bodnarchuk

Introduction

It’s time to talk about gold and one company mining it. In October, I wrote an article titled “The Bull Case That Could Send GDX Flying”. I have increasingly become interested in owning gold miners as a play for a situation where the Fed will, eventually, be forced to pivot. The problem facing the Fed is a rapid implosion of growth expectations. Even if inflation won’t moderate anytime soon, it could trigger the Fed into pivoting, providing fertile ground for a weaker dollar and a return of the gold bull market. Because the risks of such a scenario happening are rising, I’m buying Kinross Gold (NYSE:KGC) again. A miner that recently sold its Russian assets. The company now has assets in stable regions, relatively high margins, and a very shareholder-friendly approach, thanks to investor activism.

Hence, I believe KGC is significantly undervalued, offering an attractive long-term investment case.

Now, let’s dive into the details!

It’s All About A Pivot

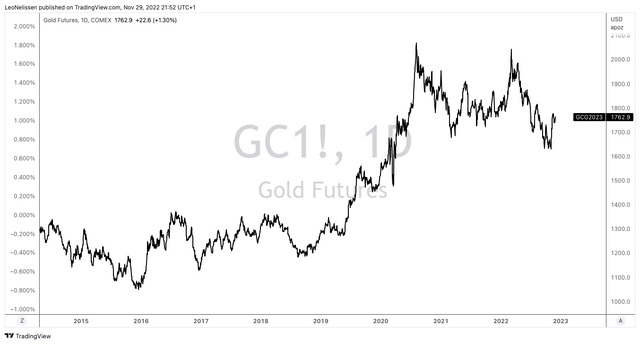

Gold is back! COMEX Gold futures are currently trading at $1,763 per ounce, that’s well below the 2022 highs above $2,000, but also off the November lows, when gold was trading close to $1,640.

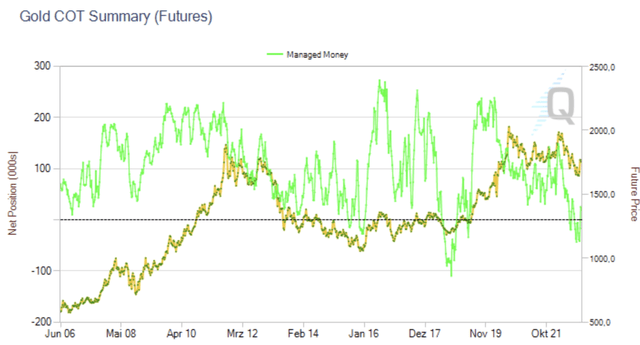

We’re dealing with a market starting to reposition itself for a less hawkish Federal Reserve. Even though this transition is very slow, investors are starting to go back into gold. In the past few weeks, money managers started to buy gold again after being net short this Fall. That was the third time since the Great Financial Crisis that smart money was net short gold.

If history is any indication, a return of big buyers could cause a steep rally in gold prices.

Now, that sounds easier than it is. A new bull case needs a few good reasons. Simply calling for a good risk/reward because managed money is slowly turning bullish isn’t enough.

For starters, the bull versus bear case looks something like this. Gold is likely to feel pressure if it becomes more likely that the Fed will become more hawkish than expected. At that point, we should expect the Fed to drain more liquidity from the system, which tends to be bearish for gold.

On the other hand, if the future rate path is expected to be more dovish than expected, we’re dealing with a gold bull case.

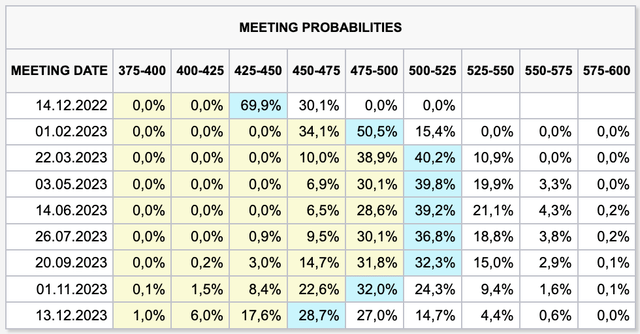

The market has currently priced in a terminal rate range of 500 to 550 basis points. This implies another 100 basis points worth of hikes until the end of the first quarter of 2023.

