Justin Sullivan

Investment Thesis

Even after the perhaps once in a decade (or more) kind of miss and downside guidance reduction, in a neat imitation of Intel (INTC), Nvidia (NASDAQ:NVDA) stock has held up relatively well (contrary to Intel), indicating that the market remains in disbelief that Nvidia isn’t going to deliver the kind of growth that would warrant the top dollar valuation. As such, Nvidia remains poised for perhaps a decade of no returns – at best.

The main evidence for this thesis is that despite the sell-off that has already occurred, the downside estimate revisions mean that the valuation remains nearly just as expensive as several quarters ago, which means even now the downside risk remains just as severe, with absolutely zero upside catalysts on the horizon.

Background

I have covered Nvidia several times before, although my last analysis dates from around a year ago. In the previous article, Peak Nvidia, I argued the stock had become a bubble at 20x P/S and 50x P/E. Admittedly I didn’t time the market perfectly, as the article was published at around $200 while Nvidia would eventually go on to over $300 and an astronomical $800B market cap, although that stock hasn’t even traded at the $200 mark since April.

From a business perspective, already last year I had been warning investors of a crypto breakdown, as well as intensifying competition.

Indeed, the past already contains some cautionary tales with regards to investing in Nvidia. A few years ago, there was a similar hype cycle regarding crypto. In the aftermath of this, Nvidia’s growth collapsed, and so did the stock, which lost half of its value.

If that happens again, and to be sure I will not try to predict anything except to remind investors of all the hype that had been generated around crypto in the last few months and quarters, then Nvidia could very well lose the majority of its gains since 2020.

(…) Likewise, although I will not make too firm stock predictions, there certainly could be an argument that Nvidia’s valuation has also reached its peak. For that, not necessarily AI (which remains one of the brightest growth prospects for the industry), but rather the crypto hype could cause trouble for the stock in perhaps several quarters from now.

In addition, two years ago I wrote about Intel vs. Nvidia as the semi battle of the decade: Nvidia Vs. Intel: The Semi Battle Of The Decade.

Analysis

Perhaps skeptics will point to the general macro environment as the cause of the stock sell-off in 2022, which is in line with that I had predicted from a high level, but the final blow obviously came when Nvidia subsequently pre-announced and announced its Q2 earnings over the last month. This currently leaves Nvidia as a business in decline still priced as a growth stock.

Q2 results

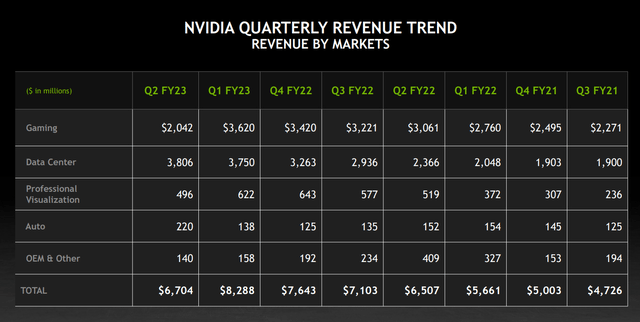

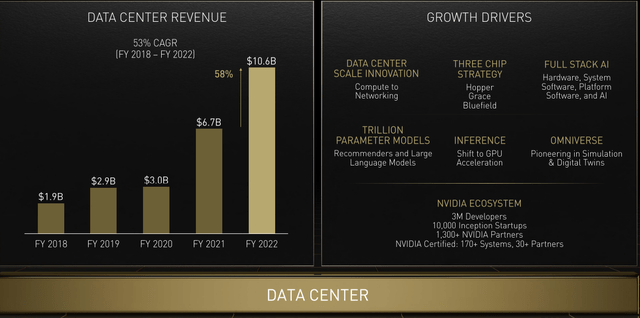

Revenue of $6.7B was up 3% YoY but down 19% QoQ – an even worse decline than Intel’s 17%. The YoY comp was saved by a 61% surge in data center, but also here this is highly misleading since the sequential trend was a low single-digit increase, indicating the growth story here is also quickly fading.

