morgan23/iStock via Getty Images

Investment thesis

Crocs (NASDAQ:CROX) is an internationally renowned company and has lost 70% from its all-time high. The company’s profitability has improved widely in recent years due to the efficiency of its management, and the prospects are equally positive. Using a discounted cash flow, the fair value is far higher than the current price, so I consider Crocs an undervalued company. After the 70% drop I consider an initial purchase reasonable, with the understanding that the bottom may not have been reached yet.

Growth and prospects

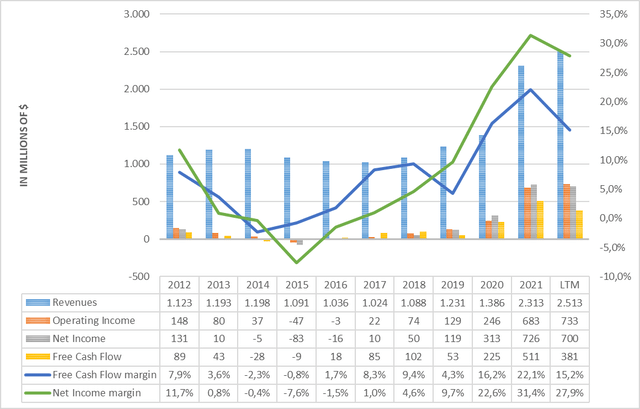

Over the past 10 years, Crocs’ profitability has often been questioned as there was virtually no improvement from 2012 to 2018. For 7 years, revenues remained static, with profit margins alternating between good and bad. From 2019 onward, however, something changed, and Crocs has not stopped growing since then.

Profitability from 2012 to date (TIKR Terminal)

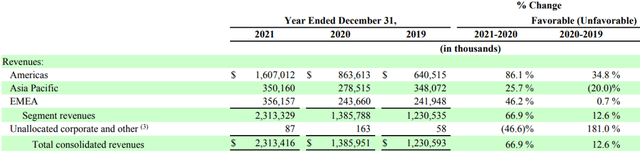

What was achieved from 2019 to 2021 is astonishing and I think also quite unpredictable: revenues increased by almost 100% and the net income margin shot up to 31.4 %. In just one-year (2020-2021) revenues increased by $927 million, when from 2012 to 2018 the growth rate was even negative. But how was this possible?

Rising volumes and prices

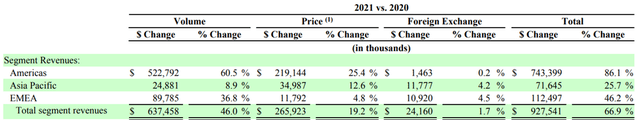

The $927 million increase in revenues between 2020 and 2021 was due to a 46% increase in deal volumes, 19.2% increase in sales prices, and 1.7% from favorable exchange rates.

Segment revenues (Crocs annual report )

A 19.2% increase in selling prices is a very high figure, and it shows how Crocs management intends to pass the burden of inflation on to customers. Moreover, this increase was not the same for every country but affected America the most where the increase was 25.4%. Since the company raised prices so much and business volumes did not fall (in fact they rose 46%), Crocs proved its soundness even in today’s complicated macroeconomic environment. After all, Crocs are still cheap despite such a marked price increase. But what has led to such a considerable increase in volume from one year to the next? The reasons are mainly two:

- 2020 was an unfavorable year for Crocs’ physical stores due to the pandemic; therefore, 2021 was the year of payback since the stores were reopened.

- In the past 3 years, Crocs has focused much more on collaborations, particularly in 2021. Kendall Jenner, Hailey Bieber, Justin Bieber, and Post Malone are just some of the stars who have collaborated with Crocs, but the list does not end there. Crocs has even started collaborations with high-fashion brands such as Balenciaga further increasing its visibility in 2021. On stockx.com it is now possible to find Crocs sold even for thousands of dollars as these are limited editions sold by resellers.

The only problem related to the strong growth between 2020 and 2021 is that it has accentuated Crocs’ dependence on America. Since 2019, geographic diversification has not improved, actually it has worsened. America occupies almost all the improvement achieved, Asia Pacific has had virtually no improvement, and Europe just over $100 million in 2 years. Greater geographic diversification could make Crocs’ revenues more stable in the event of economic slowdowns in America.

Geographic diversification (Crocs annual report )

Guidance FY 2022

We have seen how management has done a great job in increasing the brand’s popularity in recent years, but what is the 2022 guidance? Revenues are expected to be around $3.5 billion by the end of 2022, $1.18 billion more than in 2021. If expectations are met this would be an extremely positive result also considering the difficulty for most companies to increase revenues during this period. Adjusted Diluted EPS are estimated between $10.05 and $10.65, which is quite high for a company trading at just over $50 per share. In my opinion given Crocs’ growth expectations a higher P/E than the current 5.22x would be more appropriate.

