OlegMalyshev/iStock via Getty Images

While most U.S.-focused cannabis stocks are appealing at current valuations, Planet 13 Holdings Inc. (OTCQX:PLNHF) doesn’t fall into that category. The cannabis sector hit a rough spell over the last year, but Planet 13 was hit very hard by not being positioned in the growth markets. My investment thesis is Neutral on this multi-state operator (MSO) not positioned for growth.

Weak Positioning

While most MSOs reported a weak quarter, the general sector still grew revenues YoY due to boosts from the launch of recreational cannabis sales in New Jersey. Other MSOs grew from adding dispensaries in new states or expanding stores open in existing states.

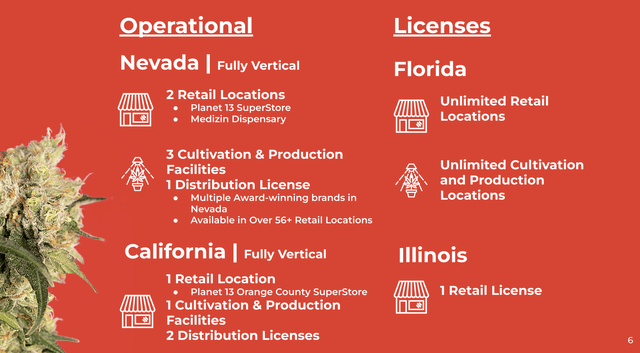

The problem with Planet 13 is a lack of any strong growth market targets, with the main business focus outside of Nevada on the ultra-competitive California market and being late to the game in Florida. Even with travel booming, the company suggested the Nevada market was tough during Q2 due to weak tourist spending.

For Q2’22, Planet 13 reported revenues collapsed 13.5% to $28.4 million. The profit picture was much worse with gross profits falling $5.2 million to $13.0 million with margins down 920 basis points YoY due to the lower revenues.

The company has a major lack of scale issue, with the 2 stores in Nevada basically driving the business. The expansion plans are focused on Florida, but Planet 13 just now closed on the property, allowing for cultivation expansion beyond the current 10,500 square foot building on the property.

Source: Planet 13 Q2’22 presentation

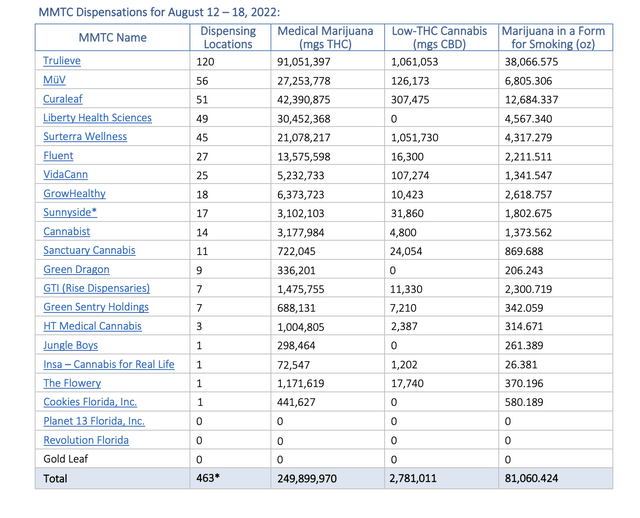

The MSO just announced plans for the location for a 3rd dispensary for Florida with a goal of opening 6 stores. The state has a lot of promise with forecasts for sales approaching $3 billion once recreational cannabis is approved, but Planet 13 is already late to the game. The state already has 463 cannabis dispensaries open, with Trulieve Cannabis (OTCQX:TCNNF) and Curaleaf Holdings (OTCPK:CURLF) and other large MSOs likely to crowd out small MSOs like Planet 13 only now joining the game.

Source: Florida OMMU Aug. 19 report

Planet 13 isn’t likely to have the first cultivation from the expanded Florida facility in stores until possibly 2H’23. At this point, the MSO will need to open up to 10 locations in order to just reach a top 10 position in the state, leaving the company in a very weak competitive position entering 2024.

The Illinois license is currently 51% owned by another investment partner. The company doesn’t have any real avenues to growth outside just opening up stores in either California or Florida where they neither have a dominate market position or a state structure limiting competitive stores.

No Growth Plan

Planet 13 lists ~232 million shares outstanding placing the market cap at around $375 million. The MSO has ~$100 million in current revenues and analysts have a goal for revenues only hitting $124 million in 2023.

The stock isn’t necessarily wildly expensive at 3x 2023 sales targets, but the MSO doesn’t offer the growth of others in the sector. The company has a cash balance of $53 million, but a lot of this money will be utilized to expand the cultivation facility bought last month in Florida and potentially grow the business in Illinois with a buyout of the current 51% owner.

The cannabis market has a lot of growth catalysts for the next decade, but Planet 13 isn’t positioned for those growth drivers. The MSO isn’t positioned in the Northeast states launching recreational cannabis in the near term or the limited license states such as Ohio or Pennsylvania with a recreational cannabis catalyst coming down the road.

The Florida market could definitely become a growth driver in the future. The competition is strong, but the amount of licensed holders actually aggressively expanding doesn’t go much beyond 10 due to the requirement for vertical integration. Some strong execution could make Planet 13 a top in the state exiting 2023, but the odds of this outcome doesn’t warrant a solid investment thesis.

Per the Co-CEO Bob Groesbeck on the Q2’22 earnings release, the company is poised to double key metrics by next year, but it doesn’t add up to anything investment worthy at this point:

Our expansions are progressing according to plan and it is likely that a year from now we will have doubled our retail and state footprint.

Takeaway

The key investor takeaway is that Planet 13 doesn’t offer the growth catalyst warranting and investment in the risky cannabis space. The stock is likely to tread water over the next year as investors gravitate to the larger MSOs with growth catalysts and the ability to squeeze out the smaller MSOs like Planet 13.

Be the first to comment