Torsten Asmus

Thesis

Both Journey Energy Inc. (TSX:JOY:CA) (OTCQX:JRNGF) and Occidental Petroleum Corp. (NYSE:OXY) have every chance to show strong outperformance in the coming months due to a) a strong macroeconomic environment and b) strong financial performance that will allow investors to achieve exceptional returns in 2023 against the backdrop of a clear shareholder return policy. But I like JOY more because it’s not as crowded as OXY and has more room for growth fueled by cheaper valuation and great fundamentals.

Oil and the continuation of its bullish cycle

Even the current round of Chinese lockdowns has not been able to bring down the price of oil and some other important commodities, demonstrating what an extraordinary period we live in. But why is this happening?

On September 29, I published our regular newsletter in Beyond the Wall Investing with an analysis of the latest notes and reports from investment banks, including Goldman Sachs with their latest analysis and forecast for oil. The bank’s analysts described quite succinctly and clearly the problem of the dominance of supply constraints over demand disruption – which is precisely what explains black gold’s insignificant response to events in China and the slowdown in overall economies around the world.

Despite outperforming cyclical assets this summer, oil prices finally succumbed to rising growth concerns, back to their lowest level since January. A strong USD and falling demand expectations will remain powerful headwinds to prices into year-end. Yet, the structural bullish supply set-up – due to the lack of investment, low spare capacity and inventories – has only grown stronger, inevitably requiring much higher prices.

We acknowledge the ongoing growth slowdown, and, as a result, now base-case global GDP growth outside of China of c.1% in 2023, simplistically anchored at the post-war average weakest years of economic growth prior to 2008. This is a cautious assumption, below consensus expectations, while in China, we expect that zero-Covid policies will remain in place through next summer. On the supply side, we continue to expect that Russian supply will decline into year-end when the EU embargo kicks-in alongside the end of the globally-coordinated SPR release. Based on these updated views, we still expect a seasonally adjusted global oil market deficit in 4Q22 and in 2023, taking account of builds required for demand growth and for the redirection of Russian oil.

As a result, from the current depressed level of positioning and prices, we reiterate our bullish price view, although our weaker demand growth expectations lead us to revise our 2023 forecast lower by $17.5/bbl on average. At our updated assumptions, it would take an economic hard-landing to justify sustained lower prices. While we acknowledge that the short-term path to prices is likely to remain volatile, with the USD in the (opposite) driving seat, we find our conviction in the long-term bullish view only reinforced by the ongoing global supply disappointments. We recommend initiating a Dec-24 long Brent position.

Source: Goldman Sachs, Wall Street Overheard Newsletter, September 29 [emphasis by author].

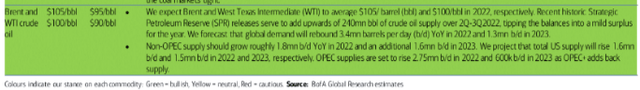

2 Days earlier, Bank of America analysts had published a 2023 price forecast for WTI and Brent of $90 and $95 per barrel, respectively. However, their forecasts included a 1.5 million b/d and 600,000 b/d increase in supply from the U.S. and OPEC, respectively, in 2023.

BofA, Wall Street Overheard Newsletter, September 29

These forecasts looked encouraging to all shareholders of OXY, VET, JOY, and other O&G stocks – most of these companies are currently priced at WTI prices of $60 per barrel over the long term (if not less), which should have led to margin and/or multiple expansion in 2023 with higher energy prices. However, as reality has shown, these forecasts have proven to be too optimistic after the recent news in the market:

Bloomberg, October 4th

Bloomberg, October 5

Before the group’s meeting in Vienna later on Wednesday, participants indicated the OPEC+ was going to consider cutting production by as much as 2 million barrels per day – double of what was previously flagged.

This OPEC + behavior is understandable – none of the producers involved want a repeat of the 2020 crisis, so any signs or attempts by anyone (including the US) to reduce global consumption are now being beaten back by strict supply-side regulation.

