gahsoon/E+ via Getty Images

Pinduoduo (NASDAQ:PDD) has borne much of the brunt of China’s extended bear market over the last 18 months. As a result, the company’s share price and underlying fundamentals have diverged considerably. On paper, the company is killing the game with its unique crowd-sourced e-commerce business model, disrupting large Chinese e-commerce incumbents Alibaba (BABA) and JD.com (JD). Digging a bit deeper, however, several risk factors cloud the business’s future. In saying that, I believe the upside potential outweighs the risk factors at today’s price. Let’s dive in.

Business model

Since 2015 Pinduoduo has pioneered a “team buying” social e-commerce model. Pinduoduo’s marketplace app allows buyers to share products on third-party social networks such as WeChat and invite friends, family, and others to form group shopping ‘teams’. Teams of buyers can then purchase products in bulk and at discounted prices. For each item sold, merchants set a standard price for individual buyers and a discounted price targeted at team buyers.

The company’s manufacturer-to-consumer model allows farmers to sell directly to consumers, eliminating almost entirely the middleman distributors – this helps keep prices low.

A large and growing active buyer base helps to incentivize merchants to sell on the platform. Ultimately this creates scale and higher sales volume encouraging merchants to offer even lower price points and customized products for price-sensitive buyers. Pinduoduo’s product range includes fresh produce and fast-moving consumer goods (FMCG), typically ordered at a higher frequency.

How Does Pinduoduo make money?

1. Marketing services (77% of Revenue)

PDD generates most of its Revenue from optional online marketing services. Specifically, merchants can bid for keywords that match product listings and appear as ads on Pinduoduo’s platform.

2. Transaction services (15% of Revenue)

The company also charges merchants commission fees (roughly 0.6%) on items purchased across the platform.

3. Merchandise Sales (8% of Revenue)

Finally, Pinduoduo sells fresh produce via its online grocery platform “Duo Duo Grocery”. This segment differs from Pinduoduo’s core e-commerce business which serves as a marketplace matching buyers and sellers. Instead, Duo Duo Grocery purchases the physical fresh produce inventory from suppliers and sells this directly to consumers.

Value proposition

1. Strong network effects and economies of scale flywheel

Pinduoduo’s social commerce model is built around network effects. Pinduoduo’s platform blurs the lines between social media and e-commerce – this feature separates it from traditional e-commerce players. Pinduoduo’s large active buyer base helps to incentivize more merchants to sell on the platform, which grows stronger as more buyers are added. By creating larger buying groups, customers can access lower prices, further incentivizing customers to use the platform. Subsequently, Pinduoduo’s team buying feature is a key aspect of its competitive advantage. These social cohesion features allow the company to leverage social media-like network effects built around community engagement.

As Pinduoduo grows, the social buying platform becomes more valuable for buyers and sellers. With a broader customer base, buyers can form larger teams and access lower prices and more product variety. For merchants, more active buyers mean greater potential sales volume. This positively reinforcing flywheel is hard to stop once it gains momentum. Evidently, Pinduoduo has grown its active buyer base to almost 900 million since it launched in 2015, rivalling established e-commerce giant Alibaba, which has 1 billion domestic customers.

2. Large and growing total addressable market

Pinduoduo primarily targets China’s lower-tiered cities and regional districts, which account for much of the nation’s growing lower-middle class. This demographic is enormous, making up roughly 70% of China’s 1.4 billion population. These consumers have largely been excluded from China’s e-commerce boom over the last 20 years. However, this is changing due to 1.) better infrastructure connecting regional China to its large tier 1 cities, 2.) improved internet access and 3.) rapidly rising disposable incomes for China’s lower-middle class. As a result, over the next decade, this demographic is expected to become the largest consumer market in the world. As one of China’s leading fresh produce e-commerce businesses, Pinduoduo is well-positioned to benefit from this powerful secular tailwind.

While sizeable Chinese e-commerce players such as Meituan and Alibaba are investing heavily in this area, Pinduoduo’s first-mover advantage and unique social commerce structure give the company a distinct advantage in attracting customers. Furthermore, the market opportunity for China’s lower-middle income demographic is enormous. Subsequently, I believe there is room for multiple winners in the space over the next 5-10 years.

3. High Margin Business Model

Pinduoduo’s core social commerce business is simply a marketplace matching buyers with sellers online. Accordingly, the company is not responsible for any logistics, warehousing or distribution of inventory sold on the platform by its third-party sellers. Financially, this capital-light structure is advantageous as it substantially reduces Pinduoduo’s CapEx and cost of revenue requirements.

Counter Thesis

1. Regulatory headwinds

Since late 2020, regulatory authorities have scrutinized China’s broader technology sector. In a bid to create more equitable wealth distribution across China, regulators have restricted the operations of the country’s large tech platforms. Measures have included anti-trust fines, forced donations and limitations on entering new consumer markets. Much of this scrutiny has been directed towards the nation’s largest tech companies, including Alibaba, Tencent, Meituan (OTCPK:MPNGF), JD.com and Baidu (BIDU). Pinduoduo has not yet been impacted materially by any regulation from the Chinese government. However, as Pinduoduo consolidates market share and becomes more dominant domestically, the threat of increased regulation becomes greater. It is tough to predict what regulatory restraints Pinduoduo might face in the future. Subsequently, as investors, it is important to monitor the political situation in China constantly.

2. U.S. Delisting fears due VIE structure

Pinduoduo has relied upon what is known as a VIE (variable interest entity) structure to facilitate offshore funding to work around China’s stringent foreign investment capital controls. However, in 2021 the United States Securities and Exchange Commission introduced new accounting policies for foreign companies listed in the U.S. The new laws stipulate that foreign companies must allow U.S. accounting authority to audit their financial statements, with failure to do resulting in delisting. While considerable steps have been taken by Chinese and U.S. regulators to allow U.S. financial authorities to audit the financial statements of Chinese companies with U.S. listings, there is still some uncertainty about whether an agreement will be finalized. If Pinduoduo fails to comply with the new rules, the company will likely be delisted from its NASDAQ listing, which will cause significant short-term selling pressure as investors are forced to sell the company’s American Depository Receipts.

3. Competition

As previously mentioned, Pinduoduo faces fierce competition from incumbent Chinese e-commerce and food delivery companies such as JD.com, Alibaba and Meituan. Additionally, the e-commerce environment the company operates in is dynamic, with consumer preferences constantly evolving. With a limited operating history and smaller capital base Pinduoduo may struggle to compete financially with these large operators in the future.

While these companies do not directly compete with Pinduoduo’s “team buying” social commerce model, they may implement similar offerings in the future. As a result, it is important to track the growth of the company’s user base, active merchants and gross merchandise volume regularly.

Financials and Valuation

Income statement and Cash flow

Looking at Pinduoduo’s income statement metrics, the company appears to be in a strong position. What stands out to me is the company’s 72% gross margin. This is far higher than the most successful traditional e-commerce companies currently operating, including rival Alibaba (36%), JD.com (8%) and Amazon (AMZN) (43%).

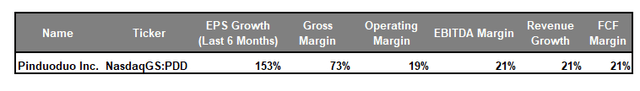

Margins and Growth Rates (Capital IQ)

Notably, the company has also reached profitability on a net income basis; this is very impressive, considering the company was founded in 2015. Moreover, Pinduoduo is producing substantial free cash flow and currently has a healthy 21% free cash flow margin. This comes with relatively low shareholder dilution in the form of stock-based compensation, which makes up roughly 13% of total operating cash flow. The company’s revenue growth over the last twelve months has slowed to 21%. However, this has primarily been due to slowing macroeconomic conditions in China and extended nationwide Covid-19 lockdowns.

Balance Sheet and Financial Strength

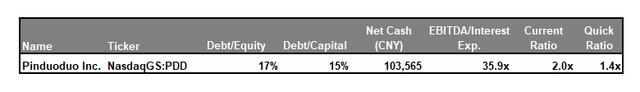

Balance Sheet Metrics (Capital IQ)

As highlighted in the table above, Pinduoduo has a healthy balance sheet with a high cash balance and minimal debt.

Valuation Multiples

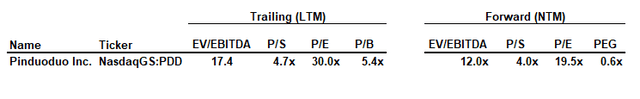

Valuation Multiples (Capital IQ)

Pinduoduo’s price-to-earnings multiple currently sits at roughly 30x. While this appears somewhat high at first glance, the company only recently became profitable on a net income basis. Subsequently, I give the P/E ratio less weight in my valuation assessment. Comparatively, on a price-to-sales basis, Pinduoduo looks cheap, currently trading below 5x its last twelve months of Revenue. Moreover, considering future growth expectations, Pinduoduo looks even more attractive with a PEG ratio of 0.6x.

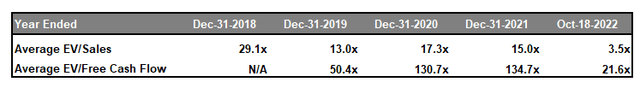

As highlighted below, the company’s EV/Sales and EV/FCF multiples have come off a long way from the company’s historical averages.

Historical Valuation Multiples (Capital IQ)

Conclusion

Given the company’s strong expected sales and earnings growth trajectory, I believe Pinduoduo offers investors a good return profile at its current valuation. While there are several potential macro and idiosyncratic risks that could impact Pinduoduo, I believe these are well and truly priced into the company’s current stock price. Moreover, in the next 2-3 years, Pinduoduo should continue to benefit from operating leverage and margin expansion, allowing the company to grow its earnings faster than the top line, enhancing returns for shareholders.

Be the first to comment