SimonSkafar/E+ via Getty Images

Littelfuse (NASDAQ:LFUS) shows $478 million in cash ready to acquire new targets. The company’s investments in eMobility and product development will likely bring double digit sales growth in the coming years. Under conservative assumptions of EBITDA margin, lower than expected sales growth of 11%, LFUS does look significantly undervalued. Yes, there are some risks coming from supply chain issues and failure of M&A operations. However, I see more upside potential in LFUS’ stock price than downside risks.

Littelfuse

Founded in 1927, Littelfuse is an industrial technology manufacturing company with business interests in the electronics, transportation, and industrial sectors.

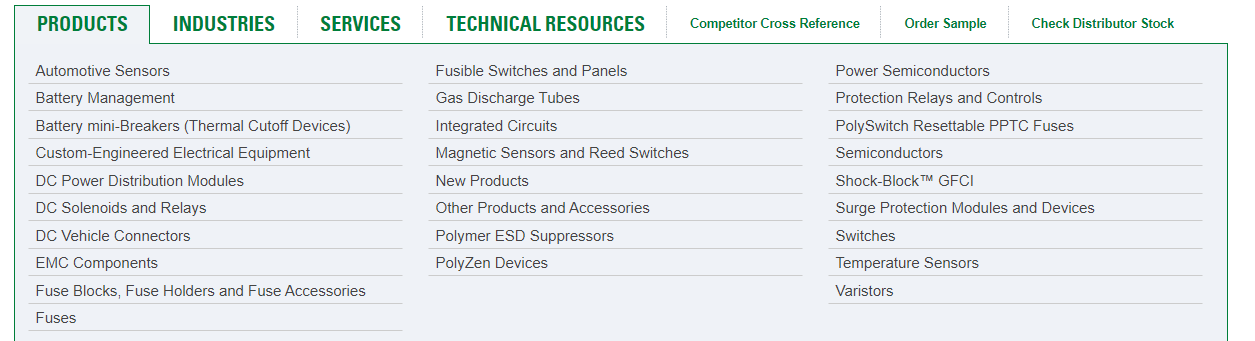

The list of products manufactured is overwhelming. The company offers DC vehicle connectors, fuses, integrated circuits, and power semiconductors among other services and technical resources:

littelfuse.com

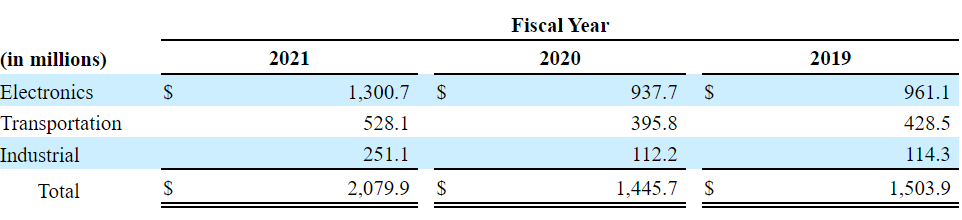

The company’s electronics business segment is responsible for the largest amount of revenue, 62% of the total amount of sales in 2021. Transportation is responsible for 25% of the revenue.

The industrial business segment is the smallest sector, but it is gaining relevance. In 2019, the industrial sector was responsible for 7% of sales, and in 2021, the percentage of net revenue was equal to 12%. In my opinion, management is trying to diversify its activities, which will most likely lead to Littelfuse’s FCF margins being a bit less volatile:

10-k

Littelfuse also shows significant geographic diversification. The company is present in Asia-Pacific, America, and Europe. In my view, the company is well-prepared for any kind of international recession. Keep in mind that recession will likely hit some regions more than others.