My view is that the Federal Reserve may become more hawkish than expected as I do not believe that inflation is going to ease as fast as expected. If I had to bet on it, I would expect a terminal rate of at least 25 basis points higher than the consensus.

However, while that would be bearish for gold, my view is also that the Fed will turn dovish faster than expected. After all, the pressure on the economy is rising rapidly.

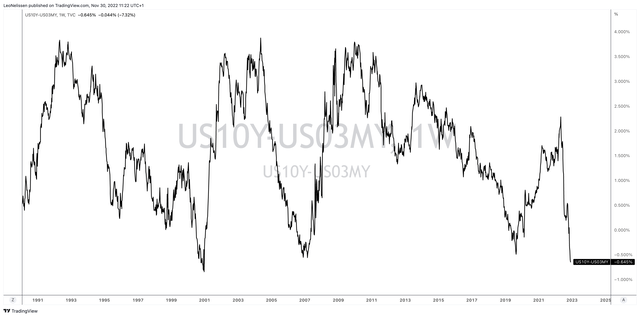

The Fed’s favorite recession indicator, the spread between the 10Y and the 3M government bond yields is now at negative 64 basis points. That’s the most inverted it has been since 2001.

TradingView (10Y/3M Yield Curve)

This bond market assessment seems about right as economic indicators like the ISM index are plummeting, indicating a high likelihood of contraction going into 2023.

Wells Fargo

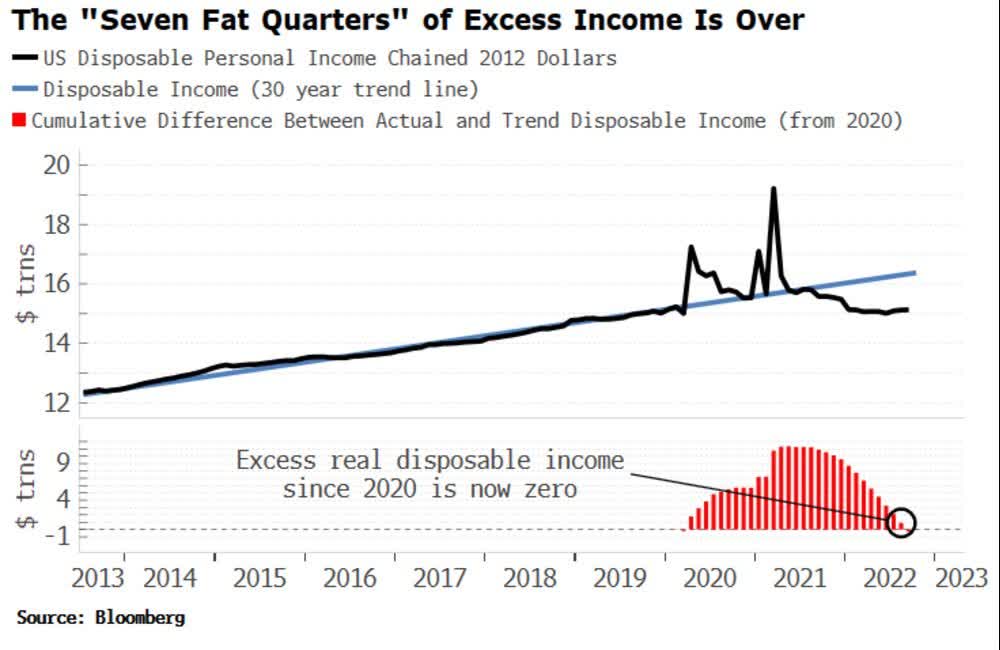

This comes at a time of severe consumer weakness. Excess real disposable income since 2020 is now zero as consumers are now using credit and even 401K investments to fill spending gaps due to high inflation. Note that this is happening while unemployment is still low!

Bloomberg

While I don’t believe in a sudden gold price explosion as risks of aggressive hikes remain high, I have turned bullish on gold as the risk/reward has become favorable. Adding to that, if gold were a no-brainer, it would be trading much higher already. That’s not the case – thankfully.

Why Kinross Gold?

