Grand Warszawski/iStock Editorial via Getty Images

As the gaming market is expanding and seeing increased investor interest, mobile gaming stands out as particularly attractive. One name that I particularly like is Playtika (NASDAQ:PLTK), a mobile gaming company with focus on casino-centric content. At a price-to-cash flow ratio < x10, I argue the company is undervalued. I support my argument with a residual earnings valuation and calculate a fair implied share price of $19.79. Buy.

About Playtika

Playtika Holding Corp. is a leading game developer and publisher with focus on mobile gaming. The company records approximately 35 million monthly active users across a portfolio of casual and casino-focused games. Some of the company’s notable products include World Series of Poker, Slotomania and Bingo Blitz. Playtika’s casino games account for approximately 50% of the firm’s total revenues. As of June 2020, when Playtika filed for IPO, the company operated 9 out of the 100 highest grossing gaming apps in the United States based on total in-app purchases on iOS App Store and Google Play Store, according to the company. Playtika was founded in 2010 in Israel and first sold shares to the public in 2020 for slightly above $30/share.

Attractive Growth Potential

Mobile gaming accounts for approximately 50% of the total gaming industry and is the fastest growing component, growing at a CAGR > 10% according to Newzoo. In addition, Newzoo estimates the paying TAM for mobile gaming at more than 2.5 billion users and a market size of $114.4 in 2024, up from $98 billion in 2020. That said, I see Playtika as well positioned to deliver outsized investor returns merely by keeping up with the broad industry growth.

In addition, Playtika could benefit from an international expansion. As of early 2022, the company generates more than 70% in the US and approximately 15% in EMEA. That said, Playtika has not yet really focused on the Asia Pacific Region excluding China, which accounts for more than 30% of addressable players.

Another growth vertical for Playtika, although less attractive than organic growth, could be M&A. Since 2010, Playtika has acquired over 7 independent game publishers, including names such as Solitaire Grand Harvest, Bingo Blitz and June’s Journey. Most notably, shortly after the acquisitions, Playtika managed to increase the title’s game revenues by more than 100% quarter-over-quarter. The company claims the success in revenues increase were due to the company’s strength in live operations and proprietary technology—called Playtika Boost.

Financials Indicate Strength

Even without any significant growth going forward, Playtika stock appears attractive merely by getting exposure to the company’s current fundamentals. Also, investors should note that Playtika’s fundamentals are also quite resilient in challenging macro-environments. This is mostly given by the company’s focus on casino games, which are arguably relatively recession-proof.

In the past three years, revenue increased at a CAGR of approximately 5%, reaching $2.58 billion in 2021. Cash from operation was higher than net income, $552 million, indicating high-quality earnings. The company generates a cyclically adjusted net-income margin of around 12%. That said, net-income in 2021 was $308 million, or $0.75/share. Looking at Playtika’s financial statement, I like that the company’s R&D expenses are relatively high (significantly above 10% of total sales) and marketing costs are conservative (kept below 20% of total sales). In 2021, Playtika expensed $386 million in R&D and $581 million of marketing expenses, respectively.

As of Q1 2022, Playtika holds cash and cash equivalents equal to $885 million and total debt of $2.54 billion. While the financial position is not stellar, as for example for Meta Platforms (META), I would say that Playtika is still in a very healthy position with optionality to pursue M&A opportunities.

To condense the financial information for decision-making, investors might look at analyst consensus estimates: Consensus estimates indicate revenues for 2022, 2023 and 2025 of $2.74 billion, $2.92 billion and $3.1 billion, representing a 3-year CAGR approximately in line with nominal GDP growth. Respectively, EPS are estimated at $0.78, $0.92, $1.07. (Source: Bloomberg Terminal, June 2022). Personally, I find these assumptions are very reasonable.

Residual Earnings Valuation

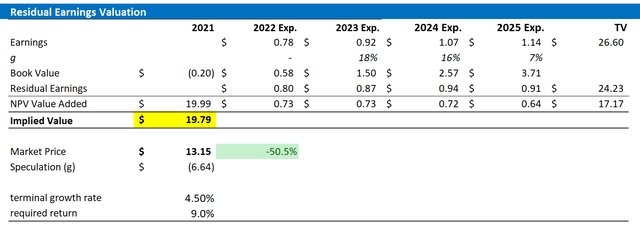

To value Playtika, I propose to use a residual earnings valuation and anchor on the following assumptions:

- I base my EPS estimates on the analyst consensus until 2024. According to the Bloomberg Terminal, as of June 2022, consensus indicates earnings per share for 2022, 2023 and 2024 of $0.78, $0.92, $1.07.

- I apply the CAPM model to derive the cost of equity and as a second step calculate the WACC according to the business leverage. My calculation returns a fair WACC of approximately 9%.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5% plus one percentage point to reflect the gaming industry’s potential (thus, 4.5% in sum).

Based on the above assumptions, my calculation returns a base-case target price for Playtika of $19.79/share, implying that Playtika appears approximately 50% undervalued.

Analyst Consensus; Author’s calculation

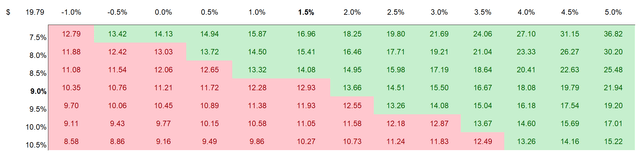

Investors might have different assumptions with regard to Playtika’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s calculation

Risks

I would like to highlight three major downside risks to my $19.79 target price:

First, Playtika has a history of being highly active in M&A. Although the company’s acquisitions have been value accretive in the past, there is no guarantee that the track-record will be sustained. In fact, M&A activities are value dilutive in general and thus investors are advised to not base their (primary) thesis on M&A.

Second, although Playtika enjoys quite a differentiated competitive positioning with casino-games, 50% of the company’s business is supported by ‘other’ casual games. Thus, Playtika’s competitive positioning and future success are deeply intertwined with the company’s ability to successfully innovate and market new games. Moreover, Playtika’s ability to innovate and launch industry-leading entertainment solutions must further be analyzed in a relative context versus competitors such as EA (EA), Zynga (ZNGA) and Activision Blizzard (ATVI).

Third, even though Playtika appears undervalued, in my opinion, this does not guarantee that the company’s share price will rise. Especially amidst a slowing macroeconomy and falling asset prices, valuation multiples compress and valuations can stay compressed for a long time.

Conclusion

I like Playtika as the company stands out in the mobile gaming industry with a differentiated positioning in the casino vertical. Moreover, the company’s stock appears approximately 50% undervalued based on a residual earnings valuation as I calculate a $19.79/share target price. True, in the short term, there is downside pressure given falling asset-prices and slowing risk-appetite in the stock market. However, in the long-term, investors are advised to focus on fundamentals–which are quite attractive for Playtika.

Be the first to comment