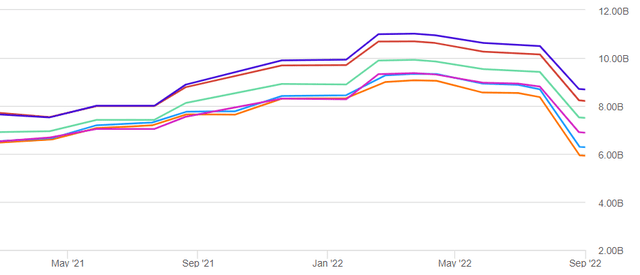

Perhaps even more incredible, if we just go back to May, the consensus at the time was for $8.44B revenue. I would argue this tells a cautionary tale: for analysts who just have to plug in numbers in their spreadsheets, it is easy to model a growth company by assuming that it adds a chunk of revenue every quarter. In the real world, however, Nvidia’s revenue is the total of millions of people going out to buy PCs, enterprises who expand or upgrade their data centers or cloud usage, and perhaps also a good chunk of crypto miners. At some point, this demand is simply going to hit a wall, and analysts clearly were living under a rock since the first talks about a recession were already starting at the beginning of the year. Obviously, one could say analysis is easy in hindsight, but the surge in growth over the last year should have provided an indication that much of this could have been a pull-in in demand.

In addition, gross margin was down to less than 43%, seemingly due to Nvidia having to write off excess inventory as a result of prepayments when the company was still anticipating unimpeded continued growth.

Segment performance

The main culprit for the underperformance has been the gaming segment which got obliterated.

Q3 guidance

Many people have put the blame on crypto, but I believe this is too easy. While clearly crypto played some role, since the sequential decline as mentioned was even worse than Intel’s Q2, the forward guidance isn’t looking any prettier, with Nvidia initially looking for another $0.8B decline sequentially to $5.9B.

What’s stunning for this is that the unassuming analysts had simply modeled growth into eternity for Nvidia, reaching over $9B in Q3, which means Nvidia’s guidance was off by 33%.

For comparison, Intel reported a 17% YoY and QoQ decline in Q2 to $15.3B and a stable sequential guidance of $15-16B. Again, Nvidia fares worse than Intel, as Q2 could have been the bottom for Intel while Nvidia is still in decline. The figure below shows the trendline for the estimates through Q4’23.

Nevertheless, although as an Nvidia skeptic it is easy to go run a victory lap, the reality is obviously that Nvidia’s results were roughly in line with Intel’s disastrous Q2. However, the narrative is completely different. For Intel, investors are avoiding the stock as they mostly paid attention to Intel’s comments of poor product execution as reason for the decline, while the sentiment I have seen among Nvidia bulls is that they believe that the general growth drivers remain unimpacted, with growth presumably going to resume soon. However, there is as of yet no evidence that (or when) high growth – never mind hyper growth – will return. Note that without such growth, the valuation can’t be justified.

In hindsight, people were initially quick to call out the demise of Intel, but as Intel said recently, it was simply the first company to report its Q2 results, with other companies – even the supposedly best-in-class companies like Nvidia – showing very similar weakness.

I would assume the truth is somewhere in the middle. Both Intel and Nvidia reported that they are under-shipping compared to the actual TAM, as OEMs are reducing inventory. As such, it will likely take a while to get an accurate view of the actual TTM (trailing twelve-month) decrease in sales due to the pressure from inflation, recession, rising interest rates and, for Nvidia, the crypto bust. In other words, there could be recovery like Intel has already forecast for Q4, but that does not mean growth will then simply resume unabated.

Sales restriction

It then got even worse. The most recent news hot off the press is that the U.S. has imposed sales restrictions for the high-end Nvidia (and to lesser extent AMD (AMD)) data center chips, with Nvidia estimating the impact at $0.4B for Q3, meaning that an additional over $1.5B of annual revenue may just have been wiped out.