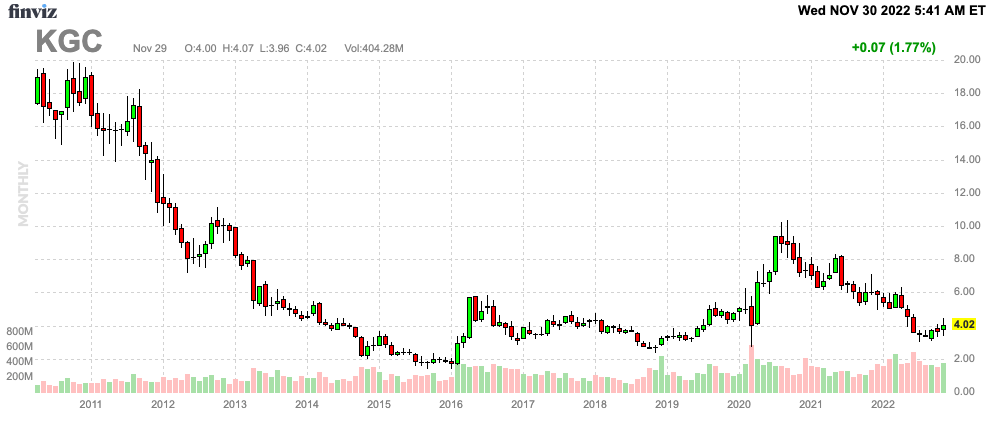

For full transparency, I have to admit that I turned bullish on KGC earlier this year. I was too early.

I lost some money on that investment. I then bought some back in the $3.50 range, which I sold. Now, I’m looking to get back in with more money and a longer-term mindset – for the reasons mentioned in the first half of this article.

FINVIZ

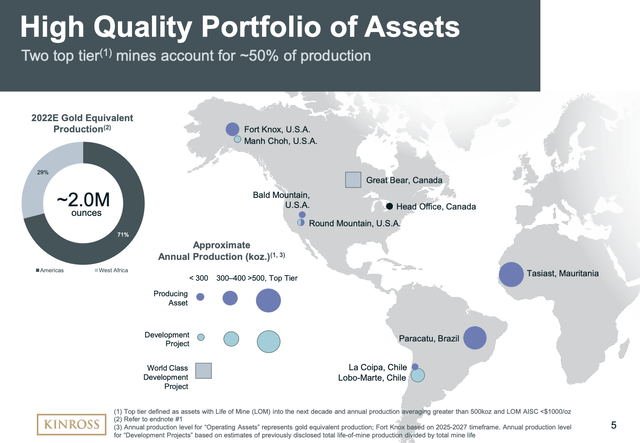

After selling its Russian assets this year, the company is now a player with an annual production profile of roughly 2 million ounces. More than 70% of this is produced in the Americas. The remaining exposure is in West Africa. Overall, the geopolitical risks are below the industry average.

With a market cap of $5.2 billion, the company is the 10th-largest stock-listed gold miner.

The company believes that its assets are not valued correctly (fairly). The company is trading at 0.7x its net asset value. The company is trading at 0.85x book value. There are just three companies in the top 20 (market cap) with a price/book ratio of less than 1.0.

Kinross’ Tasiast and Paracatu assets alone would justify its current valuation.

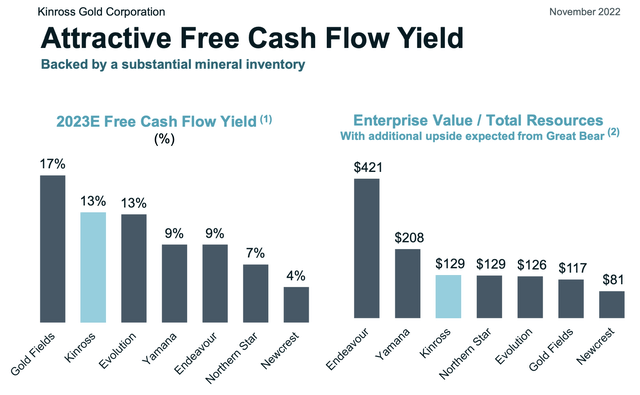

That said, Kinross Gold is a cash cow. The company has an implied 2023 free cash flow yield of 13%. Free cash flow is net income adjusted for non-cash operating items and capital expenditures. FCF is cash a company can distribute to shareholders without having to fear that its business may suffer – assuming CapEx is sufficient and the balance sheet doesn’t need to be repaired.

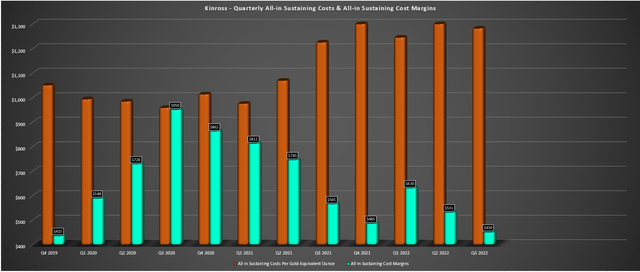

One of the reasons for high margins is a low AISC (all-in-sustaining costs). In 3Q22, the company’s AISC was $1,282. That’s 72% of the current gold price.

Kinross – AISC & AISC Margins (Taylor Dart)

Moreover, while the AISC has been in a steady uptrend due to cost pressure, the AISC is likely to peak due to fading inflation headwinds. According to mining expert Taylor Dart who wrote a very good and detailed article earlier this month (he also made the chart above):

[…] commentary in the Q3 Earnings Season suggests that inflationary pressures may have peaked, and there has been some moderation in some areas already. This doesn’t mean that costs will drop off a cliff, but it suggests that we may have seen peak costs for most producers in Q2/Q3 2022 and that we could see easier year-over-year comps in 2023.

With that said, high free cash flow is good. However, it’s even better that most of it will end up benefiting investors.

After all, it has a healthy balance sheet, meaning no need to prioritize debt reduction over cash distributions. KGC has a BBB/BBB-/Baa3 credit rating. It has no major debt maturities until 2024, and just $1.25 billion in senior notes.

Next year, the company’s net debt is expected to fall to $1.7 billion. That’s just 1.2x EBITDA.

Hence, this year, total buybacks are likely to total $300 million. In the next two years, buybacks are expected to be higher than 75% of FCF. This will only change if the net leverage ratio rises above 1.7x.

This announcement came after activist investors criticized the company’s approach to generating shareholder value.

As reported by the Financial Post:

Elliott portfolio manager Mark Cicirelli says Kinross has been trading at a significant discount compared with its peers and the value of its assets, and that the plan is a “major step toward closing that gap and realizing the upside potential in its stock.”

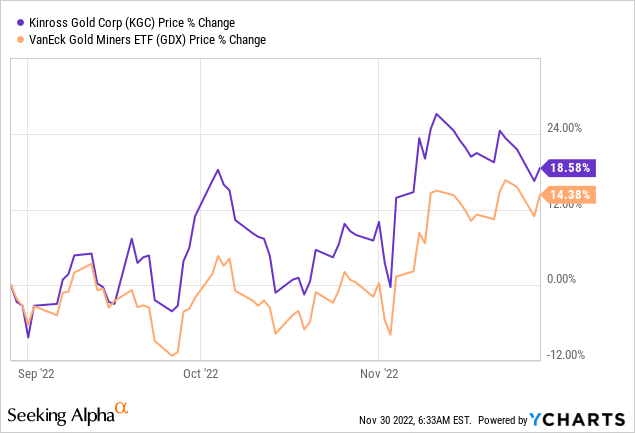

Over the past 12 months, KGC has lost 34% of its market cap. The VanEck Gold Miners ETF (GDX) has lost 12%. However, during the most recent upswing, KGC has started to outperform again. I expect this to last.

This brings me to the takeaway.

Takeaway

In this article, we discussed the gold bull case. I believe that the risk/reward is good for a prolonged, yet volatile, uptrend in gold prices. The Fed is getting closer to the end of the hiking cycle as economic risks are building. At some point, the Fed will have to prioritize financial stability over fighting inflation. That’s the biggest bull case for this shiny metal.

While there are many ways to benefit from a potential longer-term rise in gold prices, I like buying gold miners. The Canadian miner Kinross is improving its business. Its (expected) margins are rising, the balance sheet is healthy, and shareholder distributions are once again in the spotlight.

Moreover, the valuation is well-below any reasonable level.

I believe that KGC will outperform its peers and exceed $10 per share in the next 24 months.

However, please be aware that gold miners are extremely volatile. Take that into account when making investment decisions.

(Dis)agree? Let me know in the comments!

Be the first to comment