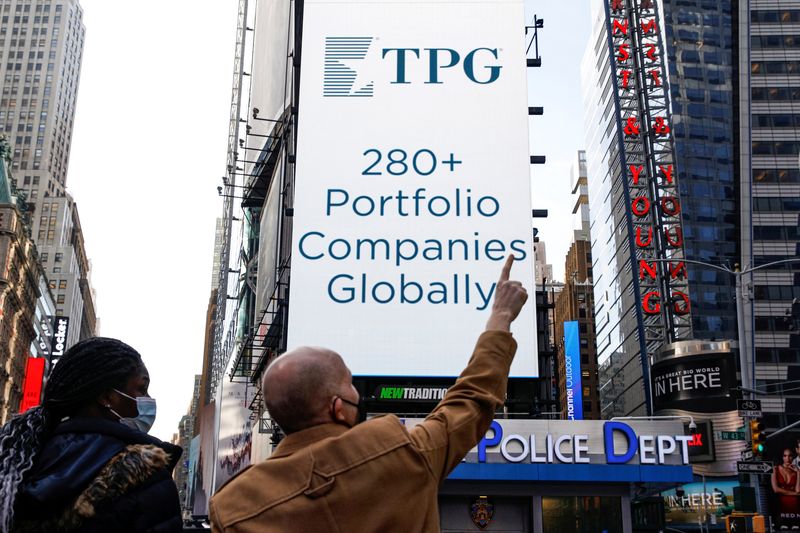

© Reuters. FILE PHOTO: A screen announces the listing of Private-equity firm TPG, during the IPO at the Nasdaq Market site in Times Square in New York City, U.S., January 13, 2022. REUTERS/Brendan McDermid/File Photo

By Krystal Hu

(Reuters) – TPG Growth, the middle market-focused arm of U.S. private equity firm TPG, has bought a majority stake in proxy firm Morrow Sodali, the companies said, without detailing terms.

New York-based Morrow Sodali, which provides shareholder engagement services including proxy solicitations and strategic advice, has nearly tripled its client base since 2020.

As activism becomes a popular tool for investment managers, Morrow has seen an increasing need from corporate clients and boards for strategic advice on ESG-related matters, executives at the firm said. “That’s where we are focusing and that is the reason why we’ve actively searched for a strategic investor like TPG,” said Morrow Sodali Chief Executive Alvise Recchi.

“We want to be an aggregator and we want to be the go-to firm of this industry.” Recchi hopes to use TPG’s financial resources and global network to further expand beyond the United States, which now accounts for about half of its revenue.

It currently operates in over 80 markets, and plans to hire more local talent and make acquisitions in Europe and Asia. Earlier this year, Morrow closed the acquisition of Canadian proxy firm Gryphon Advisors Inc, which it then rebranded as its Canadian arm. TPG Growth, which has over $14.7 billion in assets under management, has been investing in companies across industries from business services to software.

TPG went public in January after raising $1 billion in a U.S. initial public offering at a valuation of $9.1 billion.

Be the first to comment