It is hard to overstate how anxious the Biden administration is about a potential resurgence in oil prices. A large OPEC+ cut would antagonize the White House, though officials may wait to see how prices respond afterward before pulling the trigger on policy responses.

Source: Bloomberg citing Bob McNally, founder of Rapidan Energy

And a reduction in oil consumption is what the U.S. needs at this stage, according to Harris Kupperman, the CIO of Praetorian Capital. Yesterday, Harris wrote in his interesting review of the upcoming OPEC + meeting that if it is not possible to increase supply (the SPR is already at a multi-year low), then reducing consumption outside the United States is the only thing left for Biden to do. Take, for example, the decline in consumption in India. But OPEC has made it clear that it will not allow this to happen because India has become one of the most important partners for an organization that is focused solely on its own interests.

On the topic of OPEC, here’s some quick math. Global supply and demand are roughly in balance today. Add in 1.5 million bbl/d of global SPR releases that will end soon, add in 2 million bbl/d of reduced demand from Chinese covid lock-downs that appear to be ending, add in 1 million bbl/d that Russian oil will decline by in 2023 (at a minimum), add in the 1 million bbl/d that global demand seems to expand by each year and assume that global supply somehow grows by 1 million bbl/d (though it isn’t clear where that growth would be coming from) and you have a 4.5 million bbl/d swing in 2023. Now add in whatever OPEC chooses and you realize that there’s an imminent and exponential crisis for the consumers of oil.

Of course, the Fed could destroy enough global GDP to erase 4.5 million bbl/d of global oil demand and stop the price from exploding, but OPEC just told them that they’ll DO WHATEVER IT TAKES. Do you think the Fed continues its war on GDP when they now know they’ll fail to contain the price of oil?

Source: From Harris Kupperman’s note

Due to the U.S. government’s desperation, we have already learned that it is willing to replenish reserves if the WTI price falls below $80 per barrel. However, given the current situation, there is a chance they will have to do so at $90-95 (at least), which will keep the price higher and longer than is currently believed.

But what about North American oil production?

To briefly answer this question, here is a quote from one Canadian Energy CIO who shared his opinion with Larry McDonald from Bear Traps:

Interesting data point around the scarcity of oil and the ignorance around that and hyper focus on the U.S. dollar: Since 2008, North American oil production is up 83%. In that same period the rest of the world is down 6%. The rest of the world is 73% of the world’s oil so the bulk of our oil production has not only not grown, it has been on a steady decline having been either under pressure from sustained low oil prices during the big NA ramp up or the super majors being attacked by anti-energy directorships forcing these companies to abandon maintenance let alone growth. North American production has transformed into distribution models of manufacturing oil. The ability to reverse that is almost impossible because of the distribution now being expected by the market along with the lack of services avail. A slight increase in spending this year and service costs look like they are up between 30 and 40% this year already in Canada. Expansion of production is slight at best as a result of that.

Source: Bear Traps report, October 2

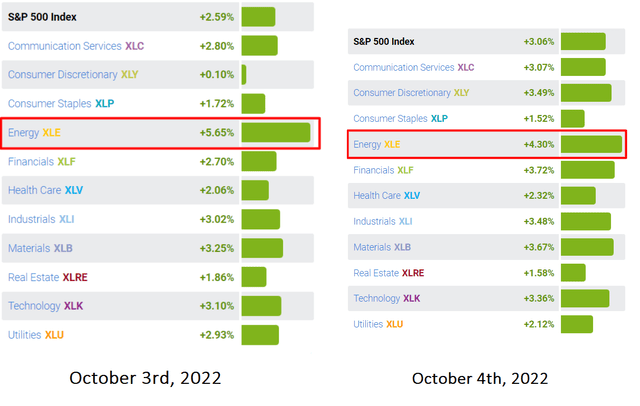

So the markets have tried to price in all that information over the last 2 trading sessions – the Energy sector has been the clear leader driving the (SPX) higher:

SectorSPDR (Sector Tracker), author’s notes

At the same time, according to a study on capital flows, some hedge funds have already started rotating capital in advance – Deutsche Bank’s September 30 Investor Positioning and Flows newsletter shows that funds have flowed into specific sectors at that time – primarily energy, EM bonds, real estate, EM local currencies, consumer goods, and munis.

![Deutsche Bank [September 30th]](https://static.seekingalpha.com/uploads/2022/10/4/49513514-16648803402609882.png)

Deutsche Bank [September 30th]

At Beyond the Wall Investing, we believe that the huge inflows of capital into energy stocks in recent days indicate a major rotation that has just begun. October is the first month of the quarter, and thus the time when many institutional investors rebalance their portfolios. As Harris Kupperman once noted, many funds are sitting on red P&Ls and desperately need a good quarter to keep their limited partners happy. Yesterday and the day before, we saw them looking to correct their P&Ls – that’s fundamentally explained, and even though the majority of retail investors are scared, the smart money is buying. The pack will follow the leaders shortly, in my view.

Yesterday, as OPEC+ did what it was supposed to do, banks were already revising their already optimistic oil calculations – Goldman Sachs raised its forecast by $10 (to $110/115 in Q4 2022 and Q1 2023, respectively). Something tells me this is just the beginning.

Why Occidental Petroleum is still a great investment?

I have written bullish articles on oil companies before – Vermillion Energy (VET), Obsidian Energy (OBE), and Baytex Energy (OTCPK:BTEGF) were my subjects of study. I still think these companies have a pretty big upside over the next 1-3 years, but you cannot buy them all at once – one always has to limit one’s appetite.

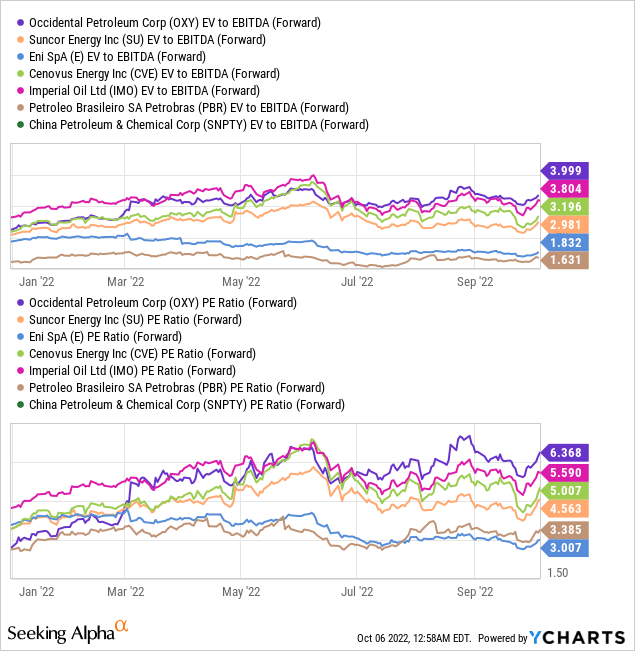

In recent months, the growth prospects of OXY have been the talk of the town, with Buffett buying this stock in large quantities – creating enormous hype around this company and driving investors in droves. This resulted in OXY trading a little bit above other companies of its size:

YCharts

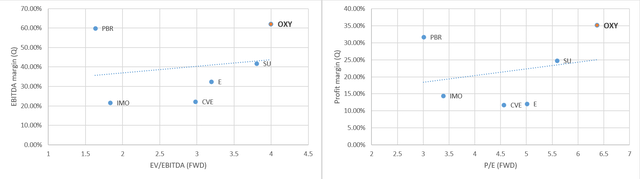

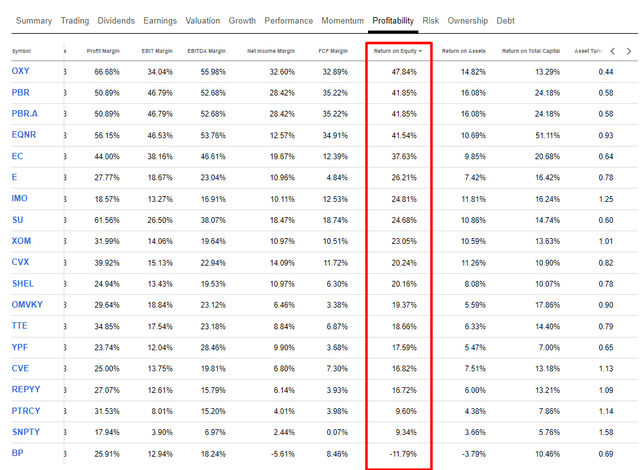

But why does Buffett buy OXY and not something else? I think that compared to supermajors like Exxon Mobil (XOM) and Chevron (CVX), OXY’s valuation is still quite modest – that’s first. Second, if you choose among the above sample of companies, it becomes obvious that Buffett chooses OXY because of its high margins:

Author’s work, based on data from YCharts

The way the company generates EBITDA and net income per $1 of revenue sets OXY apart from its Canadian same-sized peers. Yes, Petrobras (PBR) looks even better, but if an investor is faced with the task of avoiding country risk and “betting on America” while having sufficient liquidity to make the bet meaningful – then OXY seems an ideal option.

The company is also unrivaled in terms of ROE and asset turnover rate:

Seeking Alpha’s data, author’s notes

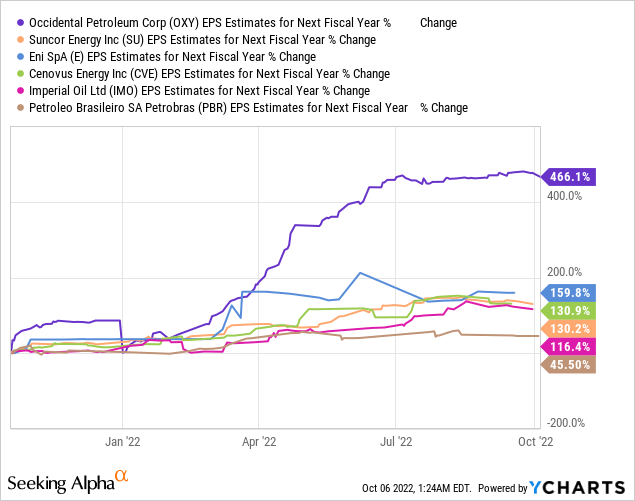

Moreover, OXY’s operating growth forecasts exceed those of other companies in the group many times over. This once again justifies the valuation and even makes the company quite cheap due to a combination of factors.

YCharts

Now that the market sentiment has improved, we can be sure that OXY will continue to bounce off its 200-week line MA and will likely reach its earlier local high sooner or later. Therefore, I rate OXY as a strong HOLD that has fuel to continue its growth.

However, I think it is better to look at smaller E&P companies – they are cheaper, have about the same level of profitability and growth, and therefore have much more potential in the medium term.

Why no-name small-cap Journey Energy instead?

In his open letter to all interested investors, Josh Young from Bison Interests already pointed out in May of this year the existing mispricing of small-cap stocks compared to the larger representatives of this industry:

If small cap E&P equities were to trade in line with their larger cap peers, this would imply significant share price appreciation for many of the equities.

Source: Bison Interests, “Small-Cap E&Ps: Compelling Opportunity“

Being a generalist by nature, I try to listen to the opinions of people who are fully immersed in an industry that I believe is gaining momentum and entering (or is already in) its new bull market cycle for obvious macroeconomic reasons. Josh Young’s expertise has allowed him to earn 390% for his fund last year – significantly more than the SPX or (XLE) have brought in. As a result, I follow him closely on Twitter and read new material on the Bison Interests website.

As far as I know, the largest position of this fund is Journey Energy, which has only 1.1K followers on Seeking Alpha. It is a $290-million exploration & production company from Alberta, Canada. It was formerly known as Sword Energy Inc. but then changed its name to Journey Energy Inc. in July 2012, according to SA. I decided to look into this company and see to what extent it is a potentially attractive company.

So what’s so special about it?

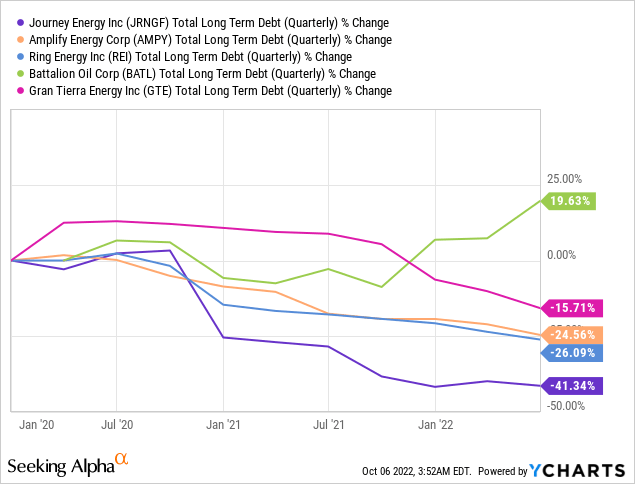

A good business in oil and gas during a bull cycle is characterized by the ability to service and reduce reliance on debt – so you can generate more free cash flow to equity, not just to the firm. Companies with large hedges or high leverage lag when high oil prices rise or stabilize at reasonably high levels.

Journey had too much debt going into 2020, but they were able to pay it down after restructuring their debt. Among its peers (by market capitalization, selected from 71 companies in the E&P industry), JOY is the company that was reducing its over-indebtedness the fastest – the momentum over the last 3 years is impressive:

YCharts

JOY is under 20% hedged, which is also a good thing for a small-cap E&P.

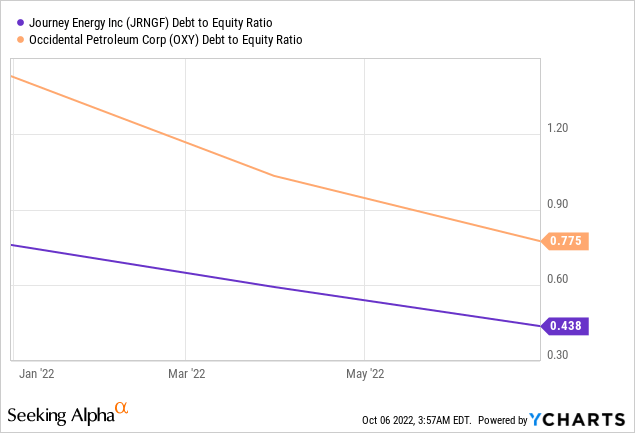

The colossal efforts to get rid of excess leverage have meant that JOY is currently not only better off than many of its peers in terms of credit risk, but even better than OXY, which has a debt-to-equity ratio that is 77% higher:

YCharts

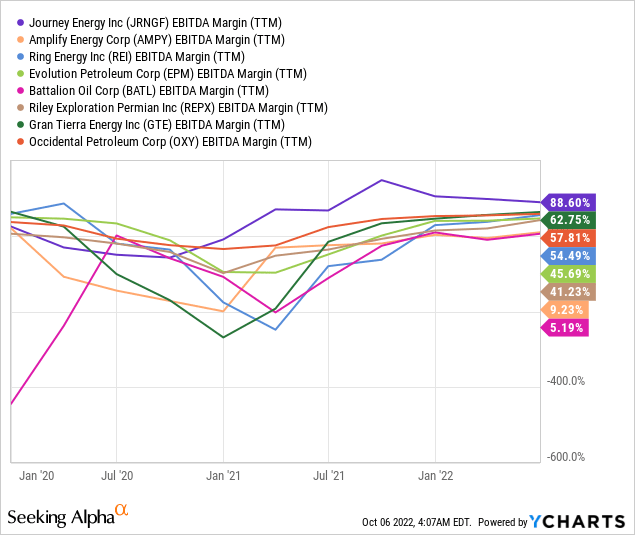

The systematic reduction of debt on the balance sheet results in a whopping EBITDA margin, which according to YCharts is 88.6% as of the last balance sheet date – this is significantly more than peers, and again more than OXY (as we recall, OXY is considered one of the most profitable):

YCharts

Another criterion for the success of any E&P company is successful acquisitions. As Josh Young says, companies that found large fields and those who bought distressed properties have fared well, which is a strategy that has been successful.