Market observations: No monopoly no more

Gaming

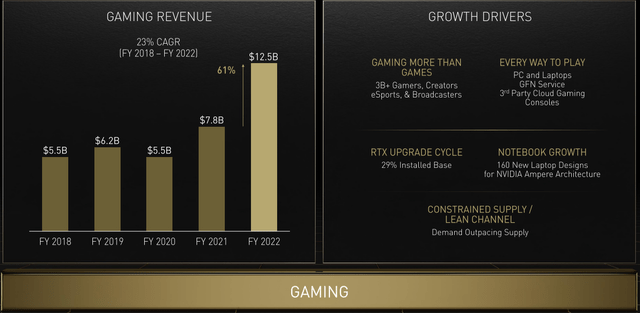

Of course, Nvidia management maintains that general trends in gaming remain strong. However, I would remind people of some trends that were shown at investor day in May.

Gaming revenue grew by 61% in 2022, which is a strong outlier compared to the nearly flat revenue trend in the previous four years. Indeed, if the Q2 bust and the continued Q3 collapse turns out to be just the beginning of a reversal to the mean, then a full-blown bear scenario for the stock may continue to play out.

In fact, looking further behind the hood indeed reveals even more causes for concern and cautiousness.

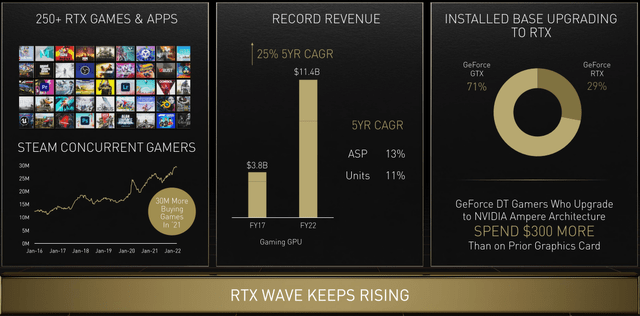

The 25% 5-year CAGR (which as the other slide showed was actually more like a 61% 1-year CAGR) was driven by a combination of ASP (average selling price) and unit increases. While on first sight it looks healthy that Nvidia benefits from both almost equally, I would argue both trends are actually very concerning.

First, the 13% CAGR for ASP implies that the average price of a GPU has almost doubled compared to five years ago. Anecdotally, I was indeed quite baffled when I saw that what is nowadays considered the price of a mid-range GPU was firmly in the high-end range when I built my own PC six years ago with a mid-range GPU.

Obviously, I would contest that this trend is not sustainable. If it isn’t simply because the market for people willing to pay top dollar for a PC isn’t infinite, then also because I would predict that investors will one day have to reckon with the fact that Nvidia’s monopoly now is just as unsustainable as Intel’s was not too long ago.

For some more anecdotal evidence, I just looked at the latest September best buy guide of a tech site, and both its midrange and high-end configurations used AMD GPUs. In other words, AMD has achieved a similarly competitive position in the GPU market as it has achieved in the CPU space. Over time, this should pressure both Nvidia’s market share and pricing.

In addition, it is not just AMD, but as has been my thesis for a few years, another well-funded competitor is entering the market with Intel. Note that Intel is an incumbent as well with a well-established position as CPU vendor. It isn’t too unrealistic to assume that Intel will be seeking to bundle the sales of its CPUs and GPUs to OEMs. So as Intel carves out a double-digit position of the market share over time, this means another several billion in annual revenue will likely be lost. Indeed, Intel’s 2026 outlook is to “approach” $10B revenue across PC and data center.

Now, I am already anticipating the sort of comments of people mocking the launch of Intel’s Alchemist this year as something Nvidia shouldn’t be scared of, but they have to be.

Before Pat Gelsinger joined Intel, Intel was an (in R&D) underfunded company that saw GPUs mostly as a side project. To make matters worse, Intel was seeking to get to par with Nvidia from its first generation by developing both dedicated ray tracing cores, dedicated matrix (tensor) cores for Intel’s XeSS alternative to DLSS, as well as by achieving best-in-industry media support with AV1 encoding (an industry first).

