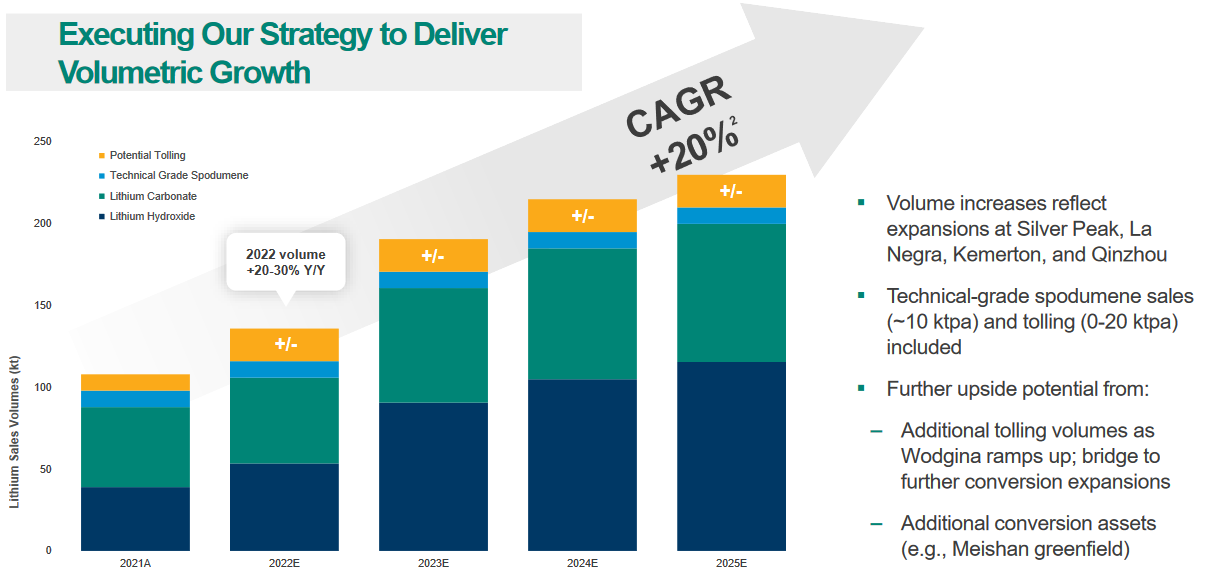

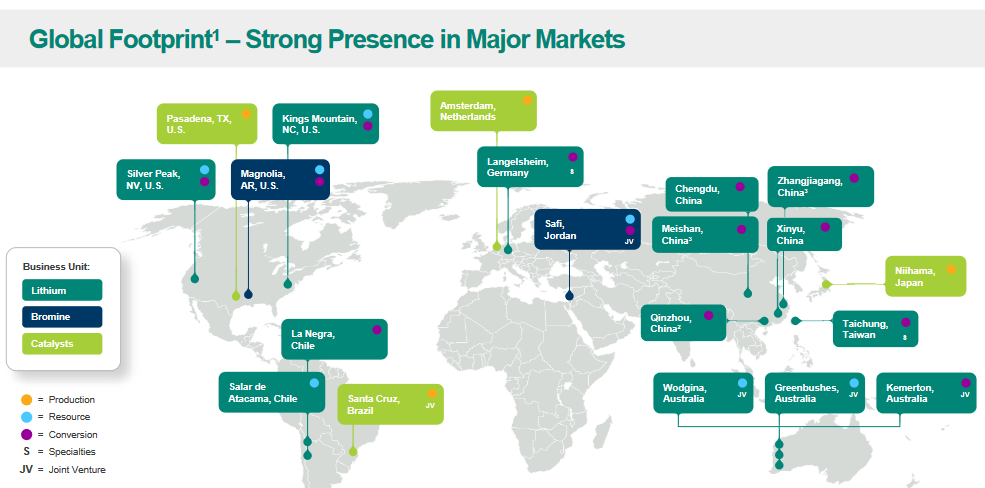

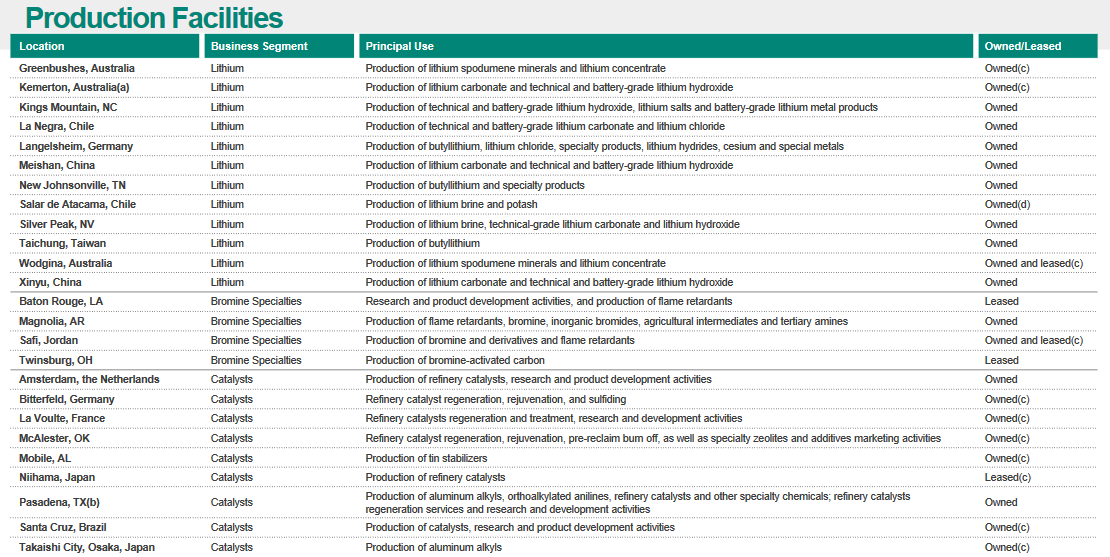

My answer is a collision between spiking demand and slowly ramping mine/refined supply could cause another doubling in prices during 2023-24. So, which company is best positioned to take advantage of an immediate rise in prices? That would be chemical company Albemarle (NYSE:ALB), which is also one of the largest, most diversified asset holders of lithium resources, mining, and refinery/processing assets in the world. Over the past year, soaring lithium prices have turned the company into a monster cash flow and earnings machine. Today, the lithium