Armastas/iStock Editorial via Getty Images

Investment Thesis

- I rate both Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Apple (NASDAQ:AAPL) as a buy: Both have strong competitive advantages, strong financials and are highly profitable. However, the results of the Seeking Alpha Factor Grades and the HQC Scorecard, both show Alphabet to be more attractive in terms of Valuation and Growth.

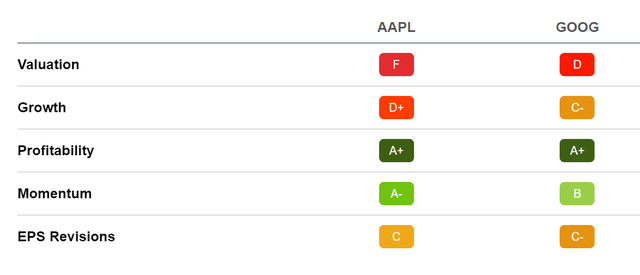

- According to the Seeking Alpha Quant Ranking, Alphabet is in a better position than Apple: While Alphabet is ranked 3rd out of 63 in the Interactive Media and Services Industry, Apple is rated 7th out of 31 in the Technology Hardware, Storage and Peripherals Industry. Within the Communication Services Sector, Alphabet is ranked 8th out of 251, while Apple is ranked 134th out of 631 within the Information Technology Sector.

- Alphabet scores 91/100 points on the HQC Scorecard. This is a very attractive overall rating in terms of risk and reward. The company produces very attractive results in all categories of the Scorecard and achieves better results than Apple in the categories of Financial Strength, Valuation, Growth and Expected Return.

- Apple currently scores 81/100 points as according to the HQC Scorecard. The company is rated as very attractive in the categories of Economic Moat (100/100), Profitability (100/100), Innovation (100/100) and Expected Return (80/100). In the categories of Financial Strength (65/100), Valuation (68/100) and Growth (60/100) Apple is rated as attractive.

The overall ratings of the HQC Scorecard demonstrates that both are high quality companies, but that Alphabet is currently slightly more attractive when it comes to risk and reward.

Apple’s and Alphabet’s Competitive Positions

Both Apple and Alphabet have strong competitive advantages over their rivals. They have strong brand images, which is underlined by the fact that the companies are ranked 1st and 3rd among the most valuable companies in the world as according to Brand Finance.

In regards to Alphabet, I see the company’s enormous amount of data and the ability to analyse and use this data as a strong competitive advantage. In my detailed analysis on Alphabet from a month ago, I also discussed the company’s strong growth potential:

“In my opinion, when investing in Alphabet, you not only invest in a financially strong company with a robust and well proven business model, but at the same time its acquisition and integration of startups enable it to maintain relatively strong growth potential. Alphabet’s Average Revenue Growth Rate of 22.88% over the last 5 year is an additional indicator of the company’s excellent growth perspectives.”

In my previous analysis on Apple, I discussed how the company’s ecosystem is one of its strong competitive advantages:

“Apple has succeeded in building a complete ecosystem. This means the system-wide integration of Apple products, which ensures an even better user experience if you own several Apple products. An example of this would be to unlock your Mac with your Apple Watch or to receive messages on all of your Apple devices.”

The Valuation of Apple and Alphabet

Discounted Cash Flow [DCF]-Model

In terms of valuation, I have used the DCF Model to determine the intrinsic value of Apple and Alphabet. The method calculates a fair value of $187.78 for Apple and $157.23 for Alphabet. At the current stock prices, this gives Apple an upside of 21.50% and Alphabet an upside of 46.30%.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Apple |

Alphabet |

|

|

Company Ticker |

AAPL |

GOOG |

|

Revenue Growth Rate for the next 5 years |

8% |

10% |

|

EBIT Growth Rate for the next 5 years |

8% |

10% |

|

Tax Rate |

13.3% |

16.2% |

|

Discount Rate [WACC] |

7.75% |

8.00% |

|

Perpetual Growth Rate |

4% |

4% |

|

EV/EBITDA Multiple |

18.7x |

13.1x |

|

Current Price/Share |

$154.53 |

$107.48 |

|

Shares Outstanding |

16,070 |

13,044 |

|

Debt |

$119,691 |

$28,810 |

|

Cash |

$27,502 |

$17,936 |

|

Capex |

$10,642 |

$29,816 |

Source: The Author

Based on the above, I calculated the following results:

Market Value vs. Intrinsic Value

|

Apple |

Alphabet |

|

|

Market Value |

$154.53 |

$107.48 |

|

Upside |

21.50% |

46.30% |

|

Intrinsic Value |

$187.78 |

$157.23 |

Source: The Author

Relative Valuation Models

Apple’s and Alphabet’s P/E [FWD] Ratio

Apple’s P/E Ratio is currently 25.54, which is 13.72% above its 5 Year Average (22.46), this provides us with an indicator that the company is currently overvalued.

Alphabet’s current P/E Ratio is 20.83, which is 25.48% below its 5 Year Average of 27.95. This serves as an indicator that Alphabet is undervalued and once again confirms the theory that it’s currently the more attractive option when compared to Apple.

Financial Overview: Apple vs. Alphabet

|

Apple |

Alphabet |

|

|

Ticker |

AAPL |

GOOG |

|

Sector |

Information Technology |

Communication Services |

|

Industry |

Technology Hardware, Storage and Peripherals |

Interactive Media and Services |

|

Market Cap |

2.50T |

1.41T |

|

Revenue |

387.54B |

278.14B |

|

Revenue 3 Year [CAGR] |

14.37% |

23.32% |

|

Revenue Growth 5 Year [CAGR] |

11.64% |

22.88% |

|

EBITDA |

129.56B |

96.89B |

|

EBIT Margin |

30.53% |

29.65% |

|

ROE |

162.82% |

29.22% |

|

P/E GAAP [FWD] |

25.54 |

20.83 |

|

Dividend Yield [FWD] |

0.59% |

– |

|

Dividend Growth 3 Yr [CAGR] |

6.27% |

– |

|

Dividend Growth 5 Yr [CAGR] |

8.45% |

– |

|

Consecutive Years of Dividend Growth |

8 Years |

– |

|

Dividend Frequency |

Quarterly |

– |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

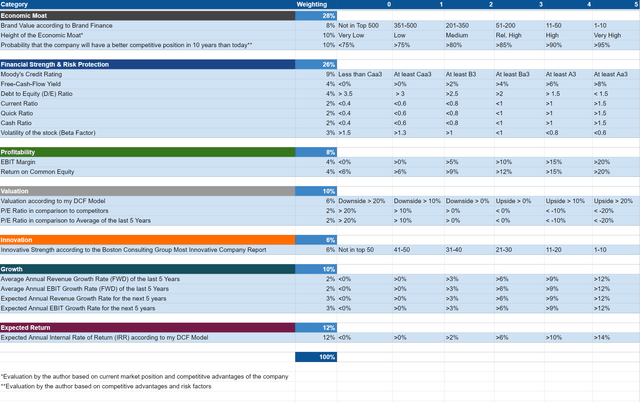

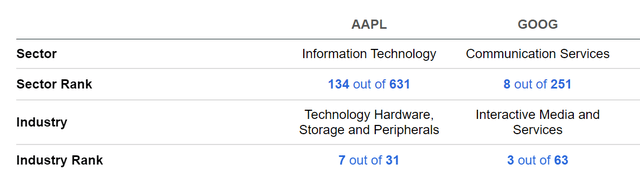

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

Apple and Alphabet According to the HQC Scorecard

As according to the HQC Scorecard, both Apple and Alphabet can currently be classified as very attractive in terms of risk and reward. While Apple scores 81/100 points, Alphabet scores 91/100.

Alphabet is classified as very attractive in all categories of the HQC Scorecard. The company is rated ahead of Apple in the categories of Financial Strength, Valuation, Growth and Expected Return.

In the categories of Financial Strength, Alphabet is rated as very attractive (87/100) while Apple gets an attractive rating (65/100). This is due to Alphabet’s higher Current Ratio (2.81 compared to Apple’s 0.86), higher Quick Ratio (2.64 vs. Apple’s 0.70) and its higher Cash Ratio (2.04 in comparison to 0.37).

In terms of Valuation, Alphabet is also rated higher than Apple. This is particularly due to Alphabet’s currently lower P/E Ratio as compared to its Average of the last 5 years.

In terms of Growth, Alphabet (88/100) is also rated higher than Apple (60/100). This is a result of the fact that I expect the company to grow with a higher Growth Rate than Apple in the coming years.

The HQC Scorecard demonstrates that both Alphabet and Apple are very attractive companies in terms of risk and reward. However, Alphabet’s higher rating strengthens my belief that it’s currently the slightly better option when choosing between the two competitors.

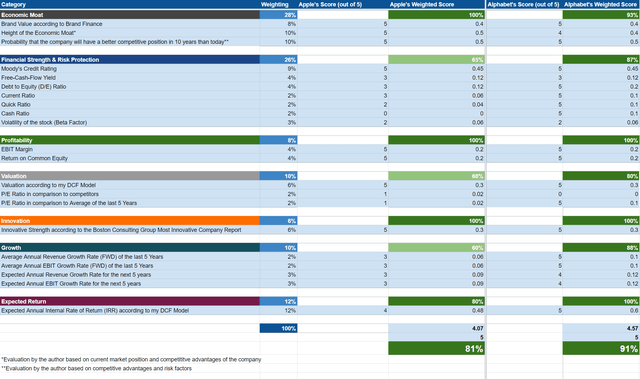

Apple and Alphabet According to the Seeking Alpha Quant Factor Grades

When looking at the Seeking Alpha Quant Factor Grades, we get further confirmation that Alphabet is currently slightly more attractive than Apple. While Alphabet receives a D rating in terms of Valuation, Apple receives an F. In terms of Growth, Alphabet receives a C- while Apple only gets a D+. These results once again strengthen my opinion that Alphabet is more attractive than Apple at this moment in time. This is particularly due to its higher ratings in terms of Valuation and Growth, thus being in line with the results of the HQC Scorecard.

Apple and Alphabet According to the Seeking Alpha Quant Ranking

As according to the Seeking Alpha Quant Ranking, Alphabet is also in a better position than Apple. While Alphabet is ranked 3rd out of 63 in its industry, Apple is only 7th out of 31 in its own industry. Within the Communication Services Sector, Alphabet is ranked 8th out of 251, while Apple is ranked 134th out of 631 within the Information Technology Sector. The Seeking Alpha Quant Ranking reinforces the theory that an investment in Alphabet is currently more attractive than investing in Apple.

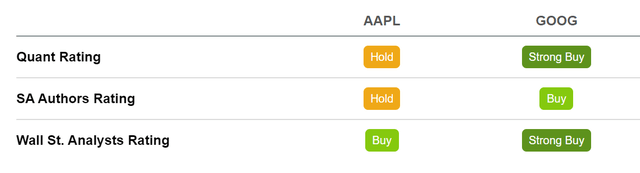

Apple and Alphabet According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

As according to the Seeking Alpha Quant Rating, Alphabet is currently a strong buy, while Apple is a hold. When considering the Seeking Alpha Authors Rating, Alphabet is a buy and Apple a hold. Meanwhile, the Wall Street Analysts Rating has Alphabet as a strong buy and Apple a buy. The ratings confirm one more time that Alphabet is currently the more attractive company.

Risks

In my previous analysis on Alphabet, I mentioned that one of the main risk factors regarding an investment in the company is the fact that the largest part of its revenue is generated by its business unit Google Advertising:

“One potential risk factor I see for Alphabet is the fact that the largest part of the company’s revenue (more than 80%) is generated by its business unit Google Advertising. Reduced spending in advertising by Alphabet’s clients could adversely affect its business and therefore result in decreasing profit margins. However, as shown in this analysis, Alphabet’s other business units are becoming more and more important: proof of this, for example, is the fact that Google Cloud already accounted for 9% of the company’s total revenue in 2Q22 while it accounted for only 7.5% in the same quarter of the previous year.”

In my analysis on Apple, I mentioned that the biggest risk factor for the company would be if its brand image got damaged:

“This could mean that Apple’s customers no longer pay premium prices for its products and thus profit margins as well as the company’s growth rates could be affected negatively.”

The Bottom Line

In my opinion, both Alphabet and Apple are excellent choices when aiming to invest in a high quality company. However, Alphabet is currently slightly more attractive than Apple when it comes to risk and reward. This is underlined by the results of the HQC Scorecard in which Alphabet receives 91/100 points while Apple scores 81/100. Although both companies are rated as very attractive in terms of risk and reward, Alphabet shows even better results than Apple in the categories of Financial Strength, Valuation, Growth and Expected Return.

The Seeking Alpha Quant Ranking strengthens my opinion that Alphabet is currently the better choice: While Alphabet is ranked 3rd out of 63 in its industry, Apple is only rated 7th out of 31 in its own. Within the Communication Services Sector, Alphabet is ranked 8th out of 251, while Apple is ranked 134th out of 631 in the Information Technology Sector.

My DCF Model shows that both Alphabet and Apple are currently undervalued. However, it also shows a higher upside for Alphabet (46.30%) than for Apple (21.50%); once again reaffirming my belief that Alphabet is currently more attractive than its rival.

I rate both companies as a buy. But if I had to pick just one at this moment in time, I would choose Alphabet. Particularly due to its lower valuation and higher growth prospects.

Be the first to comment