adaask

Both Plains GP (NASDAQ:PAGP) and Kinder Morgan (NYSE:KMI) are investment grade high yield midstream businesses. PAGP offers a higher dividend yield, but KMI has a higher credit rating. In this article, we will compare them side by side and offer our take on which one is a better buy.

Plains Vs. Kinder Morgan – Balance Sheet

Both PAGP (BBB- with a stable outlook) and KMI (BBB with a stable outlook) have investment grade credit ratings which implies they both have solid balance sheets.

KMI is set to end the year with a leverage ratio below 4.3x, has $1.1 billion in cash on hand, and has a well-laddered debt maturity schedule. It also is able to refinance its debt on fairly attractive terms thanks to its solid credit rating. There is little risk of financial distress at KMI for the foreseeable future.

PAGP has also recently significantly enhanced its balance sheet by aggressively paying down debt with proceeds from asset sales and retained free cash flow. As a result, management expects PAGP to achieve the middle of their long-term leverage ratio target by year-end. Moving forward, management says they plan to continue deleveraging further, which could mean that a credit rating upgrade is in PAGP’s future.

While both businesses have solid balance sheets, KMI’s slightly superior credit rating gives it the edge here.

Plains Vs. Kinder Morgan – Business Model

PAGP’s main focus (the source of ~80% of its EBITDA) is on Permian oil as its large and competitively positioned midstream assets in the Permian Basin are estimated by some to touch every oil barrel that is produced there. While this is a positive in that PAGP is able to focus primarily on doing one thing well, it also means that it enjoys less diversification. As a result, its long-term intrinsic value is closely tied to the long-term fortunes of the Permian Basin. PAGP also has a complementary Western Canadian NGL midstream business that generates the remainder of its EBITDA.

KMI, on the other hand, enjoys significantly superior scale and diversification. It owns the number one natural gas transmission network, CO2 transportation business, independent refined products transportation network, and independent terminal operation in North America. Given that it transports ~40% of all natural gas that is consumed or exported in the United States, KMI is an indispensable part of the U.S. energy industry.

Both businesses benefit from primarily fixed-fee, take-or-pay commodity price resistant contracts on their pipelines. They also benefit from inflation given that most pipeline contracts have escalators that are linked to various inflation-related indexes. However, KMI has the edge here as well given that 97% of its cash flow comes from these commodity price and/or volume resistant contracts and the vast majority of its counterparties are investment grade.

Overall, KMI has the superior business model with greater scale, diversification, and cash flow stability.

Plains Vs. Kinder Morgan – Dividend Safety

PAGP’s dividend coverage ratio for 2022 is expected to be an incredibly conservative 2.6x and its 2023 coverage ratio on its expected 2022 dividend payout is expected to soar to an even higher 2.9x. Meanwhile, KMI’s dividend coverage ratio is also expected to be conservative, at 2.0x for 2022 and 2.1x in 2023. Overall, we give the slight edge to PAGP here, though neither dividend is at any meaningful risk of being in danger at this point.

Plains Vs. Kinder Morgan – Track Record

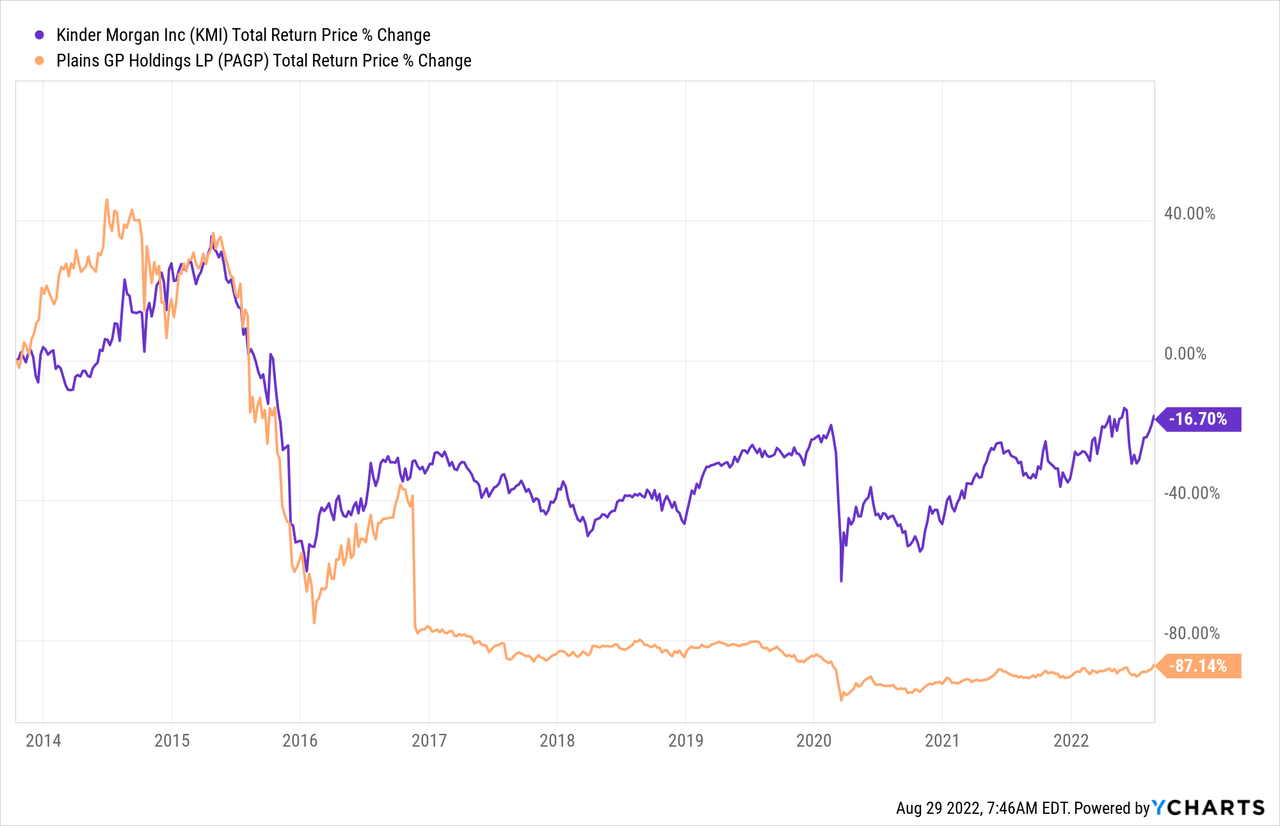

When it comes to track record, both PAGP and KMI have checkered recent track records, with significant dividend cuts for both of them. That said, over the course of their publicly traded histories, PAGP has clearly underperformed KMI:

As a result, we give the edge to KMI here, though neither business has much to be proud of on this front.

Plains Vs. Kinder Morgan – Risks And Catalysts

As midstream businesses, the risks and catalysts facing KMI and PAGP are very similar. Given that PAGP is heavily focused on Permian oil, its main risk is that Permian oil production will decline, leading to prolonged midstream infrastructure overcapacity in the region, which in turn will result in weak re-contracting for the company and ultimately poor cash flow performance. On the other hand, if Permian oil production increases and remains elevated for years to come, PAGP will likely significantly outperform the broader midstream sector and generate very attractive returns for shareholders.

KMI, meanwhile, has its bets spread more evenly across a variety of geographies and energy commodities. As a result, its performance will more closely resemble that of the overall midstream sector. That said, it is increasingly heavily weighted towards natural gas, so if natural gas’ bright future prospects come to fruition, KMI should thrive for years to come.

Plains Vs. Kinder Morgan – Valuation

When it comes to their relative valuations, PAGP looks clearly cheaper across each of the primary midstream valuation metrics. Its dividend yield is higher and its price to DCF is meaningfully cheaper, while its EV/EBITDA multiple is only slightly cheaper than KMI’s. As a result, we give a decisive win to PAGP here.

|

Valuation Metric |

PAGP |

KMI |

|

Dividend Yield |

7.0% |

6.0% |

|

Dividend Yield (5-Yr Avg) |

7.3% |

6.0% |

|

EV/EBITDA |

9.6x |

10.0x |

|

EV/EBITDA (5-Yr Avg) |

9.9x |

10.3x |

|

P/DCF |

5.6x |

8.5x |

Investor Takeaway

KMI has a slightly stronger balance sheet and a less bad track record. That said, it definitely comes out ahead in terms of having a lower risk business model thanks to its superior scale, far better diversification, and higher quality counterparty portfolio.

In terms of dividend safety, both businesses have very strong dividend coverage ratios, though PAGP likely has a slightly stronger near-term dividend growth profile given that its coverage ratio is extremely high.

Where PAGP outpaces KMI is in its valuation, particularly its 2.9 turns lower P/DCF multiple and its 100 basis point superior dividend yield. Ultimately it comes down to risk verses reward here. If you want a well-diversified low-risk all-purpose midstream holding, KMI is a solid pick here (and we rate it a Hold at the current valuation). However, if you want a more aggressive pick that could generate outperformance relative to the midstream sector assuming that the Permian Basin has a bright future, then go with PAGP (we rate it a Buy at the current valuation).

Note on taxes: both of these midstream businesses are structured as C-Corps for tax purposes, so they issue a 1099 tax form instead of a K1. This makes them suitable for inclusion in retirement accounts as well as taxable accounts and also may make them more attractive for non-U.S. investors who otherwise face stiff withholding taxes for investing in K1 issuing securities. To be clear, this is not tax advice, just my personal opinion based on my own research and experience. Be sure to do your own due diligence.

Be the first to comment