division represents more than 60% of Albemarle sales, with plans to increase mining and processing capacity by 20% annually between 2021 and 2025. I estimate another double in lithium quotes should lead to a triple in net operating income (closer to $55 EPS annually), after taxes by 2025, with lithium revenues representing roughly 80% of company results.

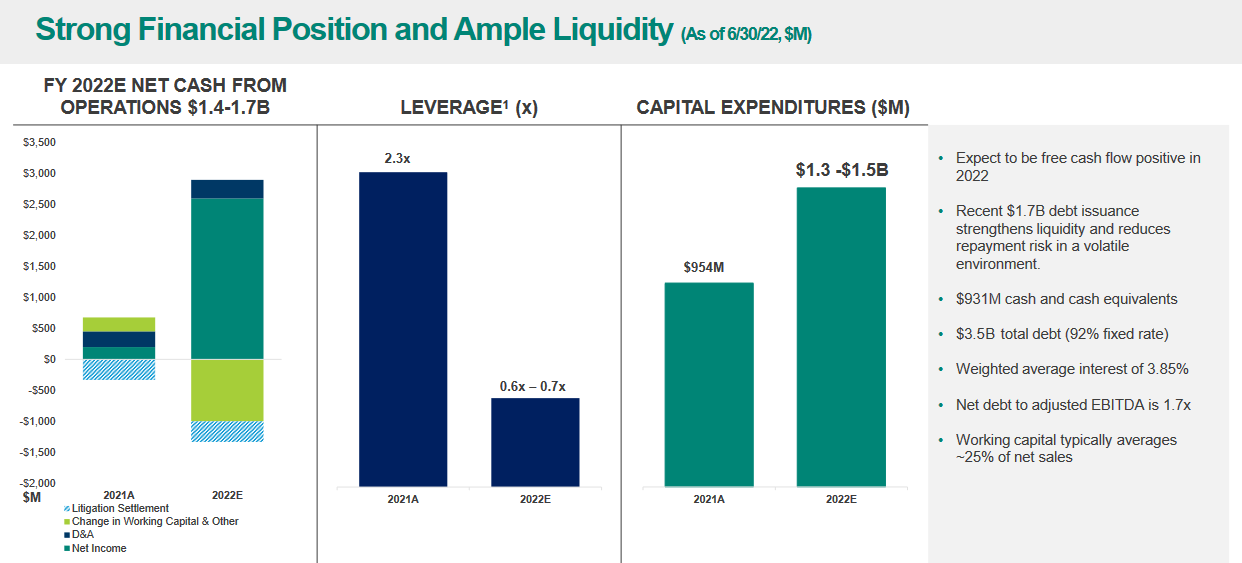

Albemarle – October 2022 Investor Presentation Albemarle – October 2022 Investor Presentation Albemarle – October 2022 Investor Presentation Albemarle – October 2022 Investor Presentation Albemarle – October 2022 Investor Presentation Albemarle – October 2022 Investor Presentation

