imaginima

The COVID-19 pandemic taught us (i.e., American citizens specifically) many things: Our history of “rugged individualism” isn’t the best approach to combating a pandemic, we were collectively unprepared for a pandemic on many levels (to be mentioned below), and that unpreparedness left us vulnerable to shortfalls in the simplest things that make our modern way of life possible.

We were unprepared as warnings and proposed plans for preparedness, dating back to the Bush administration in 2005, were ignored or at best were underfunded. Our Homeland Security department has focused exclusively on threats to the nation that would be classified as terrorism, both foreign and domestic. Our vulnerabilities to biological threats had been, and despite lessons learned are probably still, largely overlooked. In my opinion, the risk to American human life is probably greater from another virus than from a military attack from Russia, North Korea, or an enemy to be named.

When the pandemic hit in full force, particularly in the U.S., we were woefully unprepared, in my view. There was not enough personal protection equipment (PPE) for healthcare workers, frenzied and unprepared consumers cleared store shelves, general uncertainty ensued, followed in many cases by fear. Just-in-time inventory systems, accompanied by trucker shortages and international shipping, are not well-equipped to restock store shelves.

What was more surprising than empty grocery store shelves were the follow-on effects: The other supply chain issues and bottlenecks. Why were there so many container ships stuck waiting at the port of Long Beach and other places? Why did a shortage of semiconductors develop? Why were so many items in such short supply that it led to the higher-than-trend inflation we have experienced now for more than a year? The specific reasons and drivers can be debated, but the big picture reason is that we as a nation are not self-sufficient, I feel. We are highly dependent on our trading partners, which during a crisis, is not acceptable.

So as a matter of national security and to facilitate the ability of our population to be more self-sufficient, it makes sense to relocate (“reshore”) certain mission critical manufacturing and resource sourcing back within our borders. This is not a nationalistic view, but one of common sense. It’s nice to pay low prices for products made elsewhere, but what is the price difference worth? Is it worth our independence and the ability to maintain our way of life all the time, or only when we don’t face a crisis. I don’t want to make this political, but it seems obvious from both a consumer demand and business strategy perspective, that it makes sense for many businesses to reevaluate how they produce the goods and services they sell in the U.S.

While there is not space here to dive deeply into the CHIPS and Science Act or Inflation Reduction Act, I think these are two good catalysts to drive business and manufacturing back to our shores.

How to Capitalize on These Long-Term Trends

One of the most difficult shortages that U.S.-based businesses and consumers have faced since the beginning of the pandemic has been the availability of microprocessors used in countless products. The direct shortage in chips subsequently led to tight supplies of finished products, from appliances to automobiles.

As I stated in a recent article, I like Intel (INTC) based on numerous factors discussed here. The recent backing by the CHIPS Act for the company’s project in Ohio, while a relatively small reason to buy the stock, provides validation for the importance of the reshoring trend.

In addition to the CHIPS and Science Act, the Inflation Reduction Act allocates a significant amount of money to tax credits and rebates, mostly to encourage more efficient energy usage, renewable energy production, reduce pollution, and ultimately build the infrastructure required to support these initiatives. Furthermore, additional capital will be allocated to improve existing infrastructure and build needed new infrastructure. While the impact this will have on inflation in the near-term is difficult to determine, the impact on bringing more manufacturing and capital spending to the U.S. is clearer.

A concern with reshoring manufacturing, effectively offsetting the 40+ year trend of offshoring and globalization, is the rise in product and service prices driven by the higher labor costs here. For many manufacturing, retail, and labor-intensive work, robotics and automation is either at the point, or will be shortly, to help alleviate these added costs and concerns.

Direct Beneficiaries

Direct beneficiaries are the manufacturing companies that can relocate a portion of their operations back to the U.S., as well as the companies that support this effort in terms of construction. Many of these companies also require raw material inputs that will drive demand higher while this transition takes place.

Companies that can relocate some of their operations include semiconductors and other industrials. I looked at Intel specifically, and semiconductors more broadly, recently in another article. In that specific case, the CHIPS and Science Act acts as a catalyst, as does geopolitical concerns in Asia (i.e., Taiwan), and recent acquisitions and growth/innovation initiatives. Again, while I like Intel, I pair that position with a position in the VanEck Semiconductor ETF (SMH) to make sure that I capture the upside of the future winners.

To support new U.S.-based operations, I would expect industrial and construction-related names to perform well. This group includes Caterpillar (CAT), Deere (DE), and Honeywell (HON). Like with most recommendations I make, rather than investing in specific individual companies, I think a more diversified approach is advantageous. In this case, I like the Industrial Select Sector SPDR ETF (XLI). In addition to the industrials that will be critical to building out domestic operational capacity for many companies, this ETF also holds national defense names that might (but hopefully won’t) benefit from the escalation of conflict between Ukraine and Russia.

YTD Performance of Industrials (Seeking Alpha)

The reshoring of industrial and manufacturing operations will increase the demand for raw materials. Additionally, our effort to increase the prevalence of EVs, certain elements will become increasingly important, including lithium, nickel, cobalt, and copper. This will drive demand and prices of these and other commodities. In this space, many of the most important names are located outside of the U.S. BHP Group (BHP) is headquartered in Australia, Rio Tinto (RIO) in the UK but with operations in Australia, Brazil, and Guinea, and Freeport-McMoRan (FCX) while headquartered in Arizona has its major operations spread across North America, South America, and Indonesia.

