lindsay_imagery/E+ via Getty Images

Investment Thesis: Playa Hotels & Resorts could see further upside on the basis of a recovery in booking demand across its geographies as well as rising property prices.

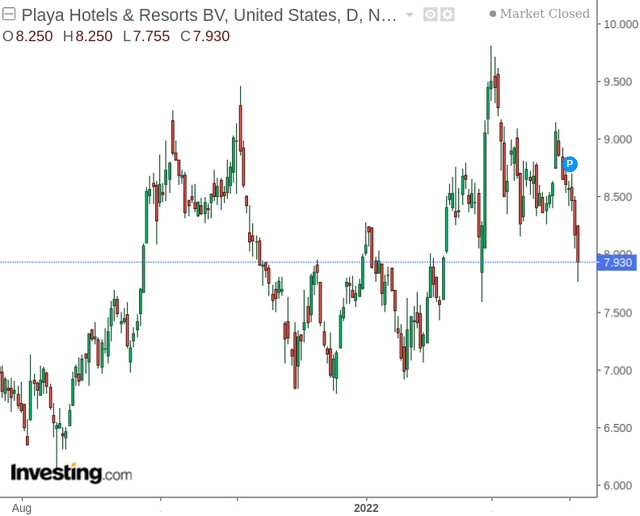

In a previous article back in August, I made the argument that while Playa Hotels & Resorts (NASDAQ:PLYA) had potential to see a further rebound in leisure travel – I also cautioned that price may be too high relative to earnings growth and the stock could see some downside as a result.

Instead, the stock has continued to appreciate – up by nearly 14% since my last article:

The purpose of this article is to determine whether I may have previously been too critical of the company’s growth prospects, and whether we could see further upside from here.

Performance

When looking at the company’s balance sheet performance in Q4 2021 as compared to last year, we can see that the cash to debt ratio has increased significantly, which indicates that Playa Hotels & Resorts is better equipped to meet its liabilities:

| Period | December 2020 | December 2021 |

| Cash and cash equivalents | 146,919 | 270,088 |

| Debt | 1,251,267 | 944,847 |

| Cash to debt ratio | 11.7% | 28.5% |

Source: Playa Hotels & Resorts Fourth Quarter and Full Year 2021 Results (cash to debt ratio calculated by author).

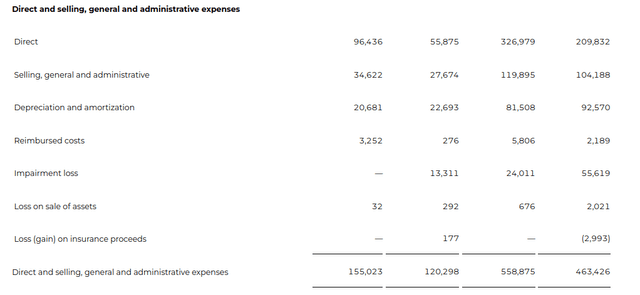

The fact that the company has been able to boost its cash reserves is particularly impressive given that for the year ended December 2021, we saw a 20% increase in direct and selling, general and administrative expenses:

Playa Hotels & Resorts Fourth Quarter and Full Year 2021 Results

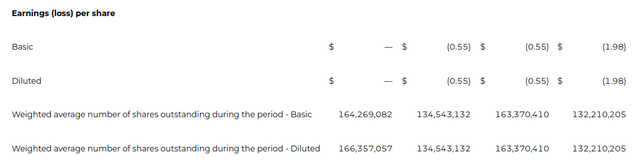

From an earnings standpoint, while Playa Hotels & Resorts still made a net loss for the year ended December 2021, this was still significantly reduced from that of the previous year:

Playa Hotels & Resorts Fourth Quarter and Full Year 2021 Results

In spite of this, one of the shortcomings in my last article was to only look at the company’s earnings growth potential from the point of view of a rebound in booking revenue.

Playa Hotels & Resorts owns as well as operates its resorts, and this means that the company stands to benefit from rising property prices – which is quite likely to continue in an inflationary environment.

Looking Forward

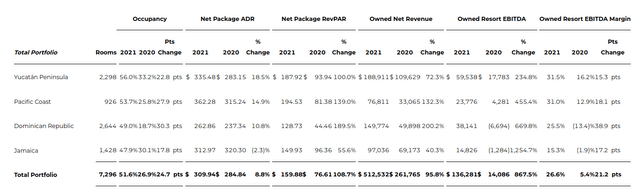

When looking at the company’s portfolio, we see that Playa Hotels & Resorts has the most exposure to the Dominican Republic and the Yucatán Peninsula in terms of rooms and net owned revenue.

Playa Hotels & Resorts Fourth Quarter and Full Year 2021 Results

While we have seen a strong rebound in RevPAR (revenue per available room) and ADR (average daily rate) across these geographies, it is also worth considering whether the potential of rising property prices (which could be expected in an inflationary environment) will ultimately benefit the company as it would allow Playa Hotels & Resorts to sell some of its properties at a higher price if it ever needed to raise cash to fund its business.

Considering the Dominican Republic specifically, housing prices specifically rose by 30% towards the end of 2021, as increases in the price of construction materials have either made newer houses more expensive to build or otherwise reduced the supply of housing stock.

These drivers are likely to have an effect on the broader property market as well. Aside from the rebound in revenue and ADR (even though we have yet to see the company return to earnings profitability), this may be one of the reasons that we are seeing Playa Hotels & Resorts continue to see its stock price climb – rising property prices provide a buffer against lower-than-expected resort bookings.

Moreover, this could further be to the advantage of Playa Hotels & Resorts – as rising housing prices could mean that instead of purchasing property outright, more customers may choose to opt for resort bookings in this region until such time that the property market starts to stabilise.

Additionally, while travel from the U.S. to Europe had been recovering as the travel industry started to reopen after COVID – we might see a situation where the ongoing situation in Ukraine discourages travel to Europe due to both the sensitive geopolitical situation as well as higher ticket prices driven by higher fuel prices and logistical challenges associated with the closure of Russian airspace to Western carriers.

From this standpoint, we could see travel interest for the Latin American market start to increase, and Playa Hotels & Resorts is well poised to take advantage of this.

Conclusion

To conclude, Playa Hotels & Resorts is in a good position to take advantage of a recovering travel market and is set to benefit from rising property prices.

While the company is yet to return to profitability from an earnings standpoint, the stock could see further upside based on the aforementioned drivers.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment