shannonstent

Investment Thesis

Livent Corporation (NYSE:LTHM) has obviously rallied post FQ2’22 earnings, albeit at a slower rate than expected. This is partly attributed to the stock market’s overlooking LTHM’s potential as a minor lithium player in the US with a market cap of $5.89B, compared to Albemarle Corporation (NYSE:ALB) at $33.75B. Otherwise, in comparison with SQM (NYSE:SQM) based in Chile, with a market cap of $29.99B. Nonetheless, it is evident that Mr. Market is slowly taking notice of this stellar stock, since the recent rising tide has also lifted most boats in the sector.

Lithium Forecasts By McKinsey & Company

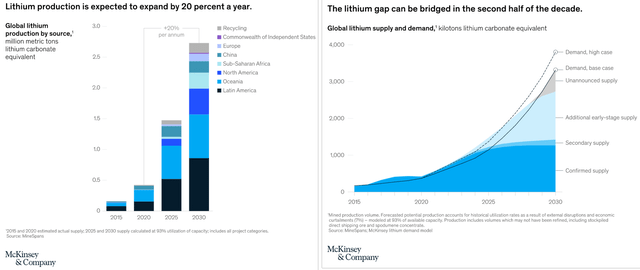

The fact remains that lithium is in short supply today due to the massive unmet demand globally, with significant new supplies expected only by the end of 2024, according to McKinsey & Company. However, the global supply chain is only likely to be rebalanced by 2027, as evident from the chart. Therefore, we expect lithium prices to remain elevated for a while longer, since batteries will also be commonly used in the booming green energy sector, expected to grow from $881.7B in 2020 to $1.97T in 2030 at a CAGR of 8.4%, beyond the typical application in EVs and industrial uses. This will directly impact LTHM’s growth and profitability over the next few years, as the company aggressively expands its capacity by nearly five-fold through 2030.

With over 5.5K GWh of lithium-ion battery demand projected by 2030, it is evident that battery producers globally are struggling to keep up with the insatiable demand, since the current global installed capacity is estimated only at 948 GWh as of May 2022. North America currently accounts for a minimal 6.6% of the total capacity at 63 GWh, which is expected to grow aggressively to over 580 GWh by 2027 at a 44.8% CAGR. As a result, there is no reason to believe that the Feds will be able to destroy long-term lithium demand through the interest rate hikes, merely a moderate deceleration in the short term, before accelerating afterward.

Livent investors, hold on to this gold mine for long-term growth and investing.

LTHM Continues To Benefit From Elevated Lithium Demand & Prices

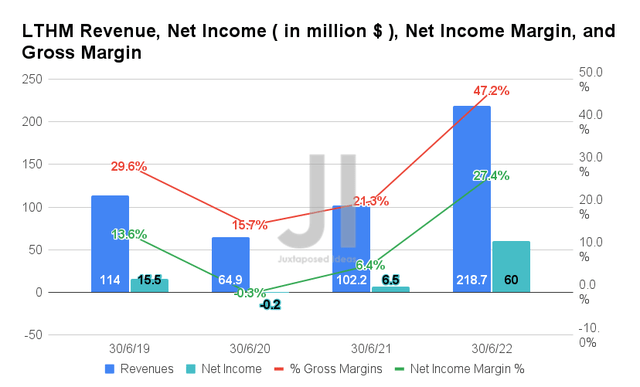

In FQ2’22, LTHM reports revenues of $218.7M and gross margins of 47.2%, representing an impressive increase of 213.9% and 25.9 percentage points YoY, respectively. This has drastically improved its profitability, with net incomes of $60M and net income margins of 27.4% reported in the latest quarter. It indicated a tremendous growth of 923% and 21 percentage points YoY, respectively.

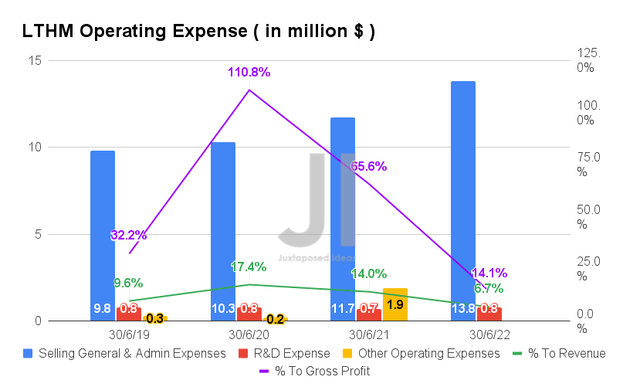

In the meantime, LTHM has also been growing its capabilities reasonably to $14.6M of operating expenses in FQ2’22, representing an increase of 2% YoY or 37.7% from FQ2’19 levels. However, the company has been reporting improved profitability due to the exponential growth in its revenues thus far. The ratio of its operating expenses to its growing sales has been moderating thus far, to 6.7% of its revenues and 14.1% of its gross profits by FQ2’22. This represents a massive improvement compared to 14%/ 65.6% in FQ2’21 and 17.4%/ 110.8% in FQ2’20, respectively.

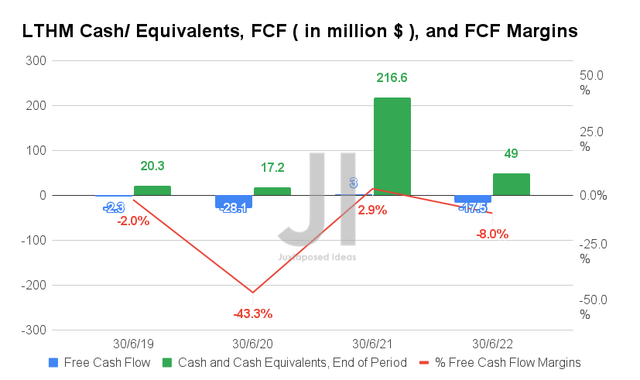

As a direct result of the company’s aggressive Capex investments, LTHM has yet to report positive Free Cash Flow (FCF) generation in FQ2’22, with an FCF of -$17.5M and an FCF margin of -8%. However, long-term investors need not worry, since the massive $228.1M Capex investments in the last twelve months would eventually be top and bottom line accretive, due to the expansion in its output capacity through 2030. FCF profitability will come soon enough by FY2024, if not earlier.

LTHM Is Riding On The Hyper Growth Wave

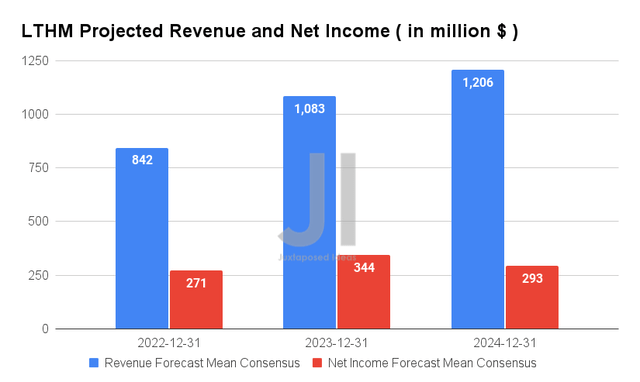

Over the next three years, LTHM is expected to report revenue and adj. net income growth at a CAGR of 42.09% and 42.31% ( adjusting for the pandemic lows ), respectively. These numbers represent a certain moderation of -8.5% in consensus estimates since our previous bullish analysis in June 2022. Thereby, indicating Mr. Market’s slight pessimism post the Fed’s hawkish comments, potentially putting downwards pressure on lithium prices moving forward.

Nonetheless, investors need not fret since consensus estimates project that LTHM will report exemplary revenues of $842M and net incomes of $271M in FY2022, indicating an optimistic increase of 4.9% and 11.9% since previous estimates in June 2022, respectively. These would represent tremendous YoY growth of 200% and 45166.66%, respectively, given the management’s recently raised FY2022 guidance due to the higher realized pricing across all lithium products.

It is no wonder then that the LTHM stock had rallied by 26.8% in the weeks post FQ2’22 earnings, significantly aided by the recent passing of the Inflation Reduction Act. The latter would aid the widespread adoption of the domestic EV battery supply chain in the US, given the highly attractive $7.5K tax credit for trucks, vans, and SUVs under $80K and cars up to $55K. This was already evident in General Motors’ (GM) recent prepayment of $198M to LTHM for a guaranteed six-year supply of lithium, on top of its previously agreed deal for 1M EVs capacity by 2025. Thereby, triggering a steady capacity growth and stock price appreciation ahead – especially since the raw material would remain in tight supply through 2027.

The global EV market is also expected to grow tremendously from $163.01B in 2020 to $823.75B in 2030 at a CAGR of 18.2%, thereby catapulting the global lithium-ion battery market from $36.9B in 2020 to $193.13B in 2028 at an impressive CAGR of 23.3%. Therefore, LTHM is on track to expand as a better-covered EV stock shortly, which could lead to an upward revision of its stock price for long-term investing. EV investors, do not miss this speeding stock with monster capabilities.

In the meantime, we encourage you to read our previous article on LTHM, which would help you better understand its position and market opportunities.

- Livent: License To Print Money – Speculative Bet For 2030

So, Is LTHM Stock A Buy, Sell, or Hold?

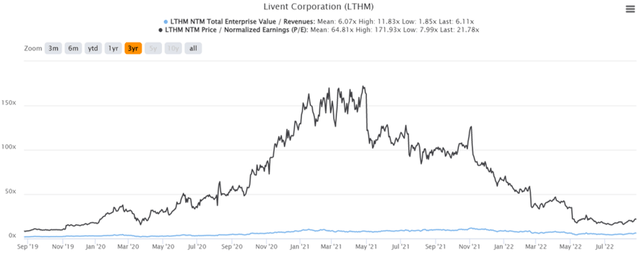

LTHM 3Y EV/Revenue and P/E Valuations

LTHM is currently trading at an EV/NTM Revenue of 6.11x and NTM P/E of 21.78x, slightly higher than its 5Y EV/Revenue mean of 6.07x though tremendously lower than its 5Y P/E mean of 64.81x. The stock is also trading at $32.41, near its 52 weeks high of $34.61, though at a premium of 67.4% from its 52 weeks low of $19.35. It is evident that the LTHM stock is riding on a high, post excellent FQ2’22 earnings call.

LTHM 3Y Stock Price

As a result of the baked-in premium, consensus estimates have also reinstated a hold rating on the LTHM stock, with a price target of $31 and a -4.35% downside from current prices. Unfortunately, LTHM will likely retrace over the next few weeks before the Fed’s next meeting on 20th September 2022, especially assuming a continually drastic interest rate hike. Therefore, keen investors would be well advised to wait for a moderate retracement, before adding this multi-bagger stock at the next dip.

Be the first to comment