Mark Nolan/Getty Images News

I recently covered significant LNG shipper Flex LNG (FLNG) and this led me to rethink investment (not) in hydrogen technology. Thinking more about hydrogen led me to have another look at Fortescue Metals Group (OTCQX:FSUGY), which is a major Australian iron ore producer that’s making a huge bet on the emergence of a hydrogen economy through its wholly-owned subsidiary FFI (Fortescue Future Industries). Like Flex LNG, Fortescue is strongly focused on dividend investors with a dividend approaching 11%. Here I dig a little and show that while Fortescue pays a big dividend, the business has ambitious plans to become a major player in the renewable economy through development of green hydrogen. My conclusion is that Fortescue is a high wire act that may or may not pay off in the future. For now it’s a highly innovative iron ore miner with major innovation in addressing its cost structure through decarbonizing (electrifying) its business.

October 2022 Investor and Analyst briefing

It’s always helpful to hear how a big company views its own near-term investment strategy, and in October Fortescue provided an interesting insight. One takeaway from the call was the strong emphasis Fortescue has on dividend stability and doing what they say they will do. This makes Fortescue a relatively calm business, which is not a descriptor that applies to all mining stocks.

Iron ore business

Mining is an extractive industry and of course as supply is exhausted new projects need to be developed. There was considerable discussion about new projects such as Iron Bridge, which is a new Magnetite mine coming on stream. Questions about Iron Bridge and several other projects seemed to indicate that Fortescue has its pipeline in good shape, with short-, medium- and long-term growth options that few companies the size of Fortescue have in place.

There was discussion about costs and a key point made by management was that the biggest cost driver for the iron ore business is fossil fuel, especially diesel. The company has been investing in decarbonizing and saved tens of millions of dollars last year. This will eventually mean $(US)3 billion savings during the period when the company exits fossil fuel use. The point about electrification of operations is that it’s simple, plug and play. There are virtually no commissioning issues and it will make costs very competitive for the business when diesel isn’t used any more. Fortescue believes that, once implemented, savings will be $US820 million annually and this will mean 20-25% cost savings (if not more!).

Lithium batteries, is there a problem about lithium supply? Fortescue doesn’t think so

Reporting on issues that are “hot” is always interesting, especially when the discussion involves a pragmatic view. There’s a lot of noise in the battery space about lithium shortages and hence the question has been raised about enough lithium to manufacture batteries at the scale likely needed for massive demand. Fortescue’s FFI has major electrification plans and a questioner asked about whether a shortage of lithium will be a problem. Andrew Forrest’s response was “Look lithium, I’m just not seeing a shortage. There are so many lithium projects that we get offered…just not keeping me awake at night.” Andrew Forrest reminded the questioner that Fortescue is a major exploration and mining company and that they will deliver the battery materials that FFI needs. Forrest thinks that FFI gives Fortescue a really clear insight into emerging battery demand. In addition to this comment it’s worth noting that a lot of the fear in lithium battery manufacture is about cobalt, nickel and manganese, which are significant elements in NMR batteries. I note that LFP batteries (Lithium Iron Phosphate) are making great inroads and these batteries don’t have cobalt, nickel or manganese.

FFI will buy lithium batteries initially, but down the track Fortescue will think about lithium mining but in the context of many other things including hydrogen and pumped hydro.

Hydrogen business

Fortescue has commenced construction of a major electrolyzer factory at Gladstone in Queensland. The site is up and running, the roof is on and first production is planned next year. One questioner asked about Enel (OTCPK:ENLAY) CEO’s view that only a fraction of electrolyzer capacity promised will be delivered. Fortescue senior management didn’t answer the question directly, but maintained confidence in their plans while noting that it’s early days for electrolyzer technology and a lot may change. Indeed senior management indicated that Fortescue’s plans for electrolyzer technology go well beyond the Queensland facility. The surprising thing was that there was no mention of Plug Power (PLUG) in the Queensland hydrogen Gigafactory discussion.

Fortescue and PLUG electrolyzer partnership

In 2021 Fortescue announced a letter of intent with Plug Power to form a 50/50 JV to build a hydrogen Gigafactory in Queensland Australia. The plan was to build 2 GW of large scale proton exchange membrane (PEM) electrolyzers to expand into fuel cell systems and other hydrogen-related refuelling and storage infrastructure. Fortescue through FFI was to provide advanced manufacturing capabilities, while Plug Power was to supply electrolyzer and fuel cell technology. FFI was to be the primary customer of the JV. This was to be part of Fortescue’s plans to become a clean energy superpower based in Australia and exploiting Australia’s superb solar PV and wind resources.

Fast forward to today and Plug Power’s role in the Queensland Gigafactory is less clear. My earlier analysis of PLUG suggested talking a big story, but not always with follow through.

Transporting hydrogen

The hydrogen story is full of hype and lack of detail. There’s a lot of vagueness about what hydrogen will be used for, and often it seems to be assumed that hydrogen will eventually have a role in wheeled transported. Given the massive uptake of BEVs (Battery Electric Vehicles), prospects for personal transport seem now to be acknowledged to be out of the question. However, there still seems hope that hydrogen will eventually have a big role in heavy wheeled transport. My take on this is that, just as happened for personal transport, Tesla (TSLA) is going to make clear that the BEV is going to take the heavy wheeled transport space too. Pay attention to the first commercial release of the Tesla Semi in upcoming weeks. AB Volvo (OTCPK:VOLAF) is also making a big play in electrification of trucking. So I’m skeptical about hydrogen and wheeled transport. There’s a lot of interest in hydrogen for specific heavy industrial applications, but this may not need major hydrogen shipping capacity.

I’ve thought for some time that if hydrogen ends up being a false lead as a transportable supply of energy, groups in the green hydrogen space may end up using the electricity rather than going on a hydrogen diversion. I note that Twiggy Forrest remains a major (personal) investor in the huge solar PV/battery Sun Cable project in Northern Australia that plans to ship 24/7 power to Singapore via 4200 km of HVDC cabling. The plan is to supply up to 15% of Singapore’s electricity needs. In the early days of this project it was mooted that the power would be shipped as hydrogen. Note what I can make of the feasibility of shipping hydrogen today.

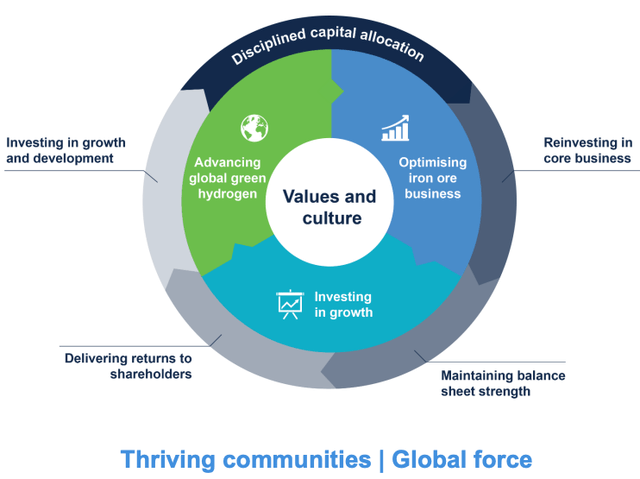

A summary of Fortescue’s business is given in the following graphic from a Fortescue presentation in May 2022. The figure is headed “Transitioning to a vertically integrated green energy company and resources company.”

Fortescue in transition (Fortescue presentation)

The above figure summarizes three core aspects of the business: i) optimizing the iron ore business (which includes decarbonizing mining operations), ii) investing in growth (which includes iron ore mining expansion and returns to shareholders) and finally a big slice of the business involves building a global green hydrogen business.