To focus on the copper mining industry, I like the Global X Copper Miners ETF (COPX), which holds a portfolio of over 40 stocks allocated about 9% U.S. and 91% rest of the world, with the top three allocations to Canada, Australia, and China. The fund has a relatively high expense ratio of 0.65% but provides a current yield of over 3%.

YTD Copper Miner Performance (Seeking Alpha)

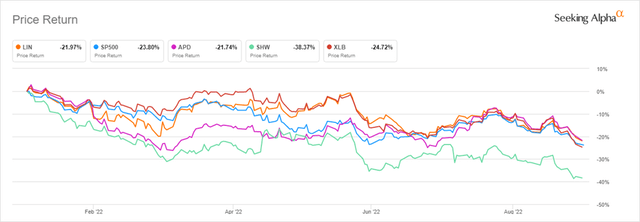

For broader exposure to materials, not necessarily focused on copper or other materials used in EVs and other renewable sources of power and sustainability, the Materials Select Sector SPDR ETF (XLB) provides a simple solution. For an expense ratio of 0.10%, you can gain access to a portfolio of nearly 30 stocks, allocated 80% to the U.S. and 20% to the rest of the world. Outside of the U.S. the remaining companies have headquarters in the UK and Switzerland, but operations around the world. With a current yield above 2%, the top three holdings include Linde plc (LIN), Air Products and Chemicals (APD), and Sherwin-Williams (SHW).

YTD Performance of Materials (Seeking Alpha)

Other key holdings important to this investment theme include Freeport-McMoRan discussed above, Newmont Corp. (NEM), which produces copper, silver, lead, and zinc, and Albemarle Corp. (ALB) that produces lithium and other specialty chemicals for use in everything from consumer electronics, to EVs, to pharmaceuticals, and countless other end uses. On a side note, Newmont also possesses a relatively large gold reserve of about 93 million ounces. While gold prices have been sliding in recent months, this could turn around and become a tailwind for the company.

YTD Performance of Materials (Seeking Alpha)

The materials sector is attractive not only because of the CHIPS Act and Inflation Reduction Act in the U.S. or because of reshoring of manufacturing, but on a valuation basis. The sector is now the smallest percentage in the S&P 500, representing only 2.5% of the index’s value.

Indirect and Long-Term Beneficiaries

One of the common, and legitimate, concerns of such a transition, will be the availability and cost of labor. Fortunately, advances and applications of robotics and automation are becoming reality every day. For this part of the thesis, I will not pretend to have any special level of expertise at this time but am confident that growth in these areas will be investible long-term. So, because I believe it is too early to pick long-term winners and losers, I suggest considering a couple of funds that focus on that space.

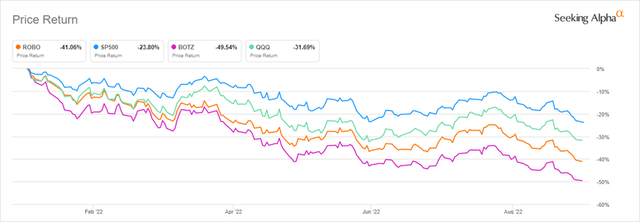

I have suggested the ROBO Global Robotics and Automation ETF (ROBO) in prior articles, and continue to do so for long-term investors, despite poor recent performance. The fund holds a portfolio allocated about 43% to the U.S. and 57% to the rest of the world, with top exposures to Japan, Taiwan, and Germany after the U.S. The portfolio currently holds about 80 equity positions, none of which are larger than 2%. The expense ratio is relatively high at 0.95%.

A less expensive alternative is the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ). The portfolio has a very similar geographic allocation to the Robo Global fund of 43% U.S. and 57% rest of the world. Japan is once again the second largest exposure but is followed by Switzerland and Norway in this case. Total equity holdings of about 40 make this portfolio a little more concentrated. The largest three positions, Keyence Corp (OTCPK:KYCCF), Fanuc (OTCPK:FANUY), and ABB Ltd (ABB) are each a little over 9% of portfolio value.

Both ROBO and BOTZ have significantly underperformed the S&P 500 and Nasdaq year-to-date, with each falling about 41% and 50%, respectively. Because large cap tech incumbents are often able to acquire or leapfrog smaller competitors, holding a broader exposure to this style (think (QQQ)) also makes sense for long-term investors.

YTD of Robotics, Automation, and Large Tech (Seeking Alpha)

Final Thoughts

The reversal of globalization will not be absolute or immediate but will be impactful for many companies and industries. The pandemic, combined with recent legislation here in the U.S. to develop manufacturing capacity for semiconductors as well as improve and expand infrastructure, are expected to serve as catalysts for this transition. These changes will take years and decades to fully develop and realize the benefits of but should provide a tailwind for companies that are both direct and indirect beneficiaries.

As a long-term investor, I understand and am comfortable with the short-term volatility and setbacks that are inevitable with undertakings of this scale. However, I am confident that investments in the specific areas discussed above will perform well in the years to come, adding value to the portfolios of those with enough patience.

The suggestions I made above are intended to be satellite positions added to an already well-diversified equity allocation. Position sizes should be chosen based on investor risk tolerance and preferences, as well as any restrictions or constraints. I look forward to your feedback in the comment section below.

Be the first to comment