MicroStockHub

Consolidation of fragmented market

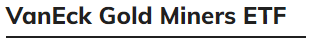

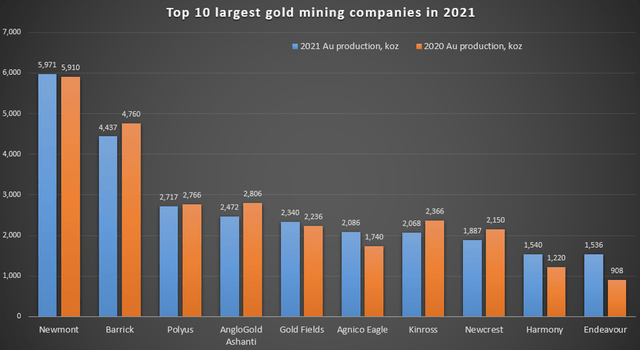

The gold sector remains one of the most fragmented industries in the mining sector. In 2019 top-5 producers contribute less than 1/5 of the world production. In contrast for most other metals, top-5 producers make up to 2/3 of global production. Gold sector has remained fragmented because there are lower barriers to entry for the industry. Even at a small scale, companies have been able to sustain themselves given the underlying economics. Also, proprietary processing techniques in the gold industry are an exception in comparison with other metals, which, in turn, helps companies sustain themselves at a small scale.

A gold miner doesn’t have to operate at the lowest cost in the industry and have a strong balance sheet to remain viable. There is no true competition in this space to drive the weaker players out of business and create stronger mining entities. This has allowed the sector to become fragmented, as most of these companies are trying to remain on an island – isolating themselves to their own little corner of the sector.

For the industry as a whole, organic growth has been stagnant in recent years, given the natural declines in existing mines and with companies unwilling to invest in major greenfield projects, which are generally fraught with execution risk, geopolitical concerns, environmental issues, and time and cost overruns.

Reasons for mergers

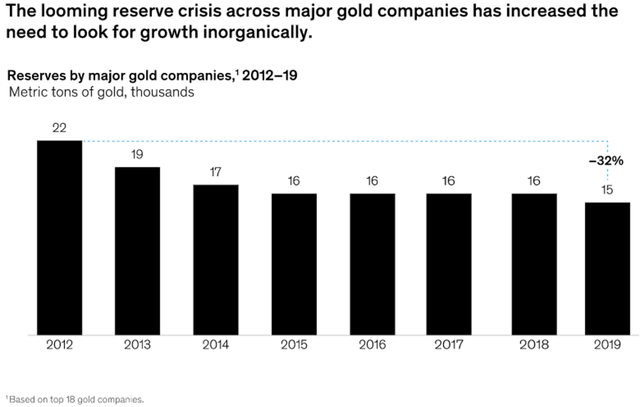

- M&A in the gold space is largely being driven by gold miners seeking to replace their depleting reserves, where ongoing exploration has for the most part failed to deliver material mine life extensions (as well as low exploration budgets over recent years) and/or new greenfield discoveries to maintain existing reserves. The heavy focus on cost-out initiatives post-2012 resulted in a dramatic decrease in exploration budgets across the industry, as well as juniors being starved of capital. Regarding operating-expenditure and capital-expenditure control, the gold industry witnessed exploration expenses being cut drastically by major producers as they primarily focused on brownfield expansion. It is expected continue of acquisitions of junior gold companies by mid-cap gold miners as a means of achieving growth. M&A will be viewed as one part of the solution to rebuild and grow reserves.

McKinsey & Company Research, S&P Global Market Intelligence

- In the past, there were deals that provide easier access to funds, operational capabilities, and so on. With the increase in cash availability and overall attractiveness, M&A is likely to gain traction.

- Some miners increasingly seek to expand to increase their relevance with generalist funds and be included in exchange-traded funds.

- Lofty ESG goals and initiatives require more capital investments which can be done only by company with substantial scale.

The gold sector has experienced a wave of consolidation over the past few years. There is long list of consolidation deals across the large-cap, mid-cap and junior gold companies, which has been dominated by North American and Australian headquartered companies including cross-border M&A deals.

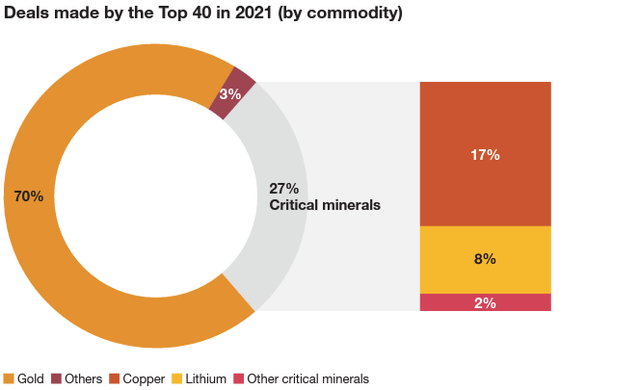

Bloomberg, Company Reports, CreditSights

Gold has dominated top-40 deals for the past several years. Gold consolidation is buoyed by a strong gold price which is benefiting from the ongoing geopolitical concerns with conflict in Ukraine, along with inflation headwinds, both of which are seeing rising demand for gold as a safe haven asset. The balance sheets of most mid-tier and large gold miners are generally very healthy, which will support the growth ambitions of these companies to continue pursuing their M&A strategies.

Value of complimentary M&A deals

According to the market research firm, the strategic rationale behind this M&A is similar to other large deals completed in the last few years, and includes achieving scale, diversifying geographically, and replenishing project pipelines.

As result combined companies generate some synergies and lower risk profile of company, which make it more attractive for investors. Since gold miners produce the same product without unique characteristics, synergies from deals are more transparent and they have higher probability to take shape. Value of deals in this case can be realized when merged companies have both different and same scale.

Finding offers with premiums

Joe Foster, portfolio manager of VanEck International Investors Gold Fund, said he looks for M&A activity to continue, particularly between mid-tier and junior-mining companies. He also looks for more “mergers of equals” in which producers do not pay a premium to acquire another company, but in which mining firms instead partner up with another with the goal of creating a stronger company.

Taking into account declining market, any bid even without premium will have some upside relative to current quotes. It is result of distance of time between making bid and publication of potential deal.

n/a MarketWatch

Potential bond calls in case of M&A

As a result of US and worldwide monetary policy tightening (Fed Funds Rate raised from 0.25% to 3.25% YTD) and growing yields (US 10 Treasury Notes YTM raised from 1.6% to 3.6% YTD), majority of bonds declined significantly. For example, IG Corporate Bond ETF (LQD) declined 24.5% YTD and HY Corporate Bond ETF (HYG) declined 17.3% YTD.

Significant decline of bond prices can lead to high return in case of redemption at par value or above. It can be realized in two scenarios:

- When credit indenture contracts contain early redemptions clause in case of merger or reorganization of a company. If parties of transaction are small companies, then their merger may lead to a deterioration in credit metrics, which may serve as a trigger for mandatory redemption of bonds.

- If large company takes over much smaller company, it is often better for the acquiring company to refinance the target company’s more expensive debt.

Be the first to comment