Intel took up a lot of work at a time when it had $0 revenue from discrete GPUs, and it is currently paying the price of this steep learning curve. Nevertheless, Intel has said that its 24-core A750 will be meaningfully higher performance than Nvidia’s RTX 3060 while most likely being cheaper. Note that the Alchemist series tops out at the RTX A770 with 32 cores, a further 33% boost. Of course, Nvidia will start to launch its next-gen RTX 4000 cards in the next few months, but the message here is that as of writing Intel has 0% market share, a number that can only increase as Intel positions its GPUs both on performance and pricing, targeting the low- to mid-end segments initially.

I’m kind of torn on this one. Because to your point, there’s some things that you would normally expect to lag. And the reason you would expect them to lag is because they’re hard, and they need to come after you have a solid base. But for better or worse, we just said we need all these things. And so we did XeSS, we did RT, we did AV1, we kind of have a lot on the plate, right? I think we’ve learned that maybe, you know, in this case, we have a lot on the plate and we’re gonna land all the planes, and that’s taken us longer than we would have expected.

Secondly, there is the question about the sustainability of the unit CAGR, which also grew at double digits over the five year period. Simply looking at the fundamentals, although one could argue that gaming is and remains a growth market in the long-term, as of today the reality is that the PC market as a whole is in decline, and in the long-term will be stagnant at best. While there may be some room for further GPU adoption, investors should also remember that both AMD and Intel have invested heavily in the capabilities of their integrated graphics, which makes GPUs redundant for many segments including the highest volume price points.

In summary, the long-term leeway for gaming growth actually seems scaringly limited when taking into account the realistic opportunity for long-term “growth” (read: lack of growth) in terms of units and average selling price, especially in light of the ever-increasing competition from both Intel and AMD, on both pricing and performance. As a result, Nvidia’s 2021 results in gaming may turn out to be an aberration instead of the new normal, let alone the new normal for growth. Simply put, Nvidia’s gaming business may end up looking a lot like Intel’s PC business, which means the rest of the businesses will have to carry the company even more to sustain high growth.

Data center

I will be brief on this one, as the general discussion is very similar as the PC discussion: Nvidia will simply run out of unit as well as pricing leverage, which will only be fueled by the increasing competition, from both AMD (which can now leverage Xilinx IP) and Intel.

Although, admittedly here too the reason I can be brief is because the general thesis of Intel’s entry into Nvidia’s data center market hasn’t changed, as already two years ago I was talking about how Ponte Vecchio was posing a threat to Nvidia. However, the GPU still isn’t shipping in volume. If Intel was earlier, it could have achieved a generational advantage over Nvidia in terms of performance but Ponte Vecchio should still be competitive to Hopper, and there is obviously a very large leeway to undercut on pricing.

While overall the opportunity for unit growth should be much larger in the data center, if chips like Ponte Vecchio and Habana Gaudi2 (which is currently shipping and which has established a clear leadership position against Ampere A100 while probably being much cheaper; for Gaudi1, Amazon (AMZN) AWS’s claim is already that it delivers 40% higher performance per dollar) can make inroads, then there could pressure on pricing.

Software

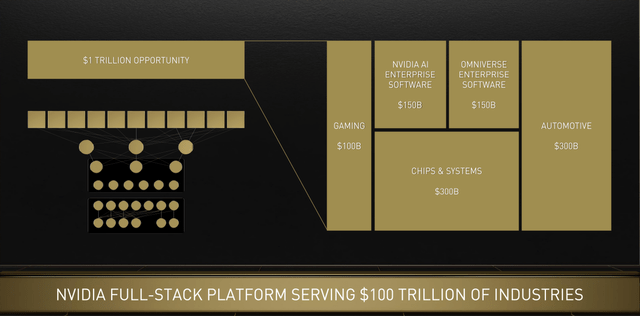

This segment warrants the most cautiousness. At the same investor day mentioned above, Nvidia management described how by doubling down on software, Nvidia was opening up a $1T revenue market opportunity. In brief, Nvidia’s view of the future is that enterprises will build enormous AI data centers filled with Nvidia GPUs, further leveraging Nvidia software to bring in juicy recurring revenue. Investors swallowed this talk with, in my opinion, too little skepticism, as I have seen the $1T claim being repeated without much criticism. Here’s a link for the full details.

Maybe more anecdotally, but there is actually already one company busy with trying to sell AI software, called C3.ai (AI) under the apt ticker AI. The company’s performance has been mixed, with at best some quarters with strong growth from a comparatively low base. Even a company like Palantir (PLTR) only generates a few billion in revenue.

Simply put, the $1T TAM is clearly an aspirational view of how Nvidia envisions the future, but there is no evidence that reality will actually turn out that way. That doesn’t mean that AI doesn’t remain a very promising and growing segment, but it just doesn’t seem responsible to try to make investors believe that Nvidia could easily 10x or 20x its revenue on a whim.

Valuation

Coming back to the near future, and this leaves us with the elephant in the room. To recap, the general (peak) Nvidia thesis is that the stock price got far too ahead of itself, anticipating growth that may not materialize for many years (if ever). In addition, as we’ve now seen over the last month, not only is this anticipated growth indeed not materializing, it is actually in decline now.

This means that even though the stock price has already declined a healthy chunk, the denominator (earnings) has also declined substantially. This means that the P/E multiple has remained fairly robust.

Just based on the multiple, the stock could easily lose another 50% if the market would rerate Nvidia as a no-growth company. Such a decline seems fairly logical given that the valuation remains a premium despite that both revenue and earnings are now trending in the opposite direction of what the valuation – being a growth company – implies.

Even TSMC (TSM), which continues to grow at a healthy clip due to being indexed to basically the whole semiconductor industry, currently trades at literally some 3x lower multiple. Again, the truth may be somewhere in the middle as I rated TSMC a buy several months ago.

Comparison to Intel

I would point investors to a comparison that shows that sometimes the market may be slow to fully price in the downside case – which leads to the actionable advice that existing investors may contemplate to close their position before the stock completely turns.

Notably, Intel first delayed its 10nm in 2015 (from 2016 to 2017). Two more one-year delays would eventually follow. The stock hardly cared for about half a decade. By then, Intel had already well lost its process leadership and AMD was back in the market with strong products that evidently outperformed Intel. It was only after the fourth delay, pushing back 7nm (now called Intel 4) by a year that the stock reacted, sending the shares in one fell swoop from $60 to $50.

Here, too, I would argue that given the most recent trends, the Q2 announcements might have been just the start of a new era for the stock, as evidenced by the downside reaction (perhaps finally) to the China restriction news. The name of the game isn’t anymore to ask by how much Nvidia will beat and raise, but how far down the bottom is, how long it will last, and if and how soon or late Nvidia will recover.

Stock verdict

Nvidia is still valued as a growth company, despite guiding for a further decline next quarter. Even if that turns out to be the bottom, and there is some sort of recovery, these results are dramatic enough that investors should question how solid the growth story really is if this much demand can disappear out of thin air on a whim. A few months ago analysts were still expecting $9B in revenue, but the actual guidance for Q3 is $5.9B. Even if prospects in the data center are brighter than gaming, that still may not be enough to return to high growth.

Risks

Metaverse, omniverse, autonomous driving, digital twins, AI… clearly Nvidia still has many buzzwords to throw at investors (and customers). If Nvidia does manage to execute like its self-proclaimed $1T market opportunity suggests it could (and very coincidentally no else tries to pursue the same opportunity, although as discussed this is not the case given AMD and Intel), then perhaps the current decline, like the bulls are expecting, will turn out to be just but a blimp on the radar, and a long-term buying opportunity.

On the other hand, as suggested, the market for neither PC GPUs nor data center chips is infinite, which means there is likely a ceiling somewhere. The current results suggest that Nvidia may have hit this ceiling in the PC space. While investors will obviously (and rightfully) proclaim that the real opportunity is the data center, the sequential growth there has also flatlined significantly after the admittedly very strong growth over the last year.

The second main risk is that the recent quarter may have given bears too much fuel to run their victory lap, since as discussed Nvidia, just like Intel, is now very likely under-shipping the actual end-market, as evidenced by the 43% gross margin which is all but likely a one-off. In that case, to some extent a relatively high valuation may be warranted.

In other words, if the stock would decline too much to a “reasonable” multiple, then once OEMs need to refill inventories, demand may return by more than expected, which could lead to greater earnings (growth) than expected, which would make the stock suddenly undervalued. Note that this is a similar scenario as Intel, which is currently valued at a higher multiple than some would perhaps expect; my thesis for Intel is bullish (as discussed elsewhere) on an expected recovery in earnings as the turnaround progresses (and succeeds).

However, undervaluation likely isn’t the case (yet?) since the stock was trading at 100x P/E not too long ago and the stock is “only” a bit over 60% down from its peak.

Analyst absurdity

Sure, this section displays some more hindsight, but back in Q1 Nvidia already gave a cautious signal by guiding for $8.1B where analysts were looking for $8.44B. At the time, this 8% QoQ growth, instead of the estimated 20% growth, was seen as a “gaming reset”. Click on the article here to read all analyst reactions (as well as the comment section).

Rolland, who has a positive rating on Nvidia’s (NVDA) shares, said that analysts are now looking for Nvidia (NVDA) to see “modest” sequential revenue growth of 8% in its second quarter, as opposed to earlier forecasts for 20% growth. Rolland trimmed his price target on Nvidia’s (NVDA) shares to $260 each from $280.

Citi analyst Atif Malik lowered his price target on Nvidia (NVDA) to $315 a share from $350, noting that the “gaming reset” provides an attractive entry point for investors. In April, Malik cut his estimates for Nvidia’s (NVDA) gaming business due to concerns about Russia and China, and said that he is now positive about the “risk-reward [potential] in the stock.”

Investor Takeaway

There is a lot more uncertainty regarding Nvidia than the market is currently discounting for, even after the decline over the last few months. The most recent China sales restriction is just the latest canary in the coal mine. Simply put, I fail to see how Nvidia would be a compelling investment after posting sequential revenue trends that were even worse than Intel. While the price has already declined, so have the earnings, which means the P/E (as well as P/S) valuation still remains among the most expensive in the market.

In addition, given Intel’s GPU entry (backed an over $16B company-wide R&D budget) and AMD’s rise from the ashes, Nvidia faces the strongest competition, ever. Given its best-in-class gross margins, this means Nvidia doesn’t just face market share pressure, but even worse, pricing power pressure. Nvidia’s position seems untenable in the long run. Remember that each dollar that Nvidia overcharges for its products directly flows through to earnings. While Nvidia does expect a recovery from the abysmal gross margin it saw in Q2, and will likely recover from the Q3 bottom, it does serve as a warning.

Hence, a “mere” market recovery may not be enough to support the stock price in the wake of fierce competitive pressure. While surely the bulls could still find ample opportunities for growth, some of this growth may just serve to grow into the valuation which was simply far too high going into the downturn.

In addition, note that this whole discussion was merely about justifying the current stock price. Any prospective investors will be looking to make alpha, not to be a decade-long bag holder. In order to grow the market cap, Nvidia would have to far outperform, but there is no evidence or indication this may happen anytime soon. Hence, the stock might (have to) decline even further if there is no swift recovery, in order to lure buyers.

As such, ultimately investors who still believe in Nvidia’s long-term potential should currently be in no rush whatsoever to open or add to their position, as the hangover from demand pull-in and the bubble valuation could last years, with no immediate catalysts in sight, which is what I previously called “peak Nvidia”.

Be the first to comment