10-k

With Acquisitions At Close To 1.58x-2x Sales, LFUS Will Likely Be Able To Acquire More Targets

The number of acquisitions executed by management are overwhelming. The prices being paid for the targets are also quite interesting. Carling Technologies, Inc. was acquired at 2x sales, and Hartland Controls was bought for 1.58x sales:

On November 30, 2021, the Company completed the previously announced acquisition of Carling Technologies, Inc. (“Carling”). At the time of acquisition, Carling had annualized sales of approximately $170 million. The purchase price for Carling Technologies was approximately $315 million. Source: 10-k

On January 28, 2021, the Company acquired Hartland Controls, a manufacturer and leading supplier of electrical components used primarily in heating, ventilation, air conditioning and other industrial and control systems applications. At the time of acquisition, Hartland had annualized sales of approximately $70 million. The purchase price for Hartland was $111.0 million and the operations of Hartland are included in the Industrial segment. Source: 10-k

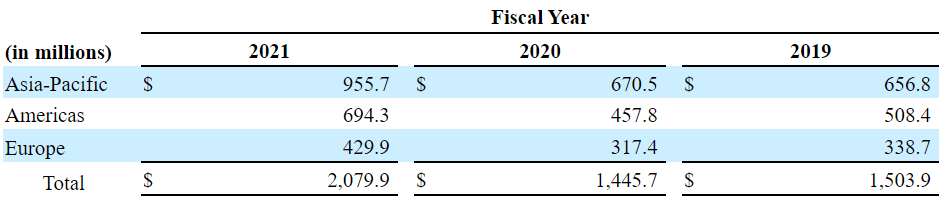

The company is buying businesses at close to 1.58x sales and 2x sales, and it currently trades at 3x-4x sales. In my opinion, if management keeps finding these acquisitions, we could expect significant EBITDA growth and valuation growth:

Ycharts

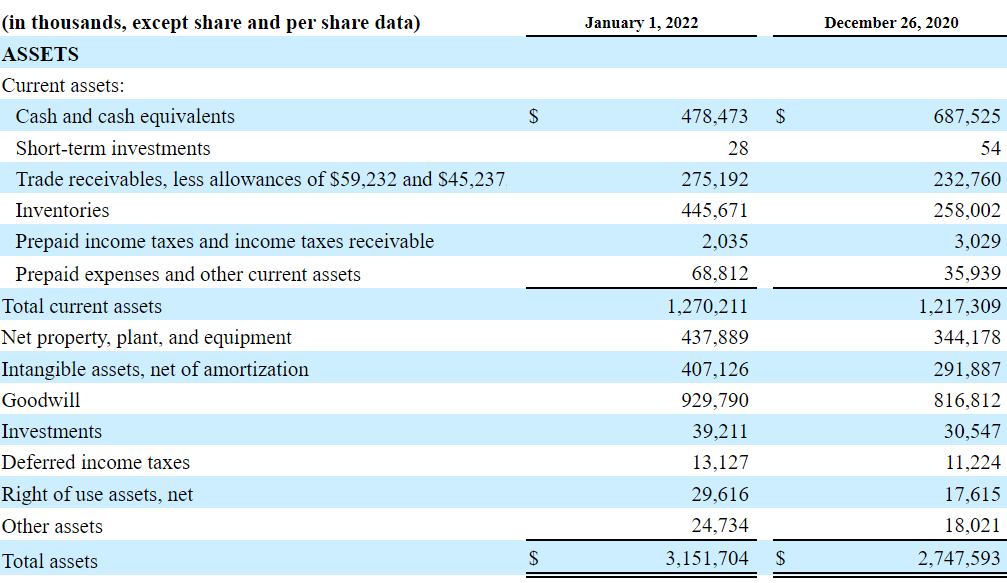

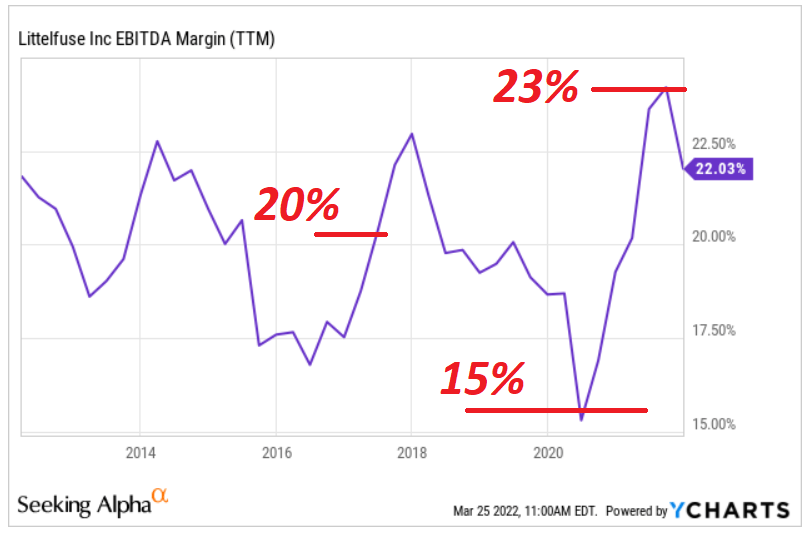

The company reports $478 million in cash, goodwill worth $929 million, and an asset/liability ratio of 1.66x. With this amount of liquidity, I do believe that bankers will finance future acquisitions:

10-k

As of today, the total amount of debt does not seem very significant. The company reports long-term debt worth $611 million, so with $478 million in cash, the net debt appears rather small for a company that expects to generate a 2022 EBITDA of more than $400 million. With all this in mind, I do believe that management will be able to receive more debt financing if the acquisition proposals are beneficial.

10-k

With eMobility, New Acquisition Targets, And 11% Sales Growth, I Obtained A Target Price Of More Than $571

In my view, management will likely enjoy significant organic growth thanks to product development and new investments in eMobility. With this in mind, let’s note that management reported more than 30% sales growth across all segments in the most recent quarterly report:

We finished the year with remarkable revenue and earnings growth, with more than 30% sales growth across all of our segments. I am confident our ongoing execution, coupled with our investments in product development, digital presence and eMobility, position us to achieve our long-term growth strategy.

Source: Quarterly Transcript

For those investors who may not understand how such an old company can be reporting double digit sales growth, note that the eMobility market is expected to grow at a compound annual growth rate of 21.6%:

The global electric mobility market is expected to grow at a compound annual growth rate of 21.6% from 2019 to 2025 to reach USD 489.3 billion by 2025.

Source: Electric Mobility (E-mobility) Market Growth Report, 2019-2025

Management expects to show organic sales growth of 5%-7%, and inorganic sales growth of 5%-7%. It means that the company could report as much as 14% sales growth in the coming years:

The Company is targeting average annual organic sales growth of 5-7 percent and average annual sales growth from strategic acquisitions of 5-7 percent. The Company expects to achieve this through content and share gains, expanded presence in high-growth markets and geographies, and targeting high-growth and niche applications.

Source: 10-k

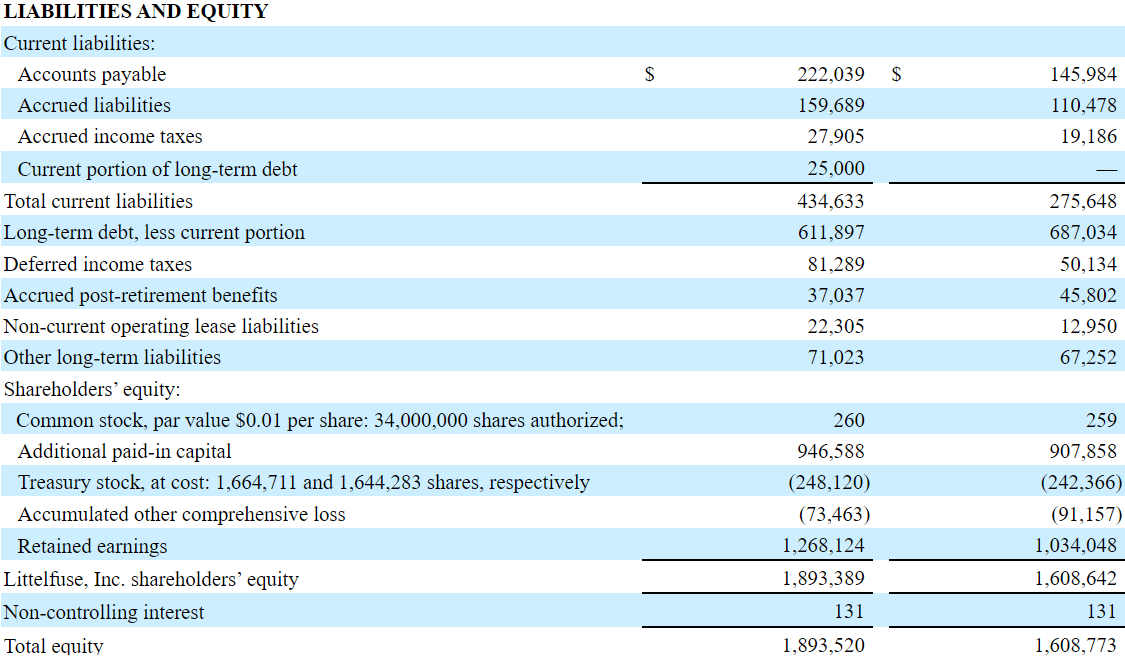

In the past, the company reported 43% sales growth, but also less than 20% sales growth. With this information and the promises of management about inorganic and organic growth, I believe that assuming sales growth of 11% makes sense:

Ycharts

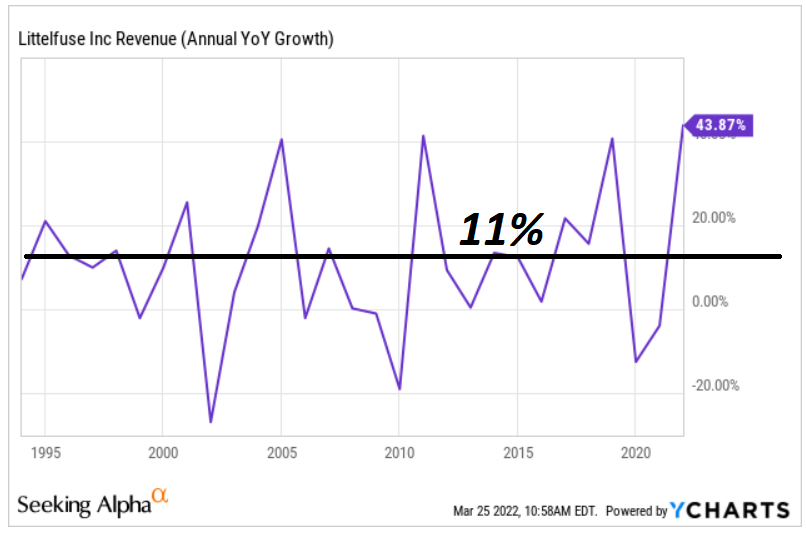

With regards to the EBITDA margin, management currently reported a 23% EBITDA margin. In 2020, it reported 15% EBITDA margin. In my view, assuming EBITDA margin of 11% appears conservative:

Ycharts

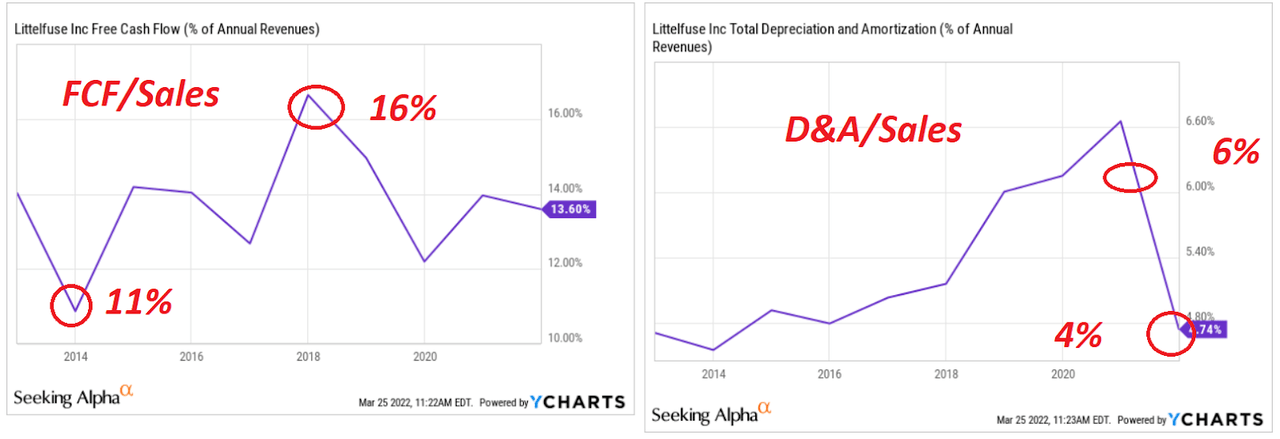

I also studied the company’s FCF/Sales and D&A/Sales ratio, which stand at 16%-11% and 4%-6% respectively. My numbers are not very far from figures that management reported in the past:

Ycharts

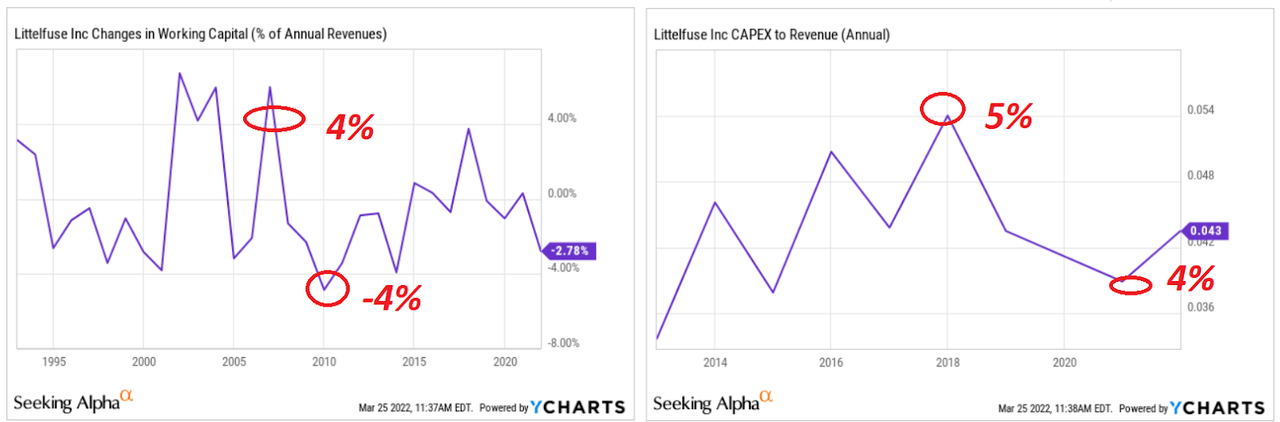

With regards to the changes in working capital/Sales ratio and capex/Sales revenue, the maximum figures that I found are close to 4%. I have not gone beyond that figure in my DCF model:

Ycharts

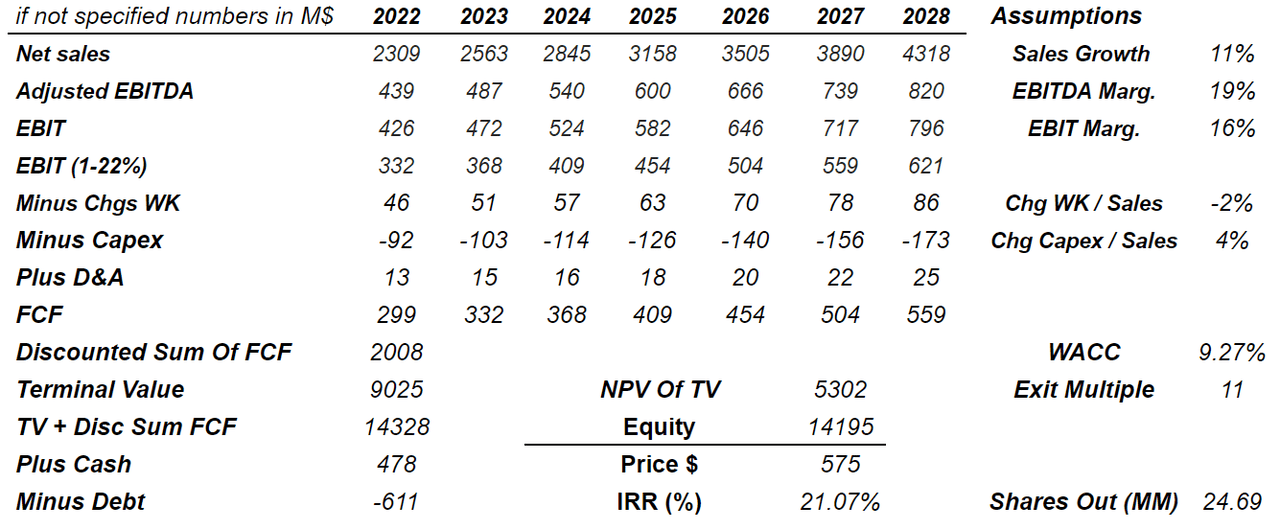

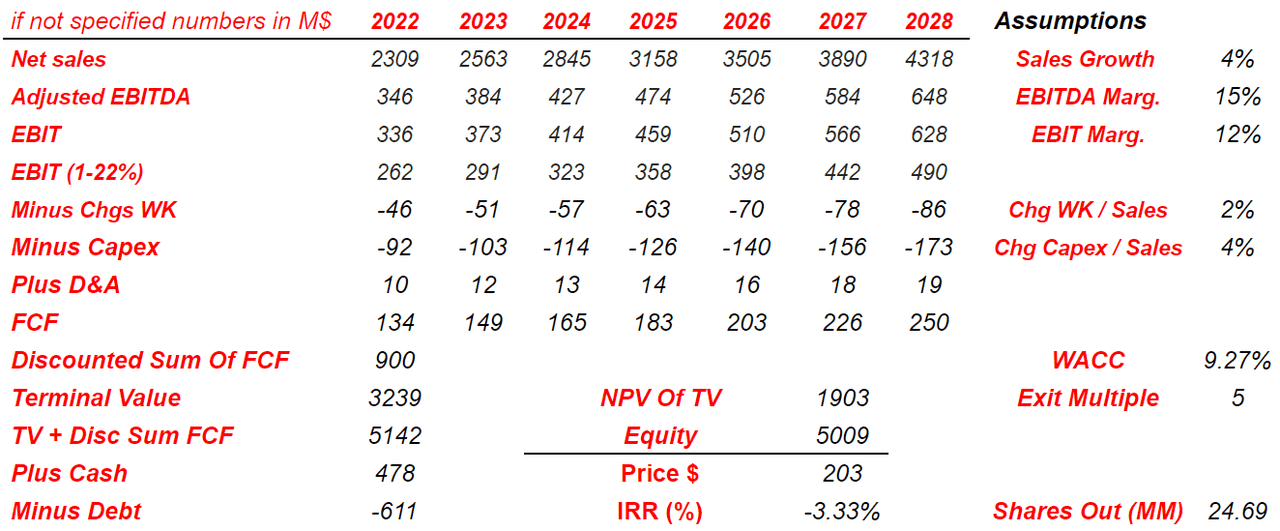

With the previous assumptions, changes in working capital/Sales of -2%, and capex/sales of 4%, I obtained 2022 FCF of $299 million and 2028 FCF of $559 million. If we also assume an exit multiple of 11x, the implied stock price would be $575 per share:

YC

Failed Acquisitions, Supply Chain Issues, And Human Resources Risks Could Imply A Valuation Of $203

A significant part of the company’s business growth is based on acquisitions. If management fails to assess the valuation of targets, future revenue may be lower than expected. As a result, management may suffer from a decrease in demand for the stock, and the share price could fall:

An acquired business, technology, service or product could under-perform relative to the Company’s expectations and the price paid for it, or not perform in accordance with the Company’s anticipated timetable. This could cause the Company’s financial results to differ from expectations in any given fiscal period, or over the long term. The success of these transactions also depends on the Company’s ability to integrate the assets, operations, and personnel associated with these acquisitions.

Source: 10-k

Littelfuse may also suffer from complications while trying to merge teams as well as to integrate new acquisitions. The operating synergies may be lower than expected, which could lead to less free cash flow than expected. The fair valuation could be lower than expected:

The Company may encounter difficulties in integrating acquisitions with the Company’s operations and may not realize the degree or timing of the benefits that are anticipated from an acquisition.

Source: 10-k

Littelfuse also warned about potential supply chain disruptions, which would affect the company’s ability to manufacture. Management may also suffer loss of reputation if clients don’t receive what they expect on the due time. Besides, if Littelfuse has to renegotiate terms with distributors, the FCF margins could also decline. Under this case scenario, I assumed that in the next six years, Littelfuse will suffer some type of dysfunctionality:

A disruption could occur within the Company’s manufacturing, distribution or supply chain network. This could adversely affect the Company’s ability to manufacture or deliver its products in a timely manner, impair its ability to meet customer demand for products and result in lost sales or damage to its reputation. Such a disruption could have a material adverse effect on the Company’s business, financial condition and results of operations. Source: 10-k

In the future, Littelfuse could also encounter difficulties in hiring qualified personnel, which would lower organic growth. Besides, as a result of inflation, existing employees may require higher salaries:

Failure to ensure that the Company has the depth and breadth of personnel with the necessary skill set and experience could impede its ability to deliver growth objectives and execute the Company’s strategy. Source: 10-k

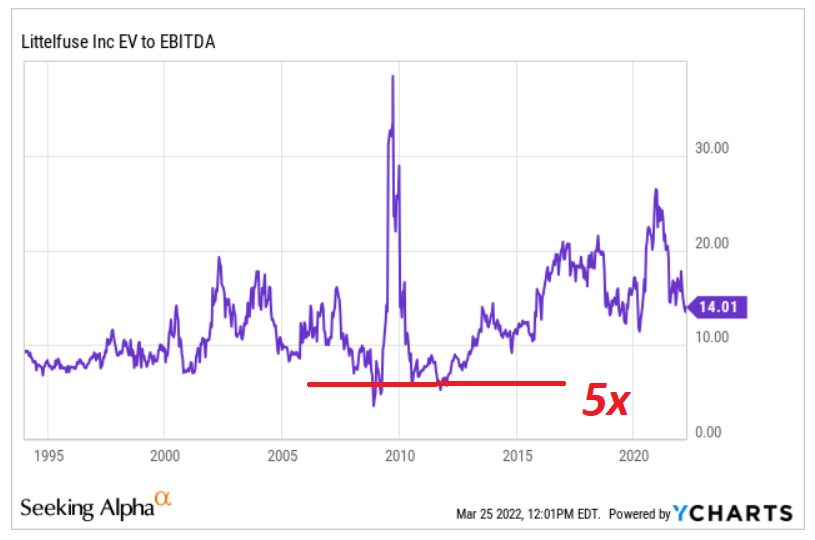

Under my worst-case scenario, I assumed an exit multiple of 5x, which is the minimum EV/EBITDA multiple seen in the past:

Ycharts

I also took into account 4% sales growth because the company will only grow organically. Also, with changes in working capital/Sales of 2%, the FCF should grow from close to $135 million to around $250 million in 2028. If we also use an exit multiple of 5x, the sum of the terminal value and future FCF should imply an equity value of $5 billion. Finally, the implied stock price should stand at $203:

YC

Conclusion

With cash in hand and a healthy balance sheet, I believe that Littelfuse will be able to acquire more competitors in the coming years. Management promised inorganic growth and organic growth from investments in eMobility, which should sum up to 14% sales growth y/y. I am a bit more pessimistic, and used sales growth of 11% and conservative EBITDA margins, which implied a valuation of more than $571 per share. I also identified supply chain risks and M&A risks, which may lower business growth. However, I believe that the current stock price of Littelfuse offers more upside potential than downside risks.

Be the first to comment