Heydude acquisition

In late 2021 Crocs announced the acquisition of Heydude for $2.5 billion. This investment was made to diversify revenues, which were too dependent on a single brand. Crocs management was very enthusiastic about this acquisition, and CFO Anne Mehlman had important words to say about it:

Heydude has experienced incredible growth in revenue and profits over the past few years. Heydude is expected to be immediately accretive to our high revenue growth, industry-leading operating margins and earnings. We expect the combined business to generate significant free cash flow, enabling us to quickly deleverage while investing to support future growth. We are excited about the combination and are confident in our ability to deliver long-term shareholder value.

According to these words, this acquisition is considered a long-term investment, but it will bring profitability improvement right away. On the day the acquisition was made public, Crocs’ shares plummeted 12%, expressing all the market’s disappointment. Personally, I do not see this decision to diversify the business as a mistake at all, rather as a sign of the company’s maturity. The last few years have been very profitable for Crocs, and the company is taking advantage of this to make itself less dependent on sales of its main brand.

Strong buybacks but no dividend

Crocs’ management has never opted for a dividend distribution because it does not yet believe that economic and financial conditions allow it. Indeed, the profitability of this company was uncertain until 2018, and only in recent years has there been a marked improvement. Moreover, the company expects that its stance will not change soon.

While the company has been reluctant to issue dividends, the same cannot be said for the buyback. From 2013 to 2021, shares outstanding went from 89 million to 58 million, thus greatly increasing the percentage share of shareholder ownership. Crocs’ management has always been in favor of buying back its own shares to remunerate its shareholders; however, now this practice has been suspended. Heydude’s $2.5 billion purchase increased the company’s debt, and until the company reaches the target of gross leverage < 2.0x there will be no further buybacks. This conservative behavior toward both dividends and buybacks highlights the responsible behavior of management, which is focused on improving its financial structure before rewarding its shareholders. Although it may seem obvious, not all companies think this way.

Further thoughts on Crocs’ success

Crocs’ success has always been very controversial as there are many people who hate this brand. However, while we have millions of haters on the one hand, we also have millions of trusted customers on the other. Their practicality, comfort and durability have conquered millions of people despite their funny appearance, and that is what matters most. Since its inception, Crocs has sold more than 720 million pairs of shoes, and in recent years it has been steadily increasing deal volumes. To date, the Crocs brand is known all over the world, and even those who do not like them cannot deny that the numbers of this company are quite positive.

How much is Crocs worth?

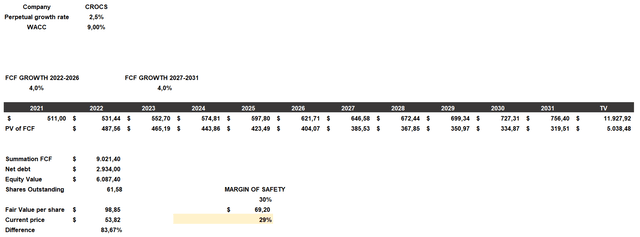

Crocs’ fair value will be calculated using a discounted cash flow that will be constructed as follows:

- The cost of equity will be 14.75% and will include a beta of 1.85, a country market risk premium of 4.2%, a risk-free rate of 3.5% and additional risks of 3.5%.

- The cost of debt will be equal to 5.03% and will include selected long-term debt of 7.5% at a tax rate of 33%.

- WACC will be 9% with a financial structure composed of 60% debt and 40% equity.

- The growth rate used for the next 10 years will be 4%. The company’s guidance is more positive on this, but I preferred to include a conservative value. This growth rate will be applied starting with free cash flow in 2021.

- Shares outstanding and net debt belong to TIKR Terminal.

Discounted cash flow (TIKR Terminal)

According to my assumptions, Crocs’ fair value is $98.85, so the company is significantly undervalued. Even using a 30% margin of safety, the fair value would be above the current price ($53.82) by 29%. It is also interesting to note that even if I applied a 0% growth rate for the next 10 years the company would still be undervalued as it would have a fair value of $60.88. Finally, I would like to point out that although Crocs is a buy for me this does not mean that the stock will necessarily perform well in the short to medium term. From a technical point of view Crocs is a “falling knife” and could even fall below $50 per share. My considerations are made considering a long-term horizon.

Be the first to comment