Scharfsinn86/iStock via Getty Images

As questions abound about the available materials to build electric vehicles in mass, green hydrogen is starting to take center stage as a viable renewable fuel. Plug Power (NASDAQ:PLUG) is a leader in the space, but the company is still delivering a lot of red to shareholders. My investment thesis is Bearish on the stock until Plug Power resolves the structural losses with the current business model.

Lots Of Promise

Green hydrogen offers a lot of promise highlighted by the recent deal with Amazon (AMZN). The e-commerce giant signed a deal with Plug to supply 10,950 tons per year of liquid green hydrogen to fuel Amazon operations. Using Plug’s electrolyzers, liquefaction capabilities and cryogenic tankers, Plug will deliver hydrogen to Amazon under this deal beginning Jan. 1, 2025. Worth noting, the company already has to deal to supply hydrogen to Amazon for use in powering forklifts.

The deal highlights the promise of the business long term and the issues with the stock now. Plug Power apparently has the contracts in place to reach $3 billion in revenues for 2025, but the stock already values the business based on this deal and Amazon always appears to offer warrant lined contracts that don’t actually benefit the company.

Plug is targeting 70 tons per day of green hydrogen production by the end of 2022. Plug claims to be on track to produce 500 tons per day in North America by 2025, and 1,000 tons per day globally by 2028, which expands the opportunity for further collaboration with potential customers, including Amazon.

The company targets a massive 600% growth rate in green hydrogen by 2025, but delays are always possible and contracts like the ones with Amazon seems to have outs not necessarily evident by the original corporate announcement. Barron’s estimated a price of $5 to $6 per kilogram and the new Production Tax Credit in the Inflation Reduction Act could further lower the price for the green hydrogen delivered to Amazon. The calculation only values this green hydrogen deal at a maximum of $60 million annually.

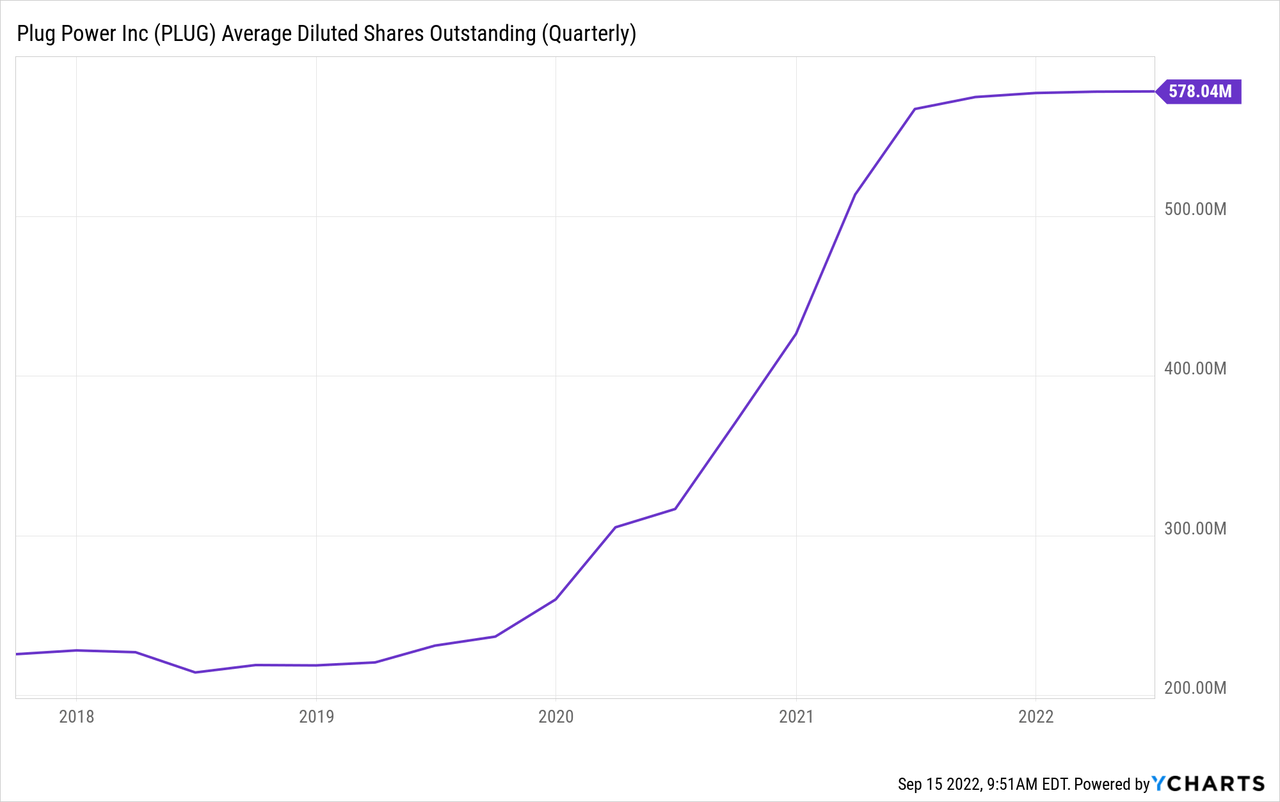

The most concerning part of the deal is the warrants issued to the e-commerce giant. Plug issued 16 million warrants to Amazon at an exercise price of nearly $23 suggesting the pricing dynamic favors the customer. Over the last 5 years, Plug has nearly tripled the outstanding share count to 578 million shares.

Reasons For Pause

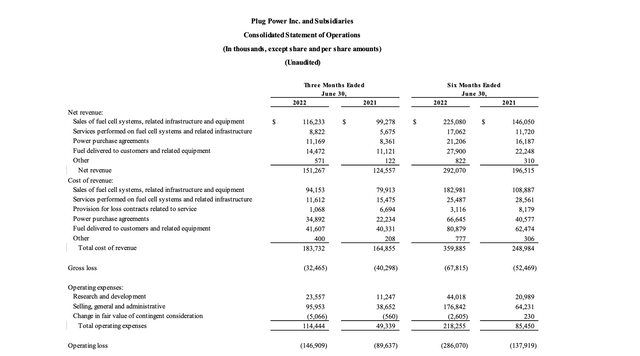

In the seasonally slow Q2, Plug only reported revenues of $151.3 million for growth of just 21%. The company reported horrible negative gross margins of 21%.

Source: Plug Power Q2’22 investor letter

Higher natural gas prices aren’t helping the situation, but Plug was already reporting massive losses over the last year when gas prices were low. The company has limited 19% margins on infrastructure and equipment sales while fuel and power are all delivered at massive losses.

Plug already spends $120 million on quarterly operating expenses for a nearly $500 million annual spending rate. A lot of the revenue upside over the next couple of years will be absorbed into this high cost structure to just reach breakeven.

Plug Power has been around a long time to not generate the sales to cover the cost of revenues. Even under the best case scenario with Amazon as a big customer in 2025, the company only forecasts 2025 revenues of $3.0 billion versus the $0.9 billion target for 2022.

Plug does project a huge reduction in costs with the shift to green hydrogen by the 2H of next year. Plug forecasts a 50% reduction in the cost of molecules over the next year due to this shift, along with the $3/kg credit from the PTC.

Though, my major caution here is that customers always want their portion of the credit. On the Q2’22 earnings call, CEO Andrew March answered this question agreeing that some of the credit might ultimately be shared with customers, but he appeared far too positive on Plug obtaining the major benefits as follows:

I did mention in my comments that we would be in a position where we’d be sharing some of the PTC with other customers.

A lot of these alternative energy suppliers like Plug struggle to reach profitability due to the prime customers shifting to the energy source in order to save money from traditional energy sources like natural gas, not to necessarily a goal of being cleaner, as suggested by corporate statements. Hence, these firms always squeeze the profits on projects and green hydrogen is likely to be no different.

The forecast the hydrogen fuel and services businesses to reach 30% gross margin by 2024. In such a scenario, a $3 billion revenue level would produce as much as $900 million in gross profits to cover the high operating expense levels.

Takeaway

The key investor takeaway is that Plug has a long way to go in order to achieve the stated goals of $3 billion in profitable revenues by 2025. Besides, the stock already trades at 6x the revenue goal for over 3 years out while the company delivers nothing but red for shareholders.

Be the first to comment