On July 28th, JOY stated that it has completed the acquisition of a private firm in the Carrot Creek region, bringing its total low decline output to about 770 boe/d (49% crude oil and NGLs). On May 9, 2022, it completed the previously announced $4.8 million purchase of infrastructure and collection assets in the Gilby region. The installation of a 15.5 MW plant in Gilby, where Journey plans to construct its second power generation facility, has already received preliminary clearance. They have allocated all expenditures, as well as a $20 million reserve, for the plant, which is scheduled to begin operations in late 2023. Up to 30% of this cost will be spent in 2022 to procure all of the longer delivery items and power generation equipment.

To compare how effective the company’s recent acquisitions have been, Josh draws a comparison with Tamarack Valley Energy (OTCPK:TNEYF) – which is almost 5x bigger – in his latest article on JOY. I have highlighted the main points below:

| Company / Metric | $/BOEPD | $/PDP Value | % Oil, Liquids, and Natural Gas |

| Journey Energy | $26,364/boepd | 70% of PDP value | 71% liquids |

| Tamarack Valley Energy | $75,000/boepd | most likely paid a premium to PDP value | 93% liquids |

| Comment: | Less = better | Less = better | Less = better |

Source: Author based on Josh Young’s article

JOY had a significantly higher takeover efficiency, which should bring significantly higher returns to shareholders over the next couple of years, in my view.

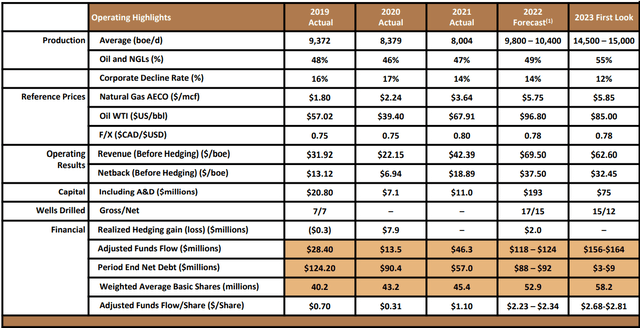

Taking the acquisitions into account, JOY updated its full-year 2022 guidance – the company plans to spend more than previously projected for the full-year 2022, but the higher production forecast offsets those costs, with adjusted funds flow $17 million higher, a 16% increase from management’s previous guidance.

JOY’s IR presentation

Moreover, management’s key assumption for 2023 is WTI at $85 bbl and AECO GAS at $160.6 mcf. As we recall, OPEC+ will defend its priorities to the last – so growth should be even higher.

Risks and Bottom Line

Perhaps I am wrong in my bullish thesis on oil prices and their stability. If the recession spreads from Europe to the whole world, then oil could fall sharply and stocks like OXY and JOY are likely to drop heavily.

Moreover, no one canceled the idiosyncratic risks. Occidental Petroleum looks much more stable than Journey Energy – for obvious reasons: higher capitalization, broader end market, and greater support from institutional investors (including the largest of them). Therefore, my thesis that JOY is likely to bring more rate of return in 2023 is under attack.

That said, I believe the fundamental quality of JOY should help the company through the end of 2022 and throughout 2023 to continue to deliver on its plan to reduce credit risk and increase production due to recent acquisitions – this will guarantee tremendous FCF. Management’s guidance for adjusted cash flow per basic share (AFF/BS) is $2.325 (mid-range), which is approximately 55% of yesterday’s closing price. The forward AFF/BS is about 65% and, as we recall, is subject to fairly conservative forecasts. This is a huge yield that is very likely to give investors an abnormal return in the coming months, in my view.

So I recommend retail investors prefer JOY over OXY to increase the return potential in the next 1-3 years.

Let me know what you think about this pick – it’s interesting to know your opinion about it. Have a nice day!

Be the first to comment