What the market thinks

Andrew (Twiggy) Forrest is a maverick Australian entrepreneur who has built a major iron ore business from scratch. In the early days many scoffed, but Fortescue is now a significant player in both the Australian and global iron ore mining sector. Continuing his individualistic streak Andrew Forrest is that rare entrepreneur in the energy and mining sector who not only acknowledges the urgency of climate issues and the need to decarbonize, but he’s putting the company he founded on the line about this from several perspectives, while at the same time executing on the iron ore mining business in a purposeful and productive way. There are two areas of controversy, the first involving the intention of Fortescue to electrify the company’s mining operations (completely exiting fossil fuel use). This mainly means ceasing to use diesel, be it for ore trains, trucks and mining equipment. The second and even more ambitious area that Fortescue is developing involves a big play in green hydrogen. This comes from Forrest’s conviction that everything needs to be decarbonized. It is interesting to try to get a sense of what the market thinks.

Seeking Alpha authors are of little help as there are only two, who are both measured in their analysis, giving FSUGY a hold rating. Astonishingly Seeking Alpha reports no Wall Street Analysis of FSUGY in the past 90 days. I call this astonishing as FSUGY is the world’s third-largest iron ore miner (2021 production 182.9 million tons, vs. Rio Tinto’s (RIO) Hammersley Mines & Channar 207 million tons and Vale’s (VALE) Northern System 185.1 million tons). Vale has 23 Seeking Alpha Wall Street ratings in the past 90 days (7 strong buy, 6 buy, 9 hold, 1 strong sell), while Rio has 5 Wall Street Analyst ratings (3 strong buy, 1 buy, 1 hold) in the past 90 days. Australian analysis of Fortescue on the ASX (FMG) has a negative view with 7 strong sell, 3 moderate sell, 9 hold and no buy recommendations. In 2022 Fortescue might produce 190 million tons of iron ore…

The absence of international analysis for FSUGY may be due to perception that the company is transitioning from a pure play iron ore miner to a green energy and resources firm. This positioning might also explain the strongly negative view about Fortescue on the ASX. My perception is that the market doesn’t like companies that behave in unusual ways. On the other hand if Fortescue’s claim that electrifying its iron ore business will lead to $US800 million annual savings, this might change perceptions. The way Fortescue approaches its iron ore business seems very purposeful for dividend investors (see comments above).

Conclusion

It’s interesting to be an investor searching for alpha in emerging industries, but perhaps more scary to be a major player in a traditional industry (Fortescue is the third-largest iron ore miner in the world) which has decided to embrace the unknown in a risky emerging industry (green hydrogen). I confess that I remain sceptical about hydrogen as I’m unconvinced that there’s a future for a gas industry as everything gets electrified. I suspect that the power industry may be able to operate without a traditional gas network. I acknowledge that this is an unusual view currently. One thing influencing my view is that Fortescue is electrifying its business (and exiting fossil fuel use) without needing to adopt hydrogen-based solutions. If Fortescue can get by without hydrogen why can’t others?

Andrew Forrest is impressive in the way that he has built Fortescue to become a major force in the iron ore industry. He isn’t shy of antagonizing the fossil fuel industry in his plans for “greening” Fortescue. This comes from taking time to get a PhD that convinced him that humankind needs to exit fossil fuels urgently (“when it comes to fossil fuels, the party’s over”). His plan is to eliminate 1 billion liters of diesel in Fortescue’s supply chain.

I see some parallels between Fortescue and Flex LNG in that both companies have very high dividends but they also operate in the energy sector which is changing rapidly. My take on Flex LNG was that dividend investors and their financial advisors might be interested, but that they needed to think about the future of LNG transport. For Fortescue, the dividend is attractive and the iron ore business looks interesting with a potential 20%-25% decrease in costs, which might impact its competitive position with other major iron ore producers RIO and VALE. Where it gets tricky is what to make of Fortescue’s green hydrogen push. Life isn’t straightforward for you and your financial advisor!

I am not a financial advisor but I follow closely major qualitative changes happening in the energy industry. I hope that my comments on Fortescue provide food for thought in deliberations that you and your financial advisor make, especially if you are a dividend investor.

Be the first to comment