Valuation

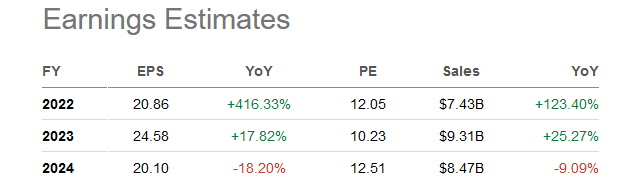

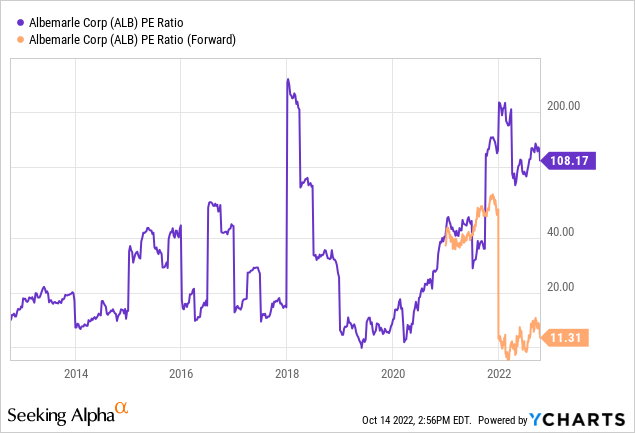

Albemarle’s valuation on trailing results looks stretched, but not completely out of bounds. However, when you start calculating forward math results, the stock price may in fact be too low. The binary investment decision is whether or not lithium quotes can go higher next year or will peak in late 2022.

As it stands, Wall Street analyst estimates have proven too conservative, time and again during the year. With raised guidance from management, current projections are listed below, including 2022 EPS of $20.86 on $7.43 billion in sales. In essence, the present consensus forecast factors into results lithium prices will stay high, but not rise appreciably from the early October level.

Seeking Alpha – Albemarle, Analyst Estimates, October 14th, 2022

On trailing price to sales and book value, Albemarle is trading around a 50% premium to 10-year average valuations. Such a premium for a business doubling revenue vs. 2021 and increasing net income by 4x does not seem extreme to me, trading stocks for 36 years.

YCharts – Albemarle, Price to Trailing Sales & BV, 10 Years

Earnings are just starting to explode, as the company has renegotiated long-term pricing terms with a variety of customers, while instituting a variable model for new contracts. When sales are made closer to spot lithium prices next year, analysts are projecting ALB to be valued around 11x forward EPS, which would be skirting a 10-year low.

YCharts – Albemarle, Price to Earnings, 10 Years

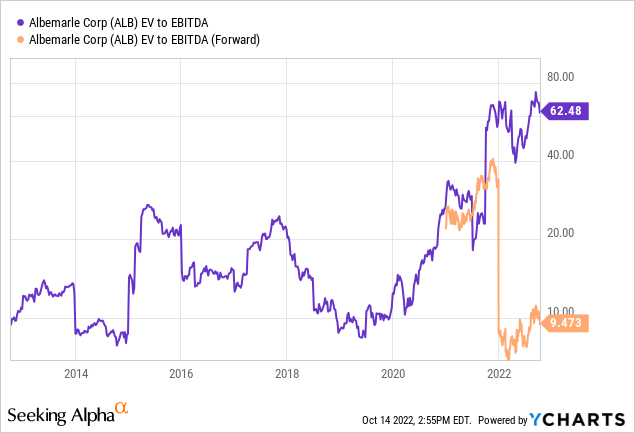

The basic EV (enterprise value = equity capitalization plus debt minus cash) to EBITDA ratio (earnings before interest, taxes, depreciation and amortization) is quite high on trailing numbers, but near a decade-low of 9x on forward projections.

YCharts – Albemarle, EV to EBITDA, 10 Years

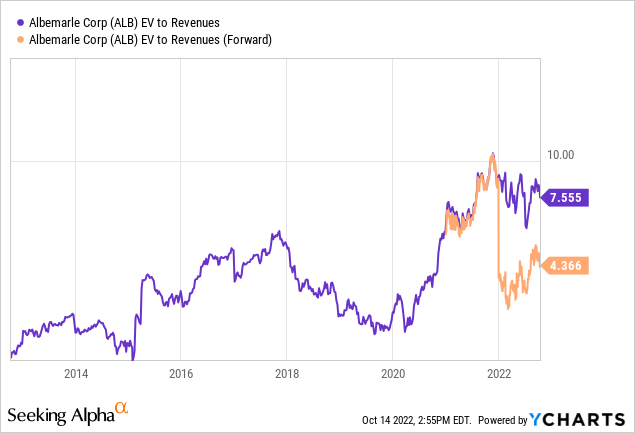

Plus, EV to forward Revenue estimates of 4x is approaching the 10-year trailing median average around 3.5x. Albemarle does not appear to be completely mispriced above reality, despite expectations for an obvious overvaluation at a lithium boom peak. What if lithium quotes keep climbing in 2023?

YCharts – Albemarle, EV to Revenues, 10 Years

Positive Intermediate-Term Momentum

I like to review three indicators on weekly charts for a simple “tell” on outlier Intermediate-term momentum, either up or down. Basically, when all three are rising strongly, stocks tend to continue higher over the next 6-12 months. When this momentum group is incredibly weak simultaneously, a smart decision is to sell or avoid the name/sector. Because it’s relatively rare to find an equity with overwhelming buy or sell interest lasting beyond a few weeks, I take notice when the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume are able to move in the same direction over many months.

For some past performance examples, gold miners generally saw a massive round of buying in early 2020 as the pandemic was hitting and money printing was moving into overdrive. All three weekly indicators of momentum went straight up into April, and precious metals turned into one of the top sectors to own into September 2020. Again, in the second half of 2021 many oil companies began to witness simultaneous weekly moves straight up in each of the ADL, NVI, and OBV creations. Guess which sector was amazingly profitable to own for shareholders between October 2021 and April 2022?

On the downside, I mentioned this “trifecta” of bad news for Warner Bros. Discovery (WBD) in an article during August here. Despite near bullish unanimity in Seeking Alpha articles since my effort, the WBD quote has declined another -15% (too much company debt and a recession in ad spending do not mix well).

For Albemarle, the stop-what-you-are-doing, head turning “buy signal” in this weekly analysis of momentum came in late 2020, about the time lithium prices began their explosion to the upside. Price was around $125 a share, boxed in green below on a 5-year chart of weekly price and volume changes. For smart or lucky shareholders buying back then, total returns have been almost +100% vs. a nearly flat capital appreciation and dividend return from the S&P 500 over the same span.

StockCharts.com – Albemarle, 5-Year Chart of Weekly Changes with Author Reference Points

Unfortunately, I cannot count all three indicators as rising today. The 2022 bear market on Wall Street has translated into very few companies experiencing substantial and overwhelming buy interest into October. However, 2 out of 3 indicators have been in solid uptrends this year (ADL & NVI), which is a better setup than 90% of other equities in the universe I follow. My conclusion is Albemarle should trend higher over time, assuming lithium prices remain high and the stock market overall does not crash soon.

Final Thoughts

What is the main downside risk owning Albemarle? By far, the biggest and clearest investment risk is lithium prices decline substantially into 2023. A number of Wall Street firms have predicted as much, with bearish calls in October. I am not so sure a cyclical drop is next. For such to happen, demand for lithium-based batteries will have to fall off the chart vs. current projections. And, the only way such is possible is during a monster recession or depression in economic activity globally.

Just as easily, weak Chinese economic growth during 2021-22 could rebound into a “more” robust gadget and EV demand backdrop next year. China is already becoming the leader in EV sales, with goals of surpassing America’s tech-heavy consumer marketplace. In the end, total lithium supply needs could be “understated” for 2023-24 in the mainstream economic projections of today.

On top of screaming-higher demand estimates for years to come, new lithium supply is coming only grudgingly. In the U.S. and other western nations, environmental protection and not-in-my-backyard thinking is translating into slow mine startups. What if lithium quotes keep rising in 2023?

Tesla (TSLA) founder Elon Musk famously explained this summer, “lithium producers have a license to print money” as metal shortages will be a way of life on rapidly rising large-battery demand related to mushrooming EV buildout. In addition, battery development for utilities and green energy farms (an effort to smooth electricity transmission) is increasingly dependent on lithium supplies. And don’t forget small electronics, computers, and smartphones uniformly count on lithium batteries for concentrated, light-weight energy storage.

Because of its current diversity in operations and ability/expertise to finance growth in lithium output from internally generated funds, I believe Albemarle is an interesting and unique choice for exposure to EV battery growth in future years. A conservative balance sheet and quickly improving level of earnings in 2022 are other reasons to grab your interest. A bullish momentum trading pattern, with a low valuation during high lithium prices are the final pieces of the puzzle to contemplate. When you put the whole picture together, I cannot find another critical metals investment with as many variables pointed in its favor. Therefore, I am officially crowning Albemarle as my top risk-adjusted buy pick in the metals category sourcing our green, renewable-energy future. Long live the king!

Major lithium resource owners also worth a look include Lithium Americas (LAC) and Sociedad Química y Minera de Chile S.A. (SQM). If you want, owning them as complementary royal court members in portfolio construction is not a bad idea.

Nickel, copper, and silver are other metals that could be in short supply starting in 2023, if the world gets serious about upgrading electrical grids, manufacturing batteries in great numbers, while building out solar and wind farms across the planet. Since late summer, I have mentioned a variety of miners that will be real or backdoor beneficiaries of ramping demand for metals. I intend to write about other choices in the months ahead. Buying them now, on the cheap, during the spreading recession and bear market on Wall Street may pay investors handsomely a year or two down the road.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment