lechatnoir

Thesis

We are initiating coverage on Five Below, Inc. (NASDAQ:FIVE) as we believe this stock can be a recession-proof consumer name in an investor’s diversified portfolio. The company has a business model that caters to low to middle income households and should provide some protection against weak consumer data or macroeconomic backdrop. In addition, the company’s ability to grow both the bottom line and top line throughout the past five years give us confidence in management’s ability to execute on strategic priorities and navigate through uncertain times.

Company Overview

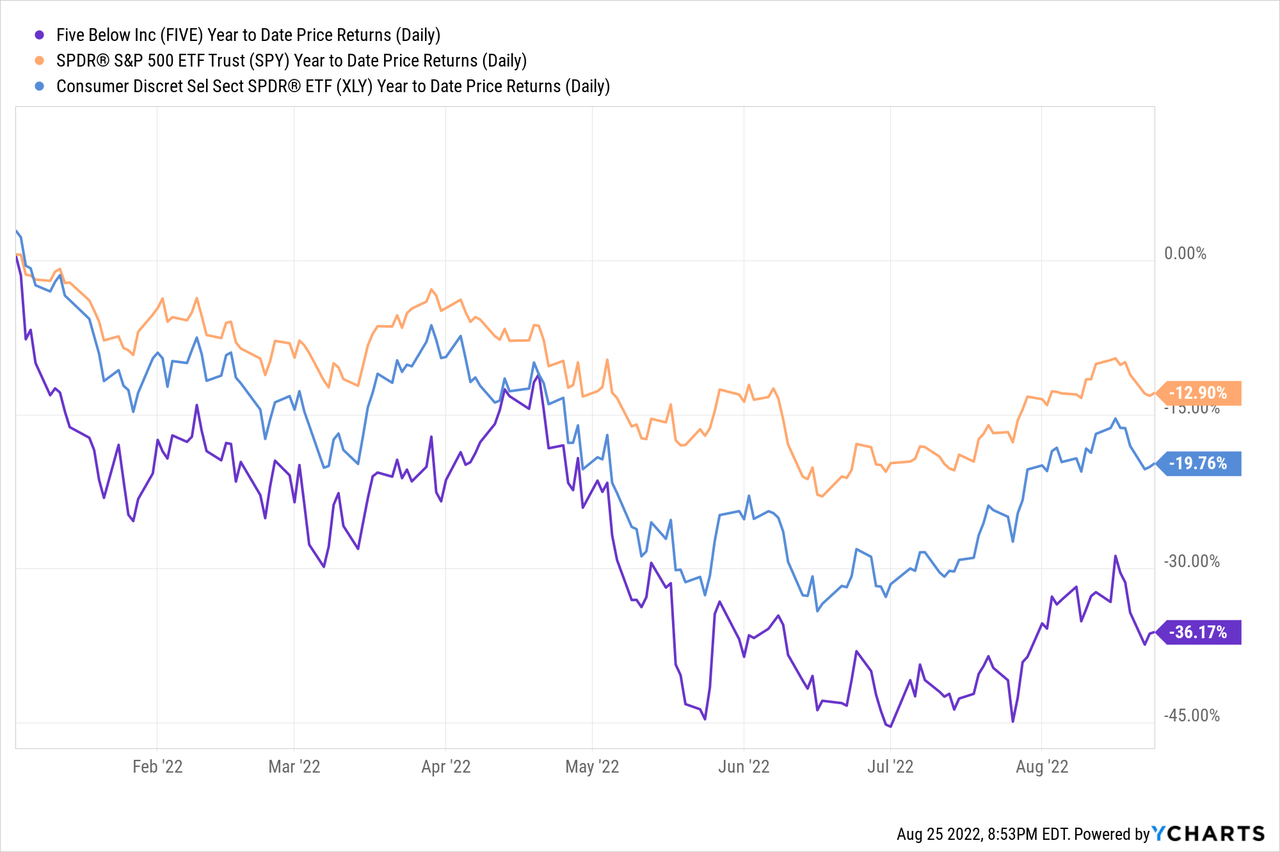

Five Below is an American discount chain that specializes in selling assortment of products that are less than $5, in addition to other products that are also low price. The retail chain focuses on the young demographic, primarily “tweens” and “teens.” The company operates more than 1,200 stores in 40 states and has numerous brand awards. Five Below’s stock price has underperformed both the consumer discretionary index as well as the broader stock market. Year-to-date, the company’s stock price is down -36.17% compared to a -12.90% in the S&P 500.

Recession-Resistant Business Model

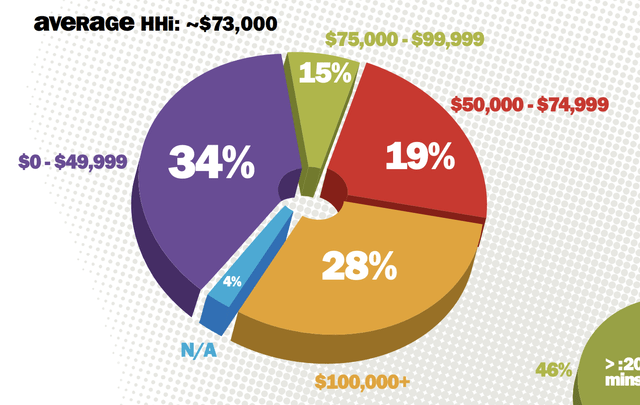

Five Below targets the younger demographic and sells products that are affordable and attractive to young consumers of low to middle-income background. As the name of the company may suggest, the company focuses primarily on selling products under $5. These prices will likely be welcomed when consumer budget shrinks, even for older consumers. Furthermore, the company has been in business since 2002 and has experience operating in a recessionary environment as a result of the 2008 financial crisis. Given the current economic backdrop, we believe that the company’s business model and management experience will help the company weather any further economic downturn and remain profitable during a deeper recession.

2022 Investor Day Presentation

Already, strategic changes are being made to prepare for a recession. Management has been looking to attract an increasingly value-oriented consumer base. As CEO of Five Below explains:

With that said, as we look to the balance of the year, we expect the macro environment to remain challenging. We know that during these times, our customer seeks out value even more. We are well positioned to deliver on our commitment to bring fresh, new WOW products that our customers want, at extreme value, and with an amazing shopping experience.

– Joel Anderson, President and CEO of Five Below

Consistent Growth

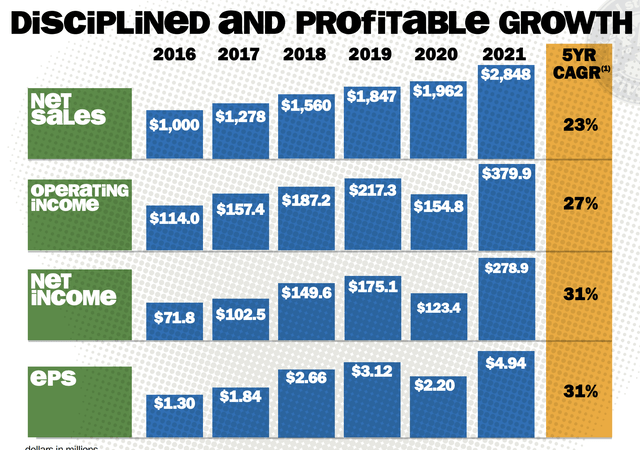

Five Below has historically reported solid growth, with a 6-year revenue CAGR of 23%. In addition to the company’s top line growth, the company has also grown its operating income and net income at a faster rate, showing that the company has been able to cut costs and improve margins. Management continues to be focused on growth as part of the “Triple Double” initiative, which is to triple the number of stores by 2030 and to double the revenue and profit by 2025. We believe that the company’s growth initiatives are good for investors, and we have faith in the management’s ability to meet these goals given their past historical successes.

2022 Investor Day Presentation

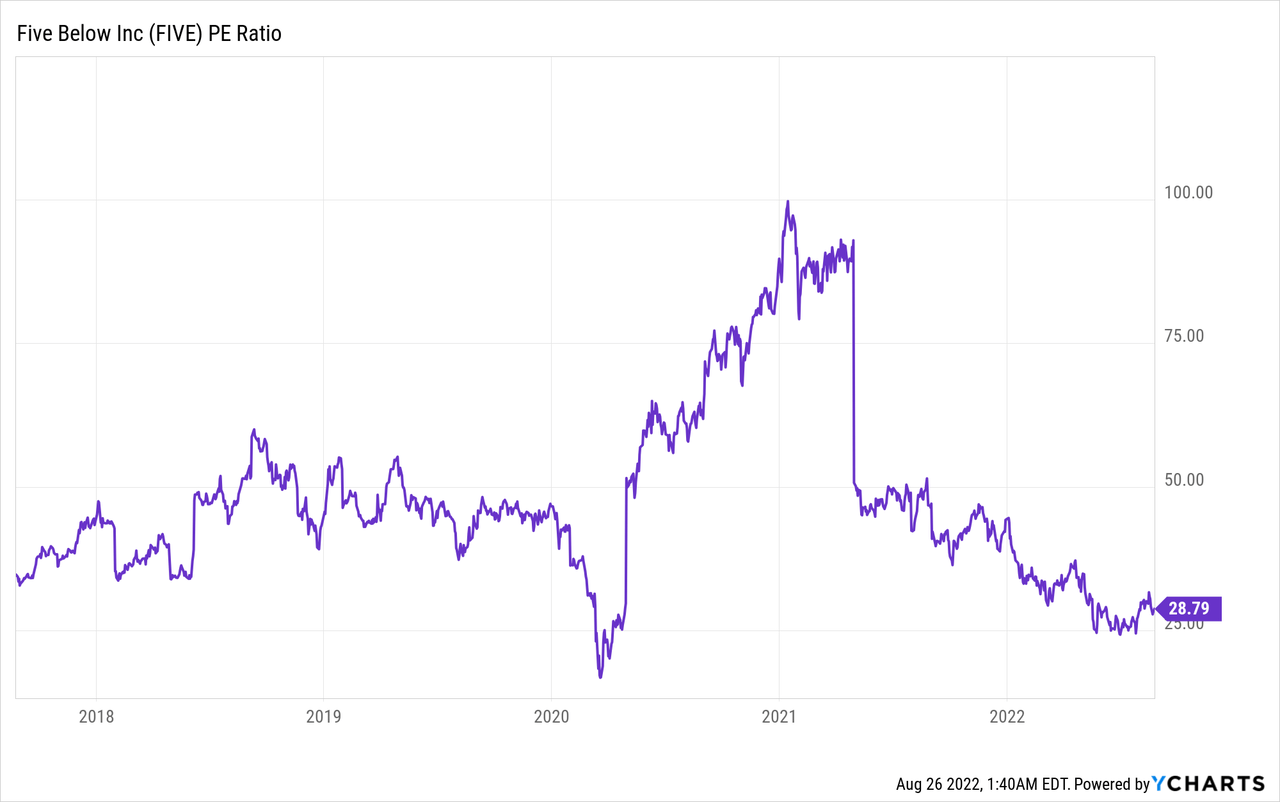

Assuming that the company does succeed in increasing its earnings two-fold by 2025, the company will have an earnings per share of ~$10. Assuming a conservative 25x P/E ratio (on the lower end of recent P/E multiples), the company’s stock price will be at around $250 per share, which represents a 83% upside from current levels. Given the recent stock buyback program and the retirement of shares, it is like that the value of the stock will be higher as EPS increases.

FIVE is expected to report earnings on August 31.

Conclusion

We believe that during these economic times, it’s important to find growth in more defensive sectors. Five Below matches our criteria by having a strong history of growth, capable management, and a recession-proof business model. We think that the company will be able to meet its “Triple-Double” initiative, and our estimates see this stock price rising up to $250 by 2025 as the EPS grows from organic earnings growth and stock buyback programs